4 Considerations before Buying Banking Stocks August 28, 2017

Banking can be a risky business. This business is exposed to business cycles from various sectors. The oil price rout between June 2014 to January 2015 eventually forced our local banks to write off bad loans related to the distressed oil and gas sector. Stock prices of local banks tumbled more than 30% as a result of rising bad loans concerns. Ironically, bank stock prices recovered since then while crude oil price is still trading around US$50 per barrel. Stock prices of OCBC and DBS are hovering near their all-time high. Before you get bullish and want to invest your hard-earned money into bank stocks, here are some considerations for you:

1. Price Volatility

Volatility signifies risk. All 3 local banks have a beta of above 1, with DBS having the highest at 1.38, according to data from the Financial Times as of 21 Aug 17. In the case of DBS, every 1% market rise or fall is likely to result in a 1.38% fluctuation in DBS stock price. Given the price volatility, investors should demand a higher rate of return for their investments in local banks.

2. Loan Book Composition

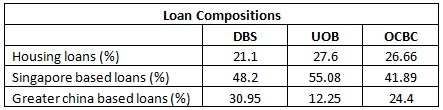

The loan book composition can give investors a sense of the risk that banks are taking to generate interest income.

Based on 2Q17 financial statements

Based on 2Q17 financial statements

UOB is more Singapore-centric as Singapore-based loans account for more than 50% of their loan book. Housing loans exposure also ranked the highest amongst the local banks. All things being equal, it is reasonable to assume that UOB has the lowest loan default risk given Singapore’s stable political landscape and housing loans are typically secured by underlying properties. Of course, analysing the loan books is much more onerous than simply focusing on geographical & industry breakdowns. Limited information is available for public to conduct a detailed assessment of banks’ loan books.

3. Non-Performing Loan (NPL) Coverage Ratio

The NPL coverage ratio defines the allowance that banks set aside to cover their non-performing loans. Banks’ current earnings can be boosted by setting aside lesser allowances. As of 2Q17, all three banks showed a year-on-year increase in NPL.UOB had the highest NPL coverage of 113.9%. DBS and OCBC had lower NPL coverages of 100% and 101% respectively. Based on these figures, it is more likely for DBS and OCBC to set aside funds to improve their NPL coverages moving forward, which will eventually weigh on their expense ratio and net income.

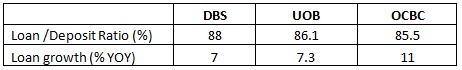

4. Loan / Deposit Ratio (LDR)

All things being equal, banks with a higher LDR will generate higher net interest income. An investor will want the bank to grow its loans and deposits while keeping a healthy LDR (80% to 90% according to Forbes).

Based on 2Q17 financial statements

Based on 2Q17 financial statements

Combining the abovementioned considerations and traditional fundamental ratios (e.g. P/B, P/E) will give investors a better sense of the risks and potential rewards they are buying into. Generally, share prices of banks with higher risk profile tend to outperform in a positive economic environment and underperform during risk averse periods. Investors who want exposure to Singapore banking sector at lower volatility can consider buying into SPDR STI ETF (Stock quote: ES3) or Nikko AM STI ETF (Stock quote: G3B). These ETFs have more than 30% weightage in Singapore banking sector while offering diversification to other industries.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Chiang Jin Liang

POEMS Dealer

Jin Liang is currently providing dealing services to over 8000 trading accounts and is part of the POEMS Dealing, the core in-house dealing department of Phillip Securities Pte Ltd.

Jin Liang believes in applying both fundamental and technical analysis in equities investing. He likes companies that can grow their earnings, stay relevant in an ever-changing landscape and focus on investor relations. Jin Liang frequently conducts educational seminars with the objective of imparting financial knowledge to the general public.

Jin Liang holds a Bachelor Degree in Electrical Engineering from Nanyang Technological University (NTU) and passed Level II of the Chartered financial Analyst (CFA) exam.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile