Hong Kong Value Stocks Q2 2024 May 14, 2024

After a long period of sluggishness, Hong Kong market has begun to pick up. The Hang Seng Index has broken through a key resistance level of about 17200, hinting at a potential shift in investor sentiment. This stellar performance could be fueled by a confluence of factors, from strategic investment decisions to improving economic forecasts.

We will explore the specific events that could lead to the market revival and briefly examine the role of supportive policies and the influx of foreign capital. Followed by the broader economic landscape shaping investors’ decisions. Beyond this understanding, many investors are eager to capitalise on potential opportunities as well; so we will also delve into specific stock picks within the Hong Kong market, with a focus on companies that might be well-positioned to benefit from this renewed optimism.

Since 2021, the HK stock market has been dwelling in a bear market, waning investor confidence and dragging the Hang Seng Index down. This coincided with a period of uncertainty in China, a key driver of the Hong Kong stock market. However, recent promises of support from Chinese market regulators have provided a surge of optimism, suggesting a potential turning point for the Hong Kong market. There is also a resurgence of foreign interest in China; since February 2024, there has been a steady increase in foreign funds flowing into the Chinese market through the Hong Kong stock connect.

With the US market appearing increasingly expensive compared to its global counterparts, many investment houses are strategically shifting their allocations, in search of value. This pivot prioritises undervalued markets, particularly those in Asia. Similarly, emerging Asian markets such as Vietnam and Thailand are attracting attention due to their long-term growth aspects and potential for higher returns.

Domestically, Hong Kong’s macroeconomic data are showing marginal improvements, and the domestic economy is expected to continue its moderate recovery. Internationally, there is growing anticipation of the Federal Reserve increasing interest rates in June. This potential move could create a more favourable environment for Hong Kong stocks as investors pull out of the US market in search of more undervalued markets.

At the time of writing as of 29 April 2024, the Hang Seng Index has turned positive in April 2024, up close to 4% YTD, breaking past an important resistance level of 17,200 points. The next level of resistance is around the level of 18,200.

Figure 1: Hang Seng Index, Source: TradingView, As of 2 May 2024

Figure 1: Hang Seng Index, Source: TradingView, As of 2 May 2024

For investors new to the Hong Kong market, a value-oriented approach can be a good first step. Value stocks tend to be less volatile than growth stocks, which potentially minimises risk for those unfamiliar with the specific market dynamics.

Seasoned HK investors can also capitalize on this by riding the current positive market momentum.

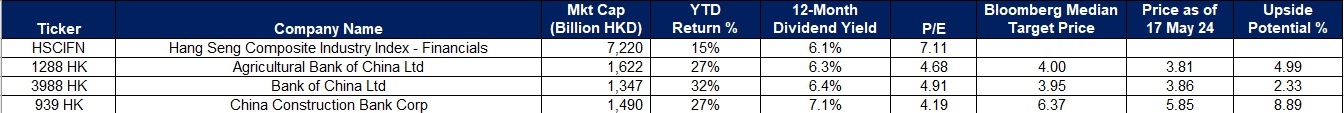

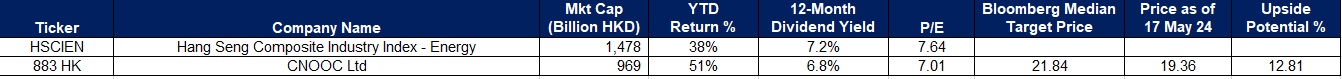

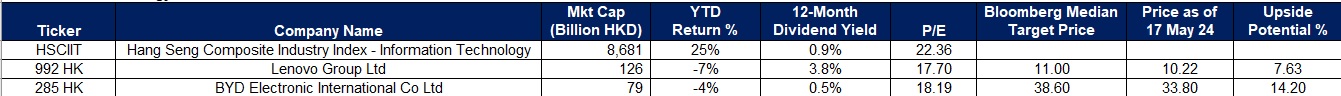

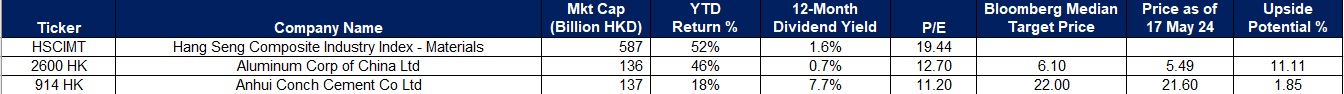

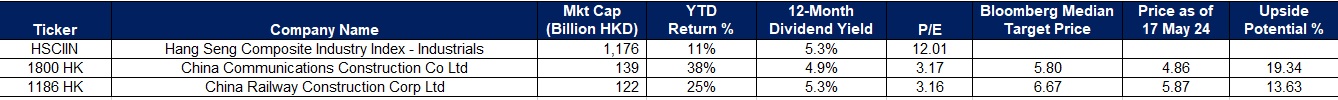

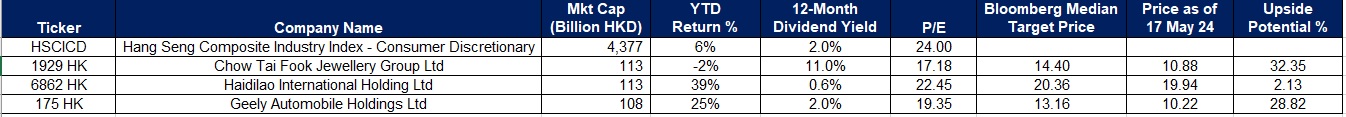

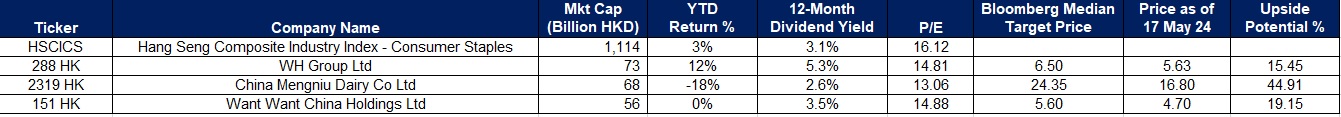

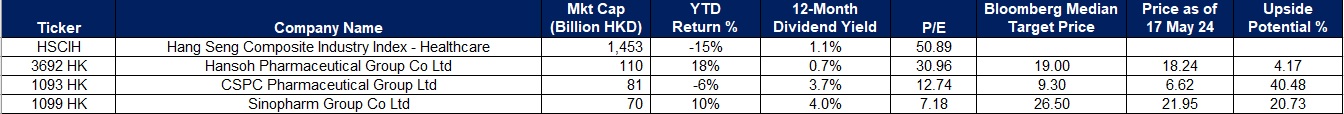

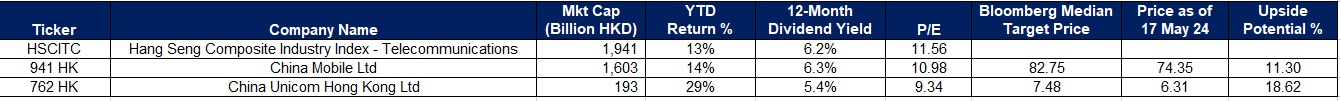

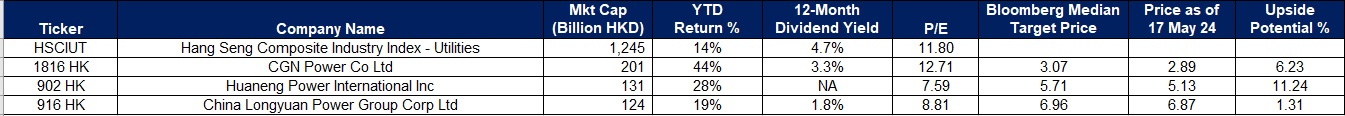

To mitigate the risk of investing in companies that appear undervalued but may fail to deliver promised returns (known as value traps), we have identified specific stocks within various sectors of the Hong Kong market. These selections are based on criteria such as positive earnings, lower price-to-earnings (P/E) ratios, and higher dividend yields compared to their sector indices, offering potential for capital appreciation while maintaining a moderate risk profile.

Undervalued Companies within Sectors compared to Sector Index

The Upside Potential is derived from dividing the Bloomberg Median Target Price by the Last Traded Price as of 17 May 2024

Financials

Energy

Information Technology

Materials

Industrials

Consumer Discretionary

Consumer Staples

Health Care

Communication Services

Utilities

In the coming weeks, we will provide sector breakdowns and specific company evaluations, to assist you in navigating this potential opportunity within the Hong Kong market.

If you would like to learn more about HK Value Stocks and the current CN/HK macroeconomic climate, you can join our upcoming webinar on 6 and 13 June 2024 here!

Additionally, we have an exciting opportunity to share with you! To celebrate the Hong Kong market’s potential resurgence, we are happy to announce that POEMS will be hosting a special lucky draw! Learn more about this special event from our page here! Don’t miss out on this opportunity to win while participating in the Hong Kong market’s potential upswing!

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Global Markets Desk (Asia Market)

The Global Markets Desk Asia Market Dealing team specializes in managing Asia Markets, covering key regions like Greater China, Malaysia, Japan, Thailand, and others. In addition to executing client orders, they also provide educational content through market journals and webinars, offering insights into macroeconomics, stock picks, and technical analyses for the Asia market landscape.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile