3 strategies for REIT CFDs as an investment tool in your Portfolio! April 6, 2021

What this report is about:

- REITs own, operate and manage income-generating real estate such as serviced apartments, offices, hotels, retail malls, medical facilities, business parks, warehouses and data centres.

- You can invest in REITs by purchasing their shares directly on the stock exchange or trade REITs with CFDs, using both short-term (opportunistic short-term trading and hedging) and long-term (carry trade) strategies.

- REIT CFDs allow you to participate in the REITs’ price movements without actually owning units in the REITs.

- POEMS also offers multiple advanced order types to cater to your varied CFD trading needs and manage your transaction risks.

What is a REIT?

Real estate investment trust (REIT) is a collective investment scheme, where the funds of individual investors are pooled together to invest predominantly in real estate and real-estate-related assets such as serviced apartments, offices, hotels, retail malls, medical facilities, business parks, warehouses and data centres.

When you invest in a REIT, you’re investing in the properties managed by that REIT. You become a part-owner of those shopping malls, business parks or whatever your REIT manages. These assets are professionally managed and rental income generated is distributed to you as a REIT unit holder, after accounting for fees such as REIT-management and property-management fees.

REITs are popular with investors as they provide a steady stream of dividend income. This is because in order for REITs to enjoy tax transparency, which means their income is not taxed, they must distribute at least 90% of their taxable income to unit holders. Investors typically receive the dividend income quarterly or half-yearly [a].

Other advantages of investing in REITs include access to the underlying real estate that the REITs invest in. These assets might otherwise be inaccessible or unaffordable to individual investors. Owning certain properties directly might not be practical for most due to their high capital and/or maintenance costs. Investing in REITs is more affordable.

Finally, REITs’ generally low correlation with the other asset classes makes them excellent for portfolio diversification [b]. This can help to reduce investors’ portfolio risks and potentially increase their returns.

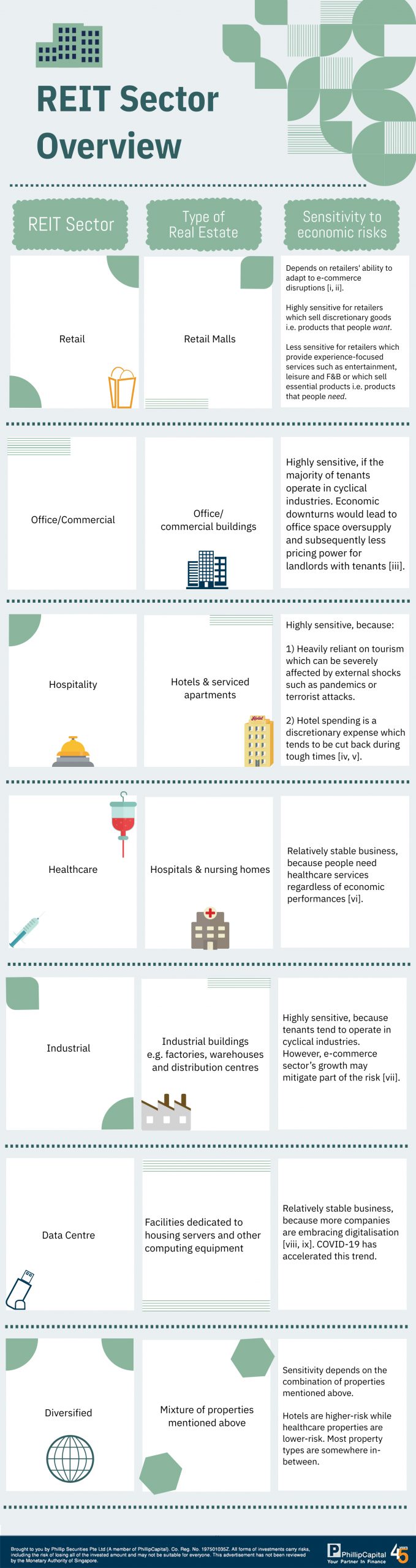

Types of REIT

REITs can be categorised according to the type of real estate they own and/or manage. There are currently 31 REITs listed on the SGX, investing in commercial/office, industrial, healthcare, hospitality, retail and other assets [c].

Different REITs have different degrees of sensitivity to economic risks, depending on the type of tenants occupying the real estate. During a market downturn, REITs that are much more sensitive to such risks may resort to reducing their dividend payouts.

How do you trade REITs with CFDs?

Investors typically invest in REITs for the long term as they are primarily aiming for steady streams of dividend income. To invest in a REIT, you can purchase the REIT’s shares directly on the stock exchange.

Alternatively, you may take a position on a REIT’s share price by using derivative products such as contracts for differences (CFDs). With CFDs, you can participate in the REIT’s market movements without actually owning units in the REIT. CFDs allow you to profit from the REIT’s rising share price (long CFDs) as well as falling share price (short CFDs).

When you trade CFDs, you are entering into an agreement with Phillip Securities to settle the price difference from the time when you initiate your trading position to the time you close your position.

Below are some of the strategies you may use to trade CFDs:

1) Short-term strategy: opportunistic short-term trading

Although REITs are generally perceived as longer-term investment vehicles, short-term volatility exists as a result of political, social and economic events. This means that there are short-term trading opportunities you can take advantage of.

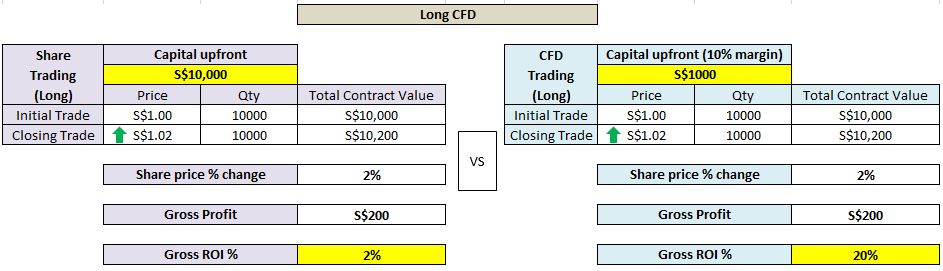

1) Long REIT CFDs

When you buy REIT CFDs (long), only a portion of the full investment capital is required to start your trade. This is known as the required margin.

* The illustration above does not include commissions, finance charges and all other fees incurred. Actual ROI will be lower than gross ROI.

In the illustration above, you will earn a 2% gross profit* when your REIT’s share price appreciates by 2%. With CFD trading, your gross ROI can be magnified to 20% because you only need to commit 10% of the total investment capital upfront to gain full exposure to price movements.

*Excluding commissions and finance charges

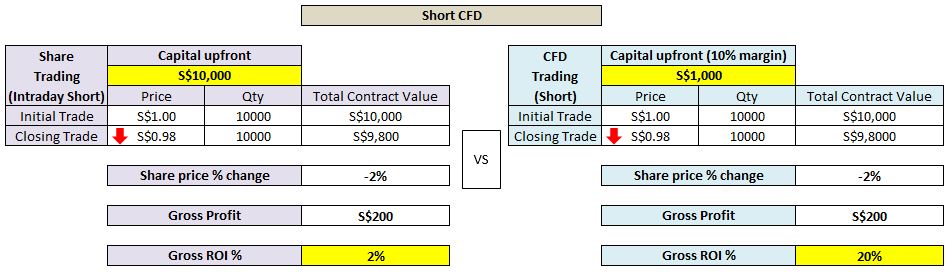

2) Short REIT CFDs

When it comes to shorting, CFDs offer more flexibility as you can hold CFD short positions for a longer period of time whereas when you short REIT or any other shares, you need to buy back the shares within the same day.

In addition, only a fraction of the full investment capital is needed to initiate a REIT CFD’s short position.

To short a REIT CFD, you may sell your REIT CFD contract directly without holding any long position.

* The illustration above does not include commissions, finance charges and all other fees incurred. Actual ROI will be lower than gross ROI.

In the illustration above, your gross ROI is magnified by 20% through shorting a CFD when the REIT’s share price falls by 2%.

This strategy is suitable for those with a higher risk appetite who aim to take advantage of short-term market movements. This is because CFDs can magnify losses if the price moves in the opposite direction.

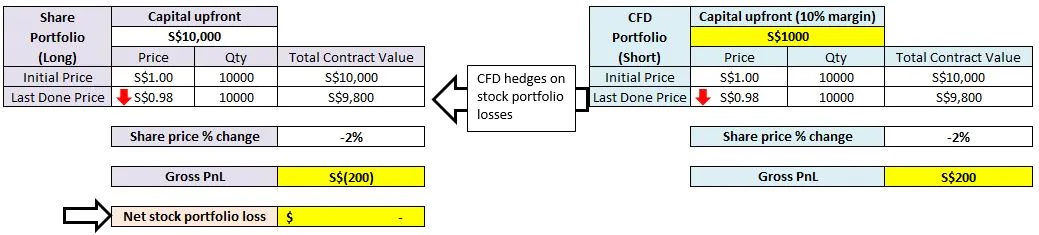

2) Short-term strategy: hedge REIT portfolio

Investors who currently hold a large basket of REITs as long-term investments may find it difficult and troublesome to liquidate them altogether during a market downturn and buy all back at one go when the market recovers.

In this case, they may want to use CFDs as a hedging instrument to manage their REIT portfolio’s short-term downside risks.

They may hold CFDs in a direction opposite to their REIT shares. For example, if they already have a long position on REIT X’s shares, they may hold a short position on REIT X’s CFD to manage REIT X’s share-price downside risks.

* The illustration above does not include commissions, finance charges and all other fees incurred. Actual ROI will be lower than gross ROI.

In the above example, when a REIT’s share price drops by 2%, the losses in your stock portfolio are cushioned by gains in your CFD (short position). This results in a zero net loss for your portfolio.

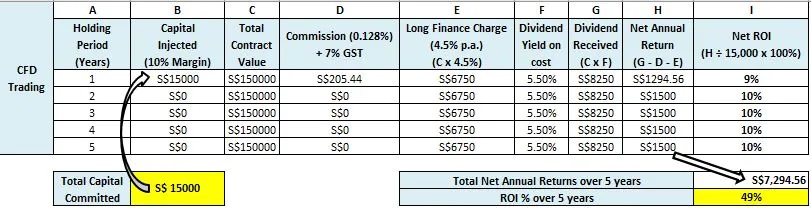

3) Long-term strategy: Carry Trade

Unlike other financial derivative products, you are entitled to dividends when you hold long CFD positions, even though you do not actually own the REIT shares.

There is yet another trading strategy where you can potentially increase your dividend income further with leverage.

This is known as the “carry trade”. It involves borrowing at a lower interest rate to invest in assets that can generate a higher rate of return.

* The illustration above does not take into account price movements and changes in dividend per share.

In the illustration, an S-REIT CFD is used to generate passive income through a carry trade. Initially, you purchase and hold the S-REIT’s CFD contract (long) worth S$150,000 with a S$15,000 margin upfront and dividend yield of 5.5%. You hold the contract for the next five years. If there is no change in the REIT’s share price and dividend per share, your net return is S$7,294.56. This represents a 49% return over the 5-year period.

Please note that there are risks associated with the carry trade:

1. Share-price volatility. Your losses will be magnified if the REIT’s share price moves against you. So, it is crucial to use leverage responsibly and cut losses quickly.

2. Decrease in dividend yields on cost. This happens when the REIT cuts its dividend payouts which reduces your dividend income.

3. Increase in CFD financing charges. Any increase in borrowing costs would further reduce your dividend income.

Conclusion

To conclude, REITs offer investors the benefits of real-estate investment along with the ease of stock trading.

REITs are popular with investors as they provide a steady stream of dividend income and are excellent vehicles for portfolio diversification. One can invest in REITs by purchasing their shares directly or trade REITs with CFDs, using both short-term (opportunistic short-term trading and hedging) and long-term (carry trade) strategies.

How to start trading REIT CFDs using POEMS

Ready to add REIT CFDs to your portfolio? To begin your journey, you are first required to open a CFD account with us.

Click here for more information on opening a CFD account.

If you already have a POEMS account, here are the few simple steps you can follow to activate your CFD account:

| Ticker | Steps | Suitable for |

| POEMS 2.0 | Login > Acct Mgmt > CFD > Online Account Opening | Desktop/ web-based trading |

| POEMS Mobile 2.0 (Download on Apple store or Google Play) | Login > Click on the menu button on the top left of the screen > “Portfolio” > “Activate CFD Trading” Link. | Smartphone applications (iOS/Android) |

| POEMS Pro (Download here) | Login > Acct Mgmt > CFD Acct Mgmt> CFD Account Opening | Desktop/ application-based trading |

As a regulatory requirement, all investors are required to complete the Customer Knowledge Assessment (CKA) to trade CFDs. The different ways to achieve a pass in CKA can be found in the CKA form.

Also, in accordance with the new regulations of the Monetary Authority of Singapore (MAS), all investors who wish to continue trading CFDs from 8 October 2019 onwards will be required to acknowledge the Risk Fact Sheet provided by Phillip Securities, which can be downloaded here.

With different platforms catering to different users, Phillip Securities offers the best for our clients.

Not sure how to start trading CFDs? Rest assured! See the below table for a simple guide on long and short CFDs as well as the various order types that we provide.

| Long CFD | Short CFD |

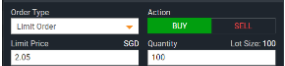

|

|

| 1) To initiate a Long CFD position, you may submit a CFD “BUY” order. | 1) To initiate a Short CFD position, you may submit a CFD “SELL” order directly. |

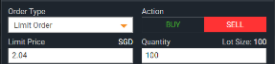

|

|

| 2) To close off your Long CFD position at hand, you may submit another CFD “SELL” order with the same quantity. | 2) To close off your Short CFD position at hand, you may submit another CFD “BUY” order with the same quantity. |

CFD advanced order types

We offer multiple advanced order types to cater to your sophisticated trading needs and manage the risks on your CFD transactions.

For more information on each order type, please refer here.

References:

1. [a] https://blog.moneysmart.sg/invest/singapore-reits-investing/

2. [b] https://www.asiaone.com/money/ultimate-guide-reits-singapore-2020

3. [c] https://www.sgx.com/securities/securities-prices?code=reits (as of 29 Mar 2021)

[i] Fraser Centrepoint Trust FY2020 Annual Report’s Market Overview

[ii] SPH REIT FY2020 Annual Report’s Market Overview

[iii] Keppel REIT FY 2019 Annual Report’s Independent Market Review

[iv] Fraser Hospitality Trust FY2020 Annual Report’s Market Overview

[v] Far East Hospitality Trust FY2019 Annual Report’s Industry Overview

[vi] ParkwayLife REIT FY2019 Annual Report’s Market Review and Outlook

[vii] https://www2.colliers.com/en-sg/news/2019-10-13-2019-radar-report-singapore-top-locations-logistics

[viii] Keppel DC REIT FY2019 Annual Report’s Market Review

[ix] Mapletree Industrial Trust FY2019 Annual Report’s Market Overview

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Tan Kean Soon

CFD dealer

Kean Soon graduated from the National University of Singapore with a Bachelor’s degree in Materials Engineering. He is a passionate CFD dealer who believes that equity markets can help grow one’s wealth with the right mindset, risk management and investing discipline.

In his free time, he enjoys educating himself on long-term investments and short-term trading as well as keeping up with the latest market news.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile