Company Overview

Advanced Micro Devices Inc. (AMD) is a leading semiconductor company that designs and manufactures high-performance computing processors, graphics processing units (GPUs), and related technologies. The company serves multiple markets including data centres, personal computers, gaming, and artificial intelligence applications, competing directly with industry giants like Intel and Nvidia.

Strong Financial Performance Drives Upgrade

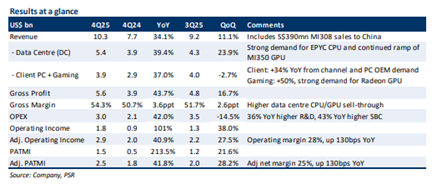

AMD’s fourth quarter 2025 results exceeded expectations, with revenue meeting forecasts at 100% of projected levels while profit after tax and minority interest (PATMI) surpassed expectations at 112% of forecasts. This outperformance was primarily driven by robust sales of Instinct MI350 series GPUs and EPYC CPUs. The company’s data centre segment emerged as the primary growth driver, with revenue accelerating 39% year-over-year to US$5.4 billion, representing 52% of total quarterly revenue compared to 47% in the previous quarter.

Investment Merits and Future Outlook

AMD’s strategic positioning in the data center market appears particularly compelling. Management expressed confidence in achieving annual data center segment revenue growth exceeding 60% over the next three to five years, supported by strength in both Instinct GPU and EPYC CPU product roadmaps. The company’s GPU development timeline shows clear progression, with MI400 series GPUs and Helios products scheduled to ramp in the second half of 2026, followed by MI500 series GPUs featuring advanced 2nm-process technology and HBM4E memory launching in 2027.

Margin Expansion and Market Share Gains

The higher proportion of data centre revenue drove significant margin expansion, with gross and net margins increasing 360 and 130 basis points year-over-year respectively. Data centre operating margins reached 32.6%, the highest level since the first quarter of 2022. AMD continued gaining server CPU market share from Intel, whose performance was constrained by supply issues. The client PC segment also maintained momentum with ten consecutive quarters of growth, achieving 34% year-over-year revenue increase to US$3.1 billion.

Research Recommendation

Based on these strong fundamentals and clear growth trajectory, Phillip Securities Research upgraded AMD to BUY from ACCUMULATE, maintaining a target price of US$280. The upgrade reflects confidence in AMD’s competitive positioning and execution capabilities across both GPU and CPU product lines.

Key Takeaways

Q: What were AMD’s key financial highlights for Q4 2025?

A: AMD’s Q4 2025 revenue met expectations at 100% of forecasts, while PATMI exceeded expectations at 112% of projections. Data center revenue grew 39% year-over-year to $5.4 billion, representing 52% of total quarterly revenue.

Q: What is AMD’s growth outlook for the data center segment?

A: AMD expects to grow data center segment revenue by more than 60% annually over the next 3-5 years, driven by strength in its Instinct GPU and EPYC CPU roadmap.

Q: What new GPU products does AMD have planned?

A: AMD’s GPU roadmap includes MI400 series GPUs and Helios ramping in the second half of 2026, followed by MI500 series GPUs with advanced 2nm-process technology and HBM4E memory launching in 2027.

Q: How did AMD’s margins perform in Q4 2025?

A: Gross and net margins increased 360 and 130 basis points year-over-year respectively, driven by higher MI350 GPU sales and increased data center revenue mix. Data center operating margins reached 32.6%, the highest since Q1 2022.

Q: What is Phillip Securities Research’s recommendation?

A: Phillip Securities Research upgraded AMD to BUY from ACCUMULATE while maintaining the target price at US$280, reflecting confidence in the company’s growth trajectory and competitive positioning.

Q: How did AMD’s client PC business perform?

A: Client PC revenue rose 34% year-over-year to $3.1 billion, marking the tenth consecutive quarter of growth. Ryzen CPU sell-through grew by more than 40% year-over-year with major customer wins across multiple industries.

Q: What contributed to AMD’s market share gains?

A: AMD gained server CPU market share from Intel, whose performance was constrained by supply issues. In the data center, hyperscalers like AWS and Google launched more than 230 new AMD instances compared to 100 instances in the previous year.

Q: Were there any notable regional sales?

A: Yes, AMD recorded US$390 million of MI308 sales to China, representing 4% of Q4 2025 revenue, which was previously not included in company guidance.

This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst.

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.