Overcoming Volatility with Regular Savings Plan

Overcoming Volatility with Regular Savings Plans (RSP)

Other than asking what to invest in and how to invest, investors are also often concerned about having sufficient funds to invest and finding the right time to invest.

“As investors, there are times when we are fixated about timing the exact peaks and bottoms of the markets.”

However, timing the market is extremely difficult, especially during such volatile times.

Time in the Market is Better than Timing the Market

Let us show you why time in the market is important with the example below:

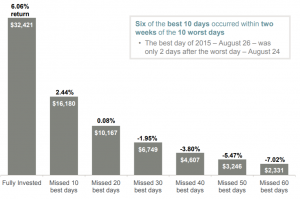

Chart 1: Performance of a $10,000 investment in S&P 500 from 3 Jan 2000 to 31 Dec 2019

Source: JP Morgan’s Guide to Retirement 2020

Assuming in year 2000, you had $10,000 to invest.

If you stay fully invested in the S&P 500 for 20 years:

- Your portfolio returns would be 6.06%

- Your portfolio value would have increased to more than $32,000 at the end of the 20-year period.

However, if you miss the 10 best days in the S&P 500 during this 20-year period:

- Your portfolio returns would have reduced to 2.44%

- Your portfolio value would have increased to approximately $16,000 only.

While there is exposure to market risks, there are also growth opportunities which you can enjoy. Especially for long-term investors, staying engaged in the market will help you to compound your wealth over time.

Don’t Let Emotions Affect You

“Then, there are emotions, and emotions are tricky.”

Decisions by emotions are usually impulsive and not based on information gathered. Investment decisions based on emotion – such as fear – is the main reason why many people are buying at market tops and selling at market bottoms instead.

Remember, having personal feelings for your investment will not improve your winning probability, but a longer investment horizon will.

So, what now?

Fret not!

“RSP(s) can help you to overcome these two stumbling blocks –

Time and Emotions.”

Instead of trying to perfectly time the market, you can have time in the market by adopting Dollar Cost Averaging (DCA).

Diversify your risk by taking advantage of DCA, buy more unit trusts when prices are low; buy less unit trusts when prices are high. This enables you to smooth out the returns and also reduce the stress in investing as you will not be required to decide whether it’s the right time to invest.

Here’s how it works:

Assuming Amy and Bob have $300 each to invest.

Amy chooses to invest all $300 in January and receives 30 units at $10/unit.

Bob however, chooses to invest $100 monthly into an RSP.

Here’s the calculations for Bob’s investment:

| January | February | March | |

| Amount Invested (a) | $100 | $100 | $100 |

| Price/Unit (b) | $10 | $5 | $8 |

| Units Received (a÷b) | $100 ÷ $10 = 10 | $100 ÷ $5 = 20 | $100 ÷ $8 = 12.5 |

| Amy’s Investment | Bob’s Investment |

| Unit Price:

$10/unit |

Average Unit Price (Total Price ÷ No of transactions)

$(10+5+8) ÷ 3 = $7.67/unit

|

| Cost of Investment:

$10/unit |

Average Cost of Investment (Total Cost ÷ No of Units purchased)

$300 ÷ 42.5 = $7.05

|

| Total Units Received: 30 | Total Units Received: 42.5 |

At the end of three months, Amy would have a total of 30 units at a cost of $10/unit.

However, with DCA, the average unit price is $7.67. Therefore, Bob would have received a total of 42.5 units, at an average cost of only $7.05/unit.

As prices fluctuate all the time, it is difficult to time the market. Adopting DCA as an investment strategy may potentially result in a lower cost per unit that is lesser than the average price per unit over time.

At PhillipCapital, the RSP begins from as low as $100*, allowing investors to start investing at affordable amounts. What’s more, you get to enjoy 0% Platform Fees, 0% Sales Charge and 0% Switching Fees when you trade via POEMS.

Visit the Unit Trust Website to learn more about Unit Trusts, RSP and the choices available for you to choose from. Begin your investment journey with us today!