Pan-United Corporation – FY21 results above our expectations on construction recovery

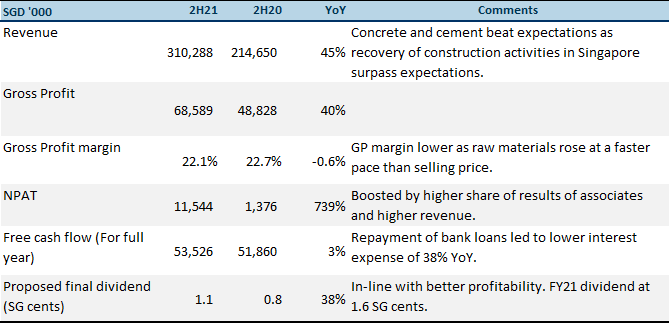

14 Mar 2022- 2H21 revenue and profit beat expectations, at 60.7% and 76.2% of FY21e estimates respectively. The beat was driven by higher sales from its concrete and cement business which recovered faster on the back of the faster pace of recovery in the construction sector.

- Net gearing was 22% lower than our forecasts; FY21 DPS 0.6 cents higher than our expectations. Full-year 2021 dividend at 1.6 cents, represented a 60% payout, signalling confidence in the near- and mid- term outlook.

- Manpower shortages, supply-chain disruptions and volatile freight costs continue to hamper growth recovery. We tweaked our GP margin expectations lower for FY22e/FY23e in anticipation of higher raw materials cost and supply-chain disruptions.

- Maintain BUY with higher target price of S$0.46, from S$0.44. We raise FY22e earnings by 11% on account of the higher demand for ready-mixed concrete brought about by the construction recovery. Our TP is based on 16x FY22e P/E, a 15% discount to its 10-year historical average P/E on account of the still uncertain environment.

The Positives

+ 2H21 revenue and profit above, driven by recovery in concrete and cement segment; higher associate contributions. Group revenue increased 45% YoY in 2H21, growing at the same pace as 1H21 as the recovery of construction activities in Singapore continued to drive growth. According to the Building and Construction Authority (BCA), ready-mixed concrete (RMC) demand rose 52.7% in 2H21 and 59.4% for full-year 2021. RMC sales volumes rose, and is now at pre-COVID levels (Figure 2). Contributions from its associate, PT. Lanna Harita Indonesia in which it owns a 10% stake, also rose on the back of higher coal prices.

+ Net gearing 22% lower than our forecasts; FY21 DPS 0.6 cents higher than our expectations. Backed by net operating cashflows of S$33mn in 2H21, PanU repaid S$17.7mn in loans to lower its overall net gearing from 0.14x to a net cash position of $17mn. Interest expenses accordingly dropped by 38% YoY. It also declared a final DPS of 1.1 SG cents for FY21, bringing full-year 2021 dividend to 1.6 SG cents, representing a payout of 60%, above its dividend policy to distribute at least 30% of its annual PATMI. This, in our view, signals the Group’s confidence in its near- and mid- term outlook.

The Negative

– Manpower shortages, supply-chain disruptions and volatile freight costs. GP margin was slightly weaker YoY as raw materials price rose at a faster pace than average selling price. Dec-21 ASPs are 9% higher YoY at S$104/cu m and 7% higher vs. the same period in 2019. Given the strong demand for construction materials in the region, we do not think prices would moderate in the near-term. PanU also faced disruptions in raw-material supplies and had to search for alternatives. Supplies from new sources require lead times of a month for BCA testing before they can be imported. This hampered its ability to fulfil contracts. We tweaked our GP margin expectations lower for FY22e/FY23e in anticipation of higher raw materials cost from supply-chain disruptions.

Outlook

BCA upgrades forecasts of construction demand for 2022. The BCA has upgraded its forecasts of construction demand for 2022 to $27bn-32bn per year from the original $25bn-32bn per year, comparable with the preliminary $30bn in 2021. The BCA also projects that demand for building materials will increase in tandem with the increased construction demand. Steel rebar demand is forecasted to grow to 1mn-1.2mn tonnes in 2022, representing ~22% YoY increase.

We note that BCA’s forecasts for average construction demand in 2022-2025 excludes the development of Changi Airport Terminal 5 and expansion of the two integrated resorts. As our forecasts have not included these projects, there is upside if they go live.

In the near term, projects in the pipeline that will likely support the group’s growth are the Singapore Science Centre’s relocation, the Toa Payoh integrated development, Alexandra Hospital redevelopment, Bedok’s new integrated hospital, Phases 2-3 of the Cross Island MRT Line and the Downtown Line’s extension to Sungei Kadut.

With an approximately 40% market share in the industry, we continue to see PanU as a key beneficiary of the construction sector recovery. PanU’s batching plants still have capacity to take on a 10-15% increase in RMC demand in Singapore.

Maintain BUY with a higher TP of $0.46, from $0.44. We raise FY22e earnings by 11% on account of the higher demand for RMC brought about by the construction recovery. Our TP is raised to $0.46 from S$0.44 based on 16x FY22e P/E, a 15% discount to its 10-year historical P/E on account of the still uncertain environment. Stock catalysts are expected from higher contract volumes and better margins.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

- recipients of the analyses or reports are to contact Phillip Securities Research (and not the relevant foreign research house) in Singapore at 250 North Bridge Road, #06-00 Raffles City Tower, Singapore 179101, telephone number +65 6533 6001, in respect of any matters arising from, or in connection with, the analyses or reports; and

- to the extent that the analyses or reports are delivered to and intended to be received by any person in Singapore who is not an accredited investor, expert investor or institutional investor, Phillip Securities Research accepts legal responsibility for the contents of the analyses or reports.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

Phillip Macro Update - Fed delivers 3rd cut and one more in 2026

Phillip Macro Update - Fed delivers 3rd cut and one more in 2026 Singapore Banking Monthly – Loan and deposit growth continue rising

Singapore Banking Monthly – Loan and deposit growth continue rising OUE REIT - Proceeds in, gearing to decline

OUE REIT - Proceeds in, gearing to decline LHN Ltd – Steeper growth ahead

LHN Ltd – Steeper growth ahead