How To Prepare Your Portfolio For Rising Interest Rates June 8, 2021

What this report is about:

- 10-year US Treasury yields have been rising, as investors price in higher inflation caused by economic reopening

- Rising yields affect market performances and benefit some sectors more than others

- Investors can position their portfolios for rising interests rates by rebalancing of existing portfolio

In recent weeks, investors have been turning their focus to 10-year Treasury yields, betting on a further acceleration of the US economic recovery. This led to a sell-off of equity markets.

In this article, we discuss US Treasuries and their impact on overall market performances.

What are US Treasuries?

US Treasury securities are debt instruments issued by the US Department of Treasury to finance government spending. These securities are considered one of the safest investments in the world because they are backed by the full faith and credit of the US government. To date, the US government has never defaulted on its debt obligations.

Source: Phillip Securities CFD

Source: Phillip Securities CFD

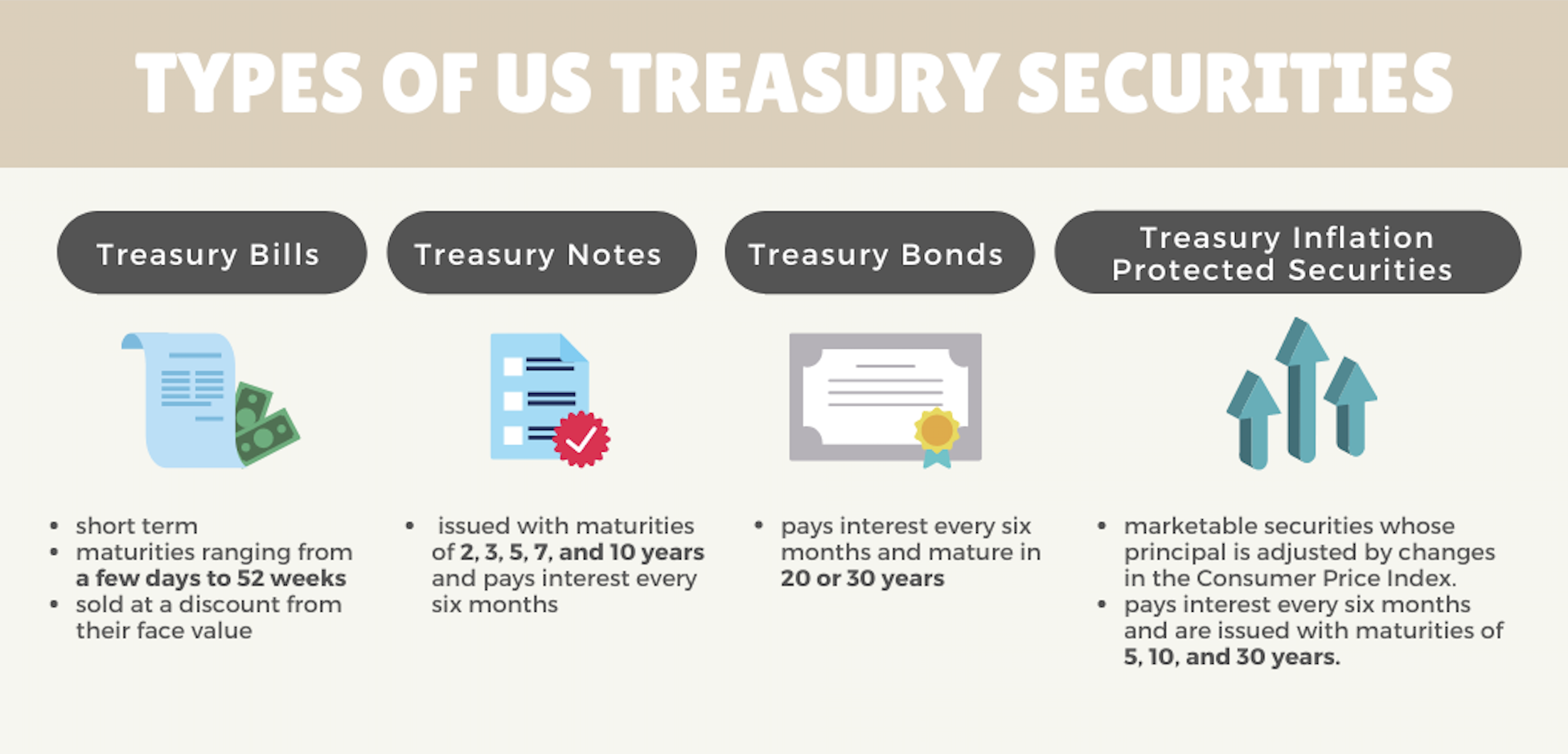

There are a few types of Treasury securities: Treasury bills, Treasury notes, Treasury bonds, and Treasury inflation-protected securities (TIPS).

Treasury bills are short-term government securities with maturities ranging from a few days to 52 weeks. They are sold at discounts to their face value.1

Treasury notes are government securities with maturities of 2, 3, 5, 7 and 10 years. They pay interest every six months.1

Treasury bonds pay interest every six months and mature in 20 years or 30 years.1

TIPS are Treasury bonds that are indexed to inflation. Their principal value rises as inflation rises and their interest payments vary with their adjusted principal value. TIPS pay interest every six months and are issued with maturities of 5, 10 and 30 years.1

Treasury yields are the total return you earn by owning US Treasury securities. Treasury yields are determined by supply and demand. When there is a lot of demand, bond prices rise while their yields drop. When there is a lot of supply, bond prices drop and their yields rise.

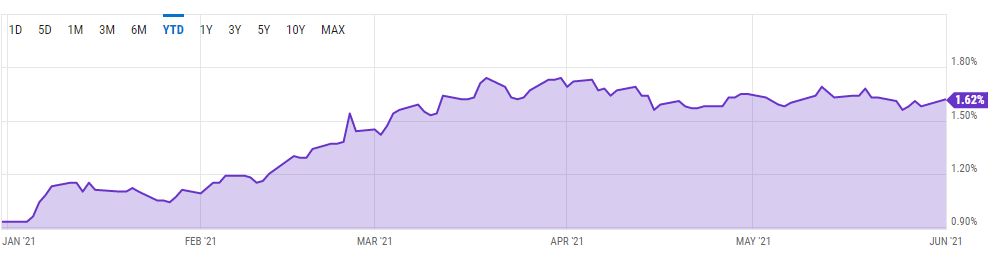

Ten-year Treasury bond yields are closely monitored as a broad indicator of investor confidence and a proxy for US mortgage rates. A recent spike in their yields from 0.93% on 4 January 2021 to 1.74% on 19 March 2021 led to a sell-off of equity markets.2

Figure 1: Y Chart 10 Year Treasury Rate2

Figure 1: Y Chart 10 Year Treasury Rate2

This was an indication that investors were expecting the economy to expand at a healthy clip, based on the following positive developments.

1) Vaccine rollout, which has helped the US reopen its economy

2) President Biden’s executive powers, backed by the Democrats’ majority in Congress

3) Loose monetary policy providing liquidity to markets

4) Expansionary fiscal policies

5) An improving job market

The above has fanned fears of inflation, even though the Fed has signaled that it would keep policy rates near zero till the end of 2023.

Impact of rising yields on market performances

Equities

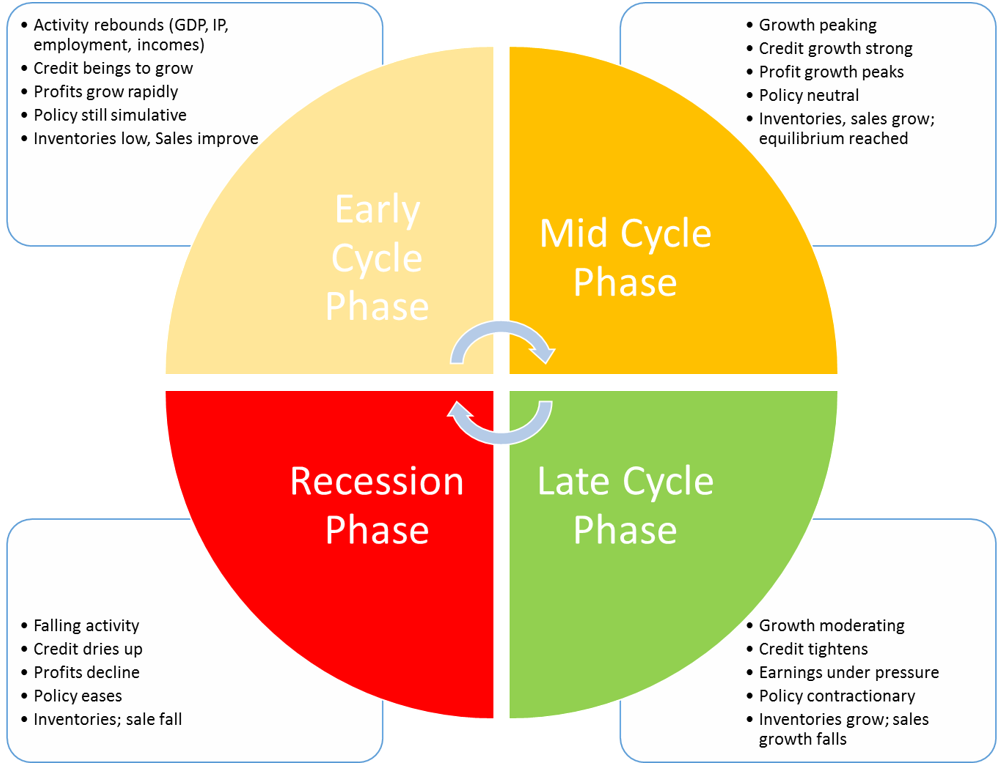

Before we understand the impact of rising yields on market performances, we would need to know the current stage of this business cycle. Fidelity has done extensive research on business cycles and we use this as our reference.

A typical business cycle has four phases. In each phase, there are distinct changes in economic activities and growth rates particularly in three key cycles (corporate profit cycle, the credit cycle, and the inventory cycle) as well as changes in employment and monetary policies. 3

Figure 2: Fidelity’s business cycle3

Figure 2: Fidelity’s business cycle3

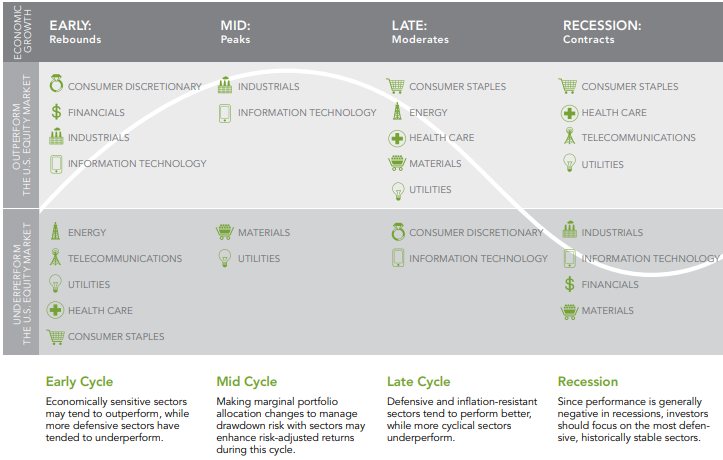

Different sectors perform differently in each business cycle. Historical analysis of business cycles since 1962 shows the relative performances of the sectors as the economy shifts from one stage of the business cycle to the next.

However, do note that business cycles can differ due to structural shifts in the economy, technological innovations, regulations and other factors.

Figure 3: Fidelity’s business cycle sector studies3

Figure 3: Fidelity’s business cycle sector studies3

One of the main differences between previous economic cycles and the current cycle is the performance of the tech sector. During the 2020 recession, the information technology sector outperformed due to heavy demand from work-from-home and decrease oversea business arrangements. In contrast, the consumer discretionary sector, especially tourism, reeled from lockdowns and restrictions in travelling.

In the early-cycle phase, monetary policies are still stimulative, along with growing credit. The financial, consumer discretionary and industrial sectors would benefit from ease of credit and increased borrowing.

As the economy shifts from early cycle towards mid-cycle, there is a rotation of funds from defensive sectors to growth sectors. Sectors like information technology can be expected to do well, particularly with the emergence of new technologies like artificial intelligence, autonomous vehicles and the Internet of things to improve our lives.

Expectations of a market recovery had driven up 10-year Treasury yields. Higher yields signal investors’ confidence in the near-term economic outlook. However, they also indicate expectations of rising inflation.

The US Federal Reserve always considers inflation and unemployment when formulating its policies. Its dual mandate is to maximize employment while maintaining average annual inflation at around 2%. When the job market starts to recover and average annual inflation meets its target, the Fed raises interest rates and tightens its monetary policy. Although the current Fed chair, Jerome Powell, has committed to providing support for the economy, Treasury yields continue to rise.

Markets can be affected by rising inflation. How should you prepare your portfolio for this?

Equities

1) Financial sectors have always been the most sensitive to interest-rate changes. Banks make profits from the spread between loans and mortgages and the interest paid to savers and holders of certificates of deposit. This spread is known as their net interest margins. Banks stand to book higher net interest margins when interest rates rise. Hence, investors can consider investing a portion of their portfolios in the financial industry.

2) Ability to pass on rising costs. Rising costs for businesses would result in higher spending and falling profitability. Some companies are able to pass on their rising costs to consumers better than others. These companies have one or more of the following economic moats:

a) Cost advantage or economies of scale: This refers to their ability to deliver goods and services at low costs

b) Strong ecosystem: They have multiple products or services to retain their customers

c) High switching costs: Customers would find it costlier or inconvenient to switch to other suppliers

d) Strong branding: They have created a loyal base of customers

e) Intellectual properties: Patents or regulations protect the companies

Companies with these strong economic moats have the pricing power to pass on rising costs to end-consumers, so we should consider them in our portfolios.

Here’s a list of ETFs that you can consider for the financial industry and companies with economic moats.

| Stock | Stock Code | Market | Features |

| Financial Select Sector SPDR Fund | XLF | AMEX | Provides exposure to an index that includes companies from the following industries: diversified financial services; insurance; commercial banks; capital markets; real estate investment trusts; thrift & mortgage finance; consumer finance; and real estate management & development |

| Vanguard Financials ETF | VFH | AMEX | Provides targeted exposure to the US financial sector, making it one option for investors seeking to tilt their portfolios towards US. banks |

| VanEck Vectors Morningstar Wide Moat ETF | MOAT | AMEX | Tracks an index of companies that have ‘wide moats’ or sustainable competitive advantages that are very difficult for competitors to breach |

| VanEck Vectors Morningstar International Moat ETF | MOTI | AMEX | Tracks an equal-weighted index of 50 non-US companies that Morningstar deems to have sustainable competitive advantages and attractive valuations |

3) Companies that are heavily dependent on debt would be negatively affected. They would have to shoulder higher interest expenses which would affect their profitability or dividend payouts. They could also be forced to raise equity to lower their debt. This would lead to dilution for existing shareholders.

4) With increasing Treasury yields, investors would also demand a higher equity risk premium. This refers to the excess return that investors require to invest in the stock market over risk-free assets. If their investments are unable to provide them with the required equity risk premium, investors might sell off their stocks and channel their funds to risk-free assets like US debt securities.

Investors looking at companies negatively affected by rising Treasury yields and inflation can consider using Contracts for Differences to hedge their positions or short-sell to capture downside opportunities.

US$

Bond yield differentials usually move in the same direction as currency pairs. Capital flows are always attracted to higher-yield currencies. As the future yields of US$ securities are expected to increase, demand for the US$ also increases. This would lead to its appreciation against other currencies. That said, there are also other factors that can affect the strength of the US$.

Investors who wish to take advantage of forex movements can consider using Forex CFDs. Forex CFDs (FX CFDs) are a form of Contract For Differences (CFD) that allow you to participate in the price movements of the underlying forex pair. Their main objective is to exchange one currency for another in expectations that the currency pair will appreciate or depreciate, depending on the position taken.

Commodities

Gold is traditionally used as a hedge against inflation

However, it is not always the best option, as many other factors affect its price. These include market volatility, US$ strength, supply and demand for physical gold, holding costs and opportunity costs. Higher Treasury yields would lead to a firmer US$. Coupled with lower market volatility and an improving economy, demand for gold could drop.

As gold pays no dividends, people may sell their gold for other assets with better returns during an economic recovery.

Copper is also known as a leading indicator of economic health. It is widely used as a fundamental raw material in many industries and products. Due to copper’s widespread applications, rising copper prices would suggest stronger copper demand and a growing global economy. As copper prices are denominated in US$, a strengthening US$ may indicate commodities are becoming more expensive in other currencies. This would in turn decrease demand for copper.

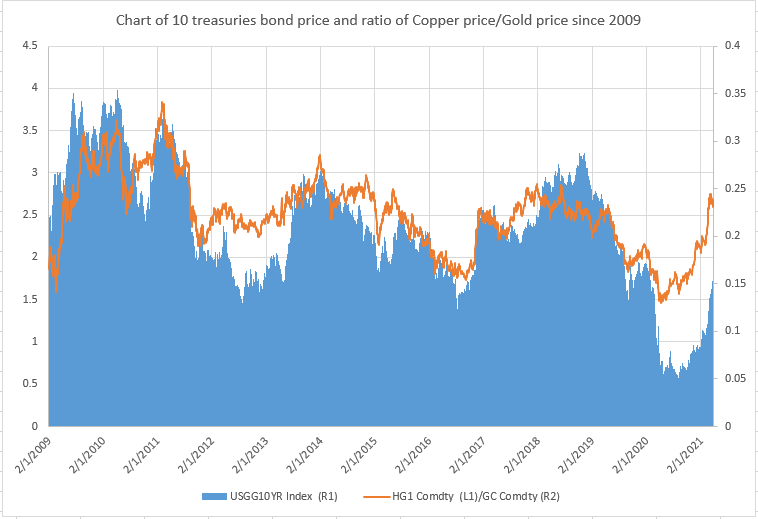

There is an interesting study by Jeffrey M. Mayberry on the power of copper-gold as a leading indicator for 10-year Treasury yields4. The copper-gold ratio is the quotient of the price per pound of copper divided by the price per troy ounce of gold. In his research, Jeffrey Mayberry noticed that 10-year Treasury yields tended to follow the direction of copper/gold.

Figure 4: 10-year Treasury bond prices and the ratio of copper/gold prices since 2009

Figure 4: 10-year Treasury bond prices and the ratio of copper/gold prices since 2009

Investors looking for the direction of 10-year Treasury bonds can monitor the ratio of copper/gold prices.

Here’s a list of ETFs that you can consider for gold and copper.

| Stock | Stock Code | Market | Features |

| SPDR Gold shares | GLD | AMEX | Offers investors one of the lowest available expense ratios for a US.listed physical gold-backed ETF |

| iShares Gold Trust | IAU | AMEX | Tracks spot prices of gold bullion by holding gold bars in a secure vault, freeing investors from the need to find a place to store the metal |

| United States Copper Index Fund | CPER | AMEX | Replicates an index which comprises a basket of exchange-traded copper futures contracts |

Investors with a greater risk appetite can consider trading using Gold CFDs. Gold can be used as a hedging strategy as well as be part of your investment portfolio.

After the recent upsurge in interest rates, we believe that yields may take a breather in the short to medium term

Longer term, as the world fully reopens from coronavirus shutdowns, we expect the unleashing of pent-up demand from billions of people the world over to trigger inflation. This could force central banks to abandon their accommodative monetary policies.

Investors can start positioning their investments for the short, medium and long terms now.

We hope this article provides you with an overall view of the potential market impact from rising Treasury yields and inflation. Be sure to check out our other articles and free webinars and courses.

If you have any questions on trading or investing, drop us an email at cfd@phillip.com.sg and we will be glad to assist you through your investment journey.

Reference:

- 1https://www.treasurydirect.gov/indiv/products/products.htm

- 2https://ycharts.com/indicators/10_year_treasury_rate

- 3https://www.fidelity.com/webcontent/ap101883-markets_sectors-content/18.01.0/business_cycle/Business_Cycle_Sector_Approach.pdf

- 4https://doublelinefunds.com/wp-content/uploads/ThePowerofCopper-Gold_Mayberry2019-Fund.pdf

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mike Ong

Senior Dealer

Mike is a member of the largest dealing team that specialises in Equities, ETFs, CFDs & Bonds, and manages >50,000 client accounts in Phillip Securities. He believes in investing long-term for passive income and evaluates stocks using fundamentals. He is currently the chief editor of the HQ education series that aims to equip clients with tools and skill sets to make better investing and trading decisions.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile