Key Takeaways

- AI is a rapidly growing industry, projected to exceed US$1 trillion by 2030, with applications across healthcare, finance, and manufacturing.

- Investment opportunities exist in AI hardware, software, and specialised applications, but they come with risks such as regulatory challenges, ethical concerns, and market volatility.

- Strategic investing in AI requires a focus on responsible investment practices, diversification, and staying informed about industry developments.

- AI’s transformative potential is reshaping industries, offering new possibilities for innovation and long-term growth.

The AI Investment Frontier

Artificial Intelligence (AI) is no longer confined to the realm of science fiction. It has emerged as one of the most transformative forces of the 21st century. From automating mundane tasks to revolutionising industries such as healthcare, finance, and manufacturing, AI is driving unprecedented levels of efficiency and innovation. As a result, it has become a focal point for investors seeking to capitalise on its expansive potential.

This market journal aims to provide a comprehensive exploration of the AI ecosystem, delving into its origins, the intricate web of technologies and supply chains that fuel its growth, and the strategies businesses are employing to harness its power. By understanding the building blocks of AI, from cutting-edge algorithms to the global networks of hardware and cloud infrastructure, investors can gain valuable insights into this dynamic and rapidly evolving field.

Through this journey, we will also spotlight the leading companies and key sectors poised to benefit from the ongoing AI revolution. Whether you are a seasoned investor or new to the space, we will equip you with the knowledge to navigate the opportunities and challenges within the AI industry, making a compelling case for its role in shaping the future of global innovation and investment strategies.

From Humble Beginnings to a Revolutionary System

So, when was AI first conceptualised? How did it come about?

Shown above on the left: Marvin Minsky, Claude Shannon, Ray Solomonoff and other “founding” scientists at the Dartmouth Summer Research Project on AI

On the right: A proposal for the Dartmouth Summer Research Project on AI

Source: ResearchGate

To answer this, we have to head back to a landmark event in 1956, the Dartmouth Summer Research Project on Artificial Intelligence, widely considered the birthplace of AI as a field of study. It was during this event that the term “Artificial Intelligence” was also first coined.

This was the first formal gathering to discuss the possibility of creating machines with an ability to “think”, and the researchers speculated that “every aspect of learning or any other feature of intelligence can, in principle, be so precisely described that a machine can be made to simulate it.”. This marked the beginning of groundbreaking explorations into areas such as problem-solving, natural language processing, and reasoning—concepts never previously undertaken for machines.

While we discuss the history of AI, we cannot overlook one individual who inspired generations of researchers to pursue the field – the father of computer science and AI, Alan Turing.

The Turing Machine and the Turing Test had two major impacts on the field:

- The Turing Machine (although theoretical) provided the mathematical foundation for programmable computers.

- The Turing Test—which still remains a significant philosophical and practical benchmark—helped define the ultimate goal of AI: creating machines capable of exhibiting intelligent behaviour indistinguishable from humans.

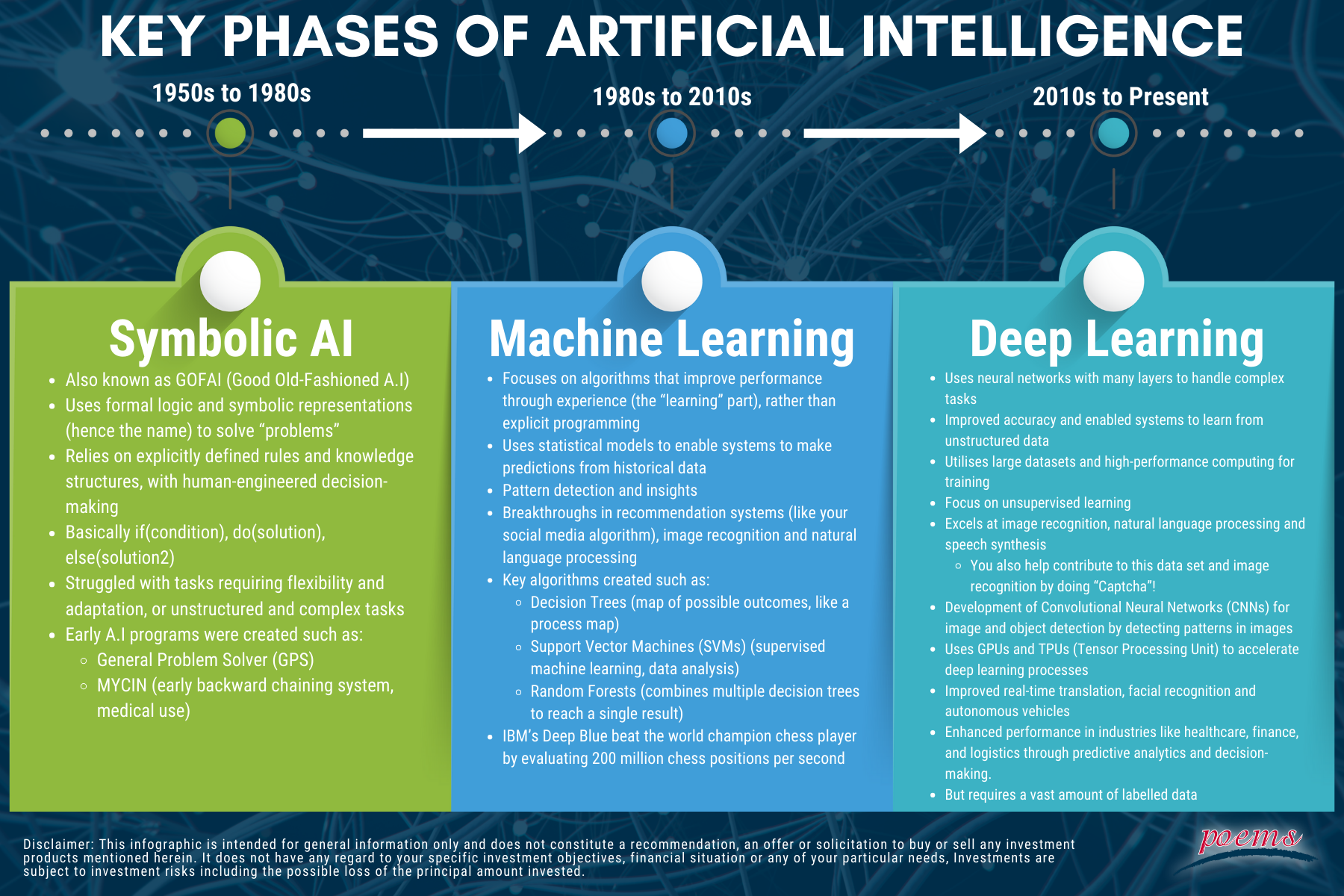

Key Phases of Artificial Intelligence

The Breakthroughs

With numerous ground-breaking achievements, AI has continuously pushed the boundaries of what is possible. Below are some of the most notable advancements in AI history:

AlphaGo

AlphaGo was developed by Google DeepMind, to play the board game “Go”, and is a reinforcement learning-based AI system. After it made headlines by defeating human players including Lee Sedol (one of the greatest “Go” players), it demonstrated two things:

- the power of deep reinforcement learning and Monte Carlo Tree Search (MCTS) in solving complex decision-making problems

- fields such as robotics and logistics could utilise reinforcement learning to improve

GPT: Generative Pre-trained Transformers

Ever wondered what the GPT in ChatGPT stood for? As seen in the header, the GPT models developed by OpenAI, represents a growth in natural language processing (NLP). GPT models can generate coherent and relevant text, write code and even interact conversationally similarly to how a human would. This innovation has driven two significant trends:

- the adoption of AI in marketing and software development, revolutionizing content creation and automation

- provided the groundwork for advanced application such as document analysis, personalisation and generation of creative content

Advancements in Natural Language Processing (NLP)

How does AI understand our instructions and produce meaningful results? This is where NLP comes in – a subset of AI focused on enabling machines to interpret and generate human language. Many large breakthroughs have been developed which allows models such as ChatGPT (which was also used sparingly to help this author understand AI) process text at unprecedented levels of accuracy, never seen before in the history of AI development.

Some key developments include:

- BERT (2018): Which stands for Bidirectional Encoder Representations from Transformers by Google. This allowed better understanding of words in text format, and contextual understanding, making question answering possible and more complete.

- Transformers (2017): Not the robots, but the transformer architecture that forms the backbone of most modern NLP systems, including GPT and BERT

- T5 and mT5: Not the trading tool, but Google’s Text-to-Text Transfer Transformer which successfully showed the versatility of unifying NLP tasks into a single framework.

The Future of AI Breakthroughs

These breakthroughs are currently paving the way for even more advanced processes of AI capabilities and creating more applications across industries. By advancing reinforcement learning, generative AI models and NLP, these technologies can also be developed and implemented into many different fields such as healthcare, finance, customer service and some creative industries, which also creates investment opportunities.

What’s Next?

In Part 2 of this three-part article, we’ll explore the anatomy of the AI industry and the companies driving this complex ecosystem.

Stay tuned!

Start trading on POEMS! Open a free account here!

With our newly launched POEMS Mobile 3 Trading App

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.