Hang Seng Index’s Biggest Revamp in 51-Year History: Winners & Losers March 25, 2021

What this article is about:

- InfoTech overtook finance as the largest industry on Hong Kong’s stock exchange in 2019

- More and more mainland Chinese companies have been making their mark in Hong Kong’s market

- Revamp of HSI is overdue to reflect these shifts

- Potential winners of the index’s overhaul are consumer and healthcare stocks, Chinese tech juggernauts and Chinese new-economy start-ups

- Potential losers are the grand old dames of Hong Kong’s finance sector and Hong Kong firms in general

The Hang Seng Index or HSI is the main benchmark of the Hong Kong stock market, widely followed by investors. As of 15 March, it has 55 constituents, covering 54% of the exchange’s market capitalisation.

In 2019, InfoTech, led by the Chinese tech giants, overtook financials as the index’s largest industry by market value [1]. Two years on, the Hang Seng Indexes Company (HSIC) – which maintains the index – plans to increase the number of constituents in the index’s biggest overhaul ever. This move will reflect the growing dominance of mainland Chinese companies, particularly the high-valued tech groups.

Largest makeover in 51-year history

After one month of consultations with stakeholders, HSIC has proposed the following changes:

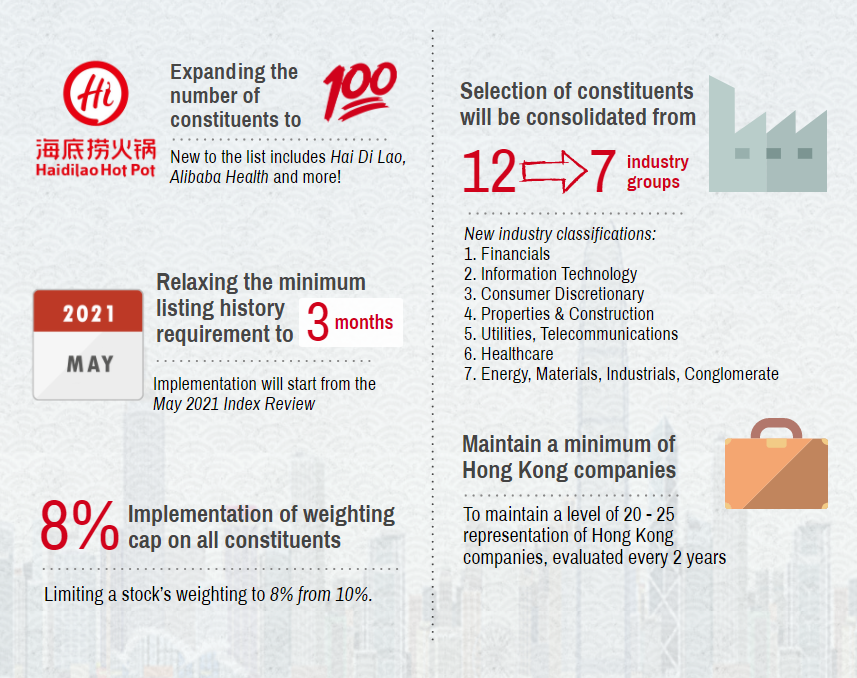

1) Expand the number of constituents in the index to 100

On 15 March, three stocks were already added to the HSI, bringing its total constituents to 55 from 52. The three were Beijing-based hot-pot restaurant chain Haidilao International, Hong Kong-based property investment holding company Longfor Group and Alibaba Health Information Technology. Alibaba Health rallied 7.5% while Haidilao added 6.4% after the review was announced. Longfor chalked up a 2.4% gain by mid-day trading [2]. HSIC intends to increase the number of constituents to 80 by mid-2022 and subsequently to 100.

2) Constituents to be selected from seven industry groups

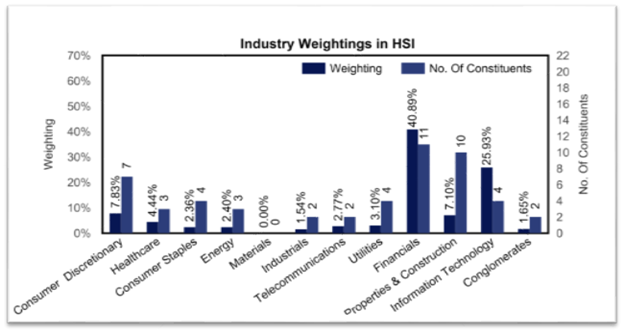

The index’s current constituents come from 12 industries. These will be consolidated into seven industry groups to better represent the major industries in Hong Kong’s stock market. Financials and InfoTech currently dominate the market, accounting for the lion’s shares of the HSI at 40.89% and 25.93% by weighting respectively.

New industry classifications:

1. Financials

2. Information Technology

3. Consumer Discretionary, Consumer Staples

4. Properties & Construction

5. Utilities, Telecommunications

6. Healthcare

7. Energy, Materials, Industrials, Conglomerates

3) Relaxing the minimum listing history requirement

The listing history requirement for stocks eligible for inclusion in the index will be shortened to three months. Currently, new listings on the Hong Kong stock exchange ranked below 25th by market cap must wait 24 months to be considered for inclusion in the HSI. Companies ranked above 25th must wait 3-18 months before being admitted to the index.

The change will start from the May 2021 index review and take effect in mid-2021. This is to facilitate the timely addition of new listings and prevent HSI from lagging behind in the inclusion of stocks that accurately represent the Hong Kong market.

4) Maintaining a minimum number of Hong Kong companies

HSIC will maintain a minimum of 20-25 constituents that are classified as Hong Kong companies in the HSI to ensure adequate Hong Kong representation. This is because the HSI is supposed to track the Hong Kong market. The 20-25 companies will be evaluated every two years.

5) Implementation of 8% weighting cap on all constituents

Lastly, each stock’s weighting in the HIS will be capped at 8%, down from the current 10%. Concurrently, the cap for secondary listings or listings that carry unequal voting rights, including Alibaba, Xiaomi and Meituan, will be raised to 8% from 5%.

Potential winners

Stocks with unequal voting rights such as the three tech behemoths – Alibaba, Xiaomi and Meituan – are potential winners as they are no longer limited by the weighting cap of 5%.

That said, recent political risks associated with Alibaba may still put off investors. Recall the Chinese regulators’ abrupt blockage of Ant Group’s S$37bn blockbuster IPO in November 2020. This soon developed into a flurry of antitrust investigations into Alibaba’s business practices. To top it off, Alibaba has been asked to divest its assets in the media sector owing to its growing media influence.

The weightings of consumer and healthcare stocks will increase by four and three percentage points respectively, at the expense of the financial sector, according to a research note put out by Goldman Sachs.

According to Smartkarma, Kuaishou Technology, NetEase, JD.com, Xinyi Glass Holdings and Country Garden Service Holdings may also be potential inclusions on the back of the expansion of constituents.

Chinese companies generally will be the greatest beneficiaries of the overhaul as the index makes room for more and more of these listings.

Potential losers

The biggest losers will be stocks in finance as they have the highest weightings in the index currently. After expansion of the number of constituents and adjustments to weighting caps, the sector’s weighting will be diluted to 34.9% from 40.89% [5].

Constituents with weightings higher than 8% will also lose out to the new weighting caps. Currently, Tencent and AIA are the only constituents with weightings above 8%.

Hong Kong firms may struggle to preserve their weightings in the index – their aggregate weighting could fall to 32% from 40% – as Chinese companies’ weightings increase, Goldman added.

Lastly, other losers may include constituents that could potentially be removed from the HSI such as Bank of Communications, China Life Insurance, WH Group and Hengan International.

Source: POEMS

Source: POEMS

HSI has been lagging its global peers in updating its weightings, which are still tilted towards old-economy stocks such as banks. Other benchmark indices such as the S&P 500 are already tech-heavy, reflecting tech’s rapid encroachment in the past two decades.

This overdue revamp will allow the HSI to include mega-cap Chinese tech companies while maintaining room for a minimum 20-25 Hong Kong companies. Easing the minimum listing requirement will also enable the index to quickly embrace new, large IPOs that will not only better represent the Hong Kong market but also increase its appeal.

Finally, the revamp is seen as good news for the ETF industry as more funds are attracted to track the index. Goldman expects passive funds tracking the HSI to grow to US$25bn from the current US$20bn. More diversified memberships and higher weightings of new-economy stocks will help the index’s performance as a whole, according to fund managers. Paul Pong, managing director of Pegasus Fund Managers, reportedly predicted that “As more new-economy firms join, the index is likely to test the level of 40,000 in the future”. [6]

Micro HK CFD Trading

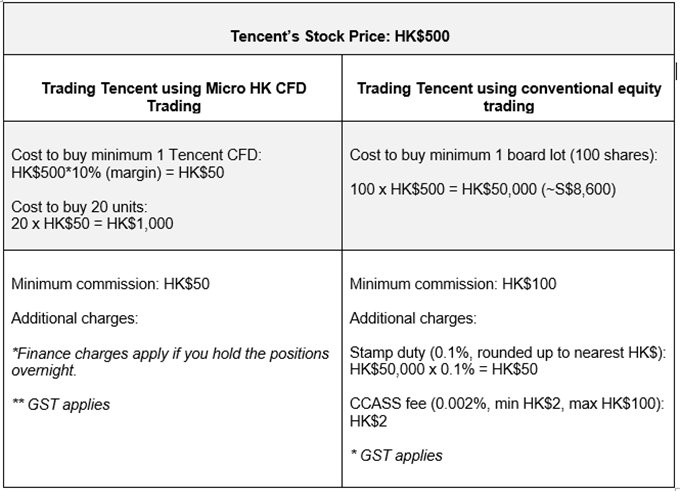

Start trading our brand-new Micro HK CFD Trading for selected counters on the Hong Kong stock exchange today! CFDs allow you to long the winners and short the losers of the HSI revamp. With our Micro HK contracts, no counters will be too expensive for you or out of your reach as you can trade smaller than board lot sizes.

Source: POEMS

Source: POEMS

Figure 4 illustrates how Micro HK CFD Trading may assist you. For more details on the benefits of trading Micro HK CFD contracts, check out our recent Market Journal.

So what are you waiting for? Start trading CFDs with us now!

References:

1. https://www.hsi.com.hk/static/uploads/contents/en/news/consultations/20201222T000000.pdf

2. https://www.scmp.com/business/companies/article/3123489/hong-kong-expands-benchmark-stock-index-prepares-money-managers

3. https://www.hsi.com.hk/static/uploads/contents/en/dl_centre/factsheets/hsie.pdf

4. https://www.hsi.com.hk/static/uploads/contents/en/dl_centre/factsheets/hsie.pdf

5. https://thesmartinvestor.com.sg/the-hang-seng-index-revamp-5-aspects-investors-should-know-about/

6. https://www.theedgemarkets.com/article/these-are-winners-and-losers-hang-seng-index-revamp

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Alex Lee

Dealer

Alex is a dealer for Contract for Differences (CFDs) and has experience in intraday trading of the equities market. He is a strong advocate of utilizing volume in confluence with various trading methodologies to identify the momentum of the market. He graduated from Singapore Institute of Management (University of London) with a Bachelor’s Degree in Economics & Finance. In his free time, Alex enjoys trading in the FX market.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile