Strong Financial Performance Despite Volume Decline

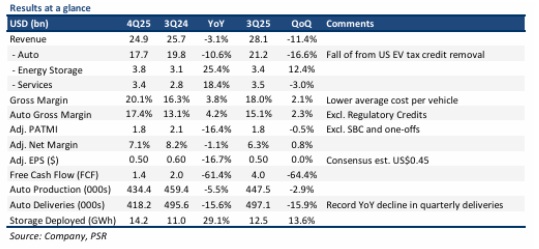

Tesla Inc. delivered mixed results in Q4 2025, with financial metrics exceeding expectations despite significant operational headwinds. The electric vehicle manufacturer reported full-year 2025 revenue and adjusted profit after tax and minority interest (PATMI) at 109% and 111% of forecasts respectively, driven primarily by higher-than-expected automotive gross margins. However, adjusted PATMI excluding stock-based compensation declined 16% due to reduced vehicle deliveries, lower regulatory credit revenue, and increased operating expenses from artificial intelligence and research and development projects.

Record Delivery Decline Impacts Core Business

Tesla’s automotive segment faced unprecedented challenges in Q4 2025, with deliveries falling to 418,000 units, representing a 16% year-over-year decline—the company’s largest quarterly drop on record. This decline stemmed directly from the removal of the US$7,500 electric vehicle tax credit, which led to higher vehicle prices and reduced consumer demand. Despite the volume decline, gross margins improved significantly by 3.8 percentage points year-over-year and 2.1 percentage points quarter-over-quarter, while average selling prices rose 6% year-over-year as the company maintained pricing power following the tax credit removal.

Non-Automotive Segments Show Promise

Tesla’s diversification efforts demonstrated positive momentum, with non-automotive revenue growing 22% year-over-year and comprising 29% of total revenue, up from 23% in Q4 2024. Services revenue increased 18% year-over-year, supported by expanding Supercharging network operations that added over 3,800 new stalls, growing the network by 19% annually. Energy generation and storage revenue surged 25% year-over-year, driven by record Megapack deployments, with plans to begin Megapack 3 and Megablock production at the Houston Mega factory in 2026.

Investment Outlook and Recommendation

Phillip Securities Research maintains a SELL recommendation with a reduced DCF target price of US$215, down from US$220 previously. The firm lowered FY26 earnings estimates by approximately 29% due to expected continued automotive delivery declines and increased operating expenses. Key concerns include ongoing headwinds from tariffs, loss of tax credits, declining market share in China where Tesla’s share dropped to 5.7% from 7.2% year-over-year, and the distant timeline for significant revenue contribution from autonomous driving, robotaxi, and robotics initiatives.

Frequently Asked Questions

Q: What was Tesla’s financial performance in Q4 2025?

A: Tesla’s Q4 2025 results exceeded expectations, with full-year revenue and adjusted PATMI reaching 109% and 111% of forecasts respectively, driven by higher automotive gross margins. However, adjusted PATMI excluding stock-based compensation fell 16% due to delivery declines and higher operating expenses.

Q: How did vehicle deliveries perform in Q4 2025?

A: Tesla delivered 418,000 vehicles in Q4 2025, marking a 16% year-over-year decline—the company’s largest quarterly drop on record. This decline resulted from reduced demand following the removal of the US$7,500 EV tax credit.

Q: What is Phillip Securities Research’s recommendation for Tesla?

A: Phillip Securities Research maintains a SELL recommendation with a DCF target price of US$215, reduced from US$220 previously, citing multiple headwinds and steep valuations of approximately 360x PE for FY26.

Q: How did Tesla’s gross margins perform?

A: Gross margins improved significantly by 3.8 percentage points year-over-year to 20.1%, driven by higher vehicle average gross profit, growth in energy storage and services segments, and increased automotive ancillary sales including FSD subscriptions.

Q: What happened to Tesla’s market position in China?

A: Tesla lost market share in China, dropping to 5.7% in Q4 2025 from 7.2% in Q4 2024, while domestic China sales fell 2% year-over-year despite the overall Chinese EV market growing 16% during the same period.

Q: How did non-automotive segments perform?

A: Non-automotive revenue grew 22% year-over-year, comprising 29% of total revenue. Services revenue increased 18% year-over-year, while energy generation and storage revenue surged 25% year-over-year driven by record Megapack deployments.

Q: What are the key risks facing Tesla?

A: Tesla faces multiple headwinds including tariffs, loss of tax credits, declining market share in China, and the distant timeline for significant revenue contribution from autonomous driving, robotaxi, and robotics initiatives, which are expected to take more than five years to materialise.

This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst.

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.