Biotechnology – Health Cure for the Future June 11, 2020

Summary

- The biotechnology sector has been attracting public interest due to the ongoing COVID-19 pandemic

- The biotechnology industry serves a wide range of different markets and is estimated to reach US$727.1 billion by 2025

- Biotech stocks have aggressive growth potential because drug patents grant monopoly power and protect the firms from competitors

- However, the high cost and failure rate for drug development programmes have resulted in a very volatile and unpredictable sector.

- Investors can reduce their unsystematic risk exposure from the biotechnology sector by investing in biotechnology-themed ETFs

- Investors can gain exposure to the biotechnology sector via IBB, BBH, XBI and FBT

Introduction

The COVID-19 pandemic has devastated economies around the world and shaken the stock markets, causing intense volatility across all sectors. The aviation and energy industries are likely to be depressed for a prolonged period, while businesses specialising in delivering online commerce and entertainment are benefitting from the global shutdown.

However, one sector has been attracting waves of investors’ interest: biotechnology. With the pandemic showing few signs of easing, biotech companies are in a race against time to meet the rising demand for treatments, vaccines and testing kits.

The course of the world economy will ultimately depend on what will happen in the biotechnology sector.

What is Biotechnology?

Biotechnology is the use of biological processes, organisms or systems to manufacture products and technologies that help improve the quality of our lives.1 Throughout the history of the human race, mankind has been using biotechnology to facilitate food production and to develop new food products. From the domestication of animals through selective breeding to fermentation process in the creation of a variety of food products, biotechnology has aided the advancement of human civilisation tremendously.

Today, biotechnology overlaps with many other contemporary technologies, such as genomics and nanotechnology, in the treatment of diseases and the reduction of environmental degradation.2 It is estimated that the global biotechnology industry will reach US$727.1 billion by 2025, at a compound annual growth rate of 7.4%.3 The modern biotechnology industry serves a wide range of different markets such as medical, agricultural and industrial.

Types of Biotechnology

| Types | Description |

| Agricultural Biotechnology | Agricultural biotechnology focuses on the development of genetically modified crops for increasing crop yields or introducing desirable characteristics into the genetic makeup of the crops. |

| Industrial Biotechnology | Industrial biotechnology includes the production of cellular structures and biological elements for use in materials for the construction industry or domestic household items. |

| Medical Biotechnology | Medical biotechnology is the use of living cells or other cell materials for the purpose of improving the health of humans; curing illnesses and preventing diseases. |

The main focus of this article will be on medical biotechnology that specialises on novel drug development and clinical research.

Why Invest in Biotech Firms?

Biotech stocks provide access to investors on the lookout for aggressive growth opportunities. These companies spend long periods of time and massive amounts of money to fund Research and Development (R&D) breakthroughs in biological treatments and diagnostic tools. Successful R&D efforts can reward biotech firms and the fortunes of their shareholders in multiple folds.

Drug patents are valid for around 20 years after the drug’s invention but the time frame is usually halved to 10 years after testing approval brings the drug to the marketplace.4

The patent protects biotech firms against imitation drug projects by competitors during the development phase and grant monopoly power to the biotech firms once their drugs successfully hit the marketplace. Orphan drugs, which are medications or medicinal products used to treat rare diseases, may even enjoy extended period of exclusivity to encourage firms to embark on projects to develop them.

The patent protection allows biotech companies to enjoy sustained period of favourable sales and earnings for their successful commercial drug or treatment.

For example, Novavax Inc (NASDAQ: NVAX) rose from a low of US$4.49 in January 2020 to a high of US$56.96 in May 2020; a gain of nearly 1,168% in just five months. The biotech firm received US$388 million from the Coalition for Epidemic Preparedness Innovations for the clinical development of its SARS-Cov-2 vaccine candidate and another of its experimental flu vaccine, NanoFlu, has blockbuster sales potential if it is approved by regulators.5

Risks of Investing in Biotech Firms

Biotechnology, while immensely exciting, has proven to be a highly volatile and unpredictable sector due to the scientifically intensive operations of biotech companies.

It takes an average of at least ten years for a new drug to complete the journey from initial discovery to the marketplace, with clinical trials alone taking six to seven years on average. The average cost to develop each drug is estimated to be around US$2.6 billion.6

Despite the vast amount of resources committed towards drug development, the success rate is very low. According to data drawn from January 2005 to October 2015, it is estimated that only 13.8% of drug development programs made it from Phase I testing to approval.7

To illustrate, Threshold Pharmaceuticals (delisted) saw their share price plunge from US$16.98 in April 2006 to US$3 in May 2006 due to the termination of the company’s clinical trials upon FDA request.8

In addition, resistance to high drug prices is prompting regulators to implement new policies that may diminish the value of drug patents and threaten the profitability of biotech firms in the future.9

Exchange Traded Funds

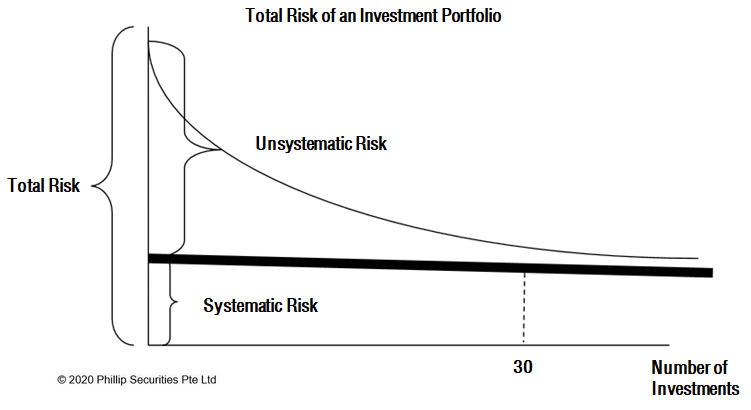

The unsystematic risk (company specific risk) exposure of investing into individual biotech stocks is very high due to the capital-intensive nature of the business and the high failure rate for product development. Nonetheless, unsystematic risk can be drastically reduced through diversification in a range of different industries and companies.

By increasing the number of investments in securities with imperfectly correlated returns, investors can reduce the unsystematic risk of their investment portfolios. Most research papers indicated that a portfolio of 20 to 30 diverse stocks is necessary to effectively remove unsystematic risk exposure.10

Rather than try to pick the winning company in the biotechnology sector, a better strategy would be to reduce the concentration risk by spreading out the dollar investment across the entire sector, which is well known for its volatility.

Biotechnology-themed Exchange Traded Funds (ETF) allow investors to reduce their unsystematic risk exposure in the biotechnology sector by buying into a basket of biotechnology stocks. They also allow investors to gain exposure to the growth potential of the sector and reduce the transaction costs of holding onto a large number of different stocks.

| ETF | iShares NASDAQ Biotechnology ETF | VanEck Vectors Biotech ETF | SPDR S&P Biotech ETF | First Trust NYSE Arca Biotechnology Index Fund |

| Ticker | IBB | BBH | XBI | FBT |

| Exchange | NASDAQ | NASDAQ | NYSEArca | NYSEArca |

| AUM | USD 8.62 billion | USD 454.0 million | USD 4.89 billion | USD 2.10 billion |

| Expense Ratio | 0.47% | 0.35% | 0.35% | 0.55% |

| Number of Holdings | 210 | 24 | 121 | 30 |

| Top 3 Holdings | – Vertex Pharmaceuticals Inc (NASDAQ: VRTX)– Amgen Inc (NASDAQ: AMGN)– Gilead Sciences Inc (NASDAQ: GILD) | – Amgen Inc (NASDAQ: AMGN)– Gilead Sciences Inc (NASDAQ: GILD)– Allergan plc (NYSE: AGN) | – Moderna Inc (NASDAQ: MRNA)– Immunomedics Inc (NASDAQ: IMMU)– Regeneron Pharmaceuticals Inc (NASDAQ: REGN) | – Sarepta Therapeutics Inc (NASDAQ: SRPT)– Charles River Laboratories Int Inc (NYSE: CRL)– Bluebird Bio Inc (NASDAQ: BLUE) |

ETF information is accurate as of 29 May 2020

Conclusion

There is no denying that the biotechnology sector is attracting much public attention from the race to treat and cure COVID-19. Demand for biotech products and services is expected to outstrip supply for the foreseeable future due to the ongoing pandemic. However, investors must also be aware of the potential negative impact that the pandemic has on biotech firms.

Biotech firms may face difficulties in securing additional funds for other projects as external resources are channelled into COVID-19 related programmes. Current clinical trials for ongoing drug programmes may be delayed to accommodate the pressing need for a vaccine for COVID-19.

With the market driven by the news and emotions of investors, the risk of further bouts of volatility remains high. Several biotech stocks have skyrocketed primarily on high hopes for their COVID-19 vaccine programmes. If their experimental vaccines are unsuccessful, the bubble will pop and send these stocks crashing down.

By diversifying the investment capital through the use of biotechnology-themed ETFs, investors can still gain exposure to the long-term growth prospects of the sector even if some of the underlying companies in the ETFs may fail in their COVID-19 vaccine programmes. By spreading the investment across a basket of biotech firms, investors may have a higher chance of hitting the winning company in the race to develop the vaccine solution for the COVID-19 pandemic.

References:

- [1] https://www.conserve-energy-future.com/biotechnology-types-examples-applications.php

- [2] https://whatis.techtarget.com/definition/biotechnology

- [3] https://www.grandviewresearch.com/press-release/global-biotechnology-market

- [4] https://www.upcounsel.com/how-long-does-a-drug-patent-last

- [5] https://www.fool.com/investing/2020/05/18/why-novavax-is-blasting-higher-today.aspx

- [6] http://phrma-docs.phrma.org/sites/default/files/pdf/rd_brochure_022307.pdf

- [7] https://cen.acs.org/articles/96/i7/Drug-development-success-rates-higher.html

- [8] https://www.investopedia.com/articles/trading/06/biotechsector.asp

- [9] https://www.healthaffairs.org/doi/full/10.1377/hlthaff.20.5.119

- [10] https://www.investopedia.com/ask/answers/05/optimalportfoliosize.asp

About the author

Mr. Joel Lim

ETF Specialist

Joel is the ETF Specialist from the ETF desk in Phillip Securities. He helps to provide sales support and trading ideas to retail investors, remisiers, in-house dealers, and fund managers. Joel also works closely with ETF issuers on new product and business development projects.

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection  ETF Market Review: February Outlook Signals Strong Performance

ETF Market Review: February Outlook Signals Strong Performance  ETF Market Analysis: Oil & Hang Seng Set for January Gains

ETF Market Analysis: Oil & Hang Seng Set for January Gains  Buffer ETFs — What Are They and How Do They Work?

Buffer ETFs — What Are They and How Do They Work?