Company Overview

OUE REIT is a Singapore-listed real estate investment trust that owns and manages a portfolio of prime commercial properties, primarily focused on Grade A office buildings in Singapore’s Central Business District and other key markets including Australia. The REIT has established itself as a quality operator of premium commercial assets with strong tenant relationships and strategic positioning in prime locations.

Strong Financial Performance Drives Outperformance

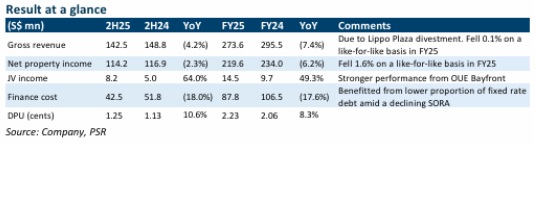

OUE REIT delivered impressive results with 2H25/FY25 distribution per unit (DPU) of 1.25/2.23 Singapore cents, representing growth of 10.6%/8.3% year-on-year and significantly beating expectations at 62.5%/111.5% of FY25 forecasts. This outperformance was primarily driven by a substantial 21% year-on-year decline in FY25 finance costs, enhanced operational performance in the commercial segment, and a remarkable 49.3% year-on-year increase in joint venture contributions.

Commercial Segment Demonstrates Resilience

The commercial segment showed robust fundamentals with like-for-like revenue and net property income growing 3.9% and 5.4% year-on-year to S$173 million and S$130 million respectively in FY25, excluding Lippo Plaza Shanghai. The office portfolio maintained exceptional occupancy at 95.4% with positive rental reversions of 9.1%, clearly indicating a flight-to-quality trend favouring prime CBD assets. This strong performance extended to OUE REIT’s joint venture operations, with OUE Bayfront earnings surging 49.3% year-on-year to S$14.5 million in FY25.

Investment Recommendation and Strategic Outlook

Phillip Securities Research maintains a BUY recommendation with an upgraded target price of S$0.45, increased from the previous S$0.40, reflecting improved risk profile following the Lippo Plaza Shanghai divestment and warranting a lower cost of equity of 6.3%. At FY26 expected dividend yield of 6.2% and price-to-NAV of 0.64x, the valuation remains compelling. As OUE REIT embarks on its Phase 3 Value Creation Journey, management is expected to focus on strategic asset recycling to redeploy capital from mature assets into similar risk-adjusted properties with higher yields.

Frequently Asked Questions

Q: What drove OUE REIT’s strong FY25 performance?

A: The outperformance was driven by a 21% year-on-year decline in finance costs, stronger operational performance in the commercial segment, and a 49.3% year-on-year increase in joint venture contributions.

Q: How did the commercial segment perform in FY25?

A: The commercial segment achieved like-for-like revenue and net property income growth of 3.9% and 5.4% year-on-year to S$173 million and S$130 million respectively, with office portfolio occupancy at 95.4% and positive rental reversions of 9.1%.

Q: What is Phillip Securities Research’s recommendation and target price?

A: Phillip Securities Research maintains a BUY recommendation with a target price of S$0.45, upgraded from the previous S$0.40, based on dividend discount model valuation.

Q: What factors support the upgraded target price?

A: The upgrade reflects the lower risk profile of the current portfolio following the Lippo Plaza Shanghai divestment, warranting a reduced cost of equity from 6.8% to 6.3%.

Q: How significant was the cost of debt reduction?

A: The cost of debt fell by 80 basis points year-on-year to 3.9% from 4.7%, cutting FY25 finance costs by 17.6% to S$87.8 million, with OUE REIT benefiting from higher fixed rate debt exposure during SORA decline.

Q: What is OUE REIT’s strategic focus going forward?

A: As part of Phase 3 Value Creation Journey, OUE REIT will focus on asset recycling to redeploy capital from mature assets into similar risk-adjusted assets with higher yields.

Q: What opportunity does the Salesforce Tower acquisition present?

A: The partial 20% stake in Sydney Salesforce Tower offers exposure to a prime Circular Quay location with 95%+ Grade A occupancy, limited office supply in 2026, and potential reversion upside from below-market rents with strong tenant stability.

Q: What are the key rental reversion opportunities?

A: Singapore office portfolio passing rent of S$10.97 per square foot sits 11% below S$12.30 market rate, with significant reversion potential from major leases like Deloitte’s 150,000 square feet expiring in 2026.

This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst.

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.