Estate Planning for Property Owners in Singapore June 1, 2020

In land-scarce Singapore, residential properties are highly regarded and usually the biggest investment for most Singaporeans. While most of these properties are HDB (Housing & Development Board) flats, a significant portion comprises private properties ranging from condominiums to landed properties.

You may hear remarks from friends or relatives that they “don’t have much except for a HDB flat and some cash (and maybe shares), so there is no need to do any estate planning”. This is despite the fact that a “simple” HDB flat could be worth $500,000 on average.1

Such remarks cannot be further from the truth.

Let us illustrate the importance of estate planning with a hypothetical scenario:

Mr Tan has two private residential properties with an estimated market value of $4 million. He passed away leaving behind his wife in her early 60s, one daughter in her teens (minor child), and two adult children, one of whom is married with children, and the other will be getting married in 2 years’ time, and plans to purchase either a new or resale HDB flat.

Mr Tan’s “simple will” states that his estate is to be divided equally among his four immediate family members.

A will which states an equal division of a family home is among family members may be a recipe for future discords.

The pitfalls in such estate planning include:

1) The minor child cannot yet own her share of the estate until she turns 21. As the trustee of her property shares is not specified, the Executor/Trustee will by default hold custody of her share of the property. If this individual is also the Guardian of the minor child, there is little accountability of the proper custodianship of the property shares which belong to the young beneficiary.

One would also need to consider if this individual is competent and reliable enough to safe-keep the young beneficiary’s shares (which may amount to $1million (ie. 25% of 2 private properties totalling $4 million) until the child turns 21?

2) The single adult beneficiary, because of his inheritance of the share of the private properties, will not be able to go ahead with his plan to purchase a new or resale HDB flat with his spouse.

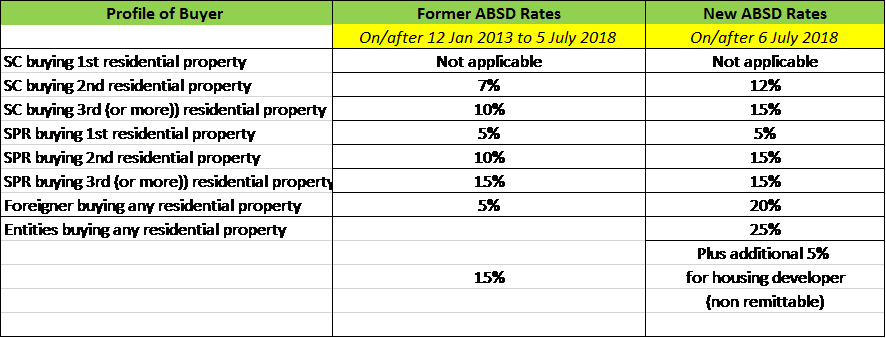

3) Should the deceased’s wife (Mrs Tan) wish to purchase another private property after inheriting her share of the property, she will be subject to a higher ABSD rate (ie. Additional Buyer’s Stamp Duty) as the subsequent property purchase will place her in a higher ABSD tier, given the increased property count.

4) Is the other (married) adult beneficiary, who already owns a private property, aware that he will be subjected to the higher ABSD tier when he inherits the property shares from his deceased father?

5) How will the four family members practically work out their living arrangements between the two residential properties?

6) And should Point (2) be deemed not feasible, how will the timing of the sale and the transaction prices of the two properties be agreed upon?

Based on these scenarios, structures involving wills and the appropriate trusts can help provide optimal estate planning solutions to reduce potential disagreements between family members and minimise property transaction expenses such as ABSD.

Many individuals are also under the misperception that when they pass on, their real estate can only either be transferred to their beneficiaries or be sold (and sale proceeds distributed to beneficiaries), with no other alternatives. What if there is an affordable way to keep the real estate in the family 10, 20 or more years after one’s passing, to allow the compounding of investment returns to work its magic?

For example, a $1.5 million residential property which grows at a rate of 4% per annum may easily be worth $4.86 million after 30 years. While the real estate is kept within the family, either occupied by estate beneficiaries or rented for rental income, the property asset compounds its capital value.

One can do this by placing the real estate in a trust, so that the property is maintained and managed by relevant professionals for the period of time one specifies in advance.

Trusts can also be used in property-related assets/investments to protect the needs of vulnerable beneficiaries, such as young and/or financially immature beneficiaries, or individuals with special needs. In such situations, the corporate trustee holds the tenancy-in-common shares according to the deceased’s instructions.

Alternatively, the corporate trustee may hold a certain percentage of the property to effectively safeguard and prevent any sale of the property that would compromise the interest of the vulnerable beneficiary.

Some of the more sophisticated uses of trusts for real estate assets/investments include the use of property trust in ABSD planning. Since the ABSD rates may differ for a Singapore citizen/permanent resident private property buyer depending whether the to-be purchased property is the first, second (or more) residential property. Structures using trusts can be put in place to affect this property count and hence the ABSD rate.

For example, a Singapore citizen who purchases a second residential property at $ 1.5 million would need to pay 12% of ABSD. This amounts to $180,000 in ABSD alone.

The amount is even larger for a Foreigner purchasing a second residential property at $1.5 million, i.e. 20% of ABSD or $300,000.

By setting up legal structures, ABSD planning can be done to manage property transaction costs.

A challenging area of property investments that many do not realise is the inability to manage the properties if mental incapacity such as dementia or Alzheimer’s disease sets in.

Most property owners/investors may be capable and willing to spend the time and effort to manage their own investments However, mental capacity may deteriorate with age. One should therefore plan for alternatives should mental incapacity make property management difficult. It is prudent to select a corporate trustee as their LPA (Lasting Power of Attorney) decision-maker for all their property and affairs. The higher level of accountability of a corporate trustee makes such a trustee a natural choice.

Estate planning, especially where it involves real estate, should not be a D-I-Y project by the owner. Rather, such planning should include relevant professionals such as professional estate planning practitioners and trust managers who are experienced in the use of wills, trusts and financial solutions to put a proper plan in place and execute it when the time is right.

Contributor:

Irene Yee

Certified Financial Planner, MBus

Affiliate of Society of Trust and Estate Practitioners (STEP)

Phillip Securities Pte Ltd (A member of PhillipCapital)

Email address: ireneyeekq@phillip.com.sg

References:

- [1] Resale prices and direct purchase prices of HDB can be found from https://www.hdb.gov.sg

About the author

Irene Yee

Certified Financial Planner, MBus

Affiliate of Society of Trust and Estate Practitioners (STEP)

Irene Yee is an award-winning estate planning financial advisory consultant with more than 20 years of practical experience in financial advisory, including banking. As an Affiliate of Society of Trust and Estate Practitioners (STEP), her integrated solutions in estate planning for clients include the use of Wills, Trusts and the Lasting Power of Attorney (LPA) and funding solutions such as insurances. Irene's forum letter to the Straits Times in 2006 contributed to the legislation of the Lasting Power of Attorney (LPA) through the Mental Capacity Act in 2008; the letter highlighted Singapore's need for the LPA in our ageing society before the LPA existed here. She is a Certified Financial Planner who has also published articles in retirement planning, including "The Mental Capacity Act, You and Your Retirement Planning" in the FPAS* Journal (December 2019). Other personal finance articles she had written were also published in "Her World", "Simply Her", "Young Parents", "Today's Parents" and "ExpatLiving Singapore". * Financial Planning Association of Singapore