Is the Bull still Alive? May 21, 2020

Have you ever wondered why an up-trending market is called a “Bull” market whereas a down trending market is called a “Bear” market? This is because when a bull strikes, it will first lower its head before swinging its horns upwards, thus when the market has an upward trend, we call it a “bull” market. On the other hand, when a bear strikes, its paws are raised high and swung downwards, so when the market experiences a downward trend, we call it a “bear” market.

History has shown that the stock market is a place where fluctuating trends are observed. Bull market comes after the bear market and vice versa, a natural process that takes place in the stock market.

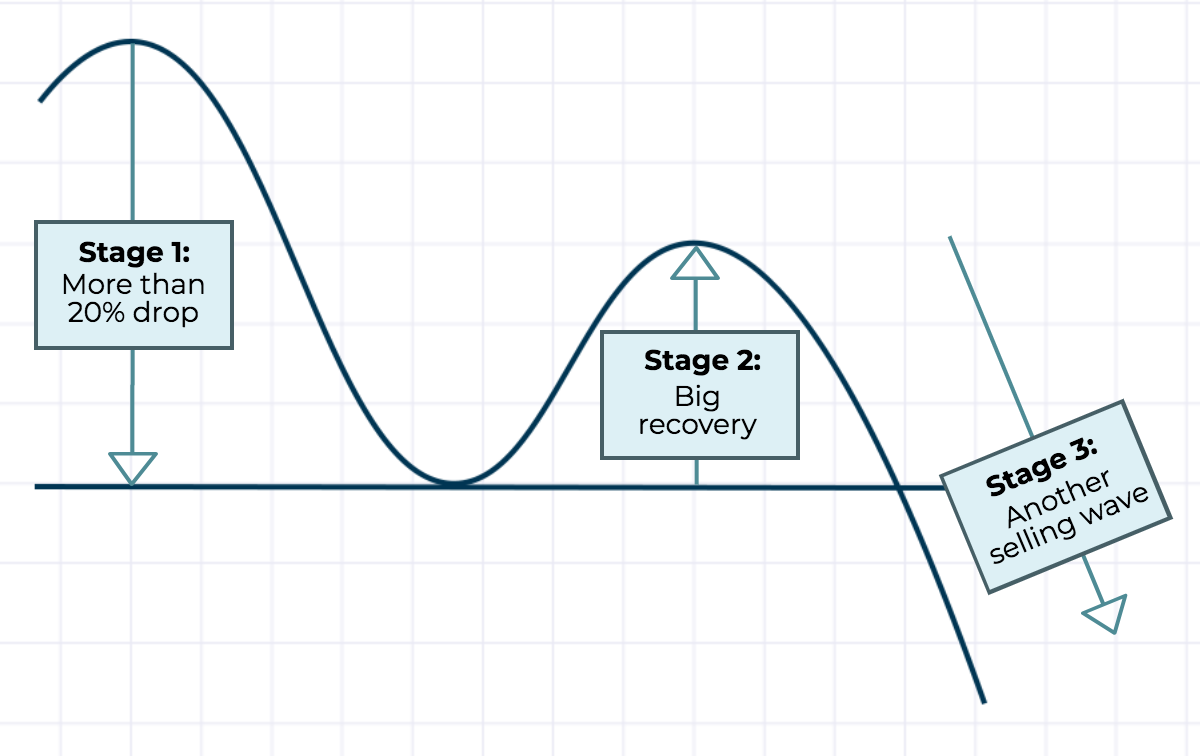

According to research done by Robert Miner[1], he found that in the past 120 years, the Dow Jones Index experienced bear market 15 times (in technical terms, bear market begins when an index falls at least 20% from the peak). He discovered that every bear market has 3 stages. First, the index tumbles fast by more than 20%, followed by V-shaped recovery or U-shaped recovery (however, it will not reach the previous peak level) before it tumbles again, usually to a much lower level than the initial stage.

Figure 1: Three typical stages of a bear market

The theory as to why the bear market has 3 stages is summarised as follows:

In the first stage, new black swan events trigger massive selloff out of fear. However, there are hopeful investors who continue holding onto their shares. As a result, the stock market tumbles to a certain point and enters stage 2.

In stage 2, market participants find the stock market undervalued and subsequently the demand for stocks increases, leading to a V-shaped or U-shaped rally, which then bringing about opportunity for investors who previously trapped in Stage 1 to sell off their shares. The stock market tumbles again as a result and triggers the next stage. When that happens, the rally in stage 2 becomes a “dead cat bounce”.

In stage 3, the selling wave continues like an avalanche, reducing confidence and diminishing hopes held by investors.

Of course, historical trends serve only as a good reference for our learning and gives a gauge on future market performance.

So, what stage are we at now after the recent stock market crash? To answer this question, allow us to first examine the Dow Jones Industrial Average (DJIA) and Straits Times Index (STI) index charts below.

Review from Recent Market Crash

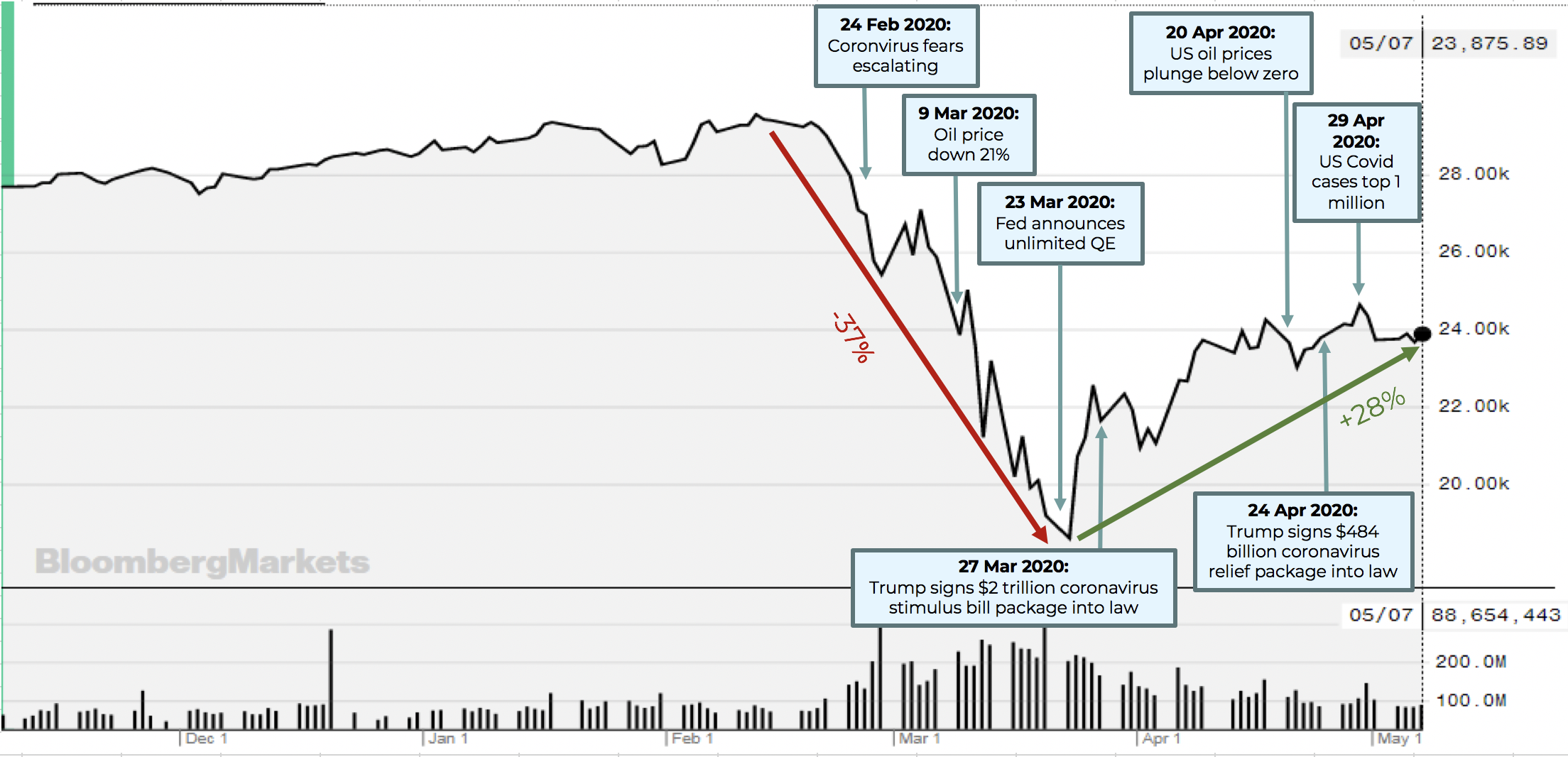

1) US Stock Market

Figure 2: DJIA Index 6-month chart [2]

The Dow Jones Industrial Average (DJIA) index fell by 37% in just 6 weeks from 12 Feb 2020 to 23 Mar 2020 due to the worsening COVID-19 outbreak worldwide coupled along with the biggest drop in oil price in decades following Saudi Arabia’s oil price war with Russia. The US Fed announced unlimited quantitative easing (QE) on 23 Mar 2020. Following which, the index recovered 28% from its low by 7 May 2020.

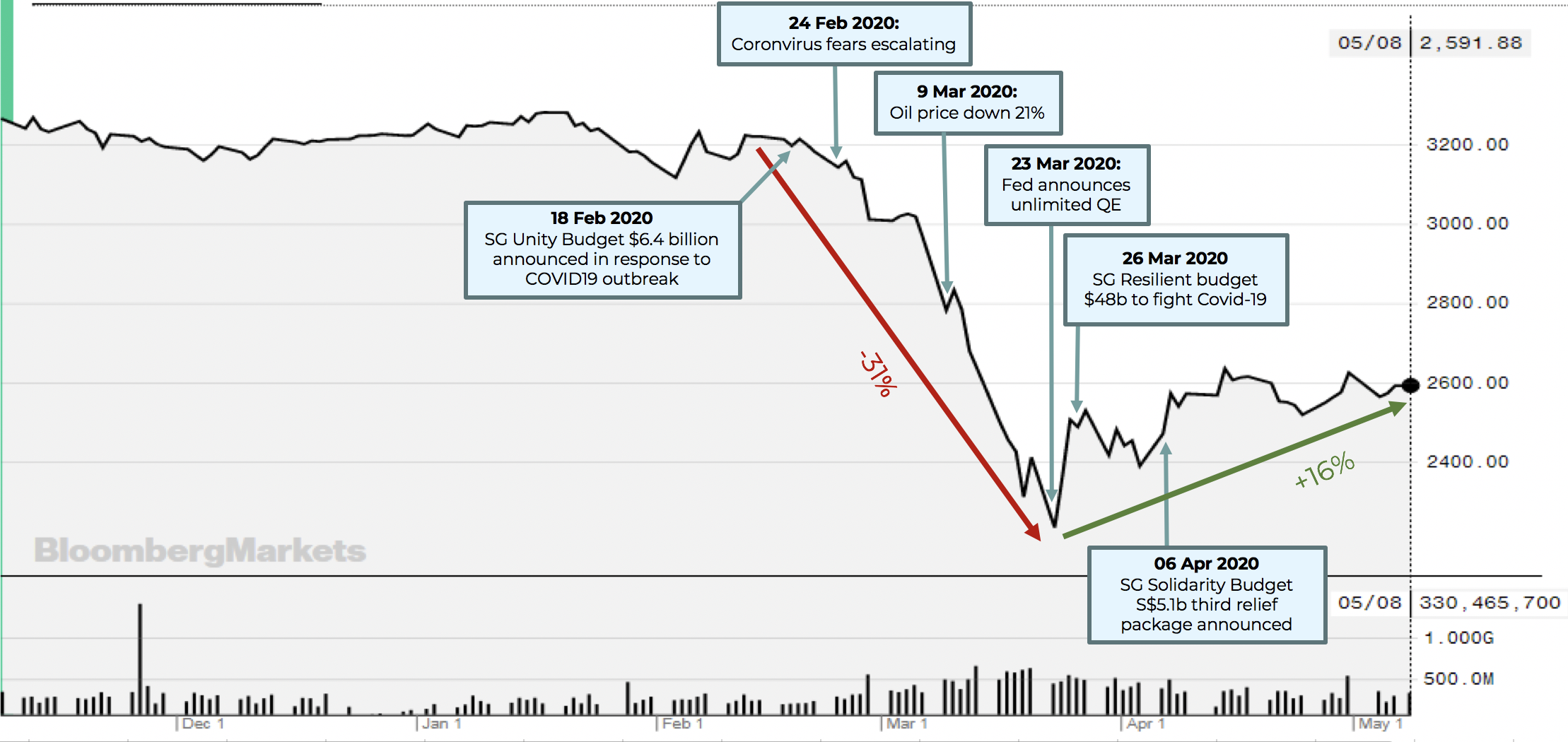

2) Singapore Stock Market

Figure 3: STI Index 6-month chart [3]

The Straits Times Index (STI) displayed similar trend patterns as DJIA index. The STI was down 31% in just 6 weeks before a slow recovery that reached 16% by 08 May 2020.

3) Observation and analysis

From both charts above, we saw that both indices are slowly recovering from the dip since 23 Mar 2020, the day where the US Fed announced unlimited QE. Quantitative Easing (QE) is the act of the US Fed buying bonds in order to inject US dollar funds to boost the US economy. In the past, the Fed committed a specific amount of US dollar funds to purchase Treasury bonds and mortgage-backed securities, and nothing more. But this time because of the unlimited QE program, the Fed committed to supply money to the US economy through open-ended ongoing purchase of bonds until a point where the Fed is satisfied that the economy is well recovered.

The recent market crash is different from what we had learned from the past bear markets.

Based on the current trend that we are seeing, we can expect similar relief packages to be announced in the next few months if the economy continues to be dampened by the COVID-19 outbreak.

Since unlimited QE was announced, both DJIA and STI indices were unaffected by this negative piece of news and saw recovery despite the release of IMF’s a report predicting a -6% contraction in global GDP (the worst recession since the Great Depression and worse than the Financial Crisis) [4], plunge in US oil prices to below zero for first time in history [5] and the rise in US’ COVID-19 cases to a million (as of 28 Apr 2020). [6]

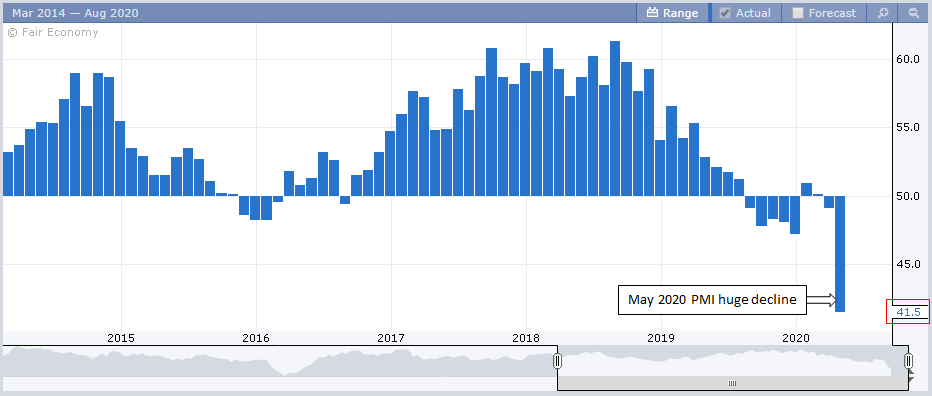

Figure 4: Institute for Supply Management Purchasing Managers’ Index (ISM PMI) bar chart [7]

In addition, the recent ISM PMI chart shows that May 2020 PMI was in sharp decline. The PMI was derived from a monthly survey sent to supply chain managers in the US based on five major survey areas: new orders, inventory levels, production, supplier deliveries, and employment. The strong PMI downtrend suggests that the US economy will be severely affected in the coming months Yet, both DJIA and STI indices did not tumble in tandem with the PMI. This could be due to on-going strong fiscal support from both the US congress and the Fed to the US economy and the stock market.

Hence, in the short term, the stock market will most likely be poised towards its path of recovery. However, should there be another Black Swan event (outside of both COVID-19 and oil prices), there is a chance the stock market would crash again and trigger the Stage 3 bear market as the stock market fears uncertainty.

What’s Next For You?

Despite the chaos in the economy we are in right now, both DJIA and STI indices are slowly recovering since the recent dip on 23 Mar 2020. In view of this, you may want to slowly add more long positions in stocks. However, if you have a higher risk appetite and would want to gain market upward movement exposure with small and limited capital, you may want to take a leveraged long position with Contracts for Differences (CFDs) to gain access to underlying stock price or index point movements.

Please see examples below on how CFDs can amplify your returns with small capital commitment when both underlying stock price or index point goes up.

Examples 1 – Equities CFD on Shares

| Share Trading | CFD Trading |

| On 04 May 2020, you initiated an open position. | |

| Share price = $1.00

Share quantity = 10,000 Total Share contract value = $1.00 x 10,000 = $10,000

Total capital commitment = $10,000 |

Share Price = $1.00

CFD contract quantity = 10,000 Total CFD contract value = $1.00 x 10,000 = $10,000

If CFD on Stock A has 10% margin requirement, the required margin = $10,000 x 10% = $1,000

Total capital commitment = $1,000 |

| On 05 May 2020, the share price increased by 2%. | |

| Share Trading | CFD Trading |

| Latest share price = S1.02

*Gross Profit = ($1.02 – $1.00) x 10,000 = $200

*Return of Investment (ROI) = $200 / $10,000 = 2% |

Latest share price = S1.02

^Gross Profit = ($1.02 – $1.00) x 10,000 = $200

^Return of Investment (ROI) = $200 / $1,000 = 20% |

| This means for a 2% increase in share price, your share trading ROI is 2% but your CFD ROI becomes 20% (10x leverage). | |

Examples 2 – Straits Times Index SGD 5 CFD

On 04 May 2020, STI index was at 2500.

In Straits Times Index SGD 5 CFD contract, each STI point is worth SGD 5.

Initial capital commitment for holding one Straits Times Index SGD 5 CFD contract

= 2500 x SGD5 x 6% x 1 = SGD750

On 05 May 2020, STI index rose 2% to 2550.

^Gross Profit = (2550 – 2500) x SGD5 x 1 = SGD250

^Return of Investment (ROI) = $250 / $750 = 33.3%

This means for every 2% gain in index point, you earn 33.3% of your original investment capital (16.7x leverage).

Although CFDs can magnify your gains through leverage, losses are also magnified and you could lose more than the original investment committed when the market or index point goes against you. The key is always to use leverage responsibly and cut losses quickly when the market turns against you.

* Calculation here omits commission, clearing fees and all other trading fees in shares trading. Actual ROI will be lower than the ROI mentioned in the examples above.

^ Calculation here omits commission and finance charge for CFD trading. Actual ROI will be lower than the ROI mentioned in the examples above.

Conclusion

Both COVID-19 pandemic and the recent oil price crash triggered market crash. Thankfully, the stock market is seeing gradual recovery given the announcement of unlimited QE on 23 March 2020. Besides, we can expect more and more relief packages to be announced in the next few months if the economy continues to be dampened by the COVID-19 outbreak. Hence, this could be the time for us to seize the opportunity to trade the market with a “long” view.

Thank you for sticking with us throughout this article! We sincerely hope that you have found value in our analysis. Be sure to check out our other articles and the courses that we offer. If you have any questions on trading or investing, feel free to drop us an email at cfd@phillip.com.sg and we will be glad to assist you through your investment journey.

Till next time folks!

Begin your CFD Trading Journey with us!

References:

- [1] PDF: DT Big Picture Update – Stock Indexes: Part 2 – March 28, 2020

- [2] https://www.bloomberg.com/quote/INDU:IND

- [3] https://www.bloomberg.com/quote/STI:IND

- [4] https://www.imf.org/en/News/Articles/2020/04/14/tr041420-transcript-of-april-2020-world-economic-outlook-press-briefing

- [5] https://www.straitstimes.com/business/companies-markets/us-oil-prices-plunge-below-zero-in-devastating-day-for-global-industry

- [6] https://www.washingtonpost.com/politics/covid-19-cases-top-1-million-in-the-united-states-about-a-third-of-known-cases-worldwide/2020/04/28/e5fafd4e-8944-11ea-9dfd-990f9dcc71fc_story.html

- [7] https://www.forexfactory.com/calendar?range=apr12.2020-may9.2020#graph=111413

About the author

Tan Kean Soon

Dealer

Kean Soon graduated from National University of Singapore with Bachelor's Degree in Materials Engineering. He is a passionate CFD dealer who believes that equity markets can help grow one's wealth with the right mindset, risk management & discipline.In his free time, he enjoys learning and experimenting with long-term investment and short-term trading ideas as well as following the latest market news to get in touch with market reality.