Unit Trusts vs Exchange Traded Funds (ETFs) – Which is better for your portfolio?

Imagine you are dining at a nice restaurant, feeling overwhelmed by the variety of seemingly delectable dishes. However, you have a limited budget and you can only afford to order one dish.

This situation is frustratingly similar to being new to investing and overwhelmed with the variety of investment options in the market. With a limited budget, you will need to carefully weigh the pros & cons of each investment product before you make your investment decision.

What are Unit Trusts and ETFs?

Unit trusts and ETFs are both funds. In simple terms, a fund is usually a basket of assets that offers diversification to investors.

Unit Trusts: Also known as mutual funds, Unit Trusts are a form of investment for which professional fund managers pool investors’ monies together to invest in a diversified portfolio of assets. A typical unit trust consists of bonds, stocks, and other types of securities.

Fund managers aggregate the value of all the different types of assets they invest in and generate a Net Asset Value (NAV). This NAV represents the value per unit of the fund, which is also the price at which it is traded. The performance of a unit trust generally depends on the fund manager’s ability to generate returns above a benchmark index.

Exchange-traded funds (ETFs) are open-ended investment funds listed and traded on a stock exchange. They aim to track or replicate the performance of an underlying index or asset. ETFs provide access to a wide variety of markets and asset classes.

The price of ETFs is determined by the value of their underlying asset and the market demand and supply of the ETF, while their performance depends on the respective index that the ETF tracks.

What are the differences between Unit Trusts and ETFs?

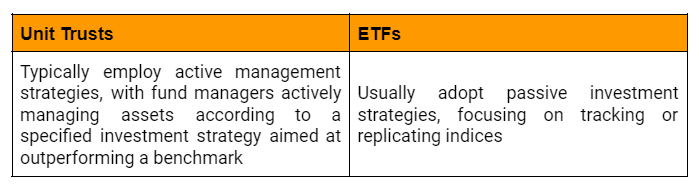

- Passive vs. Active Management

Passive Management refers to an investment style whereby the objective is to track or “mirror” an established index like the Singapore Straits Times Index (STI) or the US S&P 500 Index. This is the opposite of Active Management, which involves active screening and selection of stocks, bonds, or other securities to meet an investment objective or outperform a benchmark.

Unit trusts are typically managed by experienced fund managers who use their expertise to make discretionary investment decisions, aiming to outperform the market or a specific benchmark. In contrast, ETFs are more commonly associated with a passive management style, primarily focusing on tracking indexes.

Whether you should adopt a more active or passive approach depends on what you’re investing in and your knowledge about the markets. For example, given their smoother flow of capital, developed markets might be well-served by passively managed options. On the other hand, active management could give your portfolio an edge in emerging markets where efficiently picking stocks may have a more significant impact.

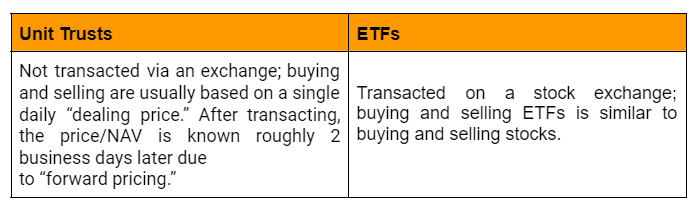

- Exchange vs. Non-exchange Trading

Unit trusts are not traded on an exchange and are “forward priced.” Forward pricing is used to determine the price of a fund’s “units” based on the end of day net asset value (NAV) of the fund. Transactions typically use a single daily “dealing price”; and the transacted price or NAV is known about two business days after the purchase is made.

As the name suggests, ETFs are traded on a stock exchange which allows for real-time price dissemination and transactions. The price of an ETF is influenced by a combination of market demand and the performance of the underlying index that the ETF is tracking.

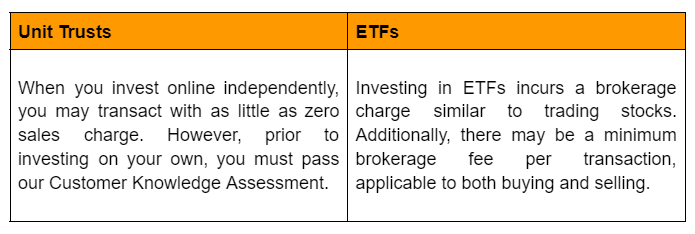

- Upfront Costs

These costs can add up, especially with smaller investment amounts. Since ETFs typically require the purchase of whole shares, frequent commission fees can chip away at your returns. In contrast, Unit trusts allow you to invest any amount, thereby minimising the impact of these fees.

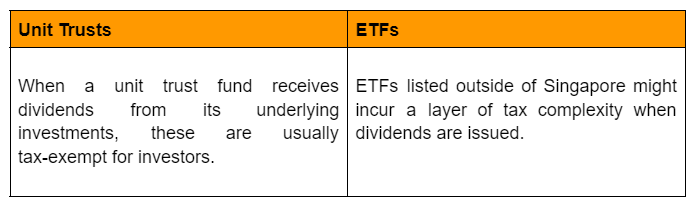

- Tax Considerations

Conclusion

If you’re a new investor in Singapore with a smaller budget, unit trust funds might be your perfect gateway to the world of investments. Their flexibility in terms of investment amount, potentially simpler tax structure, and the option for active management in specific markets make them a compelling choice. Are you ready to explore the delicious world of unit trust funds and start building your financial future?

Winshern Ho

Wealth Manager

Phillip Securities Pte Ltd (A member of PhillipCapital)