3 Aspects of Technical Analysis all traders should know! June 27, 2022

It is common knowledge that trend trading is your friend. This means that you should conduct your trades in the direction of the trend. Trading in the direction of the trend allows you to have a higher probability of profiting from the market.

In this article, you will learn the 3 methods you can use to identify the trend:

- Price action

- Moving average

- Moving average crossover

Method 1: Price Action

Uptrend – Higher Highs and Higher Lows

One method of identifying a trend is through the use of price action. Before making any trades, we need to know the trend first. The trend can range from an uptrend to downtrend and on some days, sideways.

Below are the definitions of the 3 types of trends:

- Uptrend – when prices make higher highs and higher lows

- Downtrend – when prices make lower highs and lower lows

- Sideways trend – horizontal price movements

Source: Phillip CFD [1]

Source: Phillip CFD [1]

The graph above, features an uptrend; notice the higher highs and higher lows. This uptrend signals to investors that prices are in an uptrend, favouring investors who are buying the shares. In this case, investors should invest and profit from the trade when they notice the prices moving in an uptrend.

Downtrend – Lower Highs and Lower Lows

Source: Phillip CFD [2]

Source: Phillip CFD [2]

In the graph above, you can see a pattern of lower highs and lower lows. Unless you are shorting the market, you should ideally stay out of it and refrain from buying the stock. Shorting the market refers to profiting when prices go down. For traders who short the market using CFDs, they hold the view that prices will continue to go down. In the current market environment as of June 2022, most markets are down and traders can profit by shorting the markets.

Method 2: Moving Average

A moving average is the average of prices for a specified number of days. If the trend is up, the average price should be up as well. With the help of moving averages, we can better filter out the noise.

Source: POEMS 2.0

Source: POEMS 2.0

To tell the trend with moving averages, 2 important things must be noted:

#1 Prices are above the Moving Average (MA).

#2 The Moving Average is sloping up.

The image above is for the stock Frencken (SGX:E28). It is on an uptrend, given that there are higher highs and higher lows. Though the trend is up, the prices do not move up in one straight line. The movement whips up and down, making higher highs and higher lows as it moves up. The 50-day moving average is shown in the image above. Each point on the line is the average price for the previous 50 days. Most professional traders use a 50-day moving average, also known as 50-day MA.

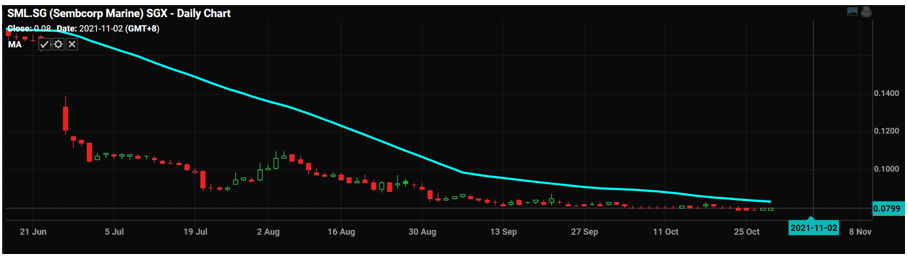

Source: POEMS 2.0

Source: POEMS 2.0

The same concept is used for downtrends. Above is an image of the stock Sembcorp Marine (S51: SGX). The prices are below the 50-day MA, with the MA sloping down. This signals that the stock is on a downtrend and profitability would be more probable if investors choose to short the stock.

Method 3: Moving Average Crossover

Source: POEMS 2.0

Source: POEMS 2.0

At times, prices may move above the MA and back down in a sideways manner. This tells us that the trend is neither up nor down. When prices are going sideways, it can be misleading for investors, making it more difficult to identify the trend when prices move above or below the 50-day MA.

Source: POEMS 2.0

Source: POEMS 2.0

The third method that traders use is the moving average crossover. The above image shows DBS bank’s (D05: SGX) chart with a 200-day and 50-day MA. The 200-day MA is illustrated in red and the 50-day MA in blue. When the 50-day MA crosses above the 200-day MA, we deem it as an uptrend. When it crosses below, we deem it as a downtrend. The 50-day MA crossed above the 200-day MA, followed by the MAs moving upwards to confirm the uptrend.

Source: POEMS 2.0

Source: POEMS 2.0

Above is an image of Dairy Farm stock (D01: SGX). The 50-day MA crossed below the 200-day MA, followed by the MAs moving downwards to confirm the downtrend.

Application – When To Enter?

Applying the methods above, investors gain a bias to long or short as a starting point. This method prevents them from speculating unnecessarily or buying and selling without knowing their basis for entry.

Source: POEMS 2.0

Source: POEMS 2.0

There will be times when the direction bias is correct, a stock is bought, and yet prices move against investors after the trade. It can be a very frustrating experience. With this understanding, knowing how to identify the trend correctly and the moving average crossover, can help to prevent such experiences.

Applying the 50-day and 200-day MA on the Frencken (E28: SGX) chart above, the 50-day MA has already crossed above the 200-day MA. Both lines are sloping to the up side so we know that it is on an uptrend. A good time to enter would be when prices touch or move below the 50-day MA and close above it, while staying above the 200-day MA. Any investor who believes Frencken is a good company would have made at least 80% in the period of 2020-2021.

Conclusion

A short recap of the 3 methods to identify:

Uptrends

#1. Higher highs and higher lows (lower highs and lower lows)

#2. Prices above MA (below MA) and sloping up (sloping down)

#3. 50-day MA crosses above 200-day MA, while sloping upwards

Downtrends

#1.Lower highs and lower lows

#2. Prices below the MA and sloping downwards

#3. 50-day MA crosses below the 200-day MA, while sloping downwards

Losses are part of trading and investing. Hence, it is paramount to have a systematic approach. Many speculators enter the market without a system, resulting in unnecessary losses. Using moving average methods to identify the trend gives investors and traders a good starting point to decide whether to buy or sell.

How to get started

As the pioneer of Singapore’s online trading, POEMS’ award-winning suite of trading platforms offers investors and traders more than 40,000 financial products across global exchanges.

Explore an array of US shares with brokerage fees as low as US$1.88 flat* when you open a Cash Plus Account with us today. Find out more here. T&Cs apply.

We hope that you have found value from reading this article! If you do not have a POEMS account, you may visit here to open one with us today!

Lastly, you can learn from investing in a community. Join our community and interact with us and other seasoned investors who often share their experience and expertise.

You will also have access to quality educational materials, stock analysis to help you in applying concepts, and even post to ask questions!

We look forward to sharing more insights with you in our growing and enthusiastic Telegram community. Join us now!

For enquiries, please email us at cfd@phillip.com.sg

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

Reference:

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Chua Minghan

Assistant Manager, Dealing

Chua Minghan graduated from the National University of Singapore with a Bachelor’s degree in Economics. He is passionate about education and went on to get a post-grad Diploma in teaching. His vision is to educate clients to make informed decisions for their trading and investments.

Minghan enjoys learning fundamental analysis, technical analysis, and strives to use data analysis to improve his trading skills.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile