The Johor-Singapore Special Economic Zone (SEZ) and the Rapid Transit System (RTS) Link Project between Johor Bahru and Singapore have been gaining traction ever since Prime Minister Lawrence Wong’s introductory trip to Malaysia on 12 June. During his visit, he highlighted the potential of the SEZ, saying that it could unlock massive economic benefits for both countries. A full-fledged agreement is expected to be signed in September this year.

Building on this momentum, let’s explore some compelling investment opportunities that may arise.

The SEZ is poised to become the “Shenzhen of Southeast Asia,” capitalizing on its strategic location, abundant resources, and access to a young workforce. Combined with the enhanced connectivity provided by the RTS Link, these projects are set to drive significant economic growth and attract substantial investments.

Key Sectors and Investment Opportunities:

Semiconductors and Electronics:

The SEZ’s focus on the electrical and electronics sectors, coupled with Malaysia’s established reputation as a semiconductor hub, offers robust growth potential. Major players from Europe and the United States are setting up shop or expanding existing operations in Penang to build new global supply chains.

Local companies such as Pentamaster Corporation Berhad (7160.KL) and Globetronics Technology Berhad (7022.KL), with their strong presence in semiconductor assembly and testing, stand to benefit from increased investments and demand in this sector. They might consider expanding into Johor Bahru in the advent of the SEZ.

Source: MIDA

Source: MIDA

Smart Manufacturing and Data Centres:

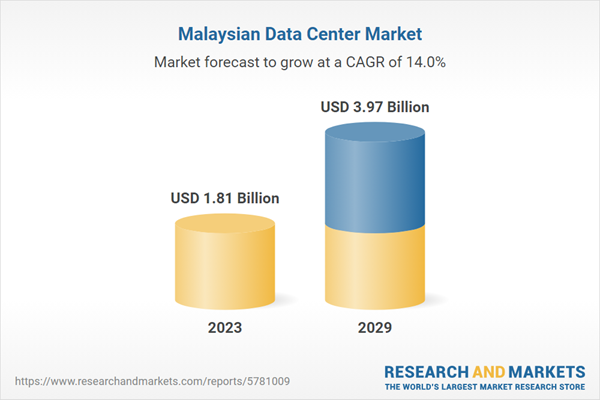

Data Centres (DC) require stable and reliable power, a consistent water supply and most importantly, robust connectivity (i.e. fibre optic infrastructure). As such, DCs are seldom built in remote areas due to the high cost involved in infrastructure development. Areas closer to the “source” are preferred. Singapore is the epicentre of DCs in Southeast Asia. As such, Johor, with its low latency access and operational advantages, is said to be in a strategic location.

According to DC Byte’s 2024 Global Data Centre Index, the city of Johor Bahru is the fastest growing data centre market in Southeast Asia. Investors can look into companies like YTL Corporation Berhad (4677.KL), which is developing the YTL Green Data Centre Park in Kulai, Johor., This park is poised to support cutting-edge AI initiatives in collaboration with Nvidia. Singtel (Z74.SP) and Telekom Malaysia (4863.KL) have also recently announced a partnership to develop a data centre in Johor, positioning southern Malaysia as a significant player in the data centre industry.

Source: Malaysia Data Center Market

Source: Malaysia Data Center Market

Medical and Aviation Sectors:

AI leverages user data and behaviour to tailor recommendations uniquely suited to individual preferences. This technology is particularly prevalent in industries such as e-commerce and entertainment.

The inclusion of medical and aviation sectors within the SEZ presents new avenues for growth. Investors can look at companies such as IHH Healthcare Berhad (5225.KL), which could leverage the SEZ’s advantages to expand its healthcare services and facilities.

Real Estate and Construction:

With the SEZ spanning six districts, significant development in real estate and construction is expected. Notable companies like UEM Sunrise Berhad (5148.KL) and Sunway Construction Group Berhad (5263.KL), known for their large-scale projects, are well-positioned to capitalise on this growth.

Sunway Construction’s project for the Yellowwood data centre in Johor, initiated in early 2023, has seen its contract value increase to RM3.2 billion. Meanwhile, UEM Sunrise Bhd is gearing up for significant developments with its 3,000 acres in Iskandar Puteri, Johor, bolstered by promising enhancements in the regional infrastructure landscape.

| Counter | Sector | P/E ratio | Div Yield (%) | Analyst Consensus | Consensus Rating |

| Pentamaster Corp (7160.KL) | IT Services | 41 | 0.4 | MYR 5.46 | (8B/2H/0S) |

| Globetronics Tech Bhd (7022.KL) | Semiconductor Manufacturing | 33.7 | 1.7 | MYR 1.26 | (0B/7H/2S) |

| YTL Corp Bhd (4677.KL) | Power Generation | 19.4 | 1 | MYR 3.70 | (1B/1H/1S) |

| Singtel (Z74.SP) | Telecommunication | 60 | 4.5 | SGD 3.19 | (17B/0H/1S) |

| Telekom Malaysia (4863.KL) | Telecommunication | 13.3 | 0.7 | MYR 7.11 | (16B/4H/2S) |

| IHH Healthcare Bhd (5225.KL) | Healthcare | 23.9 | 1.7 | MYR 7.27 | (16B/5H/0S) |

| UEM Sunrise Bhd (5148.KL) | Developer | 89.8 | 0.6 | MYR 1.05 | (2B/1H/5S) |

| Sunway Construction Group (5263.KL) | Developer | 35.6 | 1.5 | MYR 3.85 | (11B/1H/2S) |

| Eco World Development (8206.KL) | Developer | 22.1 | 3.8 | MYR 1.74 | (4B/3H/1S) |

| SP Setia Bhd (8664.KL) | Developer | 27.6 | 0.9 | MYR 1.55 | (9B/1H/5S) |

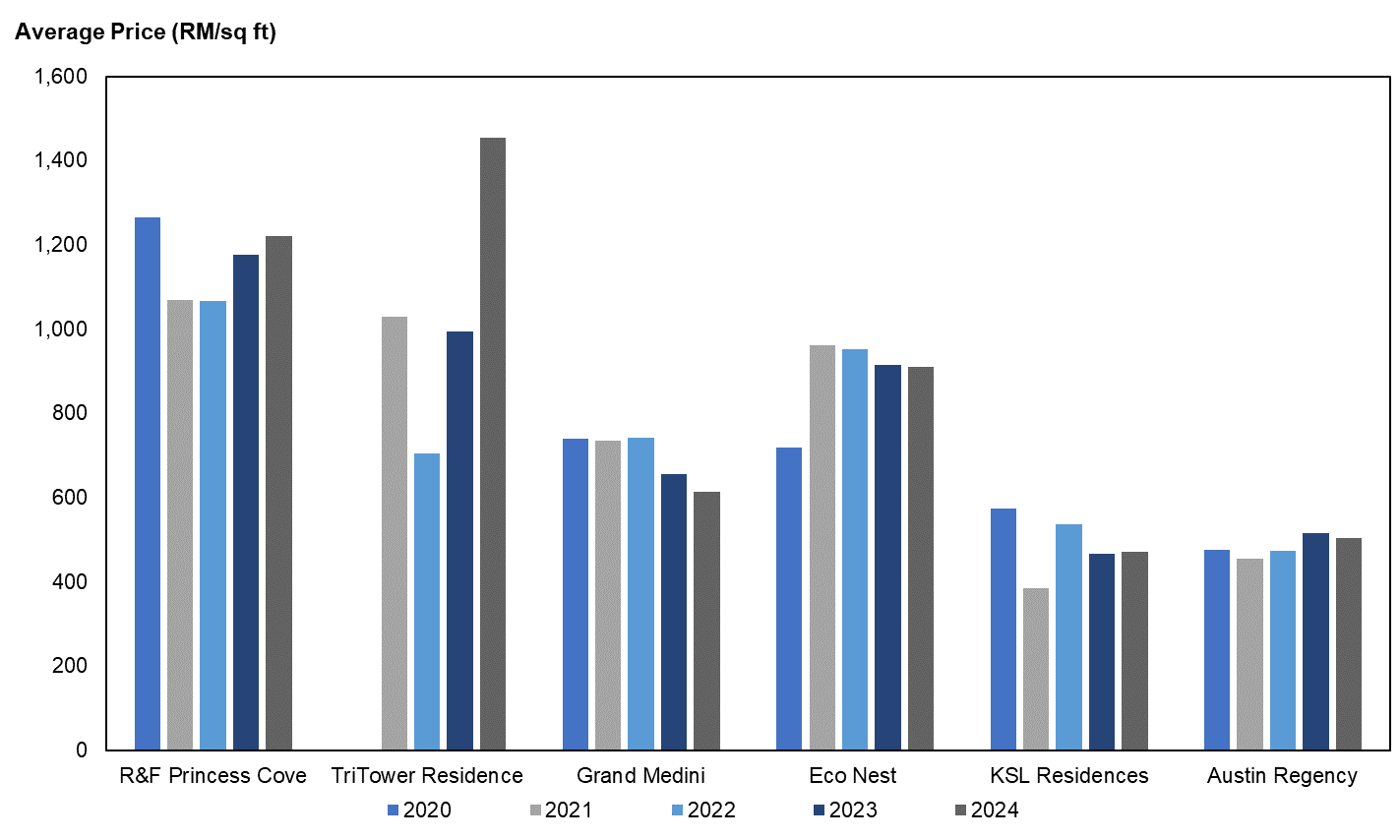

If local residential developments are what interest you. Let’s explore some summarised numbers and areas to look at and have a picture on how some of the following selected residential properties are performing:

Selected Local Housing Development:

- R&F Princess Cove by R&F Properties Co. Ltd, located near the Woodlands checkpoint, is a premier housing development known for its strategic location and high-end amenities.

- TriTower Residence @ Johor Bahru Sentral by SKS Group, also near the Woodlands checkpoint, offers modern living spaces with easy access to transport hubs.

- Grand Medini by Grand Global Medini Sdn Bhd, located near the Tuas checkpoint, is part of a larger integrated development that includes retail and office spaces.

- Eco Nest @ Eco Botanic by Eco Sky Development Sdn Bhd, another development close to the Tuas checkpoint, emphasiszes eco-friendly living within a well-planned community.

- KSL Residences @ Daya by KSL Holdings Berhad features contemporary designs and community-focused amenities, catering to both families and professionals.

- Austin Regency by Scudai Development is noted for its comprehensive facilities and prime location within a vibrant neighbourhood.

Source: Property Guru

Source: Property Guru

Real Estate Investment Ideas in Johor Bahru

Investment Rationale:

- Rapid Development and Connectivity:

- The upcoming RTS Link between Johor Bahru and Singapore will significantly enhance connectivity between the two countries. This will likely boost property values and rental demand due to easier access for commuters and increased cross-border economic activities.

- The development of the SEZ is expected to attract substantial investments, businesses, and a skilled workforce, further driving demand for both residential and commercial properties.

- Strategic Location:

- Properties situated near RTS Link stations and the SEZ, such as Bukit Chagar, Medini, and Nusajaya, are poised for substantial growth.

- Investing in these locations can offer high capital appreciation and rental yields due to increased accessibility and economic activity.

- Developer Reputation:

- Established developers like UEM Sunrise, EcoWorld, and SP Setia have a strong track record in delivering quality projects. Investing in their projects ensures reliability and potential for future value appreciation.

By investing in properties within these strategic areas, investors can leverage the anticipated growth driven by enhanced connectivity and economic development initiatives, ensuring robust returns on investment.

Connectivity and Infrastructure:

The introduction of the RTS Link will enhance Johor’s connectivity to Singapore, facilitating seamless movement of people and goods. This key infrastructure development is critical for attracting businesses and skilled labour, positioning Johor as a compelling destination for investments.

Efficient Public Transportation:

The collaboration between Prasarana Malaysia Berhad and SMRT Corporation Ltd in operating the RTS Link ensures efficient transport solutions. This partnership is expected to enhance the region’s desirability for businesses and investors, thanks to the streamlined connectivity it provides.

Strategic Synergies:

The cooperative model between Singapore and Johor offers significant strategic advantages. Singapore’s strengths in R&D, regional treasury services, and extensive free trade agreements complement Johor’s lower operational costs and expansive land availability.

Integrated Supply Chains:

Companies can optimise their operations by setting up R&D centres and sales offices in Singapore while maintaining production and logistics in Johor, thus reducing costs and improving efficiency. This model benefits both economies and strengthens the supply chain integration.

The Johor-Singapore SEZ and RTS Link Project collectively create a unique and lucrative investment landscape. By tapping into the synergies between Johor and Singapore, leveraging the enhanced connectivity, and focusing on key growth sectors, investors can capitalise on the substantial opportunities these initiatives present. This strategic investment approach not only promises significant returns but also contributes to the economic development of the region, making it a win-win scenario for investors and the local economy.

Conclusion

The strategic initiatives and infrastructural developments in Johor, such as the establishment of the RTS Link and the Singapore-Johor SEZ, are setting the stage for significant transformation in the region. These advancements not only enhance connectivity and create economic synergies between Johor and Singapore but also position Johor as a key player in Southeast Asia’s economic landscape. As these projects progress, they promise to boost property values, attract international investment, and catalyse the local economy, making Johor an increasingly attractive destination for both residential and commercial investors.

Start trading on POEMS! Open a free account here!

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.