Prime US REIT-Strong reversions from under rented portfolio

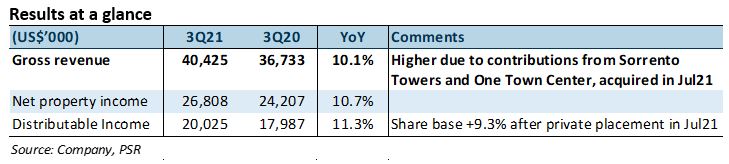

8 Nov 2021- 9M21 NPI and distributable income met expectations, at 72% of our FY21e estimates.

- Strong leasing quarter with 4.3% of NLA signed at 19.2% reversions. Two pre-terminations announced, but pre-termination fees likely to cover rents till 4Q22.

- Maintain ACCUMULATE and DDM target price of US$0.94 (COE 9.5%). No change in our estimates. Current share price implies FY21e/FY22e DPU yield of 7.6%/8.8%. Prime is our top pick in the US Office sector for greater tenant exposure to STEM/TAMI sectors. Catalysts include improved leasing and a greater return to office.

The Positive

+ Strong leasing quarter with respectable reversions of 19.2% (1Q21: 9.5%; 2Q21: 13.3%). c.4.3% of portfolio NLA signed in 3Q21, 3.6x higher QoQ, of which, most were renewals. New leases formed 17.5% of NLA signed. Half of 3Q21 NLA signed was with a legal tenant, Arnall Golden Gregory, located in 171 17th Street in Atlanta. The tenant signed an early renewal on their leases expiring in 2024, which will extend its lease until 2035. Reversion for this lease was c.20%, while reversions for the remaining leases ranged from positive single digits to low double digits. A manageable 10.2% of leases by CRI are expiring in FY22. Passing rents for 10 out of 14 of Prime’s assets are currently below market rents, implying the potential for positive reversion averaging 7.5% for the portfolio. The is because growth in market rents has outpaced the scheduled escalations embedded in Prime’s leases.

The Negatives

– Two pre-terminations announced; pre-termination fees likely to cover rents till 4Q22. A tenant at One Washingtonian Center pre-terminated its lease, resulting in a 15ppt decline in building occupancy, from 95.6% to 80.6%. Pre-termination fees will cover rents till Nov22, providing upside for Prime, should the manager be able to lease out the space before pre-termination fees are depleted. WeWork, one of Prime’s top 10 tenant contributing 2.5% of CRI, announced the pre-termination of its lease at Tower I at Emeryville. WeWork’s security deposits, in the form of cash and other collaterals, will cover rents until 4Q22. More details to follow as Prime and WeWork are currently discussing the pre-termination fee and date of vacancy. Separately, a tenant occupying 2.6% of NLA at Reston Square will not be renewing its lease when it comes due in Jul22. The tenant was acquired by another corporate and will be relocating to the acquirer’s building. In place rents of US$443.46 are currently 14.7% above market rents of US$37.00, implying negative reversions for this space.

– Portfolio occupancy slipped 0.3ppts QoQ from 91.7% to 91.4%. This was largely attributed to the pre-termination at One Washingtonian Center.

Outlook

Adapting to earlier lease commencement dates. US leasing volume has picked up, with improvements lease tenures and reduction in tenant incentives. However, some tenants with larger footprints may require longer timeframes for decision making. The delay in decision making results in a more immediate intended occupancy date, as leases are signed closer to expiry. To adapt to tenants’ changing leasing behaviour, Prime is evaluating strategies to shorten the timeframe for tenants to move in. We think this could involve Prime pre-empting tenant’s space configurations and speculatively reconfiguring vacant spaces ahead of lease conclusion – a strategy that has garnered much success for one of its peers.

More significant return-to-office likely to happen in 1Q22. Physical occupancy for 3Q21 was c.30%, an improvement from c.20% in 2Q21. While many surveyed corporates expressed interest in returning to the office in 3Q21, new waves of the virus delayed return-to-office plans. We expect significant return-to-office will likely happen in 1Q22, delaying a more meaningful recovery in carpark income. For reference, carpark and ancillary income contribute c.7-9% of pre-pandemic revenue but is currently c.30-35% below stabilised levels.

Maintain ACCUMULATE and DDM TP of US$0.94.

No change in our estimates. Current share price implies FY21e/FY22e DPU yield of 7.6%/8.8%. Prime is our top pick in the sector for greater tenant exposure to STEM/TAMI sectors. Catalysts include improved leasing and a greater return to office.

Netflix Inc. - Pricing power on display

Netflix Inc. - Pricing power on display Keppel DC REIT - DXC settlement offers partial relief from uncollected rents

Keppel DC REIT - DXC settlement offers partial relief from uncollected rents Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY)