- Home

- LGI Promotion

Subscribe to Lion Global Investors ETFs via Share Builders Plan and receive Cashback with *T&Cs.

*Please read the full Terms & Conditions for the promotion below:

Cashback Details

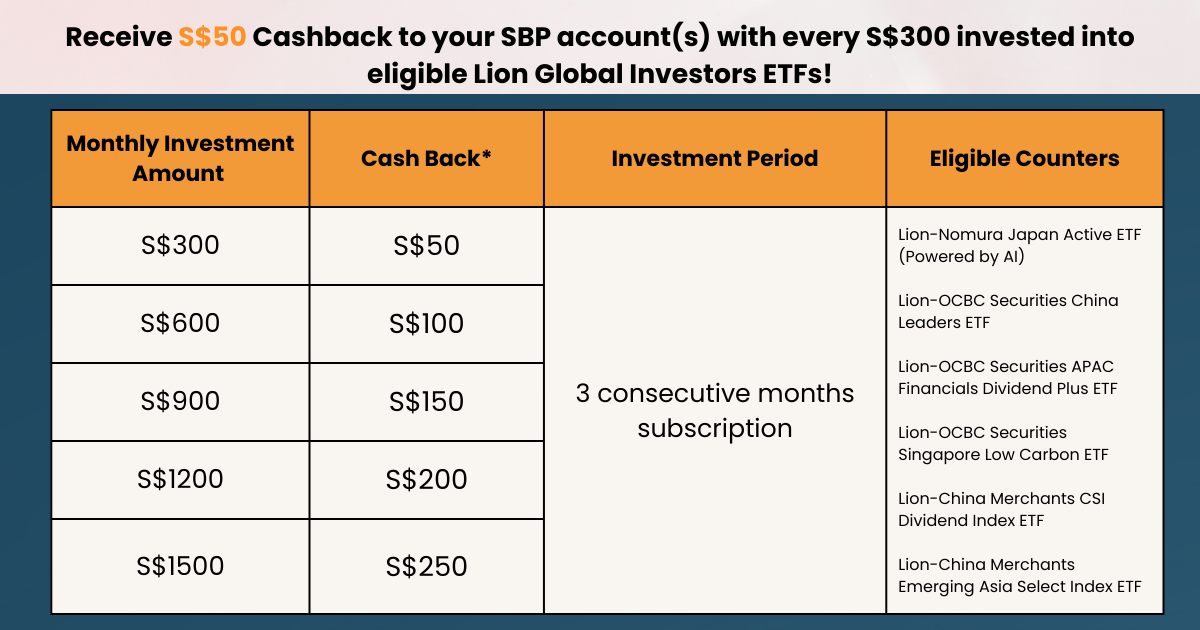

The promotion is applicable to the first 200 SBP accounts. Eligible customers will receive S$50 Cashback (credited to their Share Builders Plan (SBP) Ledger) for every S$300 fresh funds invested into selected Lion Global Investors’ ETFs*, with a minimum subscription period of three months via GIRO.

FAQ

The SBP Cashback Promotion allows participants to receive S$50 Cashback for every S$300 fresh funds invested per month in any eligible counter for three consecutive months via GIRO. The cashback is capped at S$250 per SBP account.

The maximum Cashback per SBP account is S$250.

You will receive S$50 cashback after successfully completing the three consecutive months of subscription via GIRO.

Yes

| Month | Investment counter | Monthly Investment Amount | Investment Period | Cashback |

| July 2025 | Lion-China Merchants CSI Dividend Index ETF | S$900 |

3 consecutive months |

S$150 |

| August 2025 | Lion-China Merchants CSI Dividend Index ETF | S$900 | ||

| September 2025 | Lion-China Merchants CSI Dividend Index ETF | S$900 |

*This example should not be considered as financial advice.

Yes, you are eligible for the cashback which is granted with every S$300 invested into eligible counters within your Share Builders Plan via GIRO. Please refer to the example below

| Month | Investment counter | Investment Amount | Investment Period | Cash Back |

July 2025

| Lion-China Merchants CSI Dividend Index ETF | S$100 |

three consecutive months |

S$50 |

| Lion-OCBC Securities Singapore Low Carbon ETF | S$100 | |||

| Lion-OCBC Securities China Leaders ETF | S$100 | |||

August 2025

| Lion-China Merchants CSI Dividend Index ETF | S$100 | ||

| Lion-OCBC Securities Singapore Low Carbon ETF | S$100 | |||

| Lion-OCBC Securities China Leaders ETF | S$100 | |||

September 2025

| Lion-China Merchants CSI Dividend Index ETF | S$100 | ||

| Lion-OCBC Securities Singapore Low Carbon ETF | S$100 | |||

| Lion-OCBC Securities China Leaders ETF | S$100 |

*This example should not be considered as financial advice.

There are six eligible counters:

- Lion-Nomura Japan Active ETF (Powered by AI)

- Lion-OCBC Securities China Leaders ETF

- Lion-OCBC Securities APAC Financials Dividend Plus ETF

- Lion-OCBC Securities Singapore Low Carbon ETF

- Lion-China Merchants CSI Dividend Index ETF

- Lion-China Merchants Emerging Asia Select Index ETF

To receive the maximum cashback, you must subscribe to any eligible counter with an investment of S$1,500 per month for three consecutive months via GIRO.

You will not be eligible for the promotion. The investment must be continuously maintained for three months via Giro. Any missed or delayed payments will result in disqualification.

No, your investment will not qualify for the promotion. A change in counter will not constitute as a consecutive subscription.

| Month | Investment counter | Investment Amount S$ | Cashback |

| July 2025 | Lion-Nomura Japan Active ETF (Powered by AI) | 300 |

S$0 |

| August 2025 | Lion-OCBC Securities China Leaders ETF | 300 | |

| September 2025 | Lion-OCBC Securities China Leaders ETF | 300 |

Yes, customers may increase or decrease their investment amount. However, please note that reducing your investment during the three-month GIRO subscription period will disqualify you from the promotion (Refer to illustration A below).

The cashback is determined based on your first month’s investment. For example, if you invest S$300 in the first month and increase your investment to S$600 in the second and third months, your cashback will still be S$50. (Refer to illustration B below)

illustration A

| Month | Investment counter | Investment Amount S$ | Cashback |

| July 2025 | Lion-Nomura Japan Active ETF (Powered by AI) | 600 | S$0 |

| August 2025 | Lion-Nomura Japan Active ETF (Powered by AI) | 300 | |

| September 2025 | Lion-Nomura Japan Active ETF (Powered by AI) | 300 |

illustration B

| Month | Investment counter | Investment Amount S$ | Cashback |

| July 2025 | Lion-Nomura Japan Active ETF (Powered by AI) | 300 | S$50 |

| August 2025 | Lion-Nomura Japan Active ETF (Powered by AI) | 600 | |

| September 2025 | Lion-Nomura Japan Active ETF (Powered by AI) | 600 |

| Month | Investment counter | Investment Amount S$ |

| July 2025 | Lion-China Merchants CSI Dividend Index ETF | 300 |

| August 2025 | Lion-China Merchants CSI Dividend Index ETF | 300 |

| September 2025 | Lion-China Merchants CSI Dividend Index ETF | 300 |

The Cashback will be credited to your SBP account ledger approximately 30 working days from the end of your 3 consecutive months subscription via GIRO.

No, both SBP and eGIRO application must be completed within the promotion period to qualify.

Yes, GIRO is the only method eligible for the promotion.

No, your funds will not be considered.

No, reapplying after termination during the promotion period will not qualify you for the promotion.

No, change of investment instructions between any eligible Lion Global Investors’ ETF to another eligible counter will not be considered as fresh funds, and will not qualify for the cashback.

How to Participate

To qualify for the Cash Back, simply complete these steps:

- Sign up for the Share Builders Plan (SBP)

How do I sign up for the Share Builders Plan?If you have yet to open a POEMS Account, open one here.If you are an existing POEMS Account holder, simply follow these instructions:Online Application Submission- POEMS Mobile 3 App:

- Log in to your POEMS Account

- Navigate to Trade > RSP > Share Builders Plan > Apply

- POEMS Website:

- Subscribe via this link

Step 2: Set Up GIRO for Recurring Investments

Apply e-GIRO:- POEMS Mobile 3 App:

- Log in to your POEMS Account

- Tap on the “Me” tab > eGIRO > Select SBP (Account no.) > Choose Bank > Apply

- POEMS Website:

- Log in to your POEMS Account

- Go to Acc Mgmt > Online Forms > Account Application > eGIRO > Select SBP (Account no.) > ChooseBank > Apply

- POEMS Mobile 3 App:

- Invest a minimum of S$300* per month in any of the eligible ETFs for three consecutive months via GIRO to qualify for the S$50 Cashback*

Eligibility Criteria- Existing SBP Customers:

- Customers who have already subscribed to any of the Lion Global Investors’ eligible counters, will only qualify for the Cashback when investing an additional S$300 or more in fresh funds* for three consecutive months via GIRO into these counters.

- Customers who have not subscribed to any Lion Global Investors’ eligible counters, will qualify for the Cashback after subscribing to any of the eligible counters and investing at least S$300 per month for three consecutive months via GIRO.

*Funds deposited as a result of change of investment instructions between the Lion Global Investors’ selected counters will not be considered as fresh funds and thus, not be eligible for the promotion.

Fresh Fund: Refer to the newly deposited investment amount into the SBP account during the promotion period. - New SBP Customers:

- Customers who are new to SBP, will qualify for the cashback after subscribing and investing at least S$300 per month into any of the Lion Global Investors’ eligible counters, for three consecutive months via GIRO.

- Customers who are new to SBP, will qualify for the cashback after subscribing and investing at least S$300 per month into any of the Lion Global Investors’ eligible counters, for three consecutive months via GIRO.

- Existing SBP Customers:

SBP Counters Eligible for the promotion:

| S/N | Counter Name | Counter Name on Website |

| 1 | Lion-Nomura Japan Active ETF (Powered by AI) | A LION-NOMURA JAPAN S$ |

| 2 | Lion-OCBC Securities China Leaders ETF | LION-OSPL CN LDR |

| 3 | Lion-OCBC Securities APAC Financials Dividend Plus ETF | LION-OSPL APAC FinS$ |

| 4 | Lion-OCBC Securities Singapore Low Carbon ETF | LION-OSPL LOW CARBON S$ |

| 5 | Lion-China Merchants CSI Dividend Index ETF | Lion-CM CSI Div S$ |

| 6 | Lion-China Merchants Emerging Asia Select Index ETF | Lion-CM EM Asia S$ |

* Counters not listed above will not be eligible for the promotion

- Eligible Customers must invest a minimum of S$300 fresh funds per month for three consecutive months via GIRO into any of the eligible counters listed in the table above.

- The investment transaction must be made before the 18th of each month (or the next business day if the 18th falls on a non-business day) during the promotion period.

- There is a cashback cap of S$250 per account.

- The cashback will be processed approximately 30 working days after completion of the consecutive three-month subscription period via GIRO.

Example 1:

| Month | Investment counter | Monthly Investment Amount | Investment Period | Cash Back |

| July 2025 | Lion-China Merchants CSI Dividend Index ETF | S$300 | Three consecutive months | S$50 |

| August 2025 | Lion-China Merchants CSI Dividend Index ETF | S$300 | ||

| September 2025 | Lion-China Merchants CSI Dividend Index ETF | S$300 |

*This example should not be considered as financial advice.

Example 2:

| Month | Investment counter | Monthly Investment Amount | Investment Period |

Cash Back |

|

July 2025

|

Lion-China Merchants CSI Dividend Index ETF | S$100 | Three consecutive months | S$50 |

| Lion-OCBC Securities Singapore Low Carbon ETF | S$100 | |||

| Lion-OCBC Securities China Leaders ETF | S$100 | |||

| August 2025 | Lion-China Merchants CSI Dividend Index ETF | S$100 | ||

| Lion-OCBC Securities Singapore Low Carbon ETF | S$100 | |||

| Lion-OCBC Securities China Leaders ETF | S$100 | |||

| September 2025 | Lion-China Merchants CSI Dividend Index ETF | S$100 | ||

| Lion-OCBC Securities Singapore Low Carbon ETF | S$100 | |||

| Lion-OCBC Securities China Leaders ETF | S$100 |

*This example should not be considered as financial advice.

Example 3:

| Month | Investment counter | Monthly Investment Amount | Investment Period | Cash Back |

| July 2025 | Lion-China Merchants CSI Dividend Index ETF | S$2500 | Three consecutive months | S$250 |

| August 2025 | Lion-China Merchants CSI Dividend Index ETF | S$2500 | ||

| September 2025 | Lion-China Merchants CSI Dividend Index ETF | S$2500 |

*This example should not be considered as financial advice.

Example 4:

| Month | Investment counter | Monthly Investment Amount | Investment Period |

Cash Back |

|

July 2025

|

Lion-China Merchants CSI Dividend Index ETF | S$1000 | Three consecutive months | S$250 |

| Lion-OCBC Securities Singapore Low Carbon ETF | S$1000 | |||

| Lion-OCBC Securities China Leaders ETF | S$1000 | |||

| August 2025 | Lion-China Merchants CSI Dividend Index ETF | S$1000 | ||

| Lion-OCBC Securities Singapore Low Carbon ETF | S$1000 | |||

| Lion-OCBC Securities China Leaders ETF | S$1000 | |||

| September 2025 | Lion-China Merchants CSI Dividend Index ETF | S$1000 | ||

| Lion-OCBC Securities Singapore Low Carbon ETF | S$1000 | |||

| Lion-OCBC Securities China Leaders ETF | S$1000 |

* This example should not be considered as financial advice.

- Please refer to examples 1,2,3 and 4 on the indicative cashback amount.

| Period of Promotion | T&Cs |

Investment Period |

Cash Back | Eligible Counters | |

| 01 July 2025 – 30 September 2025 |

New to SBP S$300 Subscription into any of the Lion Global Investors’ eligible counters; for three consecutive months via GIRO. |

Existing SBP Customers S$300 of fresh funds* into the Lion Global Investors’ eligible counters ; for three consecutive months via GIRO. |

Three consecutive months subscription |

Get S$50 cashback for every S$300 monthly subscription into any of the eligible counters during the promotion period. Eligible customer is allowed a maximum cashback of S$250 for each SBP account during the promotion period. |

1) Lion-Nomura Japan Active ETF (Powered by AI) 2) Lion-OCBC Securities China Leaders ETF 3) Lion-OCBC Securities APAC Financials Dividend Plus ETF 4) Lion-OCBC Securities Singapore Low Carbon ETF 5) Lion-China Merchants CSI Dividend Index ETF 6) Lion-China Merchants Emerging Asia Select Index ETF |

*Funds invested as a result of change of investment instructions between the Lion Global Investors’ selected counters will not be considered as fresh funds and hence not eligible for the promotion.

Fresh Fund: Refer to the newly deposited investment amount into the SBP account during the promotion period.

You’re all set to participate in this Promotion!

Disclaimers:

- All the examples of investment counter and amount should not be considered as financial advice.

- This promotion is intended for general information only and does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in this promotion are not necessarily indicative of future or likely performance of any fund. You should read the prospectus of the respective ETFs (which is available on websites of the issuers) and understand their structure and associated risks before deciding to invest. Any opinion or view herein is made on a general basis and is subject to change without notice. You may wish to obtain advice from a financial adviser before making a commitment to purchase any investment products mentioned herein. In the event that you choose not to obtain advice from a financial adviser, you should consider whether the investment product is suitable for you. SBP is a Regular Savings Plan and is not a deposit and not principal protected nor a capital guaranteed plan.

- Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the shares and the income from them may fall as well as rise. Past performance is not necessarily indicative of future performance. Investments in Regular Savings Plan are designed to produce returns over the medium to long term and are not suitable for short-term speculation.

- Any opinion or view herein is made on a general basis and is subject to change without notice.

- You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

- The information is correct as at the date of print and the company reserves the right to revise the charges.

- This advertisement has not been reviewed by the Monetary Authority of Singapore.