What are fixed-income funds?

In the diverse world of unit trusts, various funds employ distinct investment strategies aligned with investors’ goals and risk profiles. Each strategy offers a unique asset allocation and risk management approach tailored to specific investment objectives. In this article, we’ll cover fixed-income funds.

Fixed income investments, commonly known as bonds, are an asset class that offers regular payments to investors over a fixed interval until a predetermined maturity date. Upon maturity, investors will receive the principal amount that they originally invested. This asset class generally holds a higher claim priority compared to equity investments. When a default event occurs, any available funds that can be recovered from a bankrupt company will have to be paid to bondholders before shareholders.

A fixed-income unit trust consolidates various types of fixed-income securities into a single investment vehicle. Investing in a fixed-income fund presents several benefits, which we will discuss below:

Benefits of investing in fixed-income funds

Diversification: Instead of investing in a single bond, a bond/fixed income unit trust gives investors diversification across multiple types of securities and regions. This means that if one of the many bonds in the unit trust defaults (missing an interest or principal payment), your Net Asset Value will not be as severely impacted as if you held onto a single bond.

Professional Management: Fixed-income fund managers have the experience and knowledge to properly manage and analyse which assets to invest in. Leaning on these managers to find such investment opportunities saves investors time and effort to do their own research. As such, the reputation and track record of the fund manager should be considered when choosing which fund to invest in.

Accessibility: There are some fixed-income tools that normal retail investors do not have easy access to. These could include government treasury bills, fixed income from less accessible markets, or quasi-sovereign bonds. Fixed-income fund managers would have relationships with bond issuers, underwriters, and brokers. These relationships give managers access to unique investment opportunities at better pricing.

Income Generation: Fixed-income securities tend to pay a regular dividend, thus generating a regular stream of income for investors. By investing in a fixed income unit trust, investors could enjoy a monthly income stream compared to investing in a single bond. Most bonds only pay an income twice a year.

Liquidity: Fixed-income unit trusts offer higher liquidity compared to individual bonds, as investors can typically buy or sell fund units on any business day. This flexibility allows investors to respond more promptly to changing financial needs or market conditions.

Here are two features that you might find on the factsheet of a fixed income unit trust:

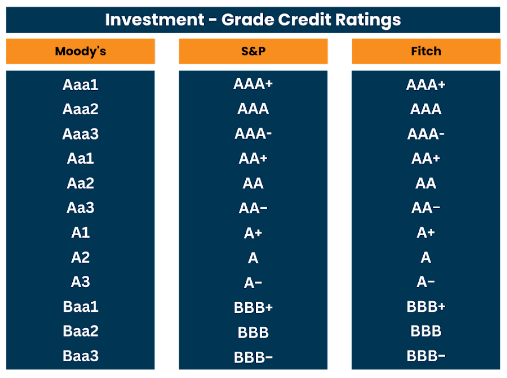

Credit Rating: Credit ratings for a fixed income unit trust is an indicator of the credit worthiness of the overall portfolio of securities within the fund. Ratings or individual fixed income securities are assigned by independent rating agencies such as Moody’s, Standards & Poor’s and Fitch Ratings. Ratings from ‘AAA’ to ‘BBB-‘ (S&P and Fitch) or ‘Baa3’ (Moody’s) denote securities considered to have a lower risk of default and thus are considered investment grade. Ratings lower than what was stated earlier denote that the security is non-investment grade. The fund manager will then issue an average rating for the overall portfolio.

Duration: Duration for fixed income unit trust is the estimation of how much the price of a bond or a portfolio of bonds is likely to fluctuate in response to an interest rate change. It is expressed as a function of years. The longer the duration, the more likely the price of the unit trust will change when interest rates change.

Risk of investing in fixed income funds

Interest rate risk: Fixed income securities are sensitive to interest rate changes. When interest rates rise, bond prices typically fall, and vice versa. Fixed income funds holding long-term bonds may be particularly vulnerable to interest rate fluctuations, potentially impacting fund performance and capital.

Credit risk: The risk that the issuer is unable to make timely interest payments and/or return the principal at maturity. Investing in funds that hold lower-rated (usually higher-yield) bonds may offer higher returns, but come with increased risk of default. It is important to do your own research and understand the regions and sectors a unit trust invests in, such as by studying the factsheet.

Learn more about fixed income at our upcoming event!

Hear from our partners, Fidelity International, Manulife Investment Management, and PIMCO, who will share their perspectives on fixed-income markets in 2024.

Sign up for the event here! https://tinyurl.com/pz8yu3c5

Conclusion

Fixed-income funds represent a fundamental component of a diversified investment portfolio, offering benefits like regular income, reduced risk, and professional management. While they are not devoid of risks, they play a crucial role in balancing portfolio performance across different market conditions. As with any investment, understanding the nuances of fixed-income funds and how they fit within your overall investment strategy is essential for achieving long-term financial success.