Market Update 10 October 2016 October 10, 2016

U.S. Events

The events to take note this week will be the U.S. Federal Reserve’s release of its September policy meeting on Wednesday, 2pm (Singapore time, Thursday, 2am).

The Fed has policy meetings scheduled in early November and mid-December. It is widely expected that the Fed policymakers will avoid a rate hike before the U.S. presidential election on 8th of November.

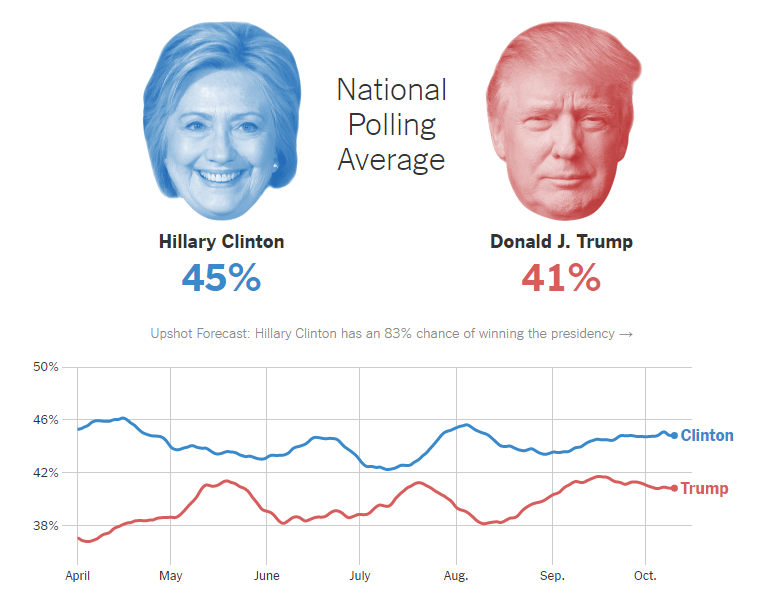

Elsewhere, after 2 rounds of presidential debate and a 2005 recording of Mr Donald J. Trump’s vulgar remarks on women, Ms Hillary Clinton appears to be taking the lead in the online presidential poll by The New York Times.

Source: http://www.nytimes.com/interactive/2016/us/elections/polls.html

Oil market

As mentioned in the previous market update on 19/09/2016, crude oil price rallied on the news of a tentative deal by OPEC to reduce output. The exact production level for each OPEC member country will be discussed at its 30th November meeting in Vienna. This will be the first oil output cut in 8 years.

WTI Crude oil price reaches USD $ 50.44 per barrel on Thursday, 06/10/2016.

On Sunday, 09/10/2016, Iraq (the country with the 5th largest proven oil reserves)’s oil minister, Jabar Ali al-Luaibi urged the oil and natural gas producers in the country to continue increasing production for the rest of the year and in 2017.

Considering that the output reduction is not fixed until November, Luaibi’s remark and the strong resistance level at USD $50 range, investors may want to consider taking profit if they have taken a long position earlier.

UCO pricing chart:

Singapore Market

Last week, STI index traded in between 2861.95 and 2901.73 points in a low volume week. STI closed 2875.24, up 5.77 points or 0.2%.

However, there is a bright spark in the Singapore market this these 2 weeks with the upcoming launch of the Phillip SGX APAC ex-Japan REIT ETF.

The investment objective of the fund is to seek to provide a high level of income and moderate long-term capital appreciation by tracking the performance of SGX APAC Ex-Japan Dividend Leaders REIT index. Indicative yield is at 5.19%. You may wish to contact your trading representatives to find out more about this ETF!

Click here to find out more

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them. The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

About the author

Chong Kai Xiang (Kai)

POEMS Dealer

Raffles City Dealing Team

Chong Kai Xiang (Kai) is an Equities Dealer in the Raffles City Dealing Team, and currently provides dealing services to over 35,000 trading accounts. Kai frequently conducts seminars to enrich his client’s trading and financial knowledge. Apart from this, Kai also provides weekly market updates to his clients to keep them informed and up to date on their stock holdings. Kai holds a Bachelor Degree of Finance from the SIM University – UniSIM and was awarded the CFA Singapore Gold Award and CFP® Certification Achievement Award in 2015.