6 ETFs you can invest in, through the CPF Scheme September 12, 2022

You might already know that you can use your Central Provident Fund (CPF) monies to invest via the CPF Investment Scheme (CPFIS). However, the CPFIS has a limited list of financial products which can be invested in, as well as limitations on which type of account can be used for these investments.

Key Takeaways

- Exchange Traded Funds (ETFs) offer a good foundation for novice and experienced investors alike to build up their portfolio and gain exposure to the equities market.

- Instead of letting your CPF monies idle to garner 2.5% or 4% interest rates, investing may offer you a way toward higher returns through the market while minimising risks.

- The CPFIS currently allows investment in six ETFs, which offer exposure to the STI index as well as the bonds, gold and REITs markets. Investors can pick and choose which ETFs to invest in to create a portfolio suiting their needs.

You can invest in Exchange Traded Funds (ETFs) using the CPFIS-OA. Any CPF member who fulfils the following criteria will be eligible to participate in the CPFIS:

- at least 18 years old

- not an undischarged bankrupt

- have more than $20,000 in his OA and/or

- $40,000 in his SA (does not require the opening of a CPFIA account)

ETFs consist of a basket of securities. This means that when you invest into a single ETF, you are investing into a variety of different stocks. This is particularly useful because ETF managers pick and choose which stocks are high-performing for you to invest in.

ETFs have a low expense ratio and are constantly rebalanced, making them suitable for long-term investments. ETFs are usually grouped into particular categories such as securities, a commodity, a sector, or an economic index which tracks the market. Currently, there are six CPF-approved ETFs listed on SGX, each of which track different assets.

Index ETFs

Both the SPDR STI ETF and Nikko AM Singapore STI ETF comprise of 30 blue chip stocks in Singapore to replicate the performance of the Straits Times Index (STI). They are amongst the most traded ETFs on SGX as they allow investors to diversify their investments across different sectors such as Finance, Industrial, Telecommunications and Consumer Goods and Services. The ETF’s performance is dependent on the return of the index (in this case the STI) that it is tracking and the value of the 30 component stocks.

A novice investor may find that the STI ETF is the simplest way to get exposure to the Singapore equities market. Given the nature of the CPF account, the investment time horizon of an individual can range from a few years to over a few decades. This fits in to the nature of long term investment using index funds.

The SPDR STI ETF has an annualised return of 5.32% since its inception in 2002, while the Nikko AM STI ETF annualised return is 6.80% since its inception in 2009. Both ETFs beat the interest rate of 2.5% or 4% offered by CPF through its Ordinary and Special Account.

However, investors must take note that interest rates for CPF deposits are fixed whereas there are no guaranteed returns for investing in ETFs. In addition, investors are entitled to dividends distributed semi-annually for both STI ETFs. The annualised dividend yield is in the range of 2% to 4%, depending on the performance of the underlying assets of the fund.

Bond ETFs

Investors can also invest in ETFs that track other asset classes such as Bonds. The ABF SG Bond ETF is one such ETF that allows investors to gain access to a basket of high-quality bonds issued primarily by the Singapore government and quasi-Singapore government entities. It is the first ETF bond fund in Singapore and invests in the constituents of the iBoxx ABF Singapore Bond Index. Investors are entitled to dividends distributed annually. The dividend yield is at a range of around 1% to 2%.

Another bond ETF, the Nikko AM SGD Investment Grade Corporate Bond ETF, has been included into the CPFIS since 22 April 2020. It is Singapore first’s investment grade corporate bond ETF. ‘Investment grade’ is a credit rating that indicates a low risk of credit default, making investment grade corporate bonds a relatively safe investment choice for investors.

Historically, corporate bonds are traded over-the-counter (OTC) in large notional amounts and are out of reach for most retail investors. With the inclusion of the Nikko AM SGD Investment Grade Corporate Bond ETF into the CPFIS, investors can now have an easy and low-cost method to gain access into corporate bonds via their CPF monies.

Gold ETF

The SPDR Gold Shares ETF allows investors to gain exposure to gold which is often considered a safe haven asset. The investment objective of the trust is for the shares to reflect the performance of the price of gold bullion, less the Trust’s expenses. This gold ETF is backed by physical gold and has a total net asset of over USD 50 billion.

However, investors can only invest up to 10% of their investible savings into the gold ETF using their CPFIA. From 30 June 2021, dual currency trading has been introduced to the SPDR Gold Shares ETF, where investors can buy the ETF in SGD, in addition to the primary USD currency.

Reit ETF

The Nikko AM-Straits Trading Asia ex Japan REIT ETF was included under ETFs in the CPFIS in November 2021. It has had an annualised return of 5.39% since its inception in 2017. The real estate investment trusts (REITs) are further diversified to include properties that are used for industrial, retail, and even tourism purposes. REIT ETFs are particularly useful in aiding investment in the real estate market without needing to deal with the hassles of buying property directly.

The ETF is designed to represent the performance of qualifying REITs across Asia, including properties in China, Hong Kong, India, Indonesia, Malaysia, Pakistan, Philippines, Singapore, South Korea, Taiwan and Thailand.

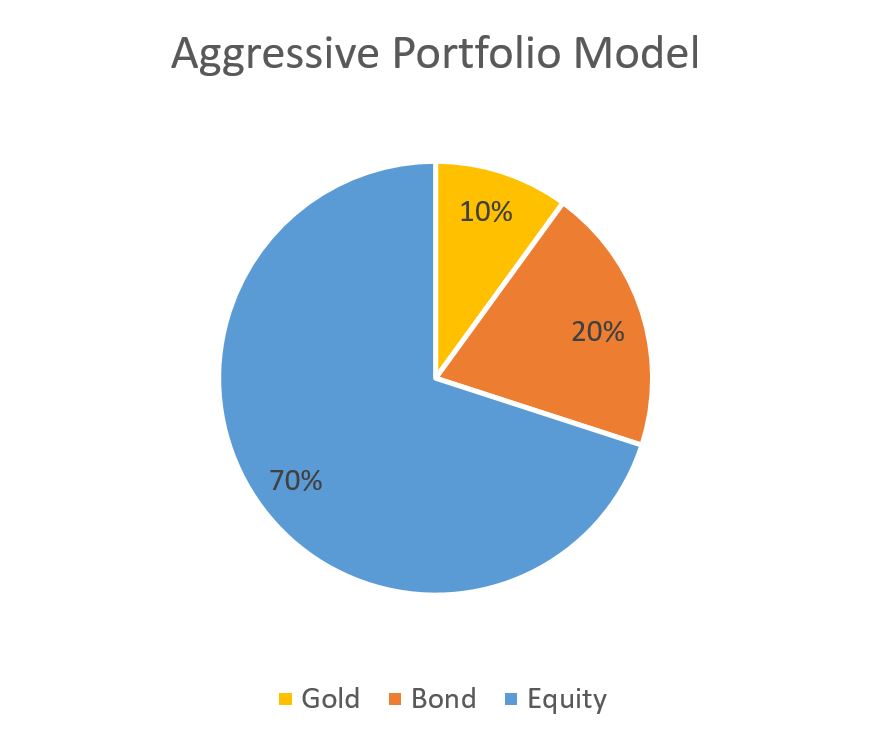

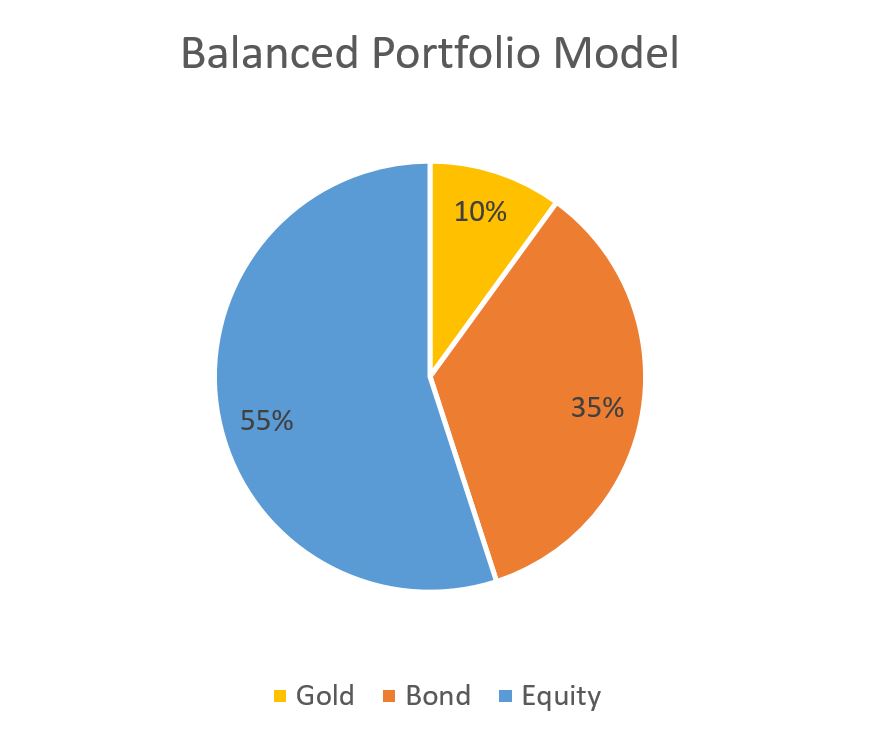

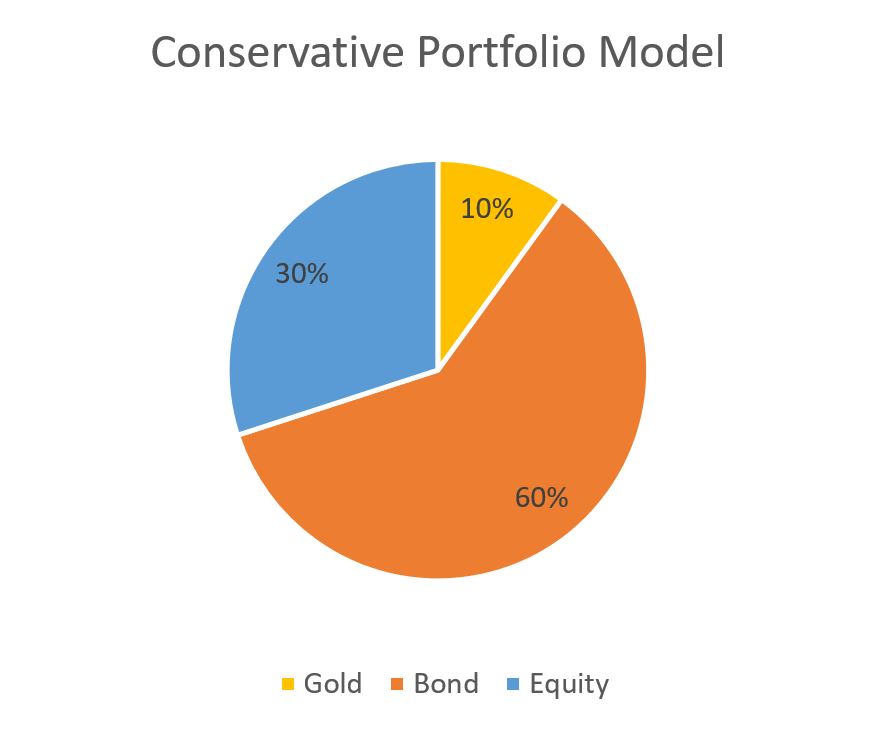

Model Portfolio

To better manage one’s risk, a combination of the above ETFs allow investors to invest in the different asset classes (Equities, Bonds, REIT and Gold) and diversify their investment risk. An investor can assign different weightings to the 3 asset classes accordingly to his/her risk appetite and investment objective. Together, the combination of these ETFs represents a relatively safe investment for investors. Investors can invest in one of the two STI ETFs and the bond ETFs to gain exposure to both equities and bond markets in Singapore. Those who believe in the real estate sector can consider investing a sum in the REITs ETF. To further hedge against possible market risks and volatility, investors can also invest in the SPDR Gold Shares. Gold generally has a negative correlation with stocks and other financial instruments based on historical data, making it ideal for investors to purchase them to reduce volatility and market risks. In other words, when stocks and bonds are performing badly, gold tends to have an inverse relationship and perform better. The paper gain from the Gold’s index performance can be used to offset the paper losses incurred by the other two asset classes.

Summary of ETFs included under CPFIS

| SPDR STI ETF | Nikko AM STI ETF | ABF SG Bond Index Fund | Nikko AM SGD IG Corporate Bond ETF | SPDR Gold Shares | Nikko Am-ST Asia ex Japan REIT ETF | |

| SGX Ticker | ES3 | G3B | A35 | MBH | O87 | GSD | CFA |

| Inception Date | 11 Apr 2002 | 24 Feb 2009 | 31 Aug 2005 | 27 Aug 2018 | 18 Nov 2004 | 29 March 2017 |

| Expense Ratio | 0.30% | 0.30% | 0.25% | 0.30% | 0.40% | 0.60% |

| Trading Currency | SGD | USD | SGD | SGD | |||

| Asset Under Management | SGD 1.57 B | SGD 607.67 M | SGD 962.61 M | SGD 545.99 M | USD 56.17 B | SGD 406.65 M |

| Dividend Frequency | Semi-annually | Semi-annually | Annually | Annually | Na | Quarterly |

| CPF Risk Classification | Higher Risk | Higher Risk | Low to Medium Risk | Low to Medium Risk | Higher Risk | Higher Risk |

| CPFIA investible savings | 100% | Up to 10% | 100% | |||

ETF information is accurate as of July 2022

Reference:

- [1] https://www.cpf.gov.sg/Members/Schemes/schemes/optimising-my-cpf/cpf-investment-schemes

- [2] https://www.spdrs.com.sg/etf/fund/spdr-straits-times-index-etf-ES3.html

- [3] http://www.nikkoam.com.sg/etf/sti

- [4] http://www.nikkoam.com.sg/etf/abf

- [5] https://www.spdrs.com.sg/etf/fund/spdr-gold-shares-O87.html

About the author

Mr. Joel Lim

ETF Specialist

Joel graduated from Singapore Institute of Management, University of London with a First Class Honours in Business. He was the recipient of SIM University of London’s Top Student Bronze Award in 2017 and was the worldwide examination topper for the “Financial Management” module in 2016. Joel was also commended by University of London for his excellent performance in the 2014 Examinations.

Joel is involved in ETF education, providing trading ideas and support to traders, dealers and fund managers. Joel also works closely with ETF issuers to educate retail investors about new ETFs during the Initial Offering Period.

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry! ![[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close](https://www.poems.com.sg/wp-content/uploads/2024/03/Valerie-Lim-LI-X-SMART-Park-Article-300x157.jpg) [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close

[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close  Deciphering the Updates: Understanding the latest CPF Changes

Deciphering the Updates: Understanding the latest CPF Changes