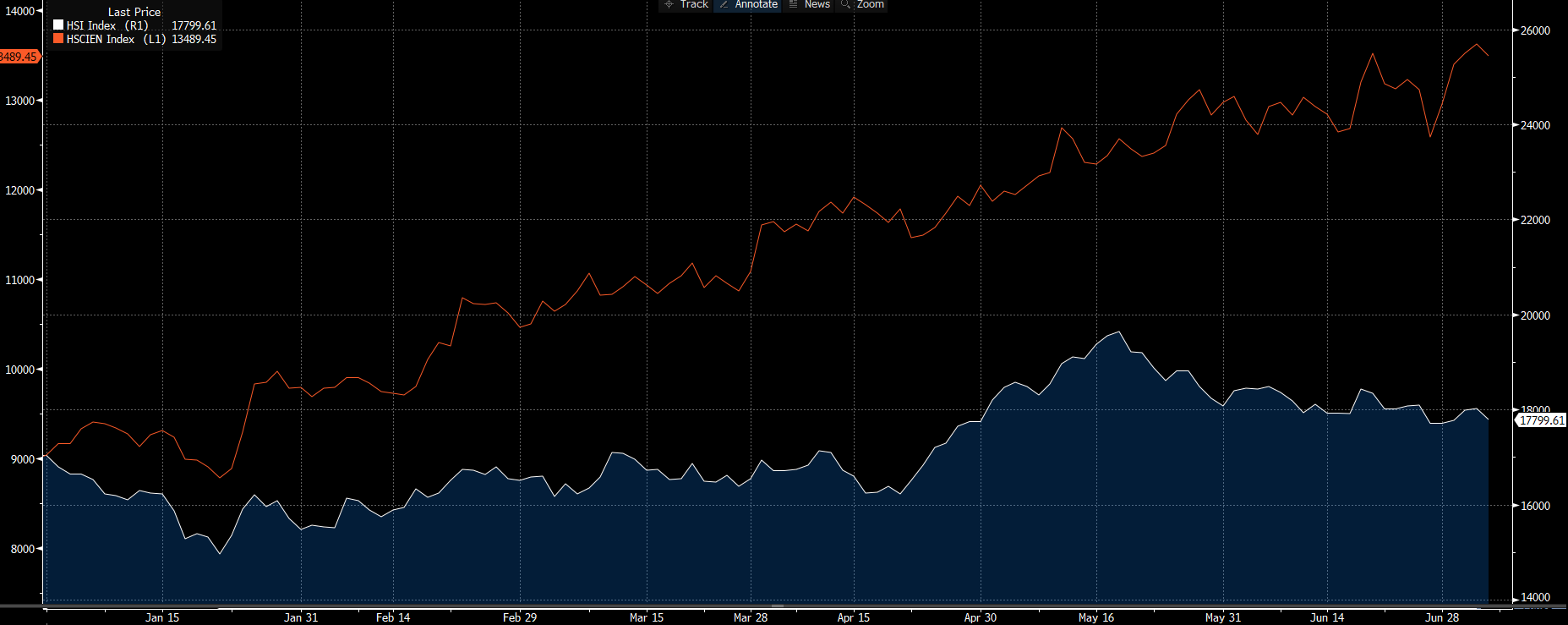

The Hong Kong market has recently experienced increased volatility. The Hang Seng Index reached a high of around 19600 before dropping 1800 points to 17800, as of the time of writing. Similarly, the Hang Seng Tech index fell from a high of around 4135 to around 3600. The slide could continue down to test the 17200 level for the HSI and 3290 level for the HSTECH.

In times of heightened volatility, purchasing value stocks has proven more relevant than ever. As part of our Value Stocks series, let’s evaluate the stocks mentioned in the previous series against their sector to see how they have performed. We will also be covering the financial, healthcare and energy sectors in this article.

HSCIIN vs 1800.HK/1186.HK

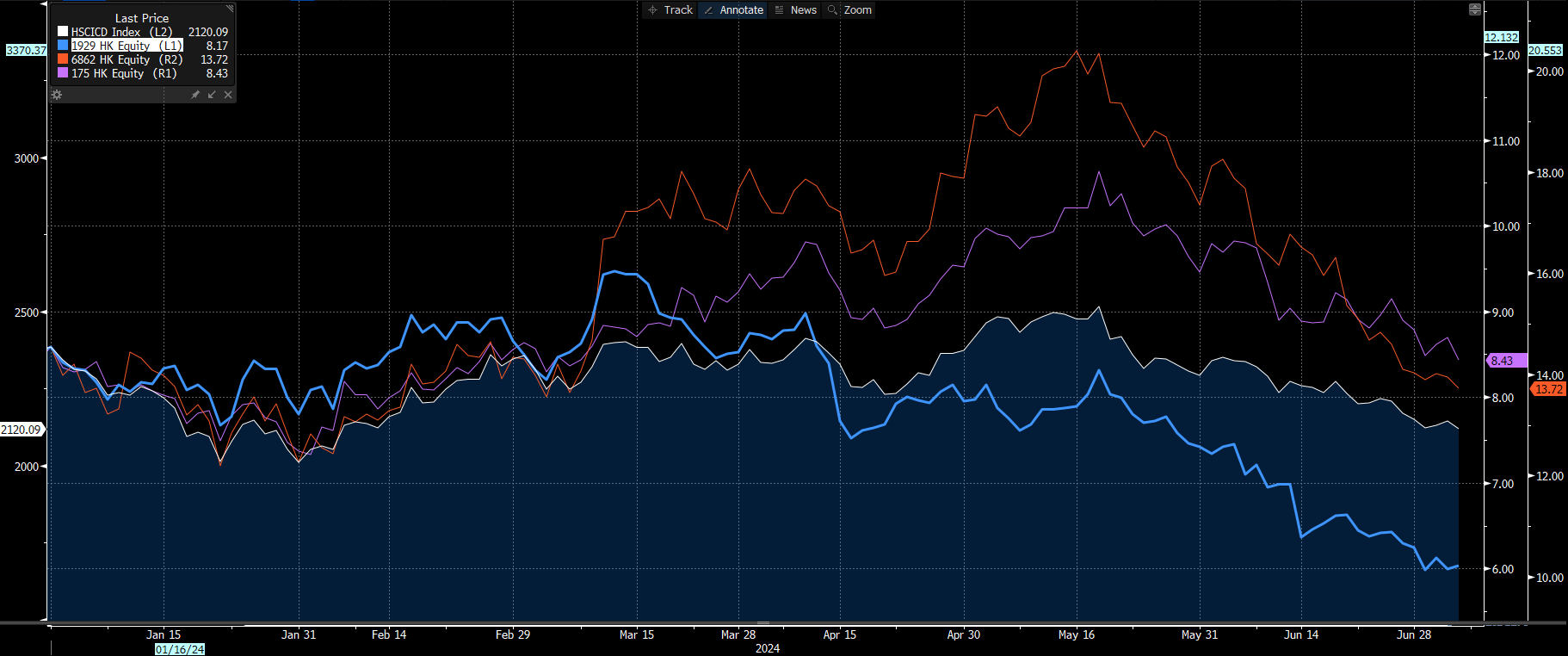

HSCICD vs 1929.HK/6862.HK/0175.HK

HSCICS vs 0288.HK/2319.HK/0151.HK

From the year-to-date charts, the majority of the individual stocks have outperformed their sector indices, with the exception of China Mengniu Dairy (2319.HK) and Chow Tai Fook (1929.HK).

Financial Sector

The financial sector encompasses firms and institutions that deliver financial services to both commercial and retail clients. This sector includes a variety of industries such as banks, investment companies, insurance firms, and real estate businesses.

The Hang Seng Composite Finance Index (HSCIFN) tracks the performance of finance companies listed on the Hong Kong Stock Exchange (HKEX). The index comprises of 49 companies, providing a comprehensive overview of the Financial sector within the Hong Kong market.

| HSI | HSCIFN | |

| P/E ratio | 9.41 | 6.30 | P/B ratio | 1.04 | 0.69 |

Source: Bloomberg as at 5 July 2024

Figure 1: Normalised data of HSI and HSCIFN

Figure 1: Normalised data of HSI and HSCIFN

In Figure 1 above, the white line represents the Hang Seng Index (HSI), while the blue line depicts the Hang Seng Composite Financial Index – Financials (HSCIFN). As observed, the HSI year-to-date (YTD) closing was at 17,885.89, while the HSCIFN was at 3142.47.

Notably, the HSCIFN has been closely tracking the HSI and slightly outperforms it.

Bank of China Limited and Industrial and Commercial Bank of China Limited (ICBC) are both part of the “Big 6” Banks in China. They both provide a comprehensive range of banking services including deposits, loans, foreign currency transaction, and provides its services to individuals, enterprises, and other clients.

| Bank of China Ltd (3988.HK) | IND & COMM BK OF CHINA-H (1398.HK) | |

| Consensus Rating | (17B/3H/0S) | (20B/2H/1S) | Consensus Target Price | HKD 4.12 | HKD 5.20 |

Source: Bloomberg as at 5 July 2024

According to their annual report, Bank of China’s non-performing loans (NPL) ratio is actually better than average and decreasing over time as well, and is second only to PSBC (Postal Savings Bank of China), beating out the rest of the “Big 6” banks in this aspect.

For the past 2 years, their total capital ratio has also been increasing, from 17.53% in March 2023 to 18.52% in March 2024. The total capital ratio is the measure of the bank’s ability to absorb losses and withstand losses in periods of financial duress.

Industrial and Commercial Bank of China Limited (ICBC) reported an increase of 6.49% of total assets, increase of 4.92% in total loans and advances to customers and a capital adequacy ratio of 19.21% in 1Q24 compared to the previous year.

Healthcare Sector

The healthcare sector includes businesses that offer medical services, produce medical equipment or drugs, provide medical insurance, or otherwise support healthcare delivery to patients.

Economically, healthcare markets are characterised by several distinct factors. Government intervention in these markets is extensive, partly due to these economic characteristics. The demand for healthcare services is highly price inelastic, meaning that the demand is insensitive to changes in price. Both consumers and producers face significant uncertainties regarding needs, outcomes, and costs of services. Additionally, patients, providers, and other industry participants have widely asymmetric information which often leads to principal-agent problems.

The Hang Seng Composite Financial Index – Healthcare tracks the performance of healthcare companies listed on the Hong Kong Stock Exchange (HKEX), which comprises 85 companies. This metric helps investors and analysts gauge the overall health and trends of the healthcare market in Hong Kong, offering insights into potential investment opportunities within this vital sector.

| HSI | HSCIH | |

| P/E ratio | 9.41 | 38.78 | P/B ratio | 1.04 | 1.58 |

Source: Bloomberg as at 5 July 2024

Figure 2: Normalised data of HSI and HSCIH

Figure 2: Normalised data of HSI and HSCIH

In Figure 2 above, the white line represents the Hang Seng Index, while the blue line represents the Hang Seng Composite Financial Index – Healthcare (HSCIH). Initially, the two indices moved in high correlation. However, a significant deviation has occurred, with the HSCIH underperforming against the HSI.

Sinopharm Group Co. Ltd. provides pharmaceutical supply chain services. The Company offers pharmaceutical manufacturing, pharmaceutical distribution, medical devices marketing, logistics and delivery, and other services. Sinopharm Group markets its products throughout China. Its parent company, China National Pharmaceutical Group Corp, is a state-owned enterprise under the direct supervision of the State-owned Assets Supervision and Administration Commission of the State Council (SASAC). Sinopharm has been enhancing its retail business by strengthening network layouts and expanding regional coverage. The company reported an 8.47% year-on-year revenue increase in their Pharmaceutical Distribution segment and a 7.75% growth in their Medical Device segment.

China Resources Pharmaceutical Group Limited operates as a pharmaceutical company. The Company researches, develops, manufactures, and distributes Chinese, western, and other medicines and health foods. Operating under the strategic “Healthy China” initiative, China Resources Pharmaceutical has increased its R&D investments and strengthened its operational efficiency through digitalisation. The company reported a revenue increase of 10.5%, a 12.7% increase in gross profit, and a 14.8% rise in revenue from its pharmaceutical manufacturing business compared to the first half of 2022. Furthermore, it has expanded digital marketing through e-commerce, live streaming, and other online channels, enhancing precision marketing and customer experience. Notably, online sales in its pharmaceutical manufacturing segment saw a year-on-year increase of 43%.

| Sinopharm Group Co Ltd (1099.HK) | CHINA RESOURCES PHARMACEUTIC (3320.HK) | |

| Consensus Rating | (16B/3H/0S) | (10B/2H/0S) | Consensus Target Price | HKD 25.84 | HKD 7.16 |

Source: Bloomberg as at 5 July 2024

HK Energy Sector

The energy sector or industry includes companies involved in the exploration and development of oil or gas reserves, oil and gas drilling, and refining. The energy industry also includes integrated power utility companies such as renewable energy and coal.

The Hang Seng Composite Industry Index – Consumer Staples (HSCICS Index) serves as a benchmark for tracking consumer discretionary companies listed on the Hong Kong Stock Exchange (HKEX), comprising a total of 31 companies within the exchange.

| CNOOC Limited (0883.HK) | CGN Power Co. Ltd (01816.HK) | China Shenhua Energy Co., Ltd (01088.HK) | |

| Consensus Rating | (19B/2H/1S) | (15B/1H/1S) | (13B/3H/1S) | Consensus Target Price | HKD 22.23 | HKD 3.16 | HKD 39.27 |

Source: Bloomberg as at 5 July 2024

The Hang Seng Energy Index – (HSCIEN Index) serves as a benchmark for tracking integrated power utility companies dealing with renewable energy and co listed on the Hong Kong Stock Exchange (HKEX). It comprises a total of 13 companies within the exchange.

| HSI | HSCIEN | |

| P/E ratio | 9.41 | 8.68 | P/B ratio | 1.04 | 1.15 |

Source: Bloomberg as at 5 July 2024

Figure 3: Normalised data of HSI and HSCIEN

Figure 3: Normalised data of HSI and HSCIEN

In Figure 3 above, the white line represents the Hang Seng Index, and the blue line represents the Hang Seng Composite Financial Index – Energy (HSCIEN). It can be observed that the energy sector does not closely follow the HIS, but rather it outperforms the index by a significant margin. This consistent upward trend might be attributed to the index’s component’s high growth rate and good performance in the recent months.

CNOOC Limited operates in the exploration and production sector. The company explores, develops, produces, and sells crude oils, natural gas products, and other products. Additionally, CNOOC provides marketing and trading services for oil and natural gas products. They have successfully reduced their all-in cost from US$28.22 to US$27.59 per barrel of oil equivalent from 1 January 2024 to 31 March 2024, alongside a strong year-over-year production growth of 9.9%, reaching 180.1 million barrels of oil equivalent.

CGN Power Co., Ltd. operates and manages nuclear power generating stations. The company manages nuclear power stations, sells electricity, and oversees the construction and management of nuclear power infrastructure. As China and the global energy industry shift towards green and low-carbon development, and with China’s goal to achieve carbon neutrality by 2060, there are broad prospects for the expansion of nuclear power.

China Shenhua Energy Company Limited is a world-leading integrated energy company primarily based on coal. Their unique integrated business model encompasses coal production, power generation, railway, port, shipping, and coal chemical operations. This synergy is key to China Shenhua’s profitability and distinctive market position. With the stabilisation of coal prices following supply-side reforms, the operating conditions of the coal industry have significantly improved, enhancing cash flow and the capacity for high dividend payouts. The company benefits from a high proportion of long-term coal sales contracts, which ensure stable performance and a focus on long-term investor returns, positioning it for potential valuation increases in the future.

Learn more about Hong Kong Value Stocks with us! You can visit our YouTube playlist here where our special guest Mr. Louis Wong, Director of Phillip Securities Hong Kong, share with us his value stocks picks!

Additionally, In line with the Hong Kong market’s potential resurgence, we are happy to announce that POEMS will be hosting a special lucky draw! Learn more about this special event from our page here! Don’t miss out on this opportunity to win while participating in the Hong Kong market’s potential upswing!

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.