Can Value be found in this 100-Year-Old Local Brand? September 1, 2020

Our Approach is very much profiting from lack of change rather than from change. With Wrigley chew gym, it’s the lack of change that appeals to me ~ Warren Buffett; CEO of Berkshire Hathaway

Good day Readers!

A quick question for you:

Think of a local born and bred Singaporean Brand that has gone international.

What comes to your mind?

Razer? OSIM? Creative Technologies? TWG Tea? Singapore Airlines? BreadTalk?

Whilst asking friends and colleagues, these notable brands came to mind.

Hint: It’s an ointment sold in a hexagonal jar, a cure-all staple for aches, joint pains and insect bites in many Chinese Families in Singapore/Malaysia.

This company has more than a century of history and has been listed on the Singapore Stock exchange since 1969. Over the years, it has become a core product embraced by many elite athletes and celebrities worldwide. [1]

This global brand is none other than Haw Par (SGX: H02). Many people associate the Haw Par brand with Haw Par villa, a theme park where its 18 levels of hell segment was notorious for giving many kids nightmares in the 1980s and 1990s. However, Haw Par is more than just a theme park. As shown in Figure 1, Haw Par’s global presence spans across five continents.

In this article, we will explore Haw Par’s business model and fundamentals after which we will look at how CFDs work and how they can be great versatile tools for your portfolio.

Be sure to also check out our latest CFD S$88 Equity Trade Rebate promotion.

Haw Par’s Fundamentals

It is no secret that Warren Buffett’s all-time favourite investment are See’s Candies, Wrigley and Coca Cola [3].

One of Warren Buffett’s investment tenets is to find businesses that have the ability to retain the majority of their earnings in the business and reinvest them at high levels of return on invested capital over time. Warren Buffett also favours businesses that sell a product or service that will not be changed (Think Coca Cola, See’s Candies, Wrigley’s Chewing Gum) nor disrupted negatively by technology.

Businesses that fit this criterion coupled with a strong brand name will be able to generate high returns on invested capital and Free Cash Flow overtime.

Without further ado, let us explore how Haw Par’s fundamentals stack up!

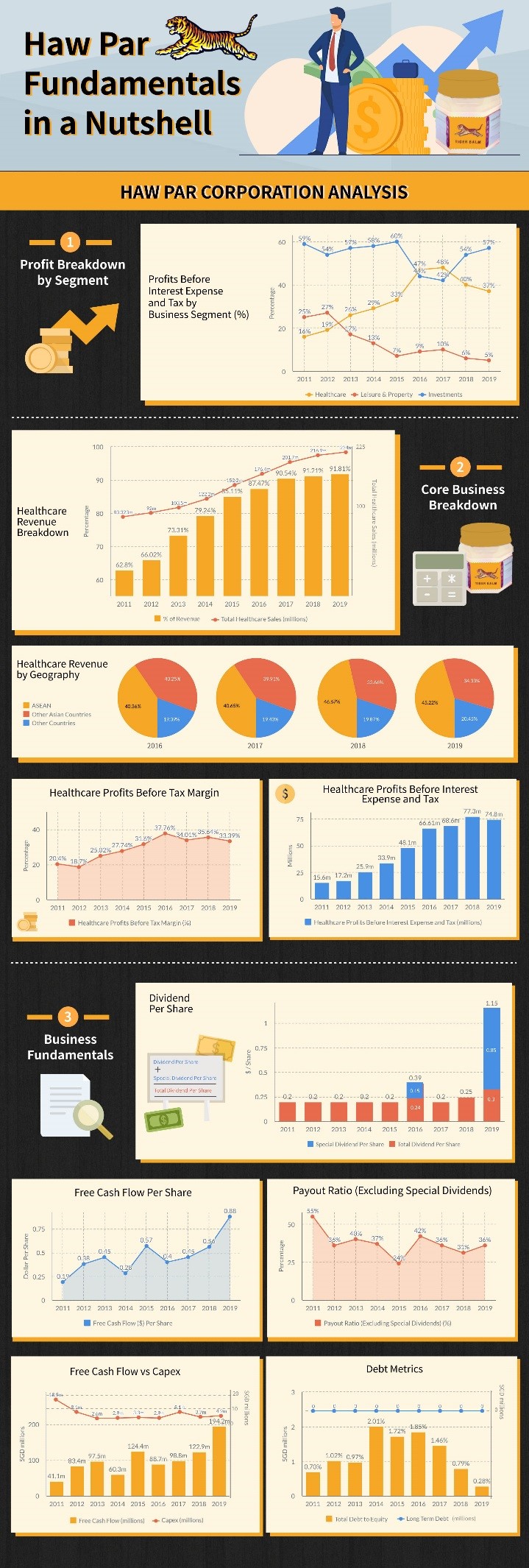

Haw Par’s business is segmented into three parts; Healthcare, Leisure and Property/Investments. Haw Par’s healthcare revenue as a % of total revenue has been steadily growing Year-On-Year. Haw Par’s core healthcare business has also been consistently profitable with stable Profit Before Tax margins. Most importantly, Haw Par’s core product has not changed in 100 years.

Haw Par’s dividends have been consistent over the last nine years, with two years of special dividends in 2016 and 2019 respectively. We can see that dividends can be sustainably paid out from its Free Cash Flow. Haw Par’s debt levels remain negligible with 0 long-term debt and low levels of Debt/Equity.

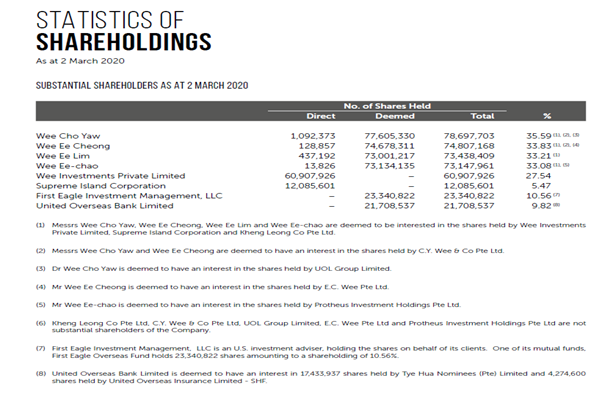

Based on the statistics of shareholdings, we observe that the management has significant skin in the game. Dr Wee Cho Yaw, Mr Wee Ee-Chao and Mr Wee Ee Lim are on Haw Par’s Board of Directors. Dr Wee Cho Yaw has been the Chairman of Haw Par group since 1978. Dr Wee is also a veteran Banker with more than 60 years of experience and is also the Chairman Emeritus and Adviser of the United Overseas Bank (UOB). UOB’s fundamentals can be found in this article.

Dr Lee Suan Yew, the younger brother of the Late Mr Lee Kuan Yew, sits on the board as a Non-Executive and Independent Director of Haw Par. He was first appointed as a director on 18 December 1995.

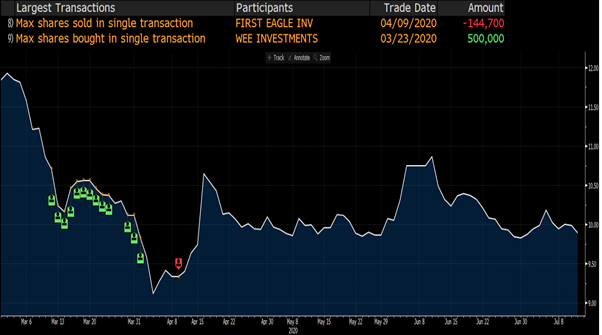

As seen in Figure 4, during 2020’s Black Thursday stock market crash, Wee Investments (Owned by Dr Wee Cho Yaw and family) had a net buy of 500,000 shares. Generally speaking, share buybacks by management implies faith in the company. It may also imply that the share is undervalued at that price.

“Faced with the choice between investing in two companies with the same earnings growth, we are prepared to pay materially more (in P/E terms) for the business with high returns on equity and superior cash flow generation.”

Marathon Asset Management

In my opinion, a great business is a function of two things. Firstly, the business must be able to generate high returns on invested capital with minimal intensity. Secondly, the business must have prudent capital allocators on the board.

Based on the data shown above, we can conclude that Haw Par fits both criteria.

Valuation

Price is what you PAY. Value is what you GET ~ Warren Buffett; CEO of Berkshire Hathaway

No matter how wonderful any stock counter may be, your return on investment is a function of the price you pay. Therefore, when investing/trading, it is crucial not to overpay and determine a floor valuation for the underlying counter.

To provide a conservative floor valuation, I will take solely the net amount of Haw Par’s Cash, its real estate portfolio and its strategic investments with its total liabilities.

| Assets | Description | Number of Shares Held | Total Value (SGD) |

| Cash and Bank Balances | Net cash Balance Sheet | NA | $465,599,000 |

| Total Liabilities | $84,829,000 | ||

| Real Estate Properties | Haw Par CentreHaw Par Glass TowerHaw Par Techno centreMenara Haw ParAccounted at Fair Value | NA | $56,263,000 |

| UOB (SGX: U11) | Share Price Taken as of Closing 5/8/2020 | 74,850,539 Shares @19.42 SGD | $1,453,597,467 |

| UOL Group (SGX: U14) | Share Price Taken as of Closing 5/8/2020 | 72,044,768 Shares @ 6.59 SGD | $474,775,021 |

Table 1: Figures shown are taken from Haw Par’s latest released 2019 Annual Report

Taking the difference between Haw Par’s Cash, its real estate portfolio and its strategic investments with its total liabilities would amount to a per share amount of S$11. As of 5 August 2020, Haw Par’s last done price was S$9.30.

This means that assuming we purchase Haw Par at S$9.30, not only will we be getting Haw Par at a discount to its net liquid assets and real estate, we will be getting Haw Par’s profitable brand and core business as well!

Conceptually speaking, this asset based method of valuation can be used when a company has many hidden valuable assets under its name. These assets act as a cushion for the company as they may be divested to improve the balance sheet, pay down debt, perform shareholder buybacks or pay dividends.

However, using an asset based valuation may be risky if the company’s core business is losing relevance and/or its business has been unprofitable for long periods of time. This is because while waiting for that particular catalyst to happen, the shareholder value will be eroded over time, destroying the difference between the intrinsic value and traded price.

Trading Contracts for Differences (CFDs)

In my opinion, contracts for differences (CFDs) are versatile tools for everyone’s portfolio. They can be used for hedging, short selling or leveraged trading. CFDs require a minimum sum upfront. This minimum sum upfront is known as the initial margin.

The COVID-19 pandemic has created an environment of great uncertainty and volatility. As such, should you foresee any further downside on certain markets / counters, you may consider using CFDs to short sell!

For a more detailed guide on Short Selling using CFDs, please check out our article.

Most markets generally impose restrictions on short selling for stocks. Furthermore, it is inconvenient to initiate a short position in the cash equity market. In such a situation, the investor would have to check with their broker on the availability of the share for borrowing before initiating the short trade, and subsequently inform the broker again to return the borrowed share after they have bought back the shares. The good news is, you can circumvent this issue by using CFDs. All you need to do is focus on what you want to short and place your trades!

That’s not all! We offer more than 5,000 global contracts to trade from.

Hedge your Portfolio against rising uncertainty with CFDs!

Contrary to popular opinion, Contracts for Differences (CFDs) are not just for technical traders. Long-term investors can utilise CFDs to hedge their positions against unforeseen events and uncertainties. When one foresees rising uncertainty and volatility in the market, the investor can enter into a CFD contract to hedge their positions.

CFD World Indices and Commodities are ideal hedging tools for equities. This is due to their cost effectiveness and correlations.

One can use CFDs as a hedge in the following two possible scenarios:

1) When the price of your existing positions has already moved / is moving against you.

2) When you anticipate future gains in your existing positions to be marginal due to an increasingly negative market sentiment.

For a detailed example on how to use CFDs for hedging, check out our hedging example at the bottom of this article!

Before one chooses to hedge his exposure, it is important to know which assets to use to hedge. Assets that have a positive correlation to your positions are used as an opposing hedge (Short), whereas assets with a negative correlation to your positions are used as a same side hedge (Long). However, do note that it is not possible to perform a perfect hedge.

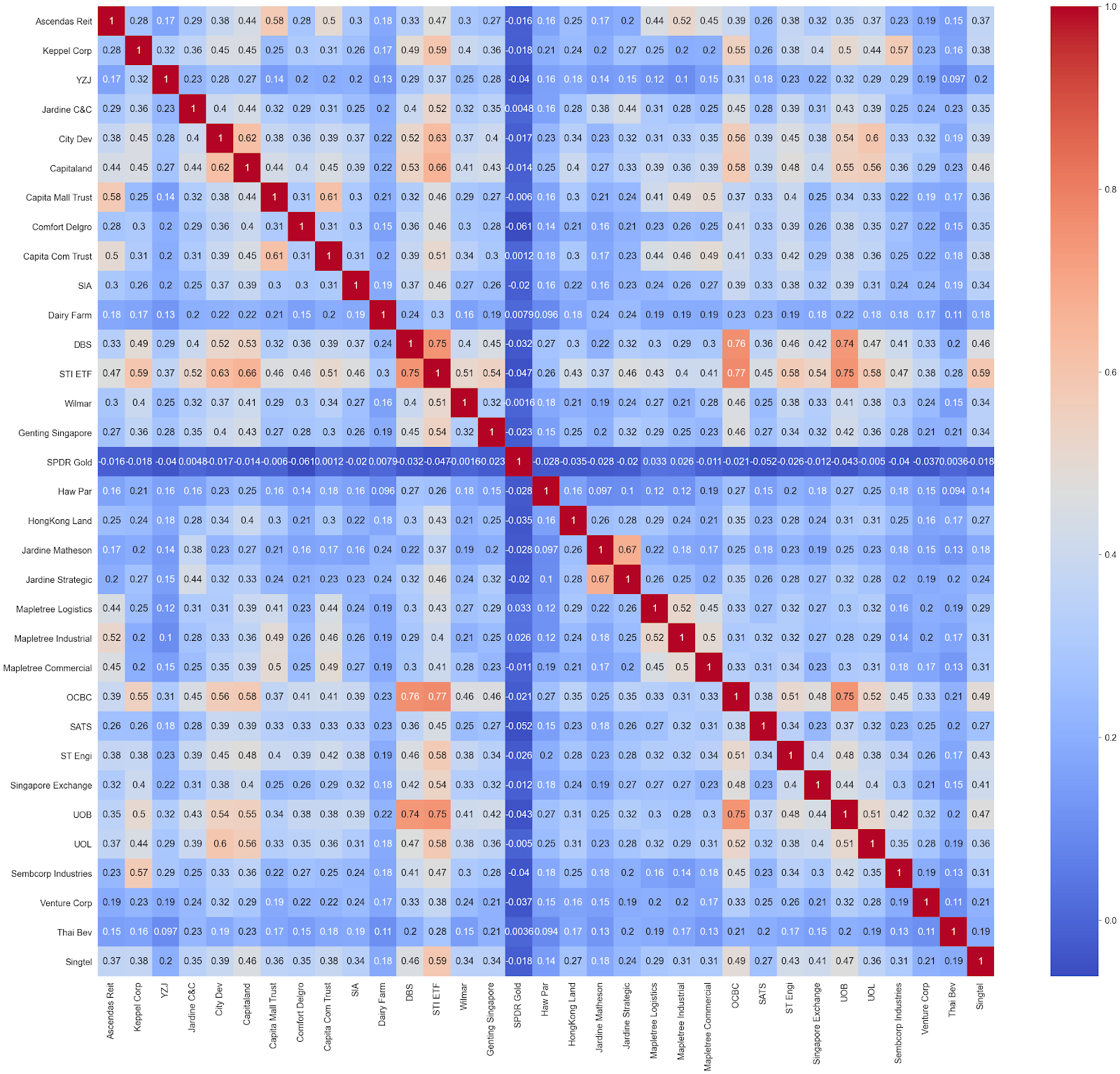

Taking data from Jan 2012 to July 2020, I have plotted the Pearson’s Correlation Heatmap for the returns of all the STI component stocks alongside Haw Par, STI ETF and the SPDR Gold ETF.

Due to the amount of counters shown in Figure 6, it may be ideal to save the image and view it on another tab separately. Surprisingly, Haw Par is not strongly correlated with UOB and UOL, despite having these investments recorded on their balance sheet.

Based on the correlation heat map, we can conclude that SPDR Gold’s returns are nearly independent to Haw Par, STI and its components. Theoretically, gold should have a strong negative correlation to equities.

However, do note that correlation between assets are not static over time and changes frequently. This shift could be due to macroeconomic factors or a change of the company’s fundamentals / business model over time.

Conclusion

As quoted by investing legend Peter Lynch, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections.”

In our opinion, it would be better to time the market based on valuations and not on news flows. We believe that whether you are a trader or a buy and hold investor, CFDs have a place in your portfolio. We sincerely hope that you have found value in this article. Be sure to check out our other articles, promotions and courses that we offer. Please feel free to email us at cfd@phillip.com.sg if you have any queries.

Till next time, folks!

Reference:

- [1] https://www.inkstonenews.com/business/how-lady-gaga-gwyneth-paltrow-benedict-cumberbatch-and-david-beckham-are-popularizing-chinese/article/2134293

- [2] https://www.tigerbalm.com/sg/pages/about/

- [3] https://markets.businessinsider.com/news/stocks/warren-buffett-berkshire-hathaway-dream-business-is-sees-candies-2019-7-1028348838#

- [4] https://hawpar.listedcompany.com/misc/ar2019.pdf

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Jay Lim

CFD Dealer

Jay graduated from the National University of Singapore with a Bachelor’s Degree in Electrical Engineering, specialising in Power Engineering.

Unveiling Opportunity: Exploring the Potential of European Equities

Unveiling Opportunity: Exploring the Potential of European Equities  Mastering Stop-Loss Placement: A Guide to Profitability in Forex Trading

Mastering Stop-Loss Placement: A Guide to Profitability in Forex Trading  Crude Realities: Understanding oil prices and how to trade them

Crude Realities: Understanding oil prices and how to trade them  Gold at All-Time Highs: What’s Fuelling the 2025 Rally?

Gold at All-Time Highs: What’s Fuelling the 2025 Rally?