The Hang Seng (HSI) and China (CSI300) index posted gains of 17.67% and 14.68% respectively in 2024, making them top performers year to date in 2025. With further rallies of 25.48% (HSI) and 4.84% (CSI300) at the time of writing, the key question for investors is whether it is time to take profit or double down and stay invested for the long term?

To understand this market momentum, let’s look at some of the main driving factors for this recent upbeat:

- Government Support for Private Sector: Chinese President Xi Jinping’s recent meeting with top business executives, including Alibaba’s co-founder Jack Ma on 17 Feb 2025, sparked optimism in the private sector. This move aims to revive business and consumer confidence, particularly in the technology sector, (to add reason why tech sector).

- Advancements in Artificial Intelligence: The introduction of DeepSeek’s low-cost AI language model has invigorated China’s tech industry. The Hang Seng Tech Index surged by nearly 20% recently, which reflects investor confidence in the sector’s growth potential.

- Takeaway from China’s ‘two sessions’: Clear targets for the year 2025 emerged from the recent ‘Two Sessions” with policymakers addressing concerns plaguing China’s economy especially consumer demand’s weakness and house prices.

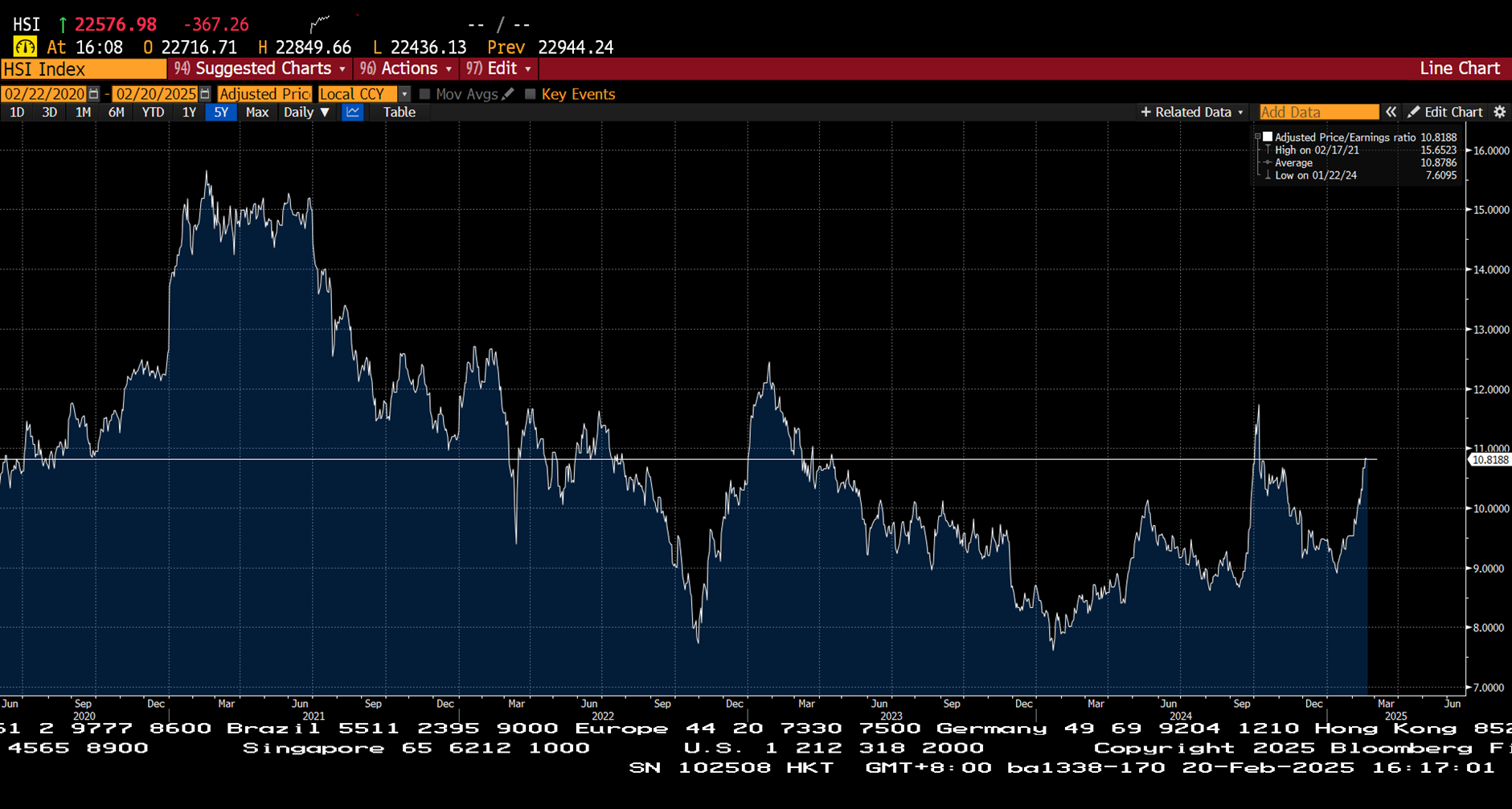

- Global Trade Tensions Drive Interest in Chinese Equities: Amid ongoing trade tensions and recession concerns linked to US President Donald Trump’s aggressive trade policies, global investors are seeking refuge in an unexpected market: Chinese equities. Attractive valuations in Hong Kong and China markets have further amplified their appeal.

Top AI related stocks listed in Hong Kong

| Stock | YTD Return (%) | Forward P/E | Analysts Average Target Price (HK$) | Potential Upside (%) | Last Traded Price (as of 19 March 25) |

| Alibaba(9988.HK) | 71.03 | 15.11 | 150.96 | 6.83 | 141.1 |

| Xiaomi(1810.HK) | 67.10 | 51.81 | 49.75 | -14.22 | 58.2 |

| Tencent(0700.HK) | 28.87 | 19.46 | 537.23 | -0.6 | 540 |

| Meituan(3690.HK) | 14.95 | 20.45 | 205.41 | 17.51 | 175.9 |

| JD.COM(9618.HK) | 29.87 | 9.84 | 203.98 | 15.6 | 176.2 |

| Baidu Inc(9888.HK) | 20.01 | 10.46 | 107.06 | 7.9 | 99.2 |

Source: Yahoo Finance on 19 Mar 2025

VS Global Counterparts

Figure 1. HSI trading at 5 years average P/E ratio

Figure 1. HSI trading at 5 years average P/E ratio

Figure 2. HSI (Orange Line) still considered undervalued compared to main global counterparts

Figure 2. HSI (Orange Line) still considered undervalued compared to main global counterparts

Figure 3. HSTECH (white) is overstretched for the short term, but likely to converge with the NDX (blue) in the long term.

Figure 3. HSTECH (white) is overstretched for the short term, but likely to converge with the NDX (blue) in the long term.

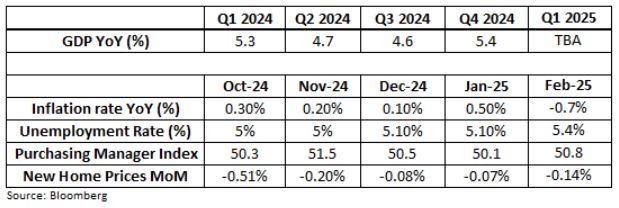

Is China’s macro environment trends reflective of recent growth?

- China’s GDP grew 5% in 2024, hitting the government’s target and outperforming expectations in Q4 2024. The government has since set a new target of 5% GDP growth for 2025

- Retail sales rose 4% year-on-year(YoY) in the January-February 2025 period, up from 3.7% YoY growth in December

- Industrial production climbed 5.9% in the first two months of 2025, slightly trailing December’s 6.2% growth, but outperforming analysts’ expectations of 5.3% in a Reuters poll

- Inflation rates remained stable in the recent months with deflationary pressures evident in the latest -0.7% reading

- While home prices are still declining, the pace of decline has moderated, signaling tentative stabilisation. Industrial output has rebounded, especially in high-tech sectors such as semiconductors and green energy, while property-related industries lagged

- Private investment is likely to remain weak in 2025, due to the overall constraints on credit growth and continued deflationary pressures in producer prices

HK IPO market going strong

On the bright side, Hong Kong is gearing up for more IPOs, adding another layer of optimism to the broader market. Notable developments include:

- Mixue Group (2097.HK): Since its listing on 3 March 2025, this stock has gained over 100% till date

- Contemporary Amperex Technology Co (CATL): Another popular company that is currently listed in China only. CATL has formally applied for a listing on the Hong Kong Stock Exchange on 11 Feb 2025 and is pending approval.

- IPO Activity Surge: According to financial data from Wind and HKEX, IPO filings on the main board of HKEX double YOY as of 3 Feb 2025. Deloitte’s Dec 2024 forecast projects of 80 IPOs in Hong Kong this year, aiming to raise an estimated sum of HK$130 billion to HK$150 billion.

To take advantage of this market, POEMS currently allow investors to trade in HK Pre-IPOs before the listing date! You can learn more about this and open an account here!

Key Takeaways

While stock prices are soaring with promising developments in the Hong Kong and China markets, underlying economic indicators reveal a mixed picture. Internal demand consumption remains weak, and while fund flows remain stable, they are not yet significant.

The recent Two Sessions on 5 Mar have definitely carved a compelling way forward for the world’s second-largest economy, but the full impact on macroeconomic data will unravel in the coming months

Diversification: The Way Forward

For investors seeking exposure to Hong Kong and China equities while managing risk, exchange-traded funds (ETFs) offer a prudent solution:

- For broad based investing, the Tracker Fund of Hong Kong (2800.HK) mirrors the performance of the Hang Seng Index, and provides diversified exposure in the Hong Kong stock market.

- For more exposure into the tech sector, especially on the AI front, the CSOP Hang Seng TECH Index ETF HKD (3033.HK) is one of the more popular ETFs.

You may also learn more about ETFs with our POEMS ETF Screener here

Specially for POEMS Users

Trade Hong Kong and China stocks with POEMS and enjoy exclusive perks! For a limited time only, we’re offering free mobile live price subscription for the Hong Kong market. Simply click subscribe on your “Market Data and Rewards” tab of your POEMS account to activate your free 3-month subscription. (renewable until September 2025)

Additionally, POEMS is one of the few platforms that offer Hong Kong Pre-IPO market trading, allowing our customers to trade Hong Kong shares one day before their official listing in the Hong Kong Exchange.

Stay ahead in the market with POEMS – your gateway to global investment opportunities!

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.