Table of contents

- Introduction

- US Extended Hours

- Benefits of US Extended Hours

- Summary

Introduction

With globalisation and technological advancements, stock trading has become highly accessible worldwide. However, the regular US trading hours, fixed from 10.30pm to 5.00am SGT (9.30pm to 4.00am SGT during Daylight Savings Time), can be inconvenient for many investors, especially in the APAC region, which operates in a different time zone. This inconvenience led to the implementation of extended trading hours, both before and after the regular market sessions, in the 1990s.

US Extended Hours Trading

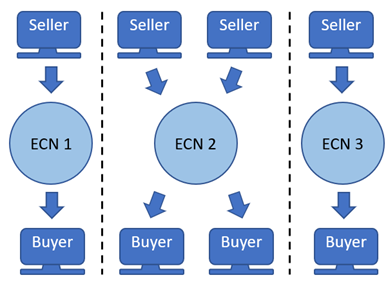

The key difference between US extended hours and regular trading hours lies in the manner of execution. During regular trading hours, trades must adhere to the National Best Bid and Offer (NBBO), ensuring the best execution practice. In contrast, during extended hours, trades occur primarily on various Electronic Communication Networks (ECNs), which are not bound by NBBO regulations. This can result in price variations across different ECNs, as they operate independently. Although trades during extended hours must still be reported to FINRA, ECNs are typically isolated, leading to potential discrepancies in prices as orders are routed to separate networks.

Illustration of ECNs Network

Illustration of ECNs Network

Benefits of US Extended Hours

Why are US extended hours so favourable among investors? Significant price movements often occur during these hours due to news releases and earnings reports. Popular stocks like NFLX, TSLA, and NVDA have experienced overnight jumps and falls of 10-20% following their earnings reports, leading to substantial gains for those with long or short positions.

Source: Bloomberg 22 July 2024

Source: Bloomberg 22 July 2024

As highlighted in green on the Bloomberg snapshot, the exponential gaps represent breakouts. These breakouts typically occur during extended trading hours due to various economic factors or news reports that drive market movement.

Trading during extended hours allows investors to capitalise on momentum as stocks may continue to rise or fall during regular market hours. This underscores the importance of extended trading hours, enabling investors to enter positions based on timely information or to capture ongoing momentum.

Investors should note that high volumes of trading usually occur from market close until 6.30am SGT (5.30am SGT during Daylight Saving Time), as most earnings and news are reported after the regular market close at 5.00am SGT (4.00am SGT during Daylight Saving Time).

However, it’s important to be well-informed while participating in extended hours trading. To learn more about extended hours trading and make the most of your investment opportunities, check out our past market journal.

Summary

In conclusion, trading during extended hours can be particularly advantageous for investors located in different time zones from the US market hours. It enables long-term investment opportunities without disrupting one’s daily schedule, especially useful for those who have work commitments the next day. However, it’s essential to be aware of the potential downsides, such as lower liquidity and higher volatility.

Excited about the potential of trading during extended hours? Don’t miss out on the opportunity to start trading on our platform! Log into POEMS now to explore the benefits of extended hours trading and take your investment journey to the next level.

For more details on extended hours trading with POEMS, visit our website or connect with our dedicated Night Desk representatives at globalnight@phillip.com.sg or (+65) 6531 1225. Start investing smarter with POEMS today!

Open an account and trade the US market today!

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.