- Home

- UOBAM Ping An FTSE ASEAN Dividend Index ETF IOP

UOBAM Ping An FTSE ASEAN Dividend Index ETF

Initial Offering Period (IOP) from 7 to 23 January 2026

About the UOBAM Ping An FTSE ASEAN Dividend Index ETF

UOBAM Ping An FTSE ASEAN Dividend Index ETF tracks FTSE ASEAN ex REITs Target Dividend Index.

The Index aims to achieve 100% dividend yield increase compared to its underlying Index – FTSE ASEAN Index.

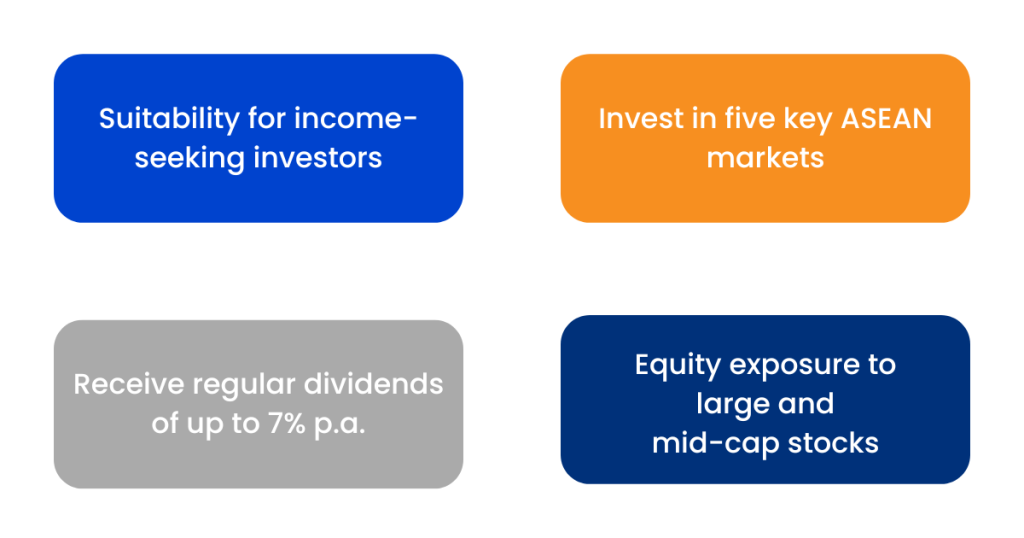

Why Invest in the UOBAM Ping An FTSE ASEAN Dividend Index ETF?

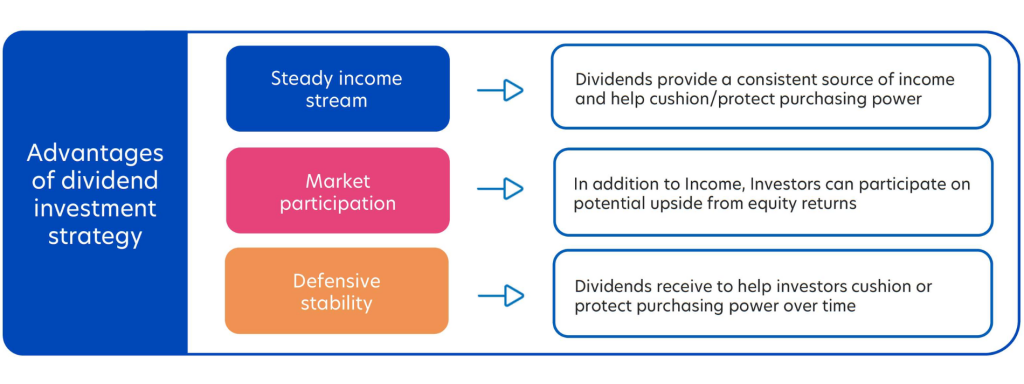

Dividend Income

It focuses on companies with strong, sustainable dividend yields which is historically a major component of total returns in ASEAN markets.

Demographic Opportunities

ASEAN is one of the world’s fastest-growing regions. Tap into its long-term growth potential, powered by a young population and a rapidly expanding middle class.

Diversification Benefits

Build a resilient portfolio with balanced exposure to both growth-oriented and mature ASEAN economies, focusing on sectors with lower cyclicality and providing portfolio diversification.

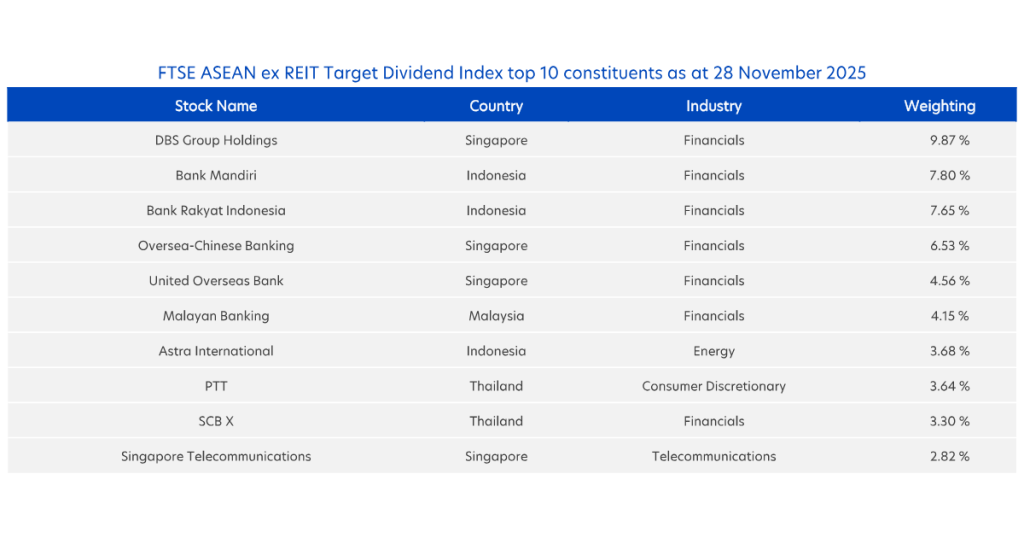

Top 10 Index Constituents

How to Subscribe to the ETF During the IOP via POEMS 2.0

- Log in to your POEMS 2.0 , then navigate to ‘Account Management’ > ‘Online Forms’ > ‘IPO Subscription – Irrevocable Form’ or click here.

- Select the IPO you wish to subscribe to.

- Review and accept the prospectus, terms, and conditions before subscribing to the financial product.

- Applications close at 5pm on 23 January Fri 2026.

- Ensure sufficient funds are available in your POEMS Account to complete the application process (including the subscription amount and GST) by 23 January Fri 2026 at 5pm.

| IOP Subscription Details | |

|---|---|

| Subscription Period | 7 January 2026 to 23 January 2026 |

| Listing Date | 29 January 2026 |

| Subscription Price | SGD 1.00 per unit |

| Minimum Quantity | 100 units |

| Commission Fees | Zero Commission |

| Trading Currency | SGD |

| Allotment | Full Allotment |

| Key Information | |

|---|---|

| ETF Name | UOBAM Ping An FTSE ASEAN Dividend Index ETF |

| Underlying Index | FTSE ASEAN ex REITs Target Dividend Index |

| Issue Price | SGD 1.00 per unit |

| Initial Offer Period (IOP) | 7 Jan 2026 to 23 Jan 2026 |

| Listing Date | 29 January 2026 |

| Base Currency | SGD |

| Trading Currency | SGD, USD |

| SGX Code | UPD (SGD) , UPU (USD) |

| Trading Board Lot Size | 1 Unit |

| Management Fee | Currently 0.45% p.a. |

| Distribution Policy | The ETF aims to pay dividends of at least 6.0 per cent p.a. in 2026 and 2027. Distributions are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund’s prospectus. |

| Classification Status | Excluded Investment Product |

- The subscription period for UOBAM Ping An FTSE ASEAN Dividend Index ETF (“ETF”) is from 7 January 2026, Monday at 9am to 23 January 2026, Friday at 5pm.

- The online subscription will close on 23 January 2026 at 5pm. No new applications, amendments, or withdrawals are allowed after this deadline.

- Eligible Accounts to subscribe for the ETF must be Cash Plus, Margin (M), Custodian (C), Prepaid Custodian (CC), Cash Management (KC) and Share Financing (V) Accounts. Cash Trading Accounts (T) are not eligible to participate in this subscription.

- Only one application is allowed per Account.

- Each ETF unit is priced at SGD 1 and the minimum order quantity is 100 units, with an incremental order size of 100 units.

- There are zero commission fees.

- The total amount payable is denominated in SGD. The settlement currency will be in SGD.

- Sufficient funds (including transfer fee and GST) must be present in the Customer’s Account by 23 January 2026 at 5pm.

- Applications will be rejected if the Account does not have or reflect sufficient funds after 23 January 2026 at 5pm.

- ETF units will be credited to the clients’ CDP or clients’ sub-account with Phillip Securities Pte Ltd by 29 January 2026.

- Customers will receive the full allotment of the number of ETF units that they subscribe to.

- Customers can start trading the ETF units when the ETF is listed on SGX on 29 January 2026 at 9am.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and/or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read and consented to these Terms & Conditions.

- Customers will be entitled to receive a S$10 cash credit for every S$5,000 subscribed into the UOBAM Ping An FTSE ASEAN Dividend Index ETF, provided that they hold their subscription from 29 January 2026, the listing date of the fund, to 28 February 2026 (the Minimum Holding Period).

- The Campaign Period runs from 7 January 2026, Wed at 9.00am to 23 January 2026, Fri at 5.00pm.

- The Cash Credit is capped at S$500 per POEMS account.

- The Cash credits is to be provided to the first 300 eligible clients of PSPL who invest in the ETF during the IPO.

- The Cash Credit will be credited to your account within one month after the holding period.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to:

- (i) Amend, add, or delete any of these Terms & Conditions without prior notice (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected; or

- (ii) Vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute regarding a client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obligated to give any reasons on any matter concerning the Promotion, and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read, understood, and consented to these Terms & Conditions.

Events Lineup

UOBAM Ping An FTSE ASEAN Dividend Index ETF: Unlocking ASEAN Div Opportunities

17 Jan, Sat 2026 11:30 AM - 12:30 PM

Mr Shankar Panchadcharam | Senior Director, Business Development | UOB Asset Management & Ms Low Soo Fang | Vice President, Equities Research | UOB Asset Management

Zoom