How big is the Russian-Ukraine conflict? May 26, 2022

The Russian-Ukraine conflict, which has already created a tense backdrop across global financial markets, has further escalated into a full-blown war.

The conflict sent ripples across the globe when Russia first invaded the eastern Ukraine region on 24 February 2022, shortly after recognising the two breakaway regions as independent republics.

Similar to the previous annexation of the Crimean Peninsula in 20141, the unprovoked nature of the armed conflict led to numerous sanctions from western NATO allies and the rest of the world. The purpose was to discourage Russian President Vladimir Putin from continued aggression by isolating and hurting the Russia economy.

Global sanctions and costly food

Since the beginning of the conflict, many countries have condemned the Russian action and imposed a series of sanctions on the country. However, does the armed conflict and the accompanying sanctions hurt only Russia?

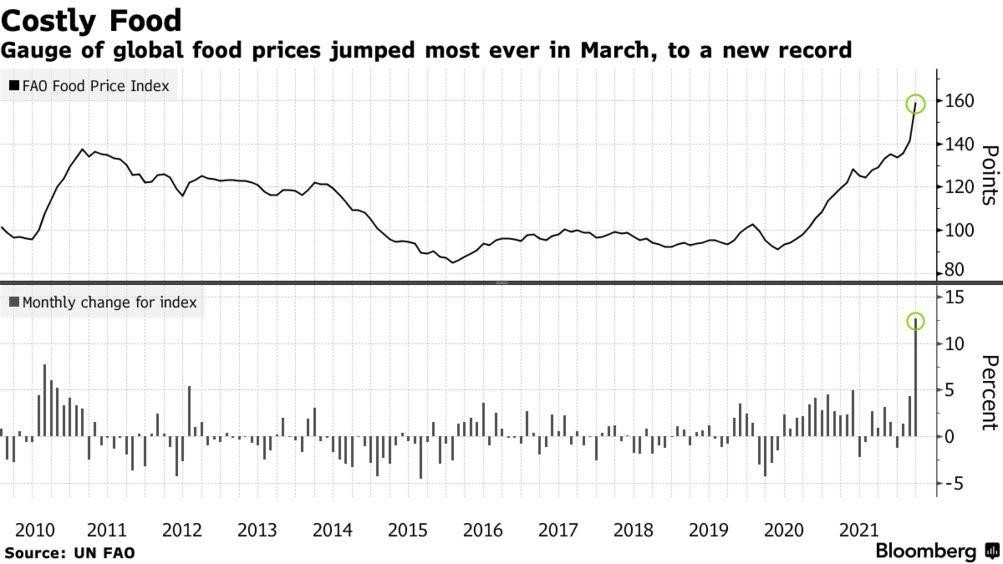

Fig.1 Food prices jumped most on Record amidst war

It should be clear by now that countries around the world are impacted by the conflict one way or another; and the most obvious would be the soaring food prices. Adding on to the current inflationary pressures across the globe, this conflict also has central banks scrambling for disinflationary measures.

With no resolution in sight, it seems that the sanctions will be in place for the foreseeable future. So, even if there is a de-escalation of the conflict, the rolling back of the sanctions may not be as straightforward due to the complexity of the implemented measures. As a result, sustained higher prices are likely to persist into the near future.

Bigger-than-expected repercussions

The sanctions do also have repercussions on the global economy due to the importance of Ukraine and Russia in the global supply chains. Though we may not have heard much about Ukraine and Russia in Singapore till the recent conflict, the fact is that these two countries are rather integrated into the world’s economy.

To understand how deeply they are integrated into the global economy, take a look at the figures below:

- Russia accounts for roughly 10% of the global supply of oil and nearly 40% of Europe’s supply

- Russia + Ukraine supply more than 30% of global wheat

- Russia + Ukraine supply more than 30% of global barley

- Russia + Ukraine supply more than 80% of global sunflower oil (one of world’s main vegetable oils used for cooking)

- Russia + Belarus (Russia’s ally) supply nearly 15% of global fertilizer

- Russia accounts 45.6% of global palladium exports among other raw materials

The data shows that Russian and Ukrainian dominance in specific areas of the supply chains cannot be underestimated. Beside energy supplies, these countries supply a substantial amount of critically important components for our daily necessities; (1) wheat and barley as feed for livestock, (2) sunflower oil for daily cooking; and (3) fertilizer for cash crops.

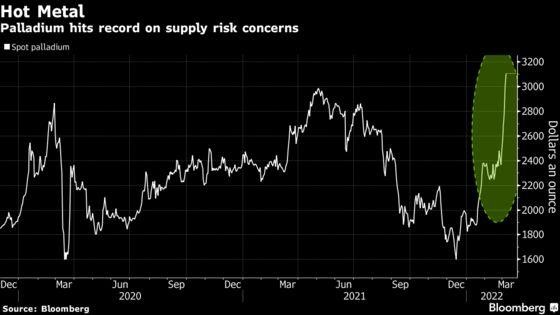

Fig 2. Record Palladium price on supply risk concerns over conflict

Russia is also a key exporter of global hard commodities used for industrial manufacturing. One example would be palladium; Russia’s export accounts for a significant portion of the global production. One use of palladium is in fuel cells for automobiles, so this translates to a higher cost of manufacturing for automobile vehicles. Hard commodity prices have hit record levels ever since the conflict; most notably when London Metal Exchange (LME) halted nickel trading after it rose more than 110% to top USD100,000/tonne2.

Now, due to the reduced quantity or the absence of these metals, substitutes will have to be sourced to make up for the shortfall. And this could further complicate things since there may not be readily available perfect substitutes and there is also the issue of not being able to easily substitute overnight due to existing binding contractual agreements.

Also, even if a substitute exists, the amount may not make up for the shortfall due to the substantial amount these countries supply to the global markets.

The aftermath of such is inflation transcending global borders is among other crises, such as the humanitarian crisis from influx of refugees to neighbouring countries, plaguing the world.

Oil concerns

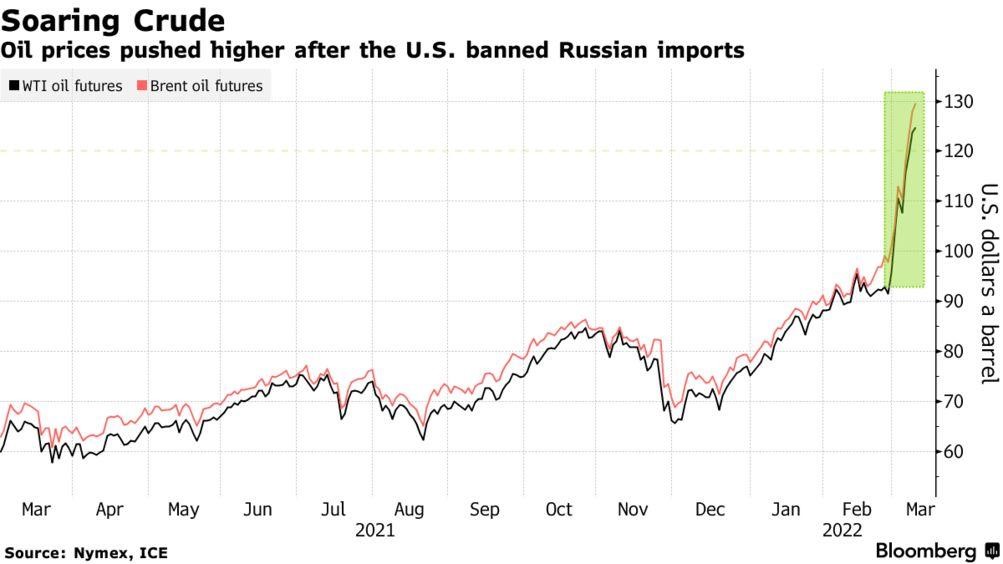

The escalated conflict has exacerbated concerns over the already surging oil price due to reopening of the global economy after the COVID-19 pandemic.

At the start of the invasion, oil price jumped more than 8% to above USD100 for the first time since 20143 and has never traded below pre-war levels.

With no end in sight to the conflict in the near future, the US and UK have resorted to sanctions on Russian oil. And though Russia temporarily escaped EU sanctions due to their reliance on Russian oil, it was suggested that the EU would act if Russia resorted to the use of weapons of mass destruction (WMD).

To complicate matters, OPEC+ as a group is not increasing output fast enough to make up for the shortfall — perhaps due to Russia being an influential member of OPEC+.

Meanwhile, countries have been trying to cool the surging oil price by releasing oil reserves.

For example, US intends to release 1 million barrels per day (bpd) of oil from reserves4. Furthermore, to ease the supply crunch, the US is looking to ease and import Venezuelan oil, which was previously sanctioned back in 20195.

However, the reality is that the world is unable to suddenly replace Russian oil. Russia is the world’s second highest exporter of crude oil and thus it would be naïve to think that the shortfall can be easily replaced without collective effort by other oil exporters.

Without an end to the conflict, there will be extended upward pressure on energy prices. This makes the event of USD200/barrel of crude oil a possibility.

Fig 3. Oil prices pushed beyond $100/barrel at record level

That said, oil prices may still be subdued and the black swan event of $200/barrel of crude oil may not fully materialise.

Countries in the EU rely on Russian supply of energy very differently. Amongst other sources of energy imports from Russia, 34% of Germany’s crude are sourced from Russia while only 9% of French oil imports consisted of Russian crude. The difference in reliance results in there being a different stance on oil bans in the EU as such there can be no easy curb on energy imports which member countries can agree upon.

Impact beyond oil sanctions

Governments around the world imposed a series of sanctions on Russia, and the corporate world followed suit and avoided not just Russian oil but Russian produce for fear of facing public backlash such as what Shell got for purchasing Russia’s oil. Companies with a business presence in Russia are also shutting down and scaling back their operations there.

Popular fast-food chain McDonald’s (MCD.U.S.), which arguably is among the biggest fast-food brands, had a very large exposure in Russia. And it closed 847 restaurants and shut its business in the country.

In a bid to further isolate Russia, big banks such as Deutsche (DBK.GY), Goldman Sachs (GS.U.S.), JPMorgan (JPM.U.S.) along with financial and tech firms such as Apple (APPL.U.S.), Google (GOOGL.U.S.), Visa (V.U.S.) are winding up their Russian businesses and exiting the country.

Though the boycott serves to isolate Russia from the rest of the world, it will inevitably have major business impacts on the countries and the companies due to the cost of unwinding business and losses incurred in their revenue stream.

Fed rate hike

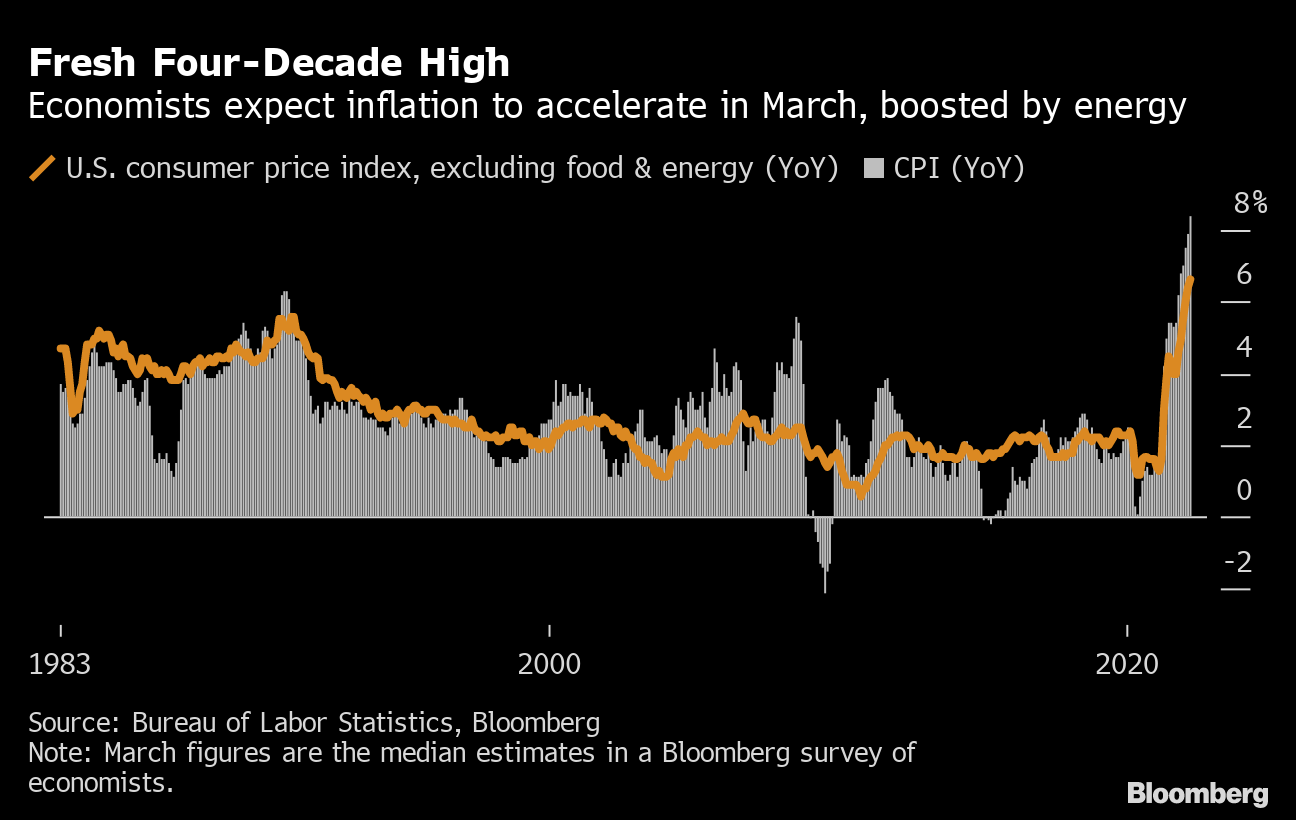

Fig 4. U.S. inflation at four-decade high

The global inflation picture already grim with the US notching the highest level of inflation at 8.4%, hitting a 41-year high since December 19816. The ongoing conflict between the former Soviet Union states is complicating things much further.

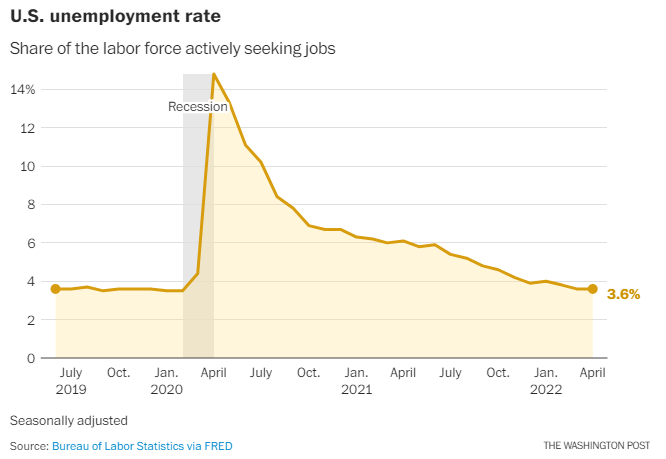

Fig. US unemployment rate at pandemic low of 3.6% in April

Earlier, inflation was debatably the only major concern as the economy was recovering well from the pandemic, with the reported unemployment rate remaining at 3.6% which is at pandemic low7.

But with the conflict, the Fed’s job of taming inflation without killing economic demand is now much harder as traditionally it is hard to achieve one without sacrificing the other. An example of how hard things can get can be seen from the time when Paul Volcker tamed inflation with recession8.

Now, the Fed has not only to subdue surging inflation but also steer the economy clear of recession. Both these issues contribute to what we term as stagflation – inflation with an economy in recession.

As for how the Fed is dealing with the issue, the decision of a 25 basis point rate hike at the March FOMC meeting marked the first step.

Fed chair Jerome Powell has also suggested the merits of frontloading of rate hikes and being aggressive early, though a deeper study of recent inflation may show it has peaked9.

In line with the market expectation to fight inflation, the Fed raises rates by 50 basis points – the biggest hike in two decades10.

How to position your portfolio?

In the face of market volatility brought upon by the war, investors may wish to tilt towards consumer staples or the defence industry.

In times of heightened risk of economic recession made worse by eroding purchasing power due to inflation, consumers typically reduce their spending on discretionary items such as luxury items like designer bags and cars. This then results in subdued demand due to a drop in consumer spending. So, while discretionary spending decreases, the spending on staples will likely be sustained as these are necessities.

The defence industry will likely get a boost from the conflict since aerospace & defence companies are likely to be contracted in response to the conflict.

Some of the ETFs to consider for Consumer Staples or Defence industry:

| Ticker | AUM | Average Vol (3 months) | Expense Ratio | Dividend Yield | 3 Year return | Consumer Staples | XLP.U.S. | U.S.$16.8B | 17.6M | 0.10% | 2.48% | 50.14% |

| VDC.U.S. | U.S.$7.2B | 222K | 0.10% | 2.42% | 49.3% | |

| Aerospace & Defence | ITA.U.S. | U.S.$3.9B | 655K | 0.42% | 0.83% | 5.58% |

| XAR.U.S. | U.S.$1.7B | 225K | 0.35% | 0.78% | 23.06% |

Separately, investors would do well to stay clear of Russia-related stocks in the near future as many are suspended or face trading halts. It would be best for investors to avoid a situation where they are unable to liquidate their stocks and ultimately have the assets locked.

You may learn more on positioning your portfolio in an inflationary environment here.

Final words

The conflict has caused turmoil in the markets recently, and the policy action from the Fed has caused many market participants to fear that the global economy is in a recession.

The risk of recession is now higher than before the conflict began, but historical data shows that the main driver of stock prices in the long term is highly correlated to the company’s earnings. Till date, among all the S&P 500 companies that released quarterly results, the majority have beaten market expectations. Most notably, the financial and travel companies are showing stronger-than-expected earnings, which goes to show consumer demand in the US remains robust. As consumption comprises more than 70% of the US economy, it indicates a strong US economy albeit not expanding as previously thought; the economy may be slowing but not necessarily foreshadowing a recession in the near future.

Hence, it is advisable for clients to remain invested and not ‘flee’ the market when there is a downturn, especially during political turmoil. Past events show that times of extreme market volatility, especially those caused by geopolitical risks, present buying opportunities. This is because the stock market downturn was short lived and rebounded fiercely in the following months11.

Reference:

- [1]https://www.cnbc.com/2022/01/27/how-russia-invaded-ukraine-in-2014-and-how-the-markets-tanked.html

- [2]https://www.scmp.com/business/commodities/article/3169700/lme-suspends-nickel-trading-after-prices-surge-more-110-cent

- [3]https://www.cnbc.com/2022/02/24/oil-prices-jump-as-russia-launches-attack-on-ukraine.html

- [4]https://www.cnbc.com/2022/03/31/us-to-release-1-million-barrels-of-oil-per-day-from-reserves-to-help-cut-gas-prices.html

- [5]https://www.reuters.com/world/us/exclusive-washington-pins-easing-venezuela-sanctions-direct-oil-supply-us-2022-03-09/

- [6]https://economictimes.indiatimes.com/news/international/us/us-records-41-year-high-inflation-rate-of-8-4-in-march-2022/articleshow/90805181.cms?from=mdr

- [7]https://www.washingtonpost.com/business/2022/05/06/jobs-report-april/

- [8]https://apnews.com/article/economy-financial-markets-us-news-ap-top-news-consumer-prices-d91989c6d267295f565fa4be7a825555

- [9]https://www.nytimes.com/2022/04/13/business/dealbook/us-inflation-peak.html

- [10]https://www.cnbc.com/2022/05/04/fed-raises-rates-by-half-a-percentage-point-the-biggest-hike-in-two-decades-to-fight-inflation.html

- [11]https://seekingalpha.com/article/4488660-how-stock-market-reacts-war-based-crash

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Lee Yong Heng

Senior Dealer

Yong Heng joined Phillip Securities in June 2020 as an Equity Dealer in the Global Markets Team. He specializes in the US and Canada markets assisting clients and supports the UK and Europe markets. Yong Heng graduated with First Class Honours from Singapore Institute of Management, University of London (SIM-GE) in 2015 with a bachelor’s degree in Economics & Finance. He also completed his CFA studies in 2019.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile