A Value(able) ETF During Rate Hikes February 24, 2022

A turbulent start of 2022

January has been a rather turbulent month, with most equity indices closing negative even after a strong rebound in the last two days. This was mainly attributed to the rising inflation and the concerns over the Russia-Ukraine conflict.

In this article, we will be focusing on the inflationary environment that the US economy is facing and not much on the political side of things.

The latest U.S January inflation data, based on the two most commonly used inflation indexes in the US:

1) Consumer price index (CPI)

CPI: A measure that examines the weighted average of prices of a basket of goods and services which are of primary consumer needs. They include transportation, food, and medical care.

2) Producer price index (PPI)

PPI: A family of indexes that measures the average change in selling prices received by domestic producers of intermediate goods and services over time. The PPI measures price changes from the perspective of the seller and differs from the CPI which measures price changes from the perspective of the buyer.

For January, the CPI rose 7.5% year-on-year, surging more than the Dow Jones estimates of 7.2% and was also the highest reading since February 1982 [1]. The core CPI, which excludes the volatile gas and grocery costs, also rose at its fastest level since August 1982 at 6% compared with the estimate of 5.9% [1].

Meanwhile, the PPI rose 9.7% year-on-year, the highest reading since 2010 [2]. The core PPI, which excludes volatile items such as food, energy and trade services, rose 6.9% year-on-year [2]. With the intense inflationary pressure in the production pipeline, producers are likely to pass the higher costs to the consumers in the way of consumer price inflation in the months to come.

With inflation numbers running hot, and the CPI rising way above the Federal Reserve’s target of 2%, we are likely to see the Fed raise its interest rates a few times this year as indicated by the Fed Chair’s hawkish tone in the January Federal Open Market Committee (FOMC) meeting where he mentioned that the Fed are ready for a more aggressive approach in dialling back some of the economic support.

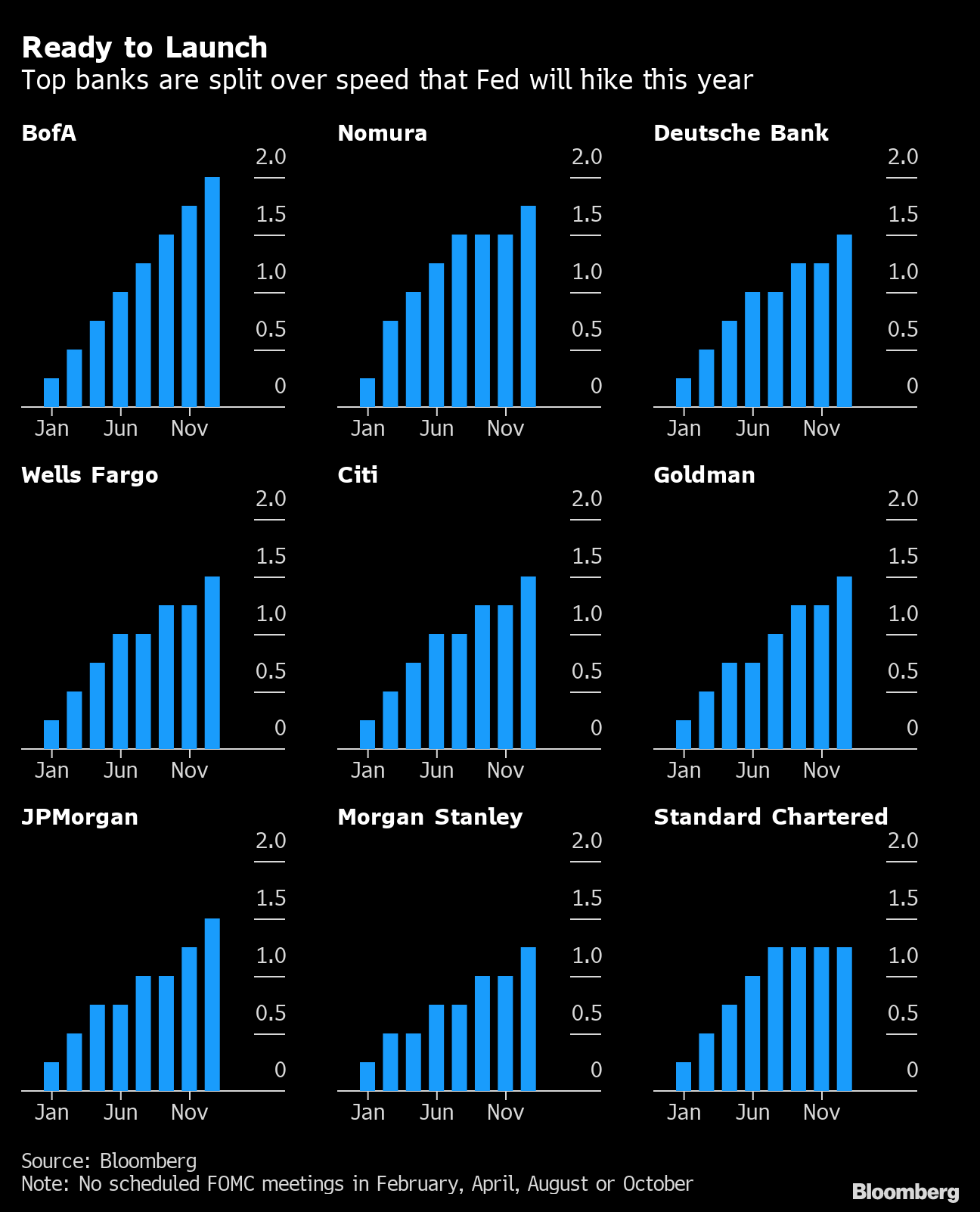

The Fed Chair also added that they will decide meeting by meeting starting from the next March meeting on its monetary policy decisions. Most of the major investment banks are forecasting at least five or more hikes this year, with the Bank of America calling 7 rate hikes by the Fed this year.

The interest rate is the Fed’s main tool to battle inflation and it does so by setting the short-term borrowing rate for commercial banks, and then those banks pass it along to consumers and businesses.

By raising interest rates, it acts as a brake on the economy by making borrowing more expensive so that consumers and businesses hold off on making any investments, thereby cooling off demand and bringing prices back in check.

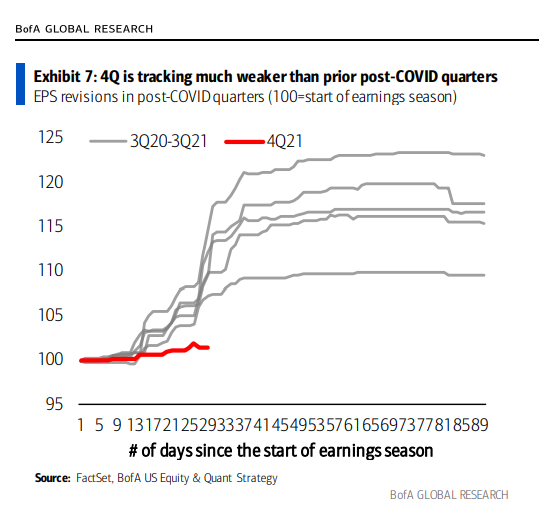

Nonetheless, it is also important for the Fed to not raise interest rates too quickly as it would dampen demand too much and eventually slow down the economy, especially so when earning revisions are at the lowest since the beginning of the pandemic (as illustrated by the graph below) as well as the fact that strategist from investment banks are starting to lower economic projection on US growth.

With all that being said, it is still unclear how much the first hike will be and what will follow it, but one thing we can be certain about is that inflation is running high and is well above the Fed’s target, and rate hikes in 2022 seems imminent for now.

What’s the opportunity in this environment?

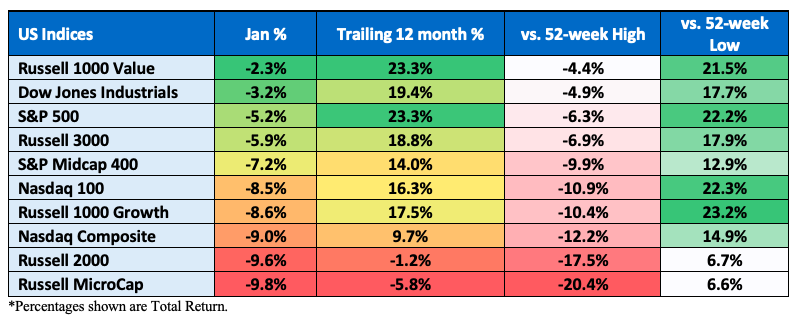

January has been a turbulent month, and many equity indices closed negative, with the S&P 500 down by 5.2% [5] and the tech-heavy Nasdaq 100 having the worst January since the 2008 global financial crisis [6].

The huge fall for the Nasdaq 100 was mainly due to the rotation out of growth stocks in the backdrop of possible rate hikes.

Growth stocks, which are usually dominated by tech, are characterised as companies that trade at higher price-to-earnings multiples than other stocks (such as value stocks) as investors are willing to accept higher valuations today on future expectations of continued above-average growth.

In low interest rate environments, the opportunity cost of waiting for future growth to materialise is low. But when interest rates rise, future growth is discounted back to present value and worth less, so investors may not be willing to pay as much for these growth stocks.

On the other hand, value stocks have cheaper price-to-earnings multiples relative to growth stocks and usually have strong current cash flows. As such, when valuing stocks using the discounted cash flow method, in times of rising interest rates, growth stocks are negatively impacted far more than value stocks.

Spotlight for value stocks

The return of value investing is in the spotlight for 2022.

The growth rate of the US economy is slowing, monetary conditions are tightening, and inflation is at its highest rate in decades.

An environment of rising inflation is attractive for value investing.

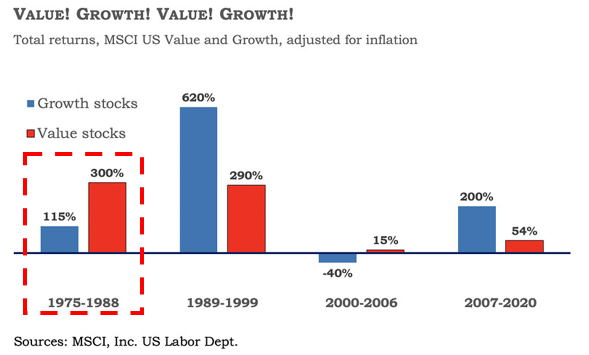

Historically, value companies have outperformed when inflation and interest rates increase, as they are less sensitive to changes in macroeconomic conditions.

High inflation and rising rates were characteristics of markets in the late 70s and 80s.

One value(able) ETF worth looking now: MOAT ETF

Given this inflationary environment and likelihood of multiple rate hikes this year, savvy investors may wish to consider the VanEck Morningstar Wide Moat ETF (AMEX: MOAT).

MOAT seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Morningstar Wide Moat Focus Index, which leverages Morningstar’s equity research to systematically target the most attractively priced U.S. wide moat companies on a quarterly basis.

The MOAT ETF remains significantly overweight to value stocks relative to the S&P 500 Index. It currently comprises nearly 45% value stocks, which is 15% overweight the S&P 500 Index exposure. The ETF’s value tilt will position it well for an inflationary, rising rate environment in 2022.

So what exactly is the “wide moat stocks” that I was referring to earlier?

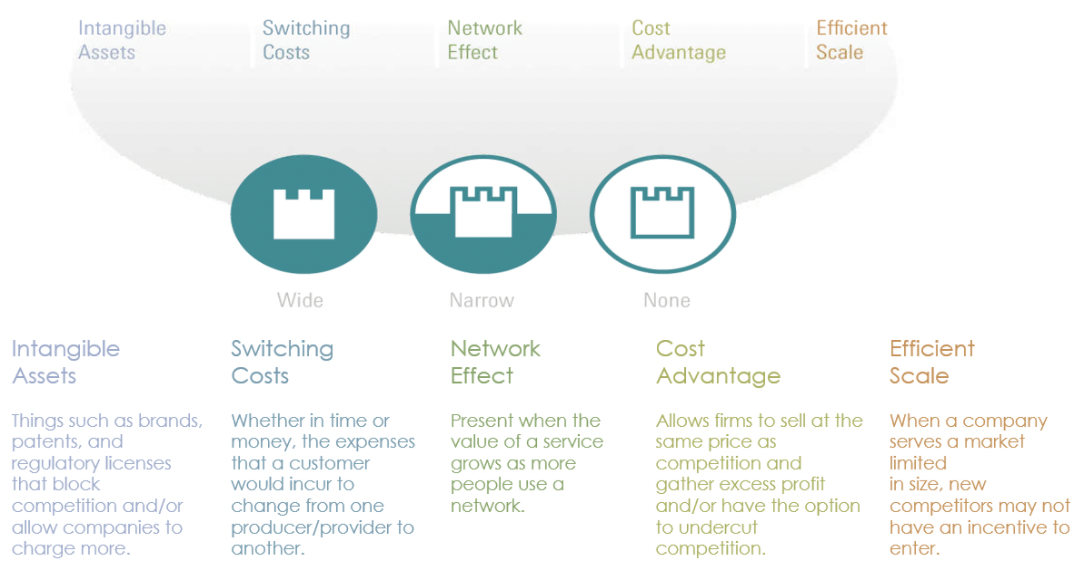

A company’s economic moat refers to its ability to maintain the competitive advantages that are expected to help it fend off competition and maintain profitability into the future. Morningstar assigns each company it analyses an Economic Moat Rating of ‘wide’, ‘narrow’ or ’none’.

Companies assigned a ‘wide’ moat rating are those in which Morningstar has very high confidence that excess returns will remain for 10 years, with excess returns more likely than not to remain for at least 20 years.

Companies with a ‘narrow’ moat rating are those Morningstar believes are more likely than not to achieve normalised excess returns for at least the next 10 years.

A firm with either no sustainable competitive advantage or one that Morningstar thinks will quickly dissipate is assigned a moat rating of ‘none’. The below infographics illustrates the five sources of moat that the Morningstar’s equity research team uses to evaluate companies’ moat.

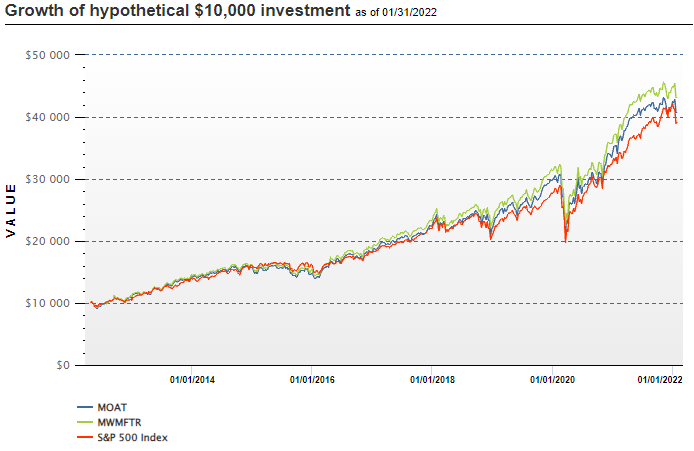

Looking at the performance between MOAT and the S&P 500 Index since the ETF inception, we can see that MOAT has served the investors well and has outperformed the S&P 500, a testament to MOAT’s value and quality approach.

Dollar Cost Averaging (DCA) Strategy

Now that you know MOAT is a good ETF to invest in. You need a systematic strategy.

Dollar cost averaging (DCA) is a simple and well-known strategy for investors. It involves investing in a stock or ETF regularly (monthly or quarterly) to smooth out the volatility of prices instead of making one lump sum of investment at a price too high.

POEMS DCA Step-by-Step Guide

So how can we use POEMS 2.0 trading platform to invest in MOAT?

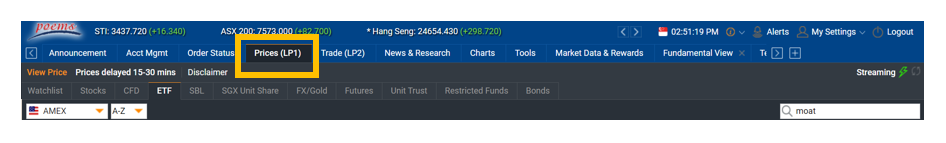

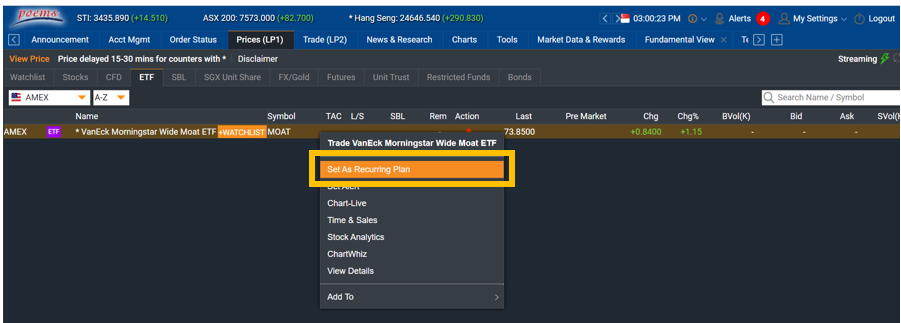

Step 1: Log onto POEMS 2.0 > Prices (LP1)

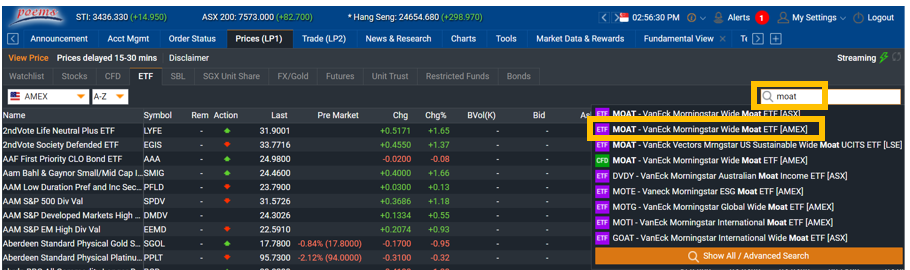

Step 2: Search and select ETF MOAT [AMEX]

Step 3: Right click and select set as recurring plan

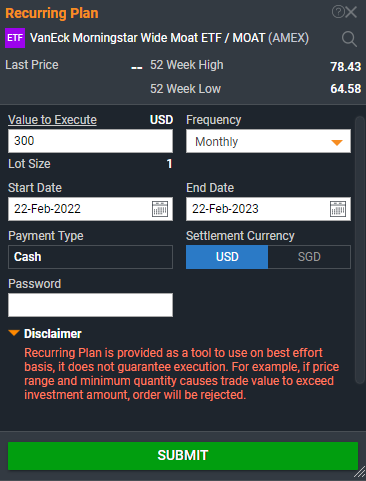

Step 4: Key in your conditions for the recurring plan

- Under “Frequency”, select the frequency that you would like to invest into MOAT. (For DCA strategy, either monthly or quarterly contributions are recommended.)

- Under “Value to Execute”, key in the value you would like to contribute on each payment date. (In the example below, it would be USD 300 on a quarterly basis.)

- Under “Start Date” and “End Date”, choose the date you would like to start this recurring plan and the date you would like to stop this recurring plan respectively.

- Under “Settlement Currency”, you have the option to choose either to settle the payments in USD or SGD for the MOAT recurring plan.

*Do note the disclaimer that the recurring plan is provided as a tool to use on a best effort basis and execution is not guaranteed. For example, if price range and minimum quantity causes trade value to exceed investment amount, order will be rejected. Hence, if you’d like to have a guaranteed execution, the best way is to log in every month or quarter to perform a trade.

Based on the inputs in the screenshot above, the recurring plan would invest USD 300 on a monthly basis, starting from 22nd February and every subsequent 22nd of each month till 22nd February 2023, amounting to a total of 13 payments for the above plan set up.

Performance

How well has DCA performed for MOAT ETF for the past 5 years (2017 – 2021)?

Over the past 5 years, using a DCA strategy on MOAT ETF gives us a return of 59%, inclusive of dividends. Not bad for an investment with minimal work!

Conclusion

We hope you have enjoyed our article and find it useful in your investment journey!

We strongly believe that MOAT ETF would not only serve your portfolio well during these turbulent times but also as a long term investment as proven by its track record in comparison with the S&P 500 Index.

With numerous headwinds in 2022, we wouldn’t be surprised to see a market correction and the stocks of companies with wide moat generally hold their value better to the downside during any potential market corrections.

In addition, if inflation is persistent, these companies typically exhibit strong pricing power to quickly pass-through cost increases to maintain their margins.

Lastly, as the saying goes: Time in the market beats timing the market. The DCA strategy on ETFs is one simple and effective way to reduce the volatility of your returns and still get a decent return.

We would be sharing a list of ETFs that we can apply DCA on in our telegram group on 9th March. Within our community, we share exclusive invites to our upcoming webinars. It is also a group where we collate feedback and add value to your investing and trading journey. So join our telegram group now! See you around!

How to get started

As the pioneer of Singapore’s online trading, POEMS’ award-winning suite of trading platforms offers investors and traders more than 40,000 financial products across global exchanges.

Explore an array of US shares with brokerage fees as low as US$1.88 flat* when you open a Cash Plus Account with us today. Find out more here. T&Cs apply.

We hope that you found value reading this article! If you do not have a POEMS account, you may visit this link or scan the QR code below to open one with us today!

Open a POEMS account within minutes and trade instantly!

For enquiries, please email us at cfd@phillip.com.sg. If you are interested in active discussions, you can also join our Telegram community here.

Reference:

- [1]https://www.cnbc.com/2022/02/10/january-2022-cpi-inflation-rises-7point5percent-over-the-past-year-even-more-than-expected.html

- [2]https://finance.yahoo.com/news/u-producer-price-inflation-stays-134021933.html

- [3]https://www.bloomberg.com/news/articles/2022-01-31/wall-street-economists-split-on-how-fast-and-far-fed-will-hike

- [4]https://www.zerohedge.com/markets/worst-earnings-season-covid-emerged-and-its-about-get-much-worse

- [5]https://www.nasdaq.com/articles/january-2022-review-and-outlook

- [6]https://variety.com/2022/biz/news/nasdaq-january-drop-covid19-pandemic-1235167945/

- [7]https://www.marketwatch.com/story/whats-happened-to-value-stocks-2020-05-14

- [8]https://www.vaneck.com/us/en/investments/morningstar-wide-moat-etf-moat/what-makes-a-moat-white-paper.pdf/

- [9]https://www.vaneck.com/us/en/investments/morningstar-wide-moat-etf-moat/performance-distributions/

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Jeremy Chua (Dealing) & Chua Minghan (Assistant Manager, Dealing)

Jeremy graduated from Nanyang Technological University with a Bachelor’s Degree in Business and is a member of the largest dealing team in Phillip Securities. He strongly believes in the importance of staying invested in the financial markets and evaluates stocks using fundamentals to make informed investment decisions.

In his free time, he enjoys researching on market events and disruptive investment themes to generate new investment ideas for the short and long term.

Chua Minghan graduated from the National University of Singapore with a Bachelor’s degree in Economics. He is passionate about education and went on to get a post-grad Diploma in teaching. His vision is to educate clients to make informed decisions for their trading and investments.

Minghan enjoys learning fundamental analysis, technical analysis, and strives to use data analysis to improve his trading skills.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile