The second quarter of 2025 was marked by heightened volatility and geopolitical friction, yet also offered compelling opportunities across Japan’s equity landscape. Below is a thematic overview of Q2, incorporating key news developments and market-moving trends.

We also hosted a webinar in April in collaboration with Nomura Asset Management, providing insights into the macroeconomic environment.Watch the replay here!

Trump Tariffs Rattle Asia-Pacific Equities

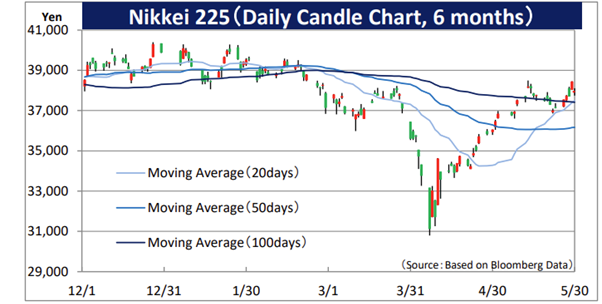

The year’s second quarter began with turmoil as U.S. President Donald Trump announced sweeping tariffs on Chinese and broader Asia-Pacific imports. On 4 Apr, Asian equity markets, including Japan’s Nikkei 225, slumped on concerns that escalating trade frictions would dampen exports and hurt corporate earnings. Stocks continued to fall on 7 Apr, as markets priced in more aggressive protectionist measures.

However, by 8 Apr, a temporary pause in Trump’s tariff escalation allowed equities to rebound sharply, with the Nikkei 225 surging nearly 6%. This brief relief rally reflected investor optimism that the worst of the trade tension had been priced in, though caution remained.

Want to learn more about tariffs and how they work? Read more here!

Market Performance & Economic Indicators

- Nikkei 225: As of 30 May, the Nikkei 225 stood at ¥37,965.10, reflecting a decrease of approximately 5.69% since the beginning of the year.

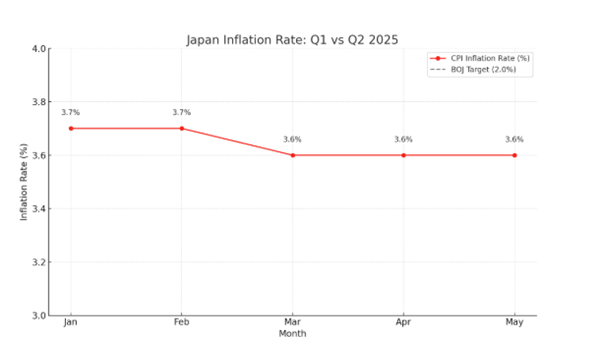

- Inflation: Japan’s core inflation rate reached 3.6% in May 2025, marking the highest level since January 2023. This surge is primarily driven by a 93.2% year-on-year increase in rice prices and a 6.9% rise in non-fresh food prices.

- Bank of Japan (BOJ) Policy: The Bank of Japan kept rates steady at 0.5% in April and May, citing global uncertainty and weak wage growth. Governor Ueda warned of rising food costs potentially pushing inflation above 2%. The next policy decision is set for 17 Jun.

- Yen Exchange Rate: The Yen’s resilience at ¥144.44 reflects a tug-of-war between bearish fundamentals (debt, yield concerns, rate differentials) and supportive factors (policy credibility, U.S. dollar weakness, and BOJ signals).

- Looking Ahead: If inflation persists and the BOJ takes even incremental steps toward normalisation, especially in H2 2025, the Yen may find further support, although major appreciation would likely be capped unless global rate dynamics shift more significantly.

Sector Highlights and Corporate Developments

Technology & Semiconductors

SoftBank Group (9984.JP) announced a US $6.5 billion acquisition of the US-based chip designer Ampere Computing. Ampere’s energy-efficient ARM-based processors cater to AI and cloud computing workloads, aligning with Japan’s strategic interest in advanced chip technologies.

Tokyo Electron (8035.JP) saw an 18% rise in equipment orders, driven by robust demand for AI and 5G production capacity. The company remains a critical supplier in the global semiconductor supply chain.

Renesas Electronics (6723.JP) acquired Sequans Communications, a leader in cellular IoT chips, strengthening its 5G and edge connectivity portfolio.

Why it matters:

These developments reflect Japan’s strategic push to regain leadership in semiconductors, with SoftBank advancing AI chip innovation and strong momentum from Tokyo Electron and Renesas in 5G and chip demand, positioning Japan to capitalise on the next wave of digital transformation.

Financials & Insurance

Mitsubishi UFJ Financial Group (8306.JP) posted record quarterly profits, boosted by improved lending margins and currency gains from a weaker Yen. The results mark a potential inflection point after years of margin compression under ultra-low rates.

Dai-ichi Life Holdings (8750.JP) acquired a £550 million stake in UK-based asset manager M&G. The move underscores a strategic push to diversify earnings and gain international exposure amid Japan’s aging demographic and saturated insurance market.

Why it matters:

MUFG’s record profits mark a potential shift for Japan’s financial sector, long constrained by low interest rates, while stronger bank earnings may ease pressure on the BOJ’s ultra-loose policies. Dai-ichi Life’s overseas expansion highlights insurers’ move to diversify beyond Japan. Together, these trends signal broader structural changes in response to evolving global conditions.

Automotive & EVs

Honda (7267.JP) reported a 42% year-on-year profit decline, citing high EV development costs and sluggish demand.

Toyota (7203.JP) committed ¥1.2 trillion to develop solid-state batteries, targeting mass production by 2027. These next-gen batteries offer higher energy density and faster charging, potentially transforming EV economics and consumer adoption.

Why it matters:

Honda’s profit decline underscores the financial strain legacy automakers face amid the EV transition, while Toyota’s major investment in solid-state batteries signals a bold bet on next-gen technology that could reshape the industry and secure a long-term competitive edge.

Want to learn more about these counters? Login with your POEMS account to use our Stock Screener and Technical Insights!

Q3 2025 Outlook: What to Watch

As Japan enters Q3 2025, several factors will shape the equity market’s direction:

- BOJ Policy Signals

- Trade Friction

- Tech & Innovation Momentum

- Currency Watch

- Earnings Season Cues

The central bank’s June meeting will be critical. Markets will watch closely for changes to interest rate guidance or asset purchases, especially if inflation stays above the 2% target. A gradual normalisation path could support the Yen but may weigh on rate-sensitive sectors.

The risk of renewed US tariffs remains a key overhang. Export-driven sectors—autos, machinery, and technology—may remain sensitive to trade headlines. Any escalation or resolution could trigger rapid sentiment shifts.

The AI boom and semiconductor buildout show no signs of slowing. Japan’s aggressive push via corporate investments (SoftBank, Tokyo Electron, Renesas) positions it favourably. Q3 may bring more M&A activity and further gains in tech-heavy indices.

If US inflation data cools and the BOJ signals policy shifts, the Yen may appreciate further. A stronger yen would ease import costs but could pressure exporters, making forex dynamics a key macro pivot.

As Q2 earnings roll in throughout July, investor focus will be on margin resilience, cost management, and capital allocation. Sectors such as insurance, machinery, and tech may deliver solid results, while consumer and auto names could remain mixed.

Conclusion

Despite external headwinds and policy uncertainty, Japan’s corporate sector is demonstrating agility and strategic clarity. With foundational shifts underway in technology, finance, and mobility, Q3 may offer opportunities for investors aligned with Japan’s long-term transformation. The balance of monetary caution and structural innovation will remain central to performance in the months ahead.

Start trading on POEMS!Open a free account here!

POEMS’ award-winning suite of trading platforms offers investors and traders more than40,000 financial products across global exchanges.

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

References:

- [1] BOJ’s Ueda calls for vigilance over food inflation risks | Reuters https://equalsmoney.com/economic-calendar/events/boj-interest-rate-decision

- [3] https://group.softbank/en/news/press/20250320

- [4] https://www.reuters.com/world/middle-east/yen-drifts-ahead-japan-bond-auction-dollar-steady-2025-05-28/

- [5] https://www.tipranks.com/news/company-announcements/mitsubishi-ufj-reports-record-profits-amid-challenges

- [6] https://asia.nikkei.com/Business/Business-deals/Japan-s-Dai-ichi-Life-to-acquire-15-stake-in-British-insurer-M-G

- [7] https://www.channelnewsasia.com/east-asia/honda-forecasts-70-cent-net-profit-drop-tariff-impact-5126336

- [8] Tokyo Electron Sales Surge 41% on AI Chip Equipment Demand | JAKOTA News

- [9] Renesas to Acquire Cellular IoT Technology Leader Sequans Through Tender Offer

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

CFD Disclaimer

This promotion is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at https://www.poems.com.sg/) before trading in this product.