Delisting & Privatization trend in 2016 January 19, 2017

After shaking off the New Year holiday mood, I thought that providing a summary and analysis on the delisting privatization trend on SGX in 2016 would be a good way to guess what is awaiting us in the year of 2017.

Delisted & Privatized Companies in 2016

As of 8th December 2016, a total of 28 companies have delisted from SGX for the year of 2016. Some of these companies are well-known names that most Singaporeans are familiar with. Two of such companies are SMRT Corporation Ltd. and Osim International.

| Company | Delisted Date | Company | Delisted Date |

|---|---|---|---|

| AAT Corp | 13-01-2016 | OGL Resources | 31-08-2016 |

| Biosensors Int’l Group Ltd | 20-04-2016 | OSIM Int’l | 29-08-2016 |

| China Dairy Group | 13-06-2016 | Otto Marine | 07-10-2016 |

| China Hongcheng Holdings Ltd | 22-11-2016 | Pacific Healthcare Holdings | 30-08-2016 |

| China Merchants Holdings (Pacific) | 26-08-2016 | Pteris Global | 07-09-2016 |

| Chinasing Investment Holdings | 05-12-2016 | Select Group | 06-09-2016 |

| China Yongsheng | 01-07-2016 | Sim Lian Group | 01-11-2016 |

| Eastern Holdings | 08-03-2016 | Sinotel Tech | 15-03-2016 |

| Eu Yan Sang Int’l | 07-10-2016 | SMRT Corp | 31-10-2016 |

| HTL Int’l Holdings | 09-09-2016 | Texchem Pack | 14-04-2016 |

| Interplex Hldgs | 08-06-2016 | Tiger Airways Holdings | 11-05-2016 |

| Lantrovision (S) | 17-06-2016 | XinRen Aluminum Holdings | 26-05-2016 |

| MFS Technology | 16-05-2016 | Xyec Holdings | 02-06-2016 |

| Nepture Orient Lines | 06-09-2016 | Zagro Asia | 13-04-2016 |

Source: SGX website

Osim International founder – Mr Ron Sim announced his intention to take the company private in late March 2016 and managed to delist the company on 29th August 2016 after gathering more than the necessary 90% shares at $1.39 per share.

The used-to-be investor favorite stock for dividend, SMRT was delisted on 31st October 2016, ending a 16-year saga which saw a government-linked entity trying to balance public needs along with private investors’ interest, often with mixed result.

Reasons for big names privatization

The privatization trend can be attributed to mainly 2 reasons:

Firstly, due to poor business environment and results, the share price of these big names have been overly punished by investors, making the owners feel that their companies were undervalued. This apparently was what prompted Mr Sim to take Osim private.

Secondly, companies listed on SGX are required to provide quarterly or semi-annually reports to investors and are required to keep track of their management responsibilities. Not only is this a cost to the company, it may also take up precious time of the management, time which they could have spent on turning the business around.

Big names with strong fundamentals who are confident to steer their business back on track would take this opportunity to delist at the undervalued price and spend the time and effort focusing on their long term business strategy instead of answering to a small handful of investors.

2017, more companies to be delisted?

If the global economy continues to be lethargic and causing the share prices of more companies to be undervalued, this is entirely possible.

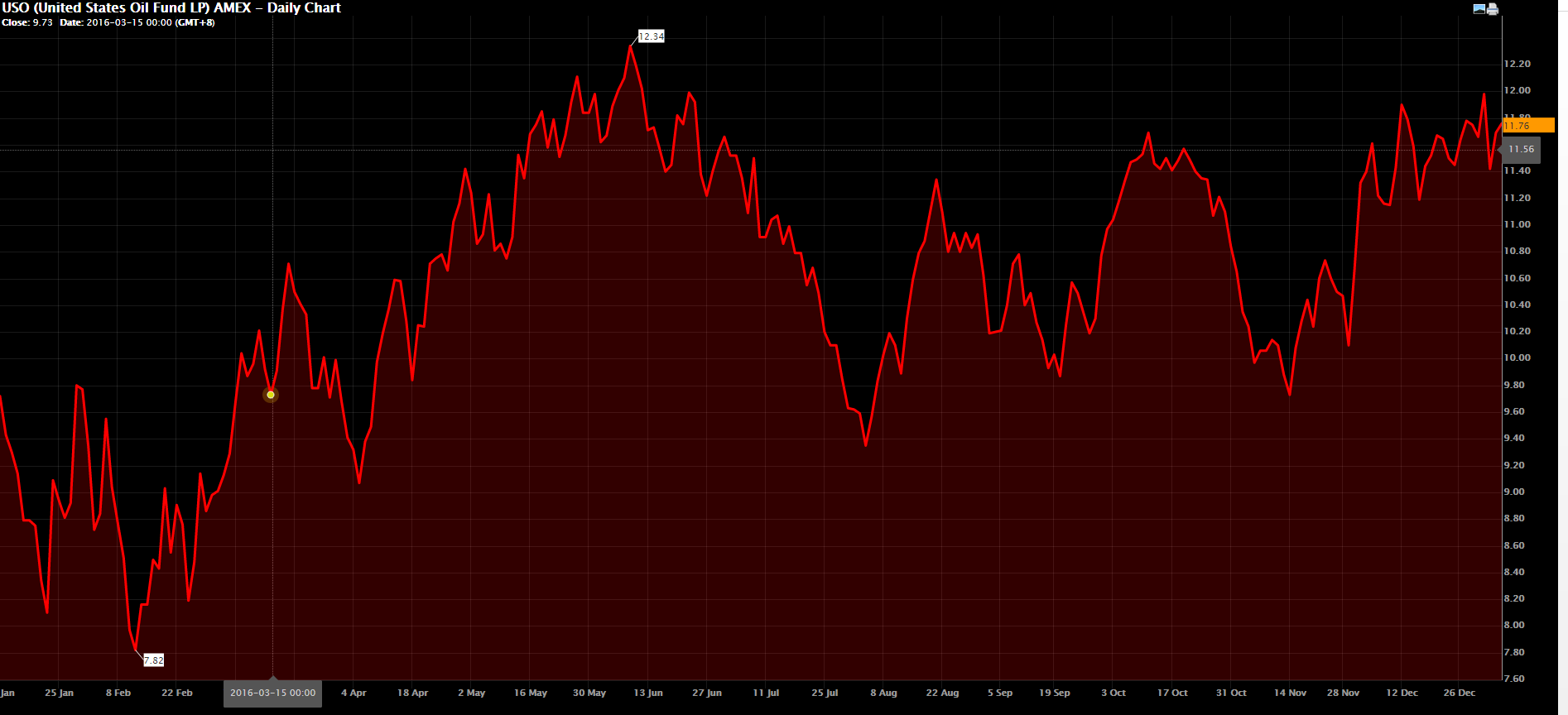

A sector to take note for potential privatization in 2017 will be the Offshore & Marine (O&M) industry. Even though oil price has rallied to above USD $50 per barrel since OPEC agreed to a production cut in late 2016, it will take at least 2 years for the O&M companies to feel the dribble down effect from the hike in oil price, provided that the oil price does sustain above USD $50 during this period.

During this period, the O&M companies will still be under scrutiny and pressure from their investors over their performances. To avoid these, some of the O&M companies may opt to delist and operate in a less stressful environment.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Chong Kai Xiang (Kai)

POEMS Dealer

Raffles City Dealing Team

Chong Kai Xiang (Kai) is an Equities Dealer in the Raffles City Dealing Team, and currently provides dealing services to over 35,000 trading accounts.

Kai frequently conducts seminars to enrich his clients' trading and financial knowledge. Apart from this, Kai also provides weekly market updates to his clients to keep them informed and up to date on their stock holdings.

Kai holds a Bachelor Degree of Finance from the SIM University – UniSIM and was awarded the CFA Singapore Gold Award and CFP® Certification Achievement Award in 2015.