Episode 1 – Traits of a Successful Trader April 19, 2022

Overemphasis on technical knowledge can lead to the downfall of a trader. However, important tools such as fundamental analysis, drawing support and resistance lines, and use of indicators as guidelines are essential to a trader’s success. So, what is it that makes the difference?

Is it discipline? We have heard that emotions should not affect our trading decisions, but how do you ensure that?

Here are 3 traits that set traders apart.

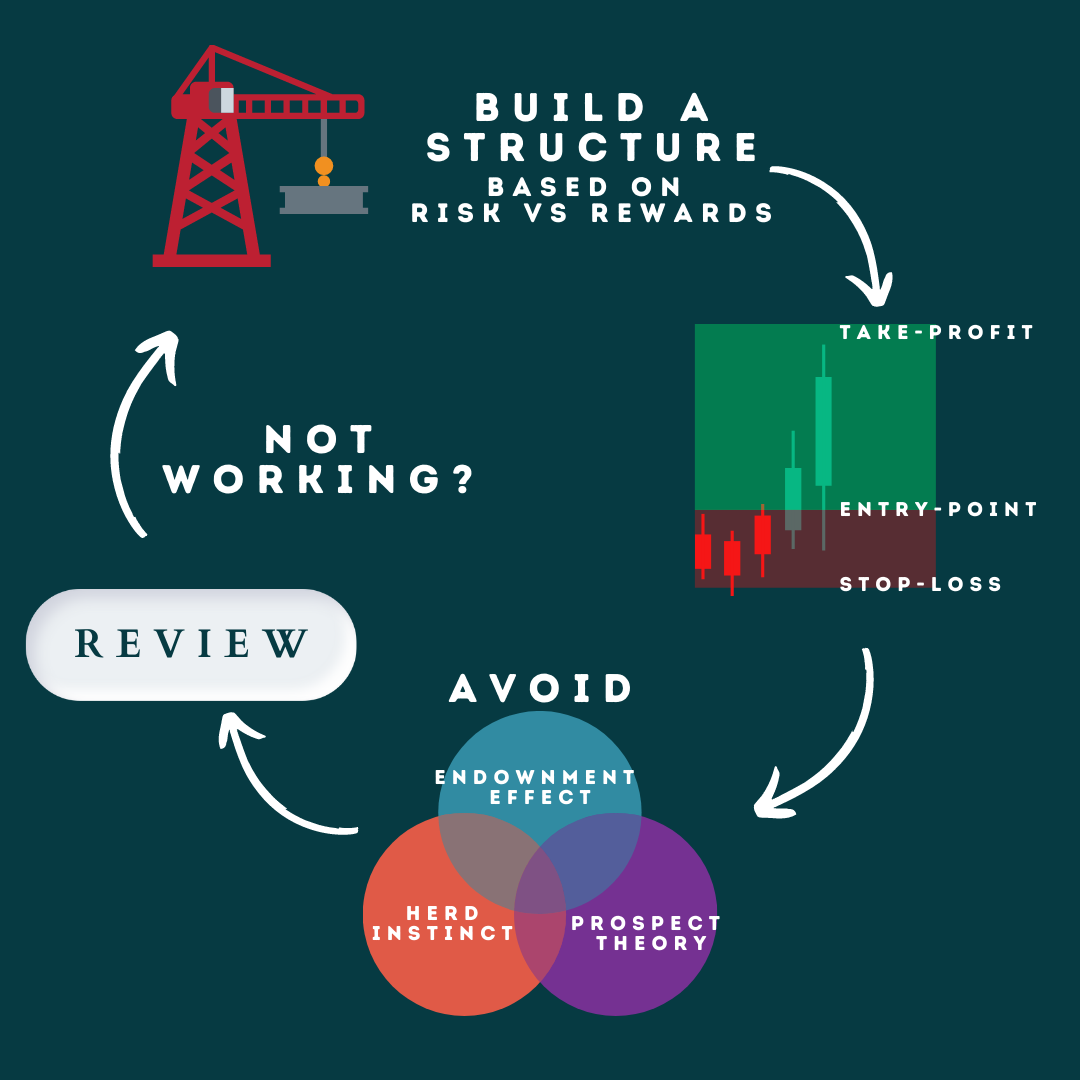

1. HAVING A STRUCTURE

The best traders have a game plan

There is no “correct answer” when it comes to what that game plan structure should be. In fact, it should be tailored to your preferences and risk appetite. But what should this structure entail? To be a successful trader, you must first know your risk-reward ratio and build your structure on it.

News and emotions often get in the way of discipline. It is therefore important for a trader to know when he will get out — even before getting into a position. This is also known as setting a target price.

Further in this discussion, we will explore how and why making the decision to exit when you are in a loss position is one of the most common mistakes any trader will make.

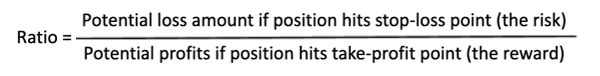

First, let us get our risk-reward game plan in place. Successful traders always compare the expected returns of a trade with the potential risk of a trade not going in their favour.

Expected returns can be seen as the take-profit point of a trade, while potential risk can be seen as the stop-loss point of a trade.

Before entering into a position, successful traders define three points: 1) Entry point, 2) Stop-loss point, 3) Take-profit point. Then, they calculate the potential risk-reward ratio based on these three points.

One of the commonly used risk/reward ratios for traders is a 1:3 ratio. This equates to expected returns being at least 3 times the amount of potential losses.

If a trade does not result in the desired returns after your analysis, do not enter into that position. Look for other opportunities.

It is important that traders stick to their risk-reward ratios to ensure that even if their losing trades are more than their winning trades, their entire portfolio could still make an overall profit.

Here is an example: Assuming that trader A, has entered into 10 different positions with all stop-losses at $1 below the entry points. With a 1:3 risk-reward ratio, this means that his take-profit points for all 10 positions will be $3 above the entry points. Even if the trader makes 7 losing trades and 3 winning trades, he will still earn a net profit of $2 as: (7 X -1) + (3 X 3) = 2. Therefore, it is important that traders must have a risk-reward ratio with the reward component more than the risk component.

2. STICKING TO A PLAN

Once you have determined your potential entry point, identify your stop-loss and take-profit price point based on your risk-reward ratio, and stick to the plan throughout the entire course.

More often than not, traders do not see their predetermined plans run the full course. Here are 3 reasons why and how it could hinder a trader’s success:

(A) Prospect theory

Many traders enter a position with a predetermined target price only to close their position and take profit too early. If this sounds familiar, it is actually a scenario of letting your emotions take control of your trading positions.

In behavioural economics, this could be due to the prospect theory which was theorised by Kahneman and Tversky in 1979.

In their research, they found that when humans are in the gain domain, they tend to become more risk averse.

A risk averse person prefers lower returns with certainty rather than higher returns with uncertainty. Therefore, when faced with unrealised profits, most traders tend to close the position too early, only to see it hit the supposed target price.

Conversely, sometimes traders enter a position with a predetermined stop-loss but end up closing the position way below the supposed stop-loss price, falling victim to the prospect theory as well.

The fear of realising a loss can also cripple a trader, prompting him to hold onto a losing trade long after the stop-loss price. Based on the theory, humans in the loss domain tend to be more risk-taking than usual.

It is only when traders come to realise that their chances of a comeback is minimal that they close their positions, but this often falls way below their targeted stop-loss price.

Therefore, the psychological effects of experiencing a loss or even facing the possibility of a loss can induce risk-taking behaviour which could make realised losses even more likely or severe.

(B) Endowment Effect

Do you recall setting a targeted take-profit point only to shift it higher after you have entered into the position? If the answer is yes, you could have fallen prey to the endowment effect – the second behavioural theory that hinders many from becoming a successful trader. The endowment effect describes a situation where an individual places a higher value on an item that he already owns, than the value he would place on that same item if he did not own it.

A social experiment was carried out with students where some were given a mug while others were not. They were then asked to indicate the selling price of the mug. The results showed that students who were given the mug, tend to place a higher selling price than those who did not own the mug.

Therefore, when a trader manages to enter a position, he may alter the take-profit price of the position to be higher than what was planned.

(C) Herd instinct

Lastly, have you bought into a position way above your targeted entry point or closed your positions way above your stop-loss point? This could be due to the herd instinct, resulting in panic buying and panic selling.

Warren Buffett once said “Be greedy when others are fearful, be fearful when others are greedy”. However, most traders become fearful when the markets are selling-off resulting in panic selling of their positions even though it has not reached its stop-loss point.

Alternatively, these traders also become greedy when their buying power increases, resulting in panic-buy at a price way above their entry point, resulting in larger (smaller) than expected losses (gains).

Herd instinct behaviour describes humans’ tendency to react to the actions of others and follow their lead. This is similar to animals reacting in groups when they stampede in unison out of danger. If the general consensus is going in one direction, one may feel wrong to go in the opposite direction or may fear being singled out for not jumping on the bandwagon.

Therefore, it is of utmost importance that you stick to your plans and never allow your cognitive biases to take control of your trading activities. Therefore, algorithmic traders tend to be more successful than retail traders as computers do not possess any emotions when carrying out trades .

3. ADAPTABLE TRADING STRATEGY

Now that you know the psychological pitfalls of a trader and the importance of sticking through a plan, the next step is one experienced traders should not miss —

Similar to how investors consult a financial advisor for a review of insurance policies, one should check:

- Have the indicators I am relying on been helpful?

- Have my entry decisions / strategies been optimal? (We will also be having upcoming journal episodes on entry and exit strategies)

- Has my risk appetite changed over the years?

- How has the trading environment developed and are my strategies still relevant?

Review and adaptability is key in our ever-changing world.

There will never be 2 trading days that are exactly the same. This constant change will however, only cause problems for traders who fully rely on textbook examples of a strategy. When it boils down to implementation, an inflexible trader will lose the ability to adapt in the face of external factors such as market volatility and so on.

Successful traders hence constantly review their strategies to ensure that they are prepared to weather all types of market conditions.

Therefore, trading goes beyond just technical and fundamental analysis.

Soft skills such as mental flexibility are required to adapt quickly.

The reluctance to change or adapt will often result in a swift drawdown of capital.

To conclude, we hope this sharing has given you useful insights for your trading journey. Remember that techniques alone may not be sufficient! Contact your Trading Representatives for more trading advice or email to ActiveTraders@phillip.com.sg to share your thoughts!

Summary infographic

Reference:

- [1]https://www.thebalance.com/day-trader-traits-4025905

- [2]https://gordontredgold.com/12-common-traits-successful-traders/

- [3]https://medium.datadriveninvestor.com/5-personality-traits-of-good-traders-and-investors-969fae042486

- [4]https://www.investopedia.com/terms/l/loss-psychology.asp

- [5]https://www.investopedia.com/terms/e/endowment-effect.asp

- [6]https://www.investopedia.com/terms/h/herdinstinct.asp#:~:text=A%20herd%20instinct%20is%20a%20behavior%20wherein%20people%20tend%20to,of%20danger%E2%80%94perceived%20or%20otherwise

- [7]https://www.investopedia.com/terms/r/riskrewardratio.asp#:~:text=The%20risk%2Freward%20ratio%20helps,sell%20or%20take%2Dprofit%20order

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Alvin Teo and Tan Yan Yi

Alvin Teo graduated from Nanyang Technological University with a Bachelor’s Degree in Economics. Coming from an Economics background, he strongly believes in the importance of understanding macroeconomic policies before making investment decisions. Alvin started investing in Singapore equities at the age of 21 and thus, he has relevant experience in the Singapore market.

Yan Yi graduated from Nanyang Technological University with a Bachelor's Degree in Banking and Finance. As an Equity Specialist, she strongly believes that all investors should make informed investment decisions. Thus she is passionate in educating and guiding clients along their investment journey. Yan Yi also diligently equips herself with market analysis skills and stays updated with economic events.

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry! ![[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close](https://www.poems.com.sg/wp-content/uploads/2024/03/Valerie-Lim-LI-X-SMART-Park-Article-300x157.jpg) [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close

[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close  Deciphering the Updates: Understanding the latest CPF Changes

Deciphering the Updates: Understanding the latest CPF Changes