Financial Results Exceed Expectations

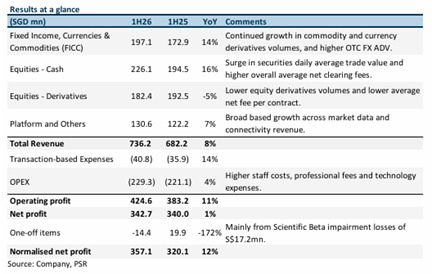

Singapore Exchange Limited (SGX) reported a solid first-half FY26 results, meeting analysts’ expectations with revenue and earnings reaching 51% and 50% of full‑year forecasts respectively. The exchange operator demonstrated resilience by achieving core operating revenue growth that successfully offset declining treasury income, highlighting the strength of its diversified business model.

Core Business Segments Drive Growth

SGX’s performance was anchored by robust growth across its primary trading segments. The Fixed Income, Currencies and Commodities (FICC) division delivered impressive 14% year-on-year growth, primarily driven by continued expansion in commodity and currency derivatives volumes alongside higher over-the-counter foreign exchange revenue. The equities segment also contributed positively with 6% revenue growth, fueled by a surge in Securities Daily Average Value (SDAV) that compensated for lower equity derivatives volumes.

However, treasury income presented headwinds, declining 14% year-on-year due to lower average yields on margin deposits as interest rates decreased. Despite this challenge, SGX maintained strong shareholder returns, increasing its interim quarterly dividend per share by 22% to 11 cents, bringing the first-half dividend to 21.75 cents, representing a 21% year-on-year increase.

Investment Outlook and Strategic Positioning

SGX operates as Singapore’s primary securities and derivatives exchange, serving as a critical financial infrastructure provider in Asia. The company has established strong market positioning through its comprehensive trading, clearing, and settlement services across multiple asset classes.

The exchange’s strategic focus on digitalisation and platform development continues to generate operating leverage benefits. Currency and commodities trading revenue increased 18% year-on-year, with currency derivatives volumes rising 18% and commodity derivatives volumes surging 24%. The OTC FX business maintained stable growth with revenue up 8% and average daily volume reaching US$180 billion, representing a 32% increase.

Looking ahead, SGX is posed to benefit from several tailwinds including Equity Market Development Programme inflows, potential trade policy uncertainty from the Trump administration, and the Federal Reserve’s monetary easing cycle, all of which should support volume growth through 2026.

Research Recommendation

Phillip Securities Research maintains an ACCUMULATE recommendation with a revised target price of S$18.30, increased from the previous S$16.90. The target price reflects a 28x price-to-earnings ratio based on FY26 estimates, up from the previous 26x multiple, positioned at two standard deviations above the five-year mean valuation.

Key Takeaways

Q: What was SGX’s dividend performance in the first half of FY26?

A: SGX increased its interim quarterly dividend per share by 22% to 11 cents. The total first‑half dividend amounted to 21.75 cents, representing a 21% year‑on‑year increase. The company maintains guidance to raise dividends by 0.25 cents per quarter until FY28.

Q: Which business segments drove SGX’s revenue growth?

A: FICC revenue grew 14% year-on-year led by commodity and currency derivatives volumes and higher OTC FX revenue, while equities revenue rose 6% from increased SDAV, partially offset by lower equity derivatives volumes.

Q: What challenges did SGX face during the reporting period?

A: Treasury income declined 14% year-on-year due to lower average yields on margin deposits as interest rates fell, creating headwinds for overall earnings momentum.

Q: How did SGX’s OTC FX business perform?

A: OTC FX revenue increased 8% year-on-year with average daily volume rising 32% to US$180 billion. SGX maintains guidance that OTC FX will contribute mid-to-high single digits to EBITDA in the medium term.

Q: What is Phillip Securities Research’s recommendation for SGX?

A: Phillip Securities Research maintains an ACCUMULATE recommendation with a target price of S$18.30, increased from S$16.90, based on 28x price-to-earnings ratio for FY26 estimates.

Q: What factors are expected to support SGX’s future performance?

A: Expected drivers include Equity Market Development Programme inflows, Preisdent Trump’s administration trade policy uncertainty, the Fed’s monetary easing cycle boosting volumes in 2026, and operating leverage from rising SDAV offsetting treasury headwinds.

Q: How did currency and commodities trading perform?

A: Revenue for these segments increased 18% year‑on‑year, with currency derivatives volumes up 18% and commodity derivatives volumes surging 24%.

This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst.

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.