All you need to know: Leverage with Daily Leverage Certificates (DLCs) November 3, 2021

What is a DLC?

Daily Leverage Certificates (DLCs) were first introduced in Europe in 2012.In July 2017, SGX became the first in Asia to offer DLCs products for trading on its exchange.

Issued by a third-party financial institution, DLCs are traded in the secondary market. They are exchange-traded financial derivative products which enable investors to take a leveraged exposure to an Underlying Asset using a fixed leverage factor of 3x, 5x or 7x. In other words, the daily percentage return of a DLC will be equivalent to the fixed leverage factor multiplied by the daily percentage return of the underlying asset.

How do DLCs work?

There are two types of DLCs – long DLC or short DLC

Long DLCs allow investors to generate leveraged gains when the price of the underlying asset increases. When investors are bullish in an underlying asset, they may choose to purchase a long DLC.

On the contrary, short DLCs allow investors to generate leveraged gains when the price of the underlying asset decreases. When investors are bearish in an underlying asset, they may choose to purchase a short DLC.

Calculating Profit & Loss for DLCs

The below examples illustrate the profit and loss calculated for a long DLC and a short DLC before factoring in any costs and fee charges.

Example 1: 5x Long ABC (Rising Underlying Asset)

Investor A has $2,000 which he uses to purchase 1,000 shares of 5x Long ABC DLC at $2 when ABC is at $20. When the underlying asset (ABC) goes up from $20 to $21 (+5%), the 5x Long ABC DLC will go from $2 to $2.50 (+25%) due to the 5x leverage factor.

Investor A will profit ($2.50 – $2)*1,000 = $500 with long DLC.

Example 2: 5x Long ABC (Falling Underlying Asset)

Investor A has $2,000 which he uses to purchase 1,000 shares of 5x Long ABC DLC at $2 when ABC is at $20. When the underlying asset (ABC) goes down from $20 to $19 (-5%), the 5x Long ABC DLC will go from $2 to $1.50 (-25%) due to the 5x leverage factor.

Investor A will lose ($1.50 – $2)*1,000 = -$500 with long DLC.

Example 3: 5x Short DEF (Rising Underlying Asset)

Investor B has $1,000 which he uses to purchase 1,000 shares of 5x Short DEF DLC at $1 when DEF is at $10. When the underlying asset (DEF) goes up from $10 to $11 (+10%), the 5x short DEF DLC will go from $1 to $0.50 (- 50%) due to the 5x leverage factor.

Investor B will lose ($0.50 – $1)*1,000 = – $500 with short DLC.

Example 4: 5x Short DEF (Falling Underlying Asset)

Investor B has $1000 which he uses to purchase 1000 shares of 5x Short DEF DLC at $1 when DEF is at $10. When the underlying asset (DEF) goes down from $10 to $9 (-10%), the 5x short DEF DLC will go from $1 to $1.50 (+50%) due to the 5x leverage factor.

Investor B will profit ($1.50 – $1)*1000 = $500 with short DLC.

Compound Return

Investors holding their DLCs for more than one day may see their returns outperform or underperform the leverage factor embedded within the DLC. This is due to the exposure of a DLC which will be reset at the end of each trading day back to its fixed leverage factor.

When markets open the next day, the performances of the Underlying Asset and DLC will be measured from the closing levels that were recorded in the previous trading day. This means that the performance of each day is locked in, and any subsequent returns are based on what was achieved the day before. Therefore, this gives rise to Compounding Effect.

Compounding effect is only favourable when the underlying asset moves in an upwards or downwards pattern. If it moves in a sideways pattern, investors may lose more than the stipulated leverage factor. Examples are shown below to explain this.

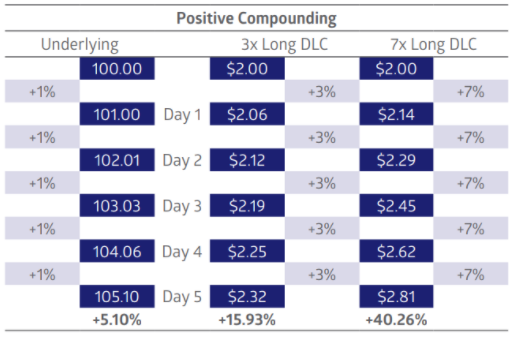

Positive Compounding

Based on the chart above, assuming that the underlying asset at Day 0 closed at 100.00, investor A bought the 3x long DLC at $2.00.

On Day 1, the underlying asset rose by 1% and closed at 101.00. Therefore, the 3x long DLC rises by 3% from $2.00 to $2.06.

On Day 2, the underlying asset rose by another 1% from the previous closing price of 101.00 to 102.01. This means that the 3x long DLC rises by another 3% from the previous closing price of $2.06 to $2.12.

If the underlying asset continues to rise at 1% per day, on Day 5, the underlying asset will be at 105.10 and the 3x long DLC will be at $2.32.

Over 5 days, the underlying asset has risen by (105.1-100)/100 * 100% = 5.1% and the 3x long DLC has risen by ($2.32-$2/$2)*100% = 15.93%. The 3x long DLC gave higher returns than the stipulated 3 times the performance of the underlying asset. Given that the underlying asset rose by 5.1%, the 3x long DLC is supposed to rise by 15.3%. However, due to the compounding effect, the 3x long DLC has risen by 15.93% instead.

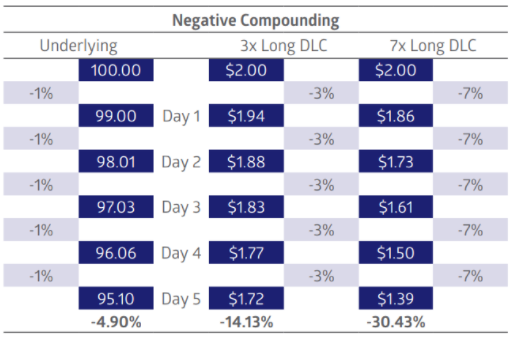

Negative Compounding

Based on the chart above, assuming that the underlying asset at Day 0 closed at 100.00, investor A bought the 3x long DLC at $2.00.

On Day 1, the underlying asset fell by 1% and closed at 99.00. Therefore, the 3x long DLC fell by 3% from $2.00 to $1.94.

On Day 2, the underlying asset fell by another 1% from the previous closing price of 99.00 to 98.01. This means that the 3x long DLC falls by another 3% from the previous closing price of $1.94 to $1.88.

If the underlying asset continues to fall at 1% per day, at Day 5, the underlying asset will be at 95.10 and the 3x long DLC will be at $1.72.

Over 5 days, the underlying asset fell by (95.1-100)/100 * 100% = -4.9% and the 3x Long DLC rose by ($1.72-$2/$2)*100% = -14.13%. The 3x long DLC gave lower losses than the stipulated 3 times the performance of the underlying asset. Given that the underlying asset fell by -4.9%, the 3x long DLC is supposed to rise by 14.7%. However, due to the compounding effect, the 3x long DLC fell by only 14.13% instead.

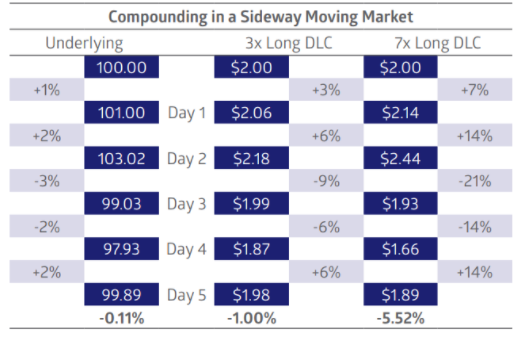

Sideways Compounding

Based on the chart above, assuming that the underlying asset at Day 0 closed at 100.00, investor A bought the 3x long DLC at $2.00.

On Day 1, the underlying asset rose by 1% and closed at 101.00. Therefore, the 3x long DLC rose by 3% from $2.00 to $2.06.

On Day 2, the underlying asset rose by another 2% from the previous closing price of 101.00 to 103.02. This means that the 3x long DLC rose by 6% from the previous closing price of $2.06 to $2.18.

On Day 3, the underlying asset fell by 3% from 103.02 to 99.03 while the 3x long DLC fell by 9% from $2.18 to $1.99. Just from looking at these 3 days, you can see that although in relative terms the 1% and 2% increases on Day 1 and 2 respectively, investors should however negate the 3% decrease on Day 3, due to the daily compound effect as the underlying asset is at 99.03 instead of going back to the breakeven point of 100.00. Similarly, the DLC should be at the breakeven point but it has fallen to $1.99.

At the end of Day 5, the underlying asset fell by -0.11%. However, the DLC fell by more than the stipulated leverage factor of 3 times. It has fallen by -1.00% which is about 9 times more than the fall of the underlying asset.

Therefore, DLCs are not designed to be traded or held for long periods of time when the market is moving sideways.

Risk of Trading DLCs

Counterparty Risk

DLCs are issued by a third-party financial institution such as Societe Generale. If the issuer defaults, investors could lose all or part of the money that was invested in the DLC. Furthermore, if the issuer is a foreign entity, foreign laws and jurisdiction may affect the ability to seek recourse.

Leverage Risk

Given that DLCs are leveraged financial products with a fixed leverage factor of 3x, 5x or 7x the performance of the underlying asset, losses could potentially be larger due to the leverage. There is a chance that investors may lose more from investing in DLCs as compared to investing directly in the underlying asset.

Liquidity Risk

As DLCs are more complex as compared to stocks, there might not be many investors. Therefore, with a lack of investors trading DLCs, the market may be illiquid and this could potentially make buying or selling a DLC difficult for investors.

Exchange Rate Risk

Investors may face exchange rate risks if the DLC is traded in Singapore dollars but the underlying asset of that DLC is denominated in another currency. (E.g. Meituan 5xLonSG220808 is traded in SGX with an issue price of SGD $1. However, the underlying asset, Meituan (3690) is listed in HKEx with the current share price as of 7 October 2021 at HKD $250.80).

Market Risk

Price levels, volatility, and liquidity of the underlying asset of the DLC are factors that could affect the trading price of the DLC. Should the underlying asset price decline until the cash settlement amount is less than or equal to zero, investors may lose their entire investment.

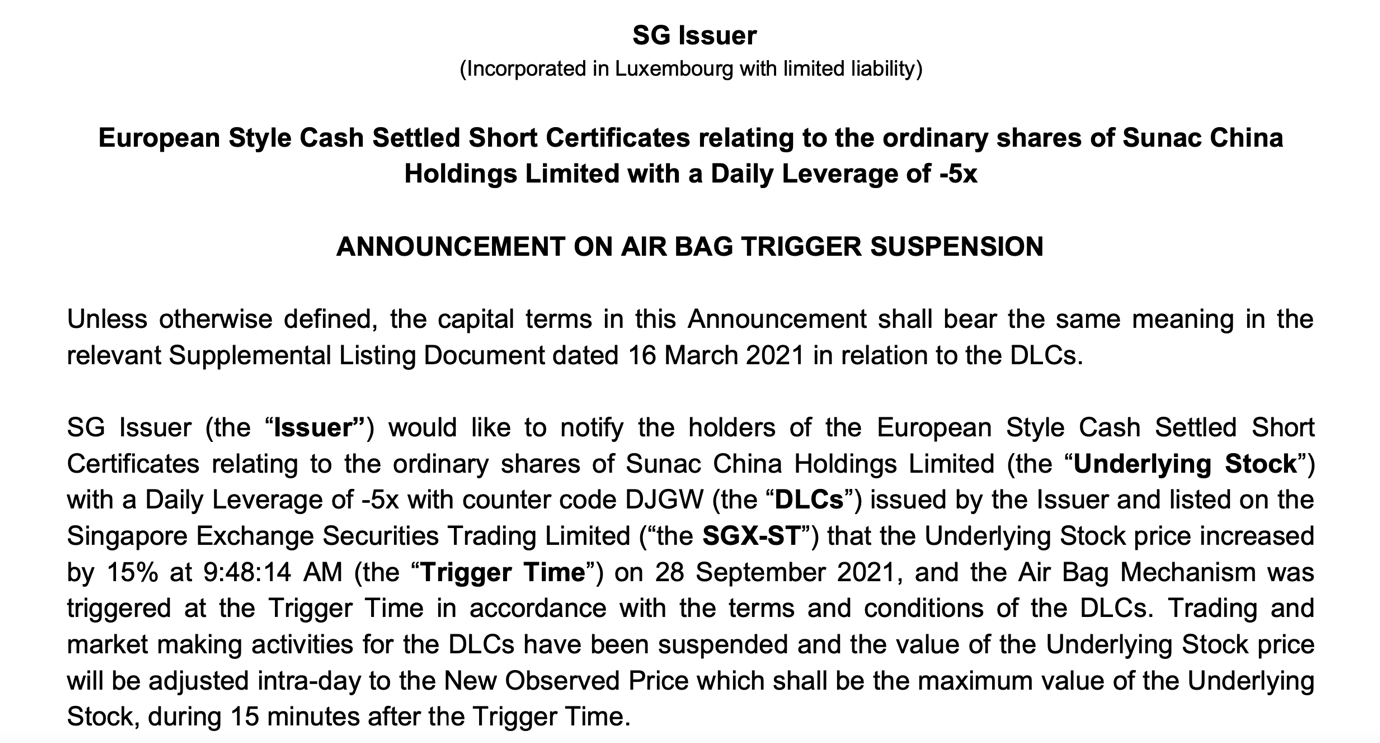

Airbag Mechanism

Similar to the protection an airbag provides for a driver in an accident, the Airbag Mechanism (Airbag) cushions the impact of loss in the value of the DLC in extreme market conditions when triggered. It is designed to reduce the actual exposure of the DLC to changes in the underlying asset in the event of adverse price movements during trading.

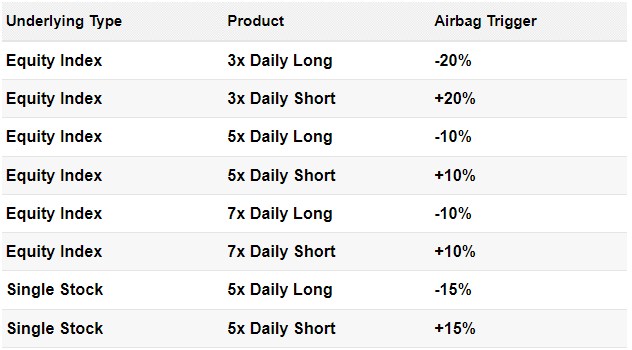

The chart above shows when the Airbag Mechanism will be triggered for different DLC products. If the DLC is a 3x Daily long product that tracks the Equity Index as its underlying asset, the airbag will only be triggered when the underlying asset falls by 20%.

If the DLC is a 5x Daily Short product that tracks the Equity Index as its underlying asset, the airbag will only be triggered when the underlying asset rises by 10%.

It is essential to note that the airbag will not be triggered on the DLC that is in line with the market direction. (e.g. the airbag will not be triggered for a 3x Daily long DLC when the underlying asset rises by 20%). Furthermore, there is also no guarantee that the Airbag Mechanism will prevent investors from losing their entire value of investment if the underlying asset continues to move beyond the airbag trigger once trading resumes.

It is possible for the Airbag Mechanism to be triggered more than once per day.

Key Timings to Note

The Airbag Mechanism can only be triggered when the market of the underlying asset is opened, which may not be the same time as the DLC trading window. (example: Meituan 5xLongSG220808 (listed on SGX) opens at 9:00am (+8 GMT). However, the underlying asset, Meituan (listed on HKEx) opens at 9:30am (+8 GMT). Therefore, the Airbag Mechanism can only be triggered from 9:30am (+8 GMT) onwards.

When the underlying asset touches the Airbag Trigger Level, the Airbag Mechanism is triggered. Trading activity of the DLC is halted and a 15-minute observation period begins. During the 15-minute observation period, the lowest level of the underlying asset (Daily long) or the highest level of the underlying asset (Daily Short) is recorded. This will be the new observed level.

Trading of the DLC will resume 30 minutes after the triggering of the Airbag Mechanism. The leverage of the DLC is subsequently applied to the performance of the underlying asset computed from the observed level instead of the last closing level.

This is an example of an Airbag trigger for 5x short Sunac China Holdings Limited DLC that occurred on 28 September 2021 when the underlying asset, Sunac, rose by 15% at 9:48 AM (+8 GMT).

Example of how Airbag Mechanism works

Assuming an investor bought a 5x long DLC that tracks the HSI (Hang Seng Index) at a price of $2 and HSI previously closed at 20,000 points, if the HSI were to drop by 2,000 points 1-hour after the market opens, this would mean that HSI has dropped by 10%. The DLC would have fallen by 50% to $1, triggering the Airbag Mechanism.

Trading of the DLC will be suspended for 30 minutes, with an observation of 15 minutes. Assuming the lowest that HSI has reached during the observation period was the same as when the Airbag Mechanism was triggered at 18,000 points, the New Observed Level (NOL) will be at 18,000 when trading resumes. After trading resumes, HSI then drops by another 10%. The DLC will then follow suit, dropping by 50% from $1 to $0.50.

Without the Airbag Mechanism, an additional 10% fall in the underlying index would have left the DLC in a bad shape. The total fall of 20% in the underlying index would have resulted in a 100% loss in the 5x long DLC.

Costs and Fees

Brokerage and Spread

Investors doing intraday trading of a DLC will be required to pay a brokerage commission and SGX Exchange fee to their broker. The SGX Exchange fee has two components: 1) Trading Fees – 0.1bps or 0.001% of traded value 2) Clearing Fees – 0.4bps or 0.004% of traded value. In addition, investors are also charged on the spread on the bid & ask prices (the difference between the offer price paid when buying the DLC and the bid price received when selling the DLC). If positions are held overnight, investors are liable for the list of charges below.

Management Fee

Investors who hold their positions overnight are liable for Management fee charges. The Management fee is charged similarly to how an issuer would charge in a fund. It is charged daily and taken from the value of the product at a prorated rate per day. (e.g. the management fee for Meituan 5xLongSG220808 is 0.4% per annum. Therefore, the management fee will be 0.4%/365 days = ~0.0011% per day)

Gap Premium

Investors who hold their positions overnight are liable for Gap Premium charges. Similar to the Management Fee, it is calculated daily and applied to the value of the product (e.g. the Gap Premium for Meituan 5xLongSG220808 is 7.5% per annum. Therefore, the Gap Premium will be 7.5%/365 days = ~0.0205% per day).

The Gap Premium is a hedging cost that protects the product from extreme market movements overnight. Without the Gap Premium, if the underlying asset were to open more than 20% against the intended direction of a 5x DLC (for example: Meituan 5xLongSG220808 opened at a price that is lower than the previous closing price by more than 20%), the loss in value of the DLC could be more than 100% due to the leverage factor of 5x. However, as hedging was paid for by the gap premium, the worst case scenario that could happen is that the DLC could be lessened to a near negligent price. Therefore, an investor cannot lose more than what he invests.

Funding Cost and Rebalancing Cost

The funding cost is the cost to fund the product replication strategy. The product replication strategy refers to the replication by a DLC of the performance of the underlying asset with a leveraged exposure of 3 to 7 times. For a long strategy, the funding cost is normally referenced from a publicly published interbank offered rate plus spread. For a short strategy, the funding cost is the cost of borrowing stocks in order to take an inverse exposure on the underlying asset. The product replication strategy aims to keep a fixed overnight leverage.

The rebalancing of costs is computed as a function of leverage and daily performance of the underlying asset. It is the cost incurred that follows from the cost of execution due to the product replication strategy.

Both of these costs are charged to a DLC overnight and will reduce the value on a daily basis if the product is held overnight.

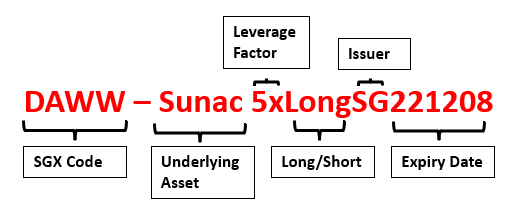

How to read the Name of a DLC

There are 6 components that make up a specific DLC Name that is listed on the exchange. They are the SGX Code for the DLC, Name of the underlying Asset, Leverage Factor, Long/Short, Issuer of the DLC, and the Expiry date of that specific DLC.

1) SGX Stock Code – This is the specific code that is assigned to the DLC by SGX. You are able to search for the DLC by typing in the Stock code (example: DAWW).

2) Underlying Asset – This is the Stock/ Index that the DLC is tracking. For example, the underlying asset for DAWW is Sunac (1918)* which is listed on the Hong Kong Exchange (HKEx).

3) Leverage Factor – This is the amount of amplification that the DLC follows the Underlying Asset in its price movement. For example: 5X would mean that if the underlying asset moves by 1% from its closing price of the previous trading day, the DLC will move by 5%.

4) Long / Short – This refers to the direction that the investor is trading towards. Investors long / short a DLC when they are bullish/ bearish in the underlying asset.

5) Issuer – This refers to the third-party financial institution that issues this specific DLC (for example: SG (Societe Generale) is the issuer of DAWW).

6) Expiry Date – The expiry date follows the YYMMDD format. DLCs have a finite lifespan and will cease to exist on their expiry date (Maximum tenure of 3 years).

Eligibility to trade DLC

Under the MAS guidelines to safeguard to retail investors, all investors are required to be Specified Investment Products (SIP) qualified to invest in DLC. Investors should have sufficient understanding of the product and either a high level of knowledge or sufficient trading experience to properly evaluate and assess the product structure, associated risks, valuation, costs and expected returns.

Investors who are interested to trade DLCs are required to complete and pass the Customer Account Review (CAR). The criterion of the CAR consists of Education Qualifications, Work Experience and Investment Experience. Investors have to satisfy at least one out of the 3 criterions to qualify.

In the event that the investor fails the CAR, they are required to complete the SGX online education program to enhance their product understanding of SIPs in order to trade them. The SGX online education programme platform can be found at: https://onlineeducation.sgx.com/specifiedinvestmentproducts/

DLC vs CFD vs Structure Warrants

| DLC | CFD | Warrants | |

| Traded on exchange? | Yes | No | Yes |

| Maximum Loss? | Initial capital | More than initial capital | Initial Capital |

| Margin Call? | No | Yes | No |

| Time Decay? | No | No | Yes |

| Compounding Effect? | Yes | No | No |

In terms of liquidity, DLCs and Warrants have an edge over CFDs as they are traded on an exchange, while CFDs are traded through the OTC market. Therefore, there will be more market participants which increases the liquidity of the product.

In addition, DLCs and Warrants are generally less risky as traders will not lose more than their initial capital as compared to CFDs. There is also no margin call for DLCs and Warrants, which means that they will not be subjected to close their positions prematurely if traders do not top up to the initial margin requirements.

DLCs and Warrants might seem better than CFDs, in terms of risk and liquidity. However, which one of these products reign supremacy? This is where the difference between DLCs and Warrants lie.

DLCs have an edge over Warrants as there is no time decay. As Warrants trade closer to the expiration date, the value of the Warrant will decline. However, the downside of DLC as compared to Warrant is the compounding effect. As mentioned above, traders could lose more than the fixed leverage factor if the product is trading sideways, due to the compounding effect.

Therefore, DLCs might be the better product to trade if you are looking to do short-term trading such as intraday trades.

Summary

Investors who trade DLCs are able to leverage the underlying asset to reap higher profits. However, is it important to note that leveraging is a double-edged sword, where losses will also be multiplied. Although the Airbag Trigger helps to cushion the impact of adverse price movements, investors are still susceptible to losing their entire invested amount if the underlying asset continues to move against the direction that they are vested in.

Unlike other financial derivative products, DLCs have a fixed leverage factor which makes them simple to understand. It is traded like a share and investors are able to trade them in the exchange.

Investors are able to see live tradable prices which makes it more transparent, as compared to OTC products. Investors have the liquidity to be able to buy and sell throughout the day.

Ultimately, it is important that investors must possess ample knowledge about the risks involved and do their own due diligence before trading DLCs.

Reference:

- Daily Leverage Certificates – Handbook

- DMGW Meituan 5xLongSG220808

- Meituan 5xLongSG220808- Key Terms Sheet

- SGX DLC Factsheet

- Understanding Daily Leverage Certificates

- Daily Leverage Certificates

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Alvin Teo

Equities Dealer

Toa Payoh Phillip Investor Centre

Alvin Teo graduated from Nanyang Technological University with a Bachelor’s Degree in Economics. Coming from an Economics background, he strongly believes in the importance of understanding the macroeconomic policies before making investment decisions. Alvin started investing in Singapore equities at the age of 21 and thus, he has relevant experience in the Singapore market.

Mooncakes: The Hidden Environmental Cost of Gifting

Mooncakes: The Hidden Environmental Cost of Gifting  Factor-Based (Smart-Beta) ETFs: How They Work, Selection Criteria, and Practical Uses for Singapore Investors

Factor-Based (Smart-Beta) ETFs: How They Work, Selection Criteria, and Practical Uses for Singapore Investors  What is an Active ETF?

What is an Active ETF?  100% Spenders in Singapore: How to Break Free from Living Paycheck to Paycheck

100% Spenders in Singapore: How to Break Free from Living Paycheck to Paycheck