- Home

- Amova ChiNext Index ETF

More About Amova E Fund ChiNext Index ETF

Designed to reflect performance of the ChiNext board of the Shenzhen Stock Exchange (SZSE), the ChiNext Total Return Index provides a benchmark for China’s innovative and venture enterprises. The ChiNext Index consists of the top 100 largest and most liquid A-share stocks listed on the ChiNext board of SZSE, weighted by free float market capitalisation.

Why Invest in Amova E Fund ChiNext Index ETF

Discover tomorrow’s potential winners across promising investment themes

ChiNext constituents comprise sectors of Energy Transition Technologies, Next-Gen Manufacturing, Smart Infrastructure, and Healthcare Life Sciences.

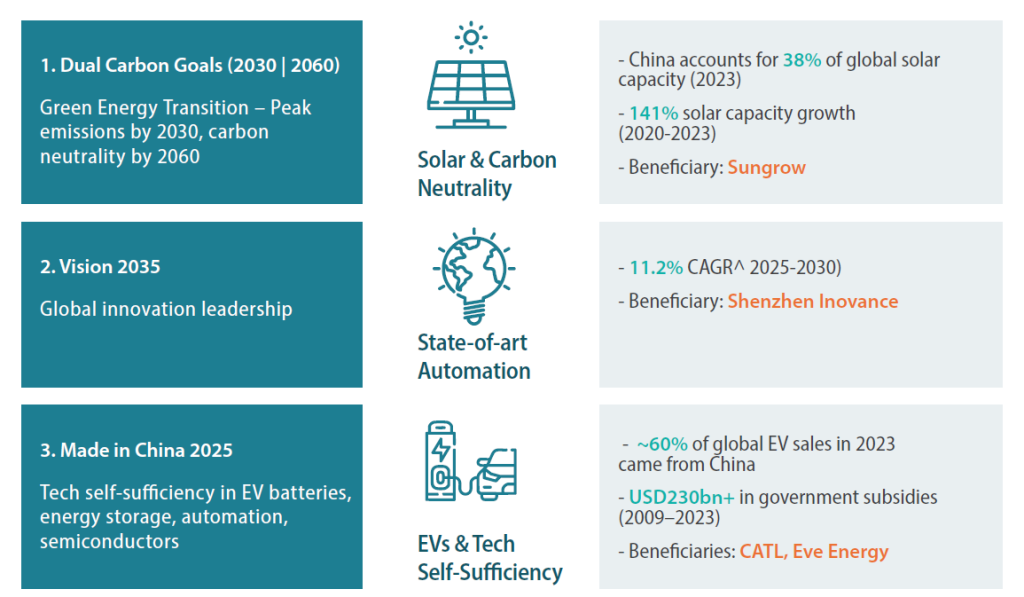

Enjoy tailwinds from China’s national vision

The ChiNext Index constituents are strategically positioned in sectors that enjoy the tailwinds of China’s national vision and goals.

Gateway to untapped opportunities

China is well-known for being a global leader with a track record in Innovation. The ChiNext Index provides investors access to companies that could be under the radar, an untapped territory of opportunities and allows for an early-mover advantage into China’s innovation economy with lower exposure to State-owned enterprises.

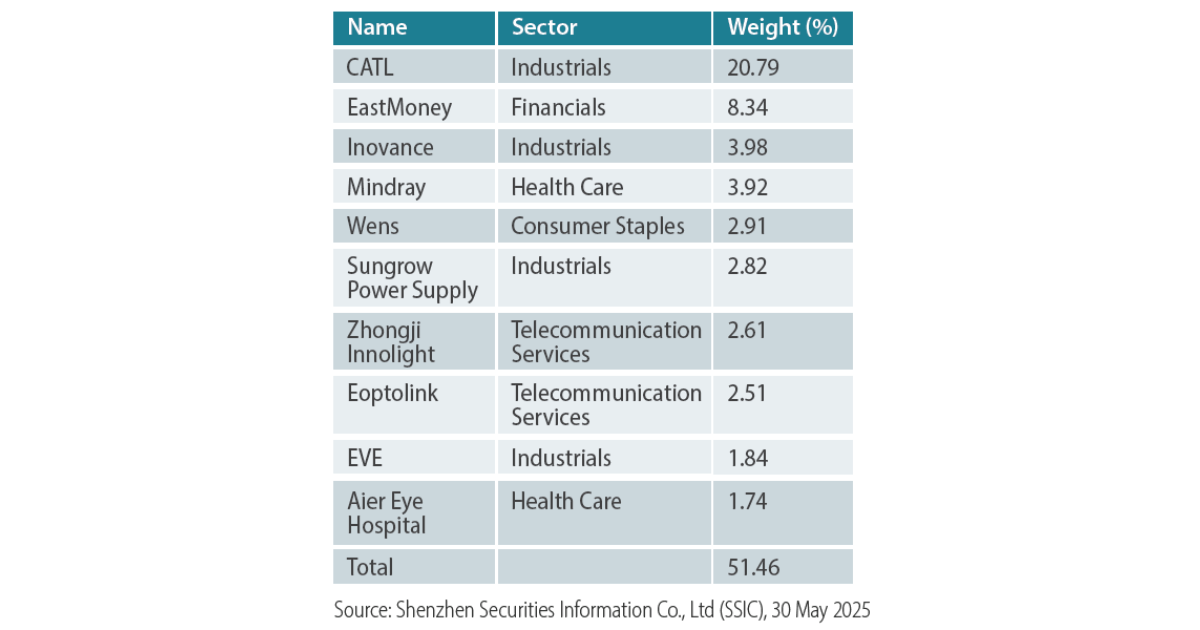

Top 10 constituents

How to Subscribe to the ETF During the IOP via POEMS 2.0

- Log in to POEMS 2.0, then navigate to ‘Account Management’ > ‘Online Forms’ > ‘IPO Subscription – Irrevocable Form’ or click here.

- Select the IPO you wish to subscribe to.

- Review and accept the Prospectus, and Terms & Conditions before subscribing to the Financial Product.

- Applications close at 5pm on Monday, 14 July 2025.

- Ensure sufficient funds are available in your POEMS Account to complete the application process (including the subscription amount, transfer fees, and GST) by 5pm on Monday, 14 July 2025.

Webinars Lineup

Your Gateway to China’s untapped opportunities

10 Jul, Thu 2025 07:00 PM - 08:00 PM

Ms Yi Dan Hou | Business Development Associate | Nikko Asset Management Asia Limited

Zoom

| IOP Subscription Details | |

|---|---|

| Subscription Period | 3 July 2025 to 14 July 2025 |

| Listing Date | 22 July 2025 |

| Subscription Price | SGD 1.00 per unit |

| Minimum Quantity | 1,000 units |

| Commission Fees | Zero Commission |

| Transfer Fees | S$10.00 (subject to GST) for Cash Management Account. Other Phillip Investment Account Types will not be subject to transfer fee charge. |

| Trading Currency | SGD, RMB, USD |

| Allotment | Full Allotment |

| Key Information | ||

|---|---|---|

| ETF Name | Amova E Fund ChiNext Index ETF | |

| Underlying Index | ChiNext Total Return Index | |

| Issue Price |

| |

| Initial Offer Period (IOP) | 3 July 2025 to 14 July 2025 | |

| Listing Date | 22 July 2025 | |

| Base Currency | RMB | |

| Trading Currency | SGD, RMB, USD | |

| SGX Code | SGD-Hedged Share Class: CXT RMB Share Class: Primary Currency (RMB): CXN Secondary Currency (USD): CXO | |

| Trading Board Lot Size | 1 unit | |

| Management Fee | 0.30% p.a. | |

| Replication Strategy | Optimisation or Representative Sampling | |

| Classification Status | Excluded Investment Product | |

- The subscription period for Amova E Fund ChiNext Index ETF (“ETF”) is from 3 July 2025, Thursday at 9am to 14 July 2025, Monday at 5pm.

- The online subscription will close on 14 July 2025 at 5pm. No new applications, amendments, or withdrawals are allowed after this deadline.

- Eligible Accounts to subscribe for the ETF must be Cash Plus, Margin (M), Custodian (C), Prepaid Custodian (CC), Cash Management (KC) and Share Financing (V) Accounts. Cash Trading Accounts (T) are not eligible to participate in this subscription.

- For Cash Management Accounts, an additional transfer fee of S$10 (subject to GST) will be charged for the subscription application.

- Only one application is allowed per Account.

- Each ETF unit is priced at SGD 1 and the minimum order quantity is 1,000 units, with an incremental order size of 1,000 units.

- There are zero commission fees.

- The total amount payable is denominated in SGD. The settlement currency will be in SGD.

- Sufficient funds (including transfer fee and GST) must be present in the Customer’s Account by 14 July 2025 at 5pm for applications to be successful.

- Applications will be rejected if the Account does not have or reflect sufficient funds after 14 July 2025 at 5pm.

- ETF units will be credited to the clients’ CDP or clients’ sub-account with Phillip Securities Pte Ltd by 22 July 2025.

- Customers will receive the full allotment of the number of ETF units that they subscribe to.

- Customers can start trading the ETF units when the ETF is listed on SGX on 22 July 2025 at 9am.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and/or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read and consented to these Terms & Conditions.

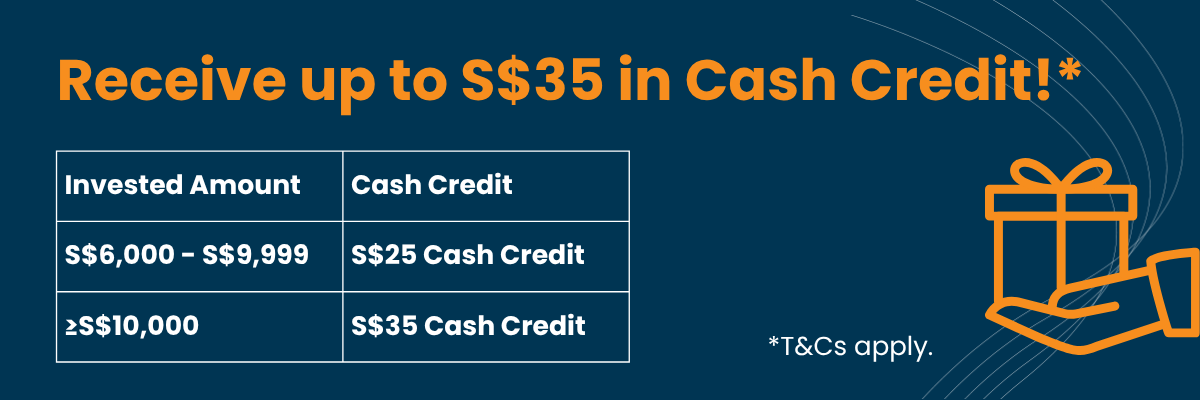

- Customers who subscribe S$10,000 or more in the Amova E Fund ChiNext Index ETF (“ETF”) will receive a S$35 in cash credit. Those who invest between S$6,000 and S$9,999 will receive a S$25 in cash credit. Cash credit will be awarded only to subscribers who successfully fulfil a one-month holding period after the listing date.

- The Campaign period is from 3 July 2025, Thursday at 9am to 14 July 2025, Monday at 5pm.

- The Cash Credit is limited to the first 250 Customers.

- The Cash Credit is limited to one reward per Customer.

- This promotion is limited and available on a first-come, first-served basis.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and/or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read and consented to these Terms & Conditions.

Events Lineup

ETFs

Mr Lai Yeu Huan | Joint Head of Asian Equity | Nikko Asset Management Asia Limited

Zoom