Key highlights

- In 2024, Japan’s stock market experienced a remarkable rebound, with the Nikkei 225 hitting its highest point since 1989.

- This growth was fuelled by robust corporate earnings across critical sectors, including Technology, Energy Minerals, Finance, and Producer Manufacturing.

- The government introduced initiatives like tax incentives to boost dividends, while the Bank of Japan raised interest rates to manage inflation.

- JPY fluctuations affected investment strategies, particularly the carry trade.

- Overall, this environment offers promising opportunities for investors in the Japanese market.

In 2024, Japan’s stock market underwent a remarkable transformation, highlighted by the Nikkei 225 reaching a record high, a level not seen since 1989. This resurgence marked a significant turning point for Japan’s economy, driven by several key developments that reshaped the financial landscape. Strong corporate earnings were a primary driver, particularly in vital sectors such as Technology, Energy Minerals, Finance and Producer Manufacturing. Companies adeptly capitalised on increased domestic and global demand, reflecting renewed confidence in Japan’s economic outlook.

Government Initiatives and Corporate Responsibility:

The Japanese government has actively implemented policies aimed at fostering economic growth and encouraging companies to prioritize shareholder returns. Initiatives include tax incentives for businesses that increase dividends and engage in share buybacks, aiming to enhance investor confidence and attract foreign capital.

Furthermore, the recent interest rate adjustments signify a shift in the Bank of Japan’s approach to monetary policy, reflecting a commitment to stabilising the economy amidst rising inflation. These strategic moves highlight the government’s dedication to creating a favourable investment climate, encouraging companies to give back more to their investors while ensuring sustainable growth.

As Japan navigates this transformative period, investors are presented with a unique opportunity to engage with a market poised for further expansion.

The combination of record highs, sector growth, and supportive government policies creates a promising landscape for investment in 2024 and beyond.

In 2024, several key developments shaped the Japanese economy and stock market, particularly regarding the Nikkei 225, interest rates, wages, and the yen.

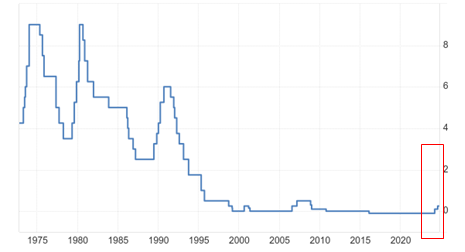

Interest Rate Hikes

First Rate Hike in March: In March 2024, the BOJ raised interest rates for the first time in over a decade, moving from -0.1% to 0%. This decision was primarily driven by rising inflation, which had begun to exceed the BOJ’s target of around 2%. The central bank aimed to curb inflationary pressures and stabilize the economy, signalling a shift in its long-standing accommodative stance.

Second Rate Hike in July: Following the initial hike, the BOJ increased the rate again in July, bringing it to 0.25%. This second adjustment was further motivated by ongoing inflation concerns and a recovering economy, reflecting the need to normalize monetary policy as economic conditions improved.

Figure 2: Japan Interest Rate

Sources: Trading Economics

Sources: Trading Economics

Japanese Yen: Navigating Volatility and Opportunities

The Japanese yen has a significant history as a global currency, often viewed as a safe-haven during market uncertainty. Its value against the U.S. dollar has fluctuated due to factors like Japan’s monetary policy, trade balances, and global economic conditions. Historically, the yen was around 360 to the dollar until the 1970s, appreciated as Japan’s economy grew, and reached about 75 yen to the dollar in 2012 amid economic turmoil.

Source: Bloomberg (Year to date through 24 September 2024)

Source: Bloomberg (Year to date through 24 September 2024)

In 2024, the yen experienced volatility influenced by the Bank of Japan’s interest rate hikes. Initially, these hikes boosted the yen’s value, reflecting increased investor confidence in Japan’s economic outlook. However, this appreciation faced challenges from global economic pressures and geopolitical tensions.

The Yen Carry Trade and Market Implications

A significant aspect of yen fluctuations is the carry trade, a popular investment strategy where investors borrow in low-interest-rate currencies, like the yen, to invest in higher-yielding assets abroad. This strategy has historically contributed to yen depreciation, as investors sell yen to acquire foreign currencies, which in turn affects the exchange rate.

Impact of Rising Interest Rates

- Unwinding Carry Trades: As the Bank of Japan raises interest rates, the cost of borrowing in yen increases. Investors who had engaged in carry trades may start unwinding their positions to avoid higher interest payments, leading to a rapid repatriation of funds back to Japan. This unwinding can create significant selling pressure on higher-yielding currencies and result in increased demand for the yen, causing its value to rise sharply

- Stock Market Reactions: A stronger yen can hurt Japan’s export-driven economy, as it makes Japanese goods more expensive for foreign buyers. Consequently, this can lead to reduced corporate earnings for exporters, negatively impacting stock prices. In a context where many companies had previously benefited from weaker yen conditions, the rapid appreciation could trigger a stock market downturn.

- Investor Sentiment: The initial confidence spurred by interest rate hikes can quickly turn to caution as markets react to the potential consequences of a strong yen. Increased volatility and uncertainty may drive investors away from Japanese equities, exacerbating declines in the stock market.

While initial interest rate hikes may boost confidence, the subsequent effects on currency valuation and corporate performance can lead to significant market corrections, highlighting the delicate balance that investors must navigate in the Japanese financial landscape.

Sector Performance:

Technology:

Tech stocks initially thrived, fuelled by innovations and significant investments in digital transformation. However, as interest rates began to rise, some growth stocks faced challenges from increased borrowing costs, prompting a revaluation of valuations in this dynamic sector.

Energy Minerals:

The energy minerals sector showed resilience amid global demand fluctuations. Companies focused on resource extraction and supply chain optimization helped drive profitability.

- Japan Petroleum Exploration Co Ltd. (1662.JP)

- Fuji Oil Co Ltd (5017.JP)

- Idemitsu Kosan Co Ltd (5019.JP)

Financials:

The financial sector experienced a significant boost from the Bank of Japan’s recent interest rate hikes. With rates rising, banks and financial institutions benefited from improved profit margins, resulting in heightened trading activity and renewed interest from investors eager to capitalise on this upward trend.

- Mitsubishi UFJ Financial Group (8306.JP)

- Sumitomo Mitsui Financial Group (8316.JP)

- Tokio Marine Holdings Inc (8766.JP)

Producer Manufacturing:

The producer manufacturing sector experienced significant growth as demand for machinery and industrial products surged. Investments in automation and efficiency improvements bolstered profitability.

Energy Minerals+23.16%Financials+21.52%Producer Manufacturing+21.35%Electronic Technology+20.28%Health Technology+19.37%Consumer Good+16.12%Communications+13.29%Process Industries+9.40%Consumer Durables+5.77%

| Sector: | YTD Return % |

| Technology Services | +32.66% |

Source: Trading view Dated 24/09/2024

Foreign Investment and Market Volatility:

In 2024, Japan saw a significant increase in foreign investment in its equities, as international investors recognized opportunities in a market perceived as undervalued compared to others globally, contributing to the upward trajectory of the Nikkei 225. However, despite periods of growth, the market experienced volatility driven by external factors such as geopolitical tensions, inflation concerns, and fluctuations in global markets, leading to cautious investor sentiment and varying trading volumes. With the Nikkei 225 reaching record highs and strong corporate earnings in key sectors, Japan presents considerable growth potential. Recent interest rate hikes indicate a favourable economic shift, while the yen’s appreciation and rising wages further stimulate consumer spending.

Seizing Opportunities in Japan’s Resilient Market

The current environment presents an opportune time to capitalise on the promising growth potential in Japan’s stock market. With strong corporate earnings, supportive government policies, and evolving economic conditions, investors can explore new avenues for both income and growth. By leveraging the right tools and insights, you can strategically position yourself to benefit from the opportunities in the Japanese market.

To help you make the most of these opportunities, POEMS offers trading in the Japan market at highly competitive rates starting from just 0.08%. Explore our rates here! For those ready to take their investing to the next level, opening a POEMS account is easy and free. Get started with your POEMS account today!

For a more comprehensive trading experience, don’t miss out on the Stock Analytics feature in POEMS Mobile 3. This tool offers in-depth insights into your favourite stocks, all in one convenient place. Discover Tokyo Electron (8035.JP) and other key stocks with Stock Analytics here.

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.