DBS Group Holdings Ltd - Tenacity in adversity

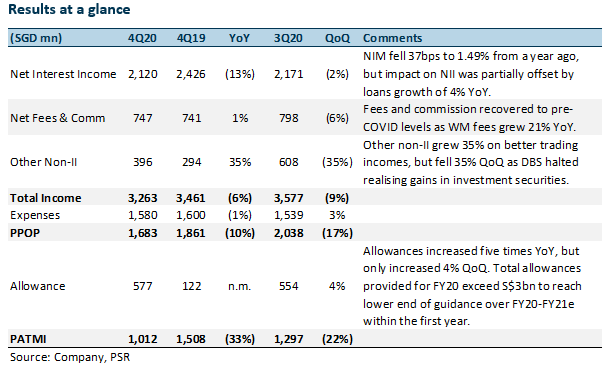

15 Feb 2021- FY20 earnings in line as lower credit costs compensated for weaker-than-expected income.

- NIM fell 27bps to 1.62% YoY but loan growth of 4% YoY cushioned NII. NIM further contracted 4bps to 1.49% QoQ.

- Fees and commissions grew 1% YoY, recovering to pre-COVID levels.

- Allowances matched 3Q20 levels despite the consolidation of troubled Lakshmi Vilas Bank (LVB).

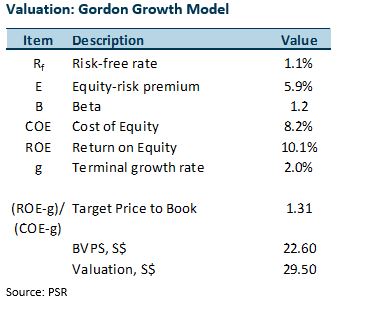

- Upgrade to ACCUMULATE from NEUTRAL with higher GGM TP of S$29.50, from S$22.60. We increase earnings by 6% for lower allowances following a better credit outlook. We now assume 1.31x FY21e P/BV in our GGM valuation, up from 1.26x.

The Positives

+ Fees and commissions back to pre-COVID levels

Fees and commissions grew 1% YoY in 4Q20 from S$741mn to S$747mn. WM fees grew 21% YoY to offset weakness in investment-banking and credit-card fees.

We forecast 12% growth in fees and commissions for FY21e as economic conditions improve. Investment-banking and credit-card fees are expected to recover to pre-COVID levels while WM fees should continue to power ahead.

+ FY20 allowances at lower end of 2-year guidance

4Q20 allowances of S$577mn ticked up 4% QoQ. They included S$183mn of GP from its consolidation of LVB.

FY20 allowances totalled above S$3bn. But this was at the lower end of the S$3-5bn guided by the bank for FY20-21. GP reserves hit S$4.31bn, in excess of MAS’ requirement by 42%.

We think that FY20 provisions will be sufficient for asset-quality deterioration in FY21 and expect credit costs to normalise to pre-COVID levels along with the economic recovery.

The Negative

– NIM down by 4bps QoQ to 1.49%

NIM further tightened in 4Q20, contributing to a 2% decline NII QoQ. FY20 NII fell 6% on a 27bp YoY drop in NIM. The impact on NII was muted by 4% loan growth YoY in FY20.

The bank guided for NIM of 1.45-1.50% for FY21e as interest rates stabilise. Nevertheless, a cheap funding environment should allow it to continue with its low-yield lending, including interbank loans, to boost NII.

Outlook

Clarity on loan moratorium

Loans under moratorium fell significantly to S$4.5bn, to roughly 1.2% of DBS’ loan book, as Singapore exited the first phase of its loan moratorium. Low delinquencies from the loans that exited moratorium support a lower credit-cost forecast of S$1bn for FY21e. This implies FY20-21 allowances of S$4bn, midway of the S$3-5bn range guided by the bank.

Pipeline for growth

DBS’ LVB consolidation will expand the bank’s footprint in India. Earlier operating concerns have waned after DBS took decisive action to provide for NPAs.

The bank’s securities JV in China and digital-exchange partnership with SGX are also expected to augment its business from FY21.

Investment Action

Upgrade to ACCUMULATE with higher target price of S$29.50, up from S$22.60

We raise FY21e earnings by 6% as we lower allowances by S$1bn. We also lower COE in our GGM valuation from 9.4% to 8.2% and assume a 10.1% FY21e ROE. This reflects lower risks as equity markets improve.

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)