1. Introduction

When is the right time to invest? The truth is, timing the market is difficult, even for professionals. That’s why systematic investing strategies like Dollar-Cost Averaging (DCA) and Dollar Value Averaging (DVA) are popular. These approaches take the guesswork out of investing, helping you stay consistent and focused on long-term growth.

In this article, we’ll explain how you can apply DCA and DVA to your own investment journey.

2. What is Dollar-Cost Averaging?

DCA is the investment strategy of investing a fixed amount of money at regular intervals, regardless of the price or market conditions.

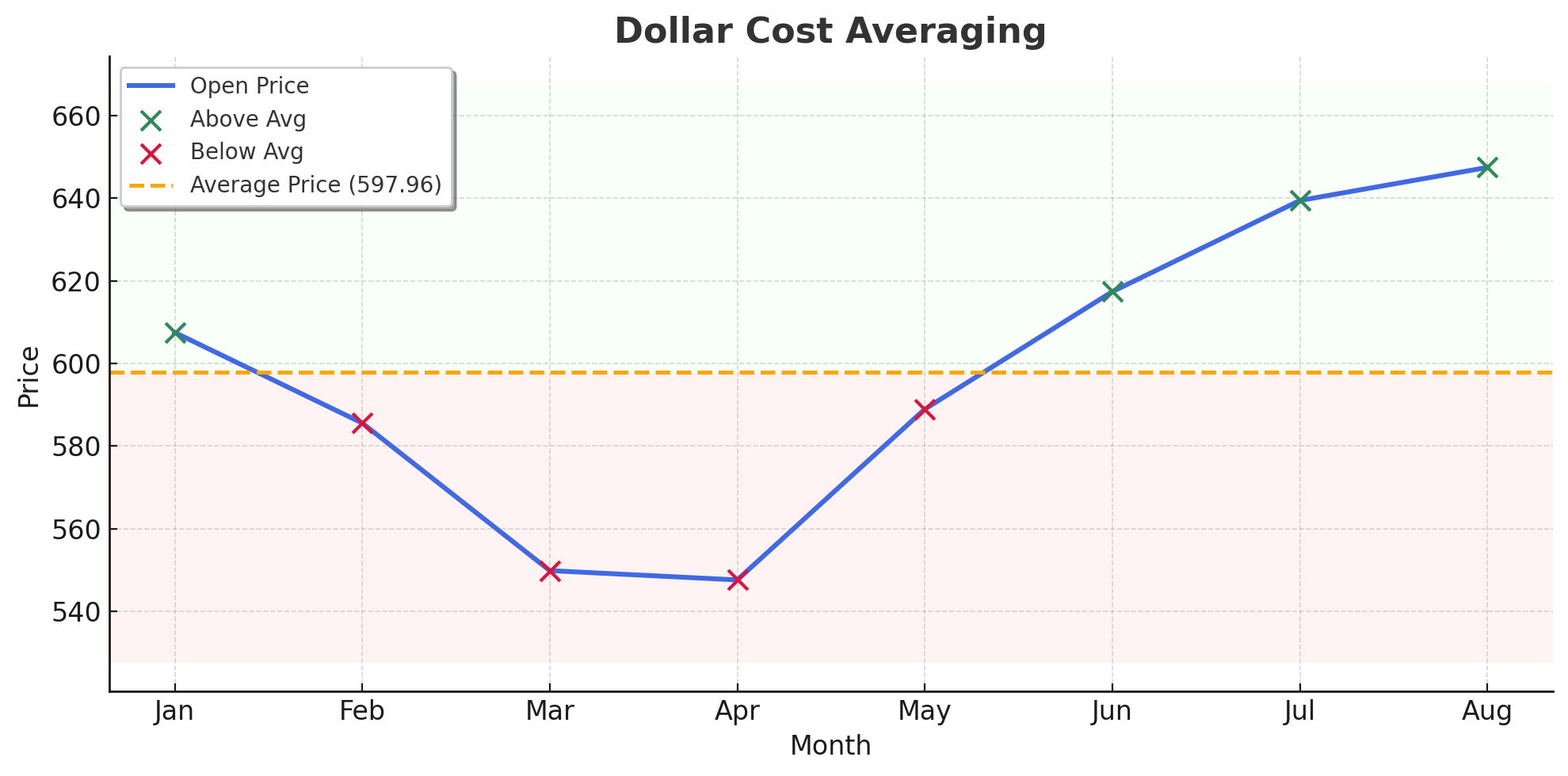

Let’s look at an example of the results of investing US$500 at the end of each month in the SPDR S&P 500 ETF Trust (SPY) from Jan to Aug 2025:

Dollar Cost Average (DCA) Chart

Dollar Cost Average (DCA) Chart

As of 25 Sep 2025, the market price stands around US$657.94, while the average cost price at month-end based on the above DCA example is US$597.96, registering an approximate 10% growth on the US$4,000 invested.

By spreading your investments over time, DCA reduces the risk of investing all your money at the wrong moment. It also encourages discipline, since contributions are made consistently regardless of short-term market fluctuations.

This strategy is especially suitable for investors who prefer a straightforward, recurring approach that works well with a fixed monthly budget, without needing to monitor the market closely.

Benefits of DCA:

- Reduces the risk of investing all at once at the wrong time

- Encourages discipline with consistent contributions

- Simple to implement, especially for investors with a fixed monthly budget

3. What is Dollar-Value Averaging?

DVA takes a more active approach. Instead of investing a fixed amount each time, contributions are adjusted based on market price.

DVA adjusts contributions based on market performance—investing more when prices are low and less when prices are high—helping you to take advantage of market swings.

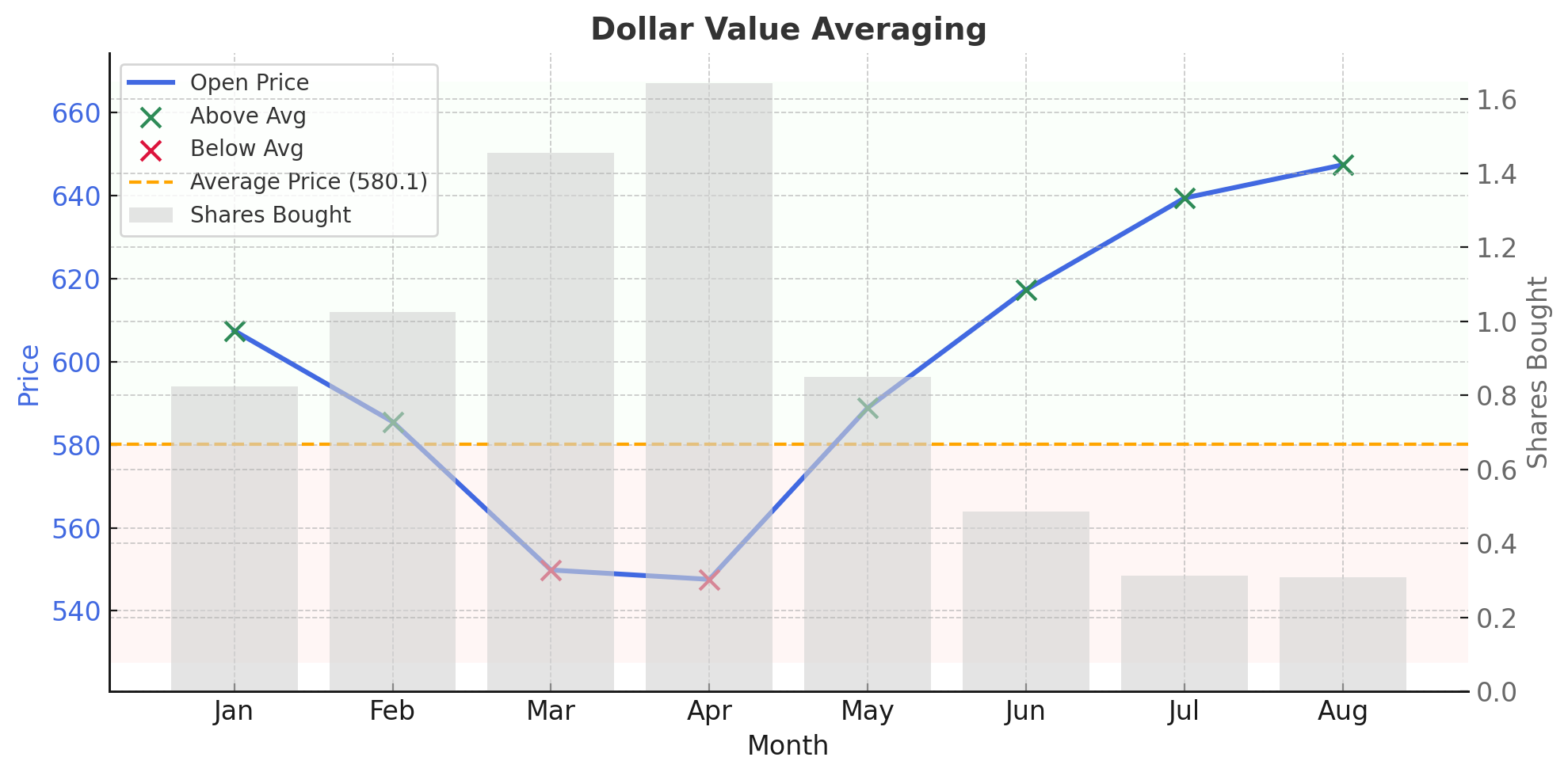

Applying this method to the earlier example of investing in the SPY from Jan to Aug 2025, the results would look like this:

| Month | Price ($) | Investment ($) | Shares Bought |

| Jan | 607.5 | 500 | 0.823 |

| Feb | 585.56 | 600 | 1.024 |

| Mar | 549.83 | 800 | 1.455 |

| Apr | 547.57 | 900 | 1.643 |

| May | 588.93 | 500 | 0.849 |

| Jun | 617.38 | 300 | 0.485 |

| Jul | 639.46 | 200 | 0.312 | Aug | 647.47 | 200 | 0.308 |

Dollar Cost Average (DCA) Chart

Dollar Cost Average (DCA) Chart

Likewise, as of 25 Sep 2025, the market price of SPY is approximately US$657.94, while the average cost per share is US$580.10, representing a total position of 6.899 shares. With a total investment of US$4,000, this corresponds to an approximate 13.48% return.

A noticeable decrease in share purchases during periods of strong upward price momentum. This strategy is particularly suitable for investors who prefer a performance-sensitive approach and are comfortable with variable contribution amounts.

Benefits of DVA:

- Adjusts contributions based on market conditions: buy more when prices are low, less when prices are high

- Potentially higher returns than DCA if consistently applied

- Suitable for investors comfortable with variable contributions and active portfolio management

4. Pros and Cons of the Different Strategies

| Strategy | Pros | Cons |

| Dollar Cost Average (DCA) | Simple and consistent; reduces emotional decisions | May underperform in steadily rising markets (opportunity cost) |

| Dollar Value Average (DVA) | More responsive to market swings; potentially higher returns | Requires monitoring and flexible cash flow; more complex |

5. Conclusion

Both investment strategies provide a structured way to invest consistently and remove the stress and uncertainty of trying to time the market. Ultimately, your choice between DCA and DVA depends on your personal financial situation, risk tolerance, and investment goals. If you prefer a hands-off, steady approach, DCA may be the right fit. If you are comfortable with actively responding to market fluctuations and seeking to optimise returns, DVA could offer additional growth potential.

Both strategies reinforce the fundamental principle of disciplined, long-term investing: consistency matters more than timing. By sticking to a systematic plan—whether through DCA or DVA — investors can navigate market ups and downs with greater confidence, gradually building a portfolio that supports their individual long-term financial goals. Check out our other articles if you’re interested in learning more about fractional shares.

Visit our website or contact our dedicated Night Desk team at globalnight@phillip.com.sg or (+65) 6531 1225.

Start investing smarter with POEMS today — open an account and trade the US markets now!

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.