Bank Earnings Comparison 1H2016 October 26, 2016

It is Q3 earnings season again. Analysts are working overtime to churn out their reports within the next few days while market participants stay up-to-date on recent earnings to determine the fair value (in their personal opinion) of each company.

Our local Banks, DBS, OCBC and UOB, seem to hold a special place in investors’/traders’ hearts as a result of their high market capitalization or earnings capabilities, or simply because their services are something that we use on a daily basis. Banks seem to be one of the market participants’ top focuses and this is no surprise as bank earnings are an indication of growth within the nation and determines spending in general which can come in the form of business expansion, buying properties or a growing population. Spending and inflation encourages more loans taken up which in turn benefit bank’s earnings.

Earnings

Banks in general earn in two segments: Net Interest Income (NII) and Non-net interest income (Non-NII).

NII – Consists of interest earned from loans being issued to businesses and consumers in different sectors and geography

Non-NII – Consists of transaction fees, service charges, inactivity fees, commission and investment/trading income etc

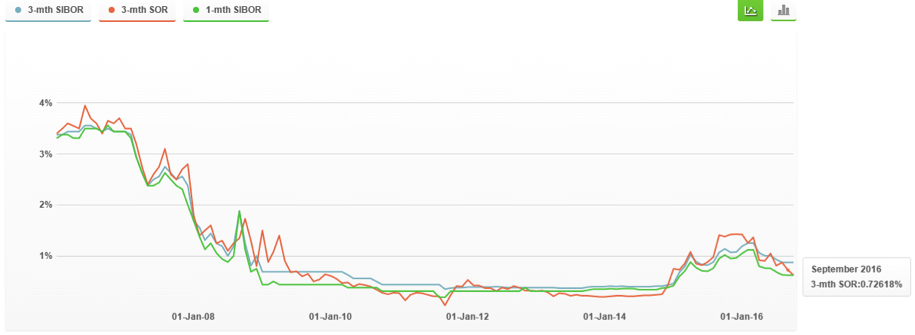

In the last 3 quarters, the 3-month Interbank Offer Rate (SIBOR) declined from 0.932% to 0.873%, while the 3-month Swap Offer Rate (SOR) fell from 0.81% to 0.726%. This in turn affects variable loan yields as they will be repriced to the lower benchmarks. This will affect NII earnings, which still makes up a majority of bank earnings, at 60% or more.

Source: http://www.moneysmart.sg/home-loan/sibor-vs-sor-trend

Based on net interest margin, DBS leads the pack, but with recent debt restructuring of Ausgroup, Marco Polo Marine and the recent happenings of Swiber, we may see some downward pressure on that. With UOB having the least amount of China and O&G loans, we start seeing more analysts with buy calls on UOB due to their conservative approach. If you believe that China will slow down further, UOB would be a safer choice, considering they have the highest SGD denominated loans as well.

| DBS (1H16) | OCBC (1H16) | UOB (1H16) | |

|---|---|---|---|

| Net Interest Margin (NIM) | 1.86% | 1.71% | 1.73% |

| Non-Performing Loan (NPL) | 1.10% | 1.10% | 1.40% |

| Exposure to Greater China (Based on Loans) | 29.61% | 23.99% | 11.48% |

| Exposure to O&G (Based on Loans) | 6.59% (Excludes Swiber) | 6.13% | 4.38% |

| Capital Adequacy Ratio | 16.30% | 17.50% | 15.90% |

| Leverage Ratio | 7.70% | 8.20% | 7.40% |

| Loan/Deposit Ratio | 91.80% | 82.20% | 84% |

Valuation

BankShare Price CAA 21/10/16P/B RatioP/E RatioDividend Yield

| UOB | 18.82 | 0.97 | 9.75 | 3.72% |

| OCBC | 8.49 | 0.99 | 9.83 | 4.24% |

| DBS | 15.03 | 0.89 | 8.77 | 3.99% |

| STI ETF | 2.88 | 1.19 | 11.91 | 3.23% |

The banks’ current valuations are extremely close to each other and discounted to STI ETF, with DBS leading the pack with regards to discount, which is no surprise due to their higher exposure to O&G. However, if you are a value investor and feel satisfied with a 4% region yield, banks does seem attractive. The question we need to ask ourselves is where will the growth be coming from? And on top of earnings and valuation, we still need to consider liquidity, asset quality and solvency risks.

Q3 Earnings Release Dates

BankQ3 Earnings Release Dates

| UOB | 28/10/16 |

| OCBC | 27/10/16 |

| DBS | 31/10/16 |

I would definitely be looking out for banks’ earnings this quarter due to the shakeup in Singapore O&G Sector. I do see some decline in asset quality which may lead to a pickup of non-performing loans and provision. Furthermore, we see slow growth economy and a chance of further weakness, therefore it is no surprise that the risk of banks will increase. A possible hope for the banks might come in the form of Non-NII earnings as there might be more activity Post-Brexit.

However, in my personal opinion as a value investor, the stock market has been transferring money from the impatient to the patient. I would remind our readers to look beyond the noise and be objective.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them. The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

About the author

Sky Kwah Wen Yao

Dealing Manager

Raffles Place & Marine Parade Dealing Team

Sky Kwah is part of the POEMS Equity Dealing Team that provides dealing services to over 28,000 trading account customers. Sky gives talks in tertiary institutions like NTU & SIM and he often conducts seminars on Fundamental Analysis, most recent was at the Investfair 2016. He particularly focuses on value stocks in Singapore and the US with a top-down macro approach. He is frequently interviewed by MediaCorp News 938Live radio station or 联合早报 as a market commenter and he hopes to help clients become better stewards of wealth and believes in succeeding in what truly matters – the fullness of life. Sky holds a Bachelor Degree of Commerce with a triple major in Financial Accounting, Investment Finance, and Corporate Finance, from the University of Western Australia.