Market Update 14 November 2016 November 14, 2016

U.S. Presidential Election – The “shocking” win

Be it the stock market or the political arena, last week was an action-packed week, which can be considered one of the most significant week this year.

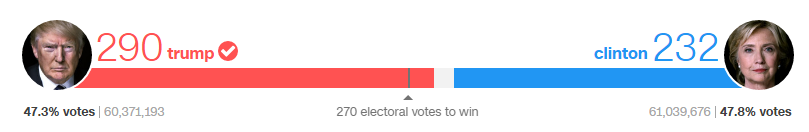

Unless you have been staying in a cave without any connection to the world, you should most probably know by now that Donald Trump has won the 2016 U.S. presidential election last Wednesday.

Trump’s victory over Hillary Clinton by garnering the necessary 270 votes came as a surprise to many of the market watchers.

Source: http://edition.cnn.com/election/results/president

The market reacted strongly during the votes counting process and after the results were announced, with the Dow Jones Futures down 700 points or 5% at one point.

And as sharply as the drop, the U.S. Futures rebounded and the U.S. market opened flat on the same day itself.

This complete U-turn of market prices on the same day may be attributed to panic selling on Trump’s victory and the market’s realization that it may be a déjà vu of Brexit all over again.

The sharp decline in the market after Brexit was plugged 2 days after the event and a sharp rally followed.

Things to expect from President Trump

With the House and the Senate under the Republicans’ control, any changes that Trump proposes will most likely pass through.

Let us recap on some of the ideas Trump communicated during his election campaign:

- The intention to renegotiate or withdraw from The North American Free Trade Agreement (NAFTA)

- The intention to withdraw from the Trans-Pacific Partnership (TPP)

- Tax relief for middle class and simplification of tax brackets

- The establishment of tariffs to discourage companies from laying off U.S. workers in order to relocate to other countries and ship their products back to U.S. tax-free.

In summary of the points above, Trump is going to take a protectionist stance on U.S. economy. If these points do come into play, the short term foreseeable effect should be the prosperous growth of the U.S. economy while funds flow out from Asia and emerging market into the U.S. Yield-play investment products like bonds and REITs are expected to see a decline due to the outflow into riskier assets in the U.S.

The U.S. dollar is expected to strengthen due to the demand for it.

Countries like Singapore that are export-oriented with an open economy will likely suffer from the withdrawal of NAFTA and TPP.

However, the above summary is only based on the ideas that Trump communicated during his election campaign. It is still relatively early to conclude that all of the points above will be fulfilled by him.

Oil market

With the U.S. election over, the next event to take note will be the OPEC meeting in Vienna on 30th November. The agenda of the meeting will be to decide on the production level of each member country so that the oil price can be supported.

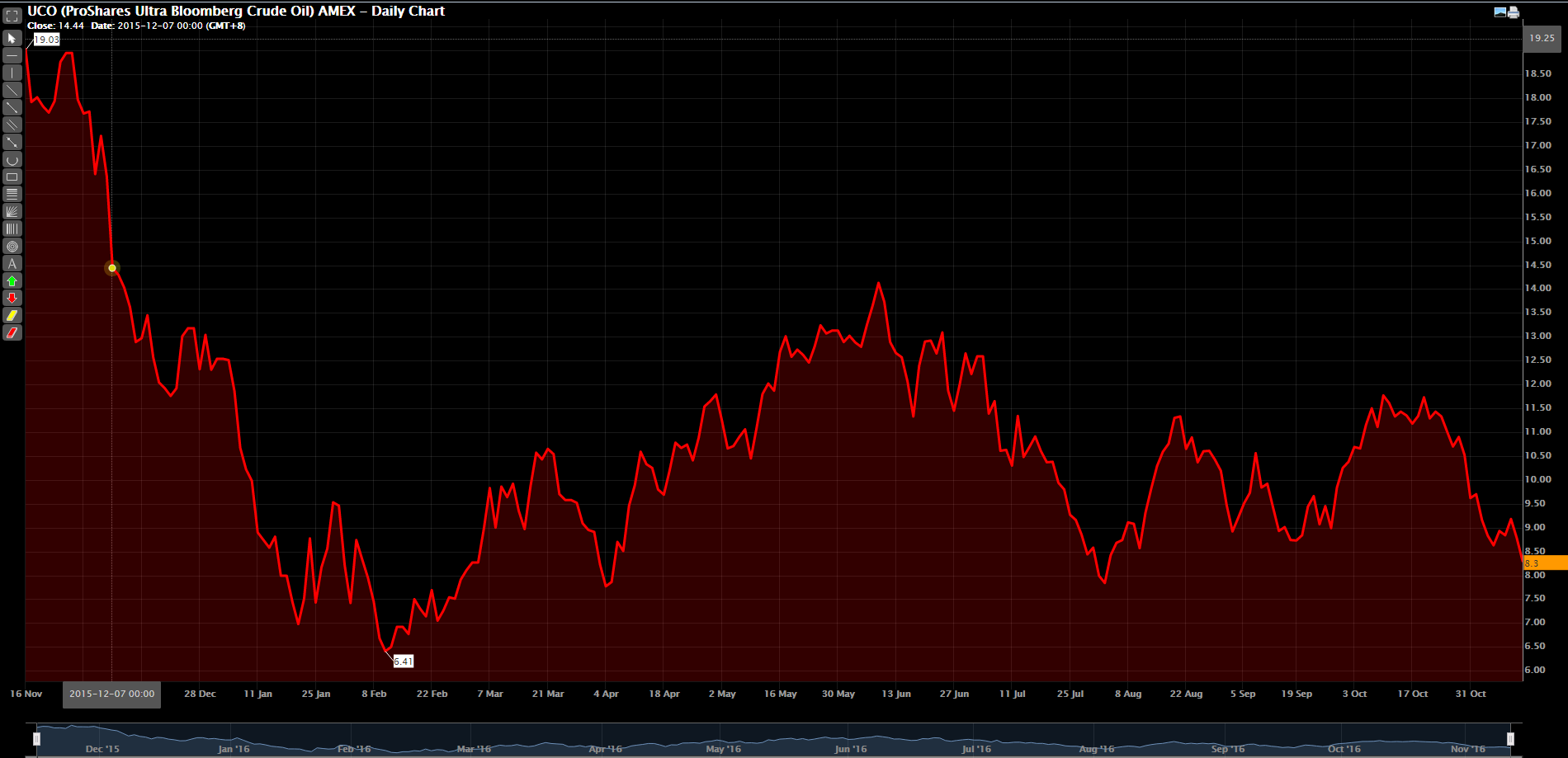

WTI Crude oil futures price closed at USD $43.13 per barrel on Friday, 11/11/2016, continuing the decline since the height of USD $51.60 in October. The decline over the last week is partially due to the strengthening of U.S. dollars since the election.

The immediate support price range of crude oil will be around USD $39-$42, investors who thinks that the OPEC meeting will end in a positive note can consider buying oil-related ETFs when crude oil price reaches the support region. Some examples of positively co-related oil ETF are CSOP WTI Oil Annual Roll December Futures ER ETF (3135:HK), United States Oil Fund (USO.AMEX) and Proshares Ultra Bloomberg Crude Oil (UCO.AMEX).

UCO pricing chart:

Source: POEMS 2.0 platform

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Chong Kai Xiang (Kai)

POEMS Dealer

Raffles City Dealing Team

Chong Kai Xiang (Kai) is an Equities Dealer in the Raffles City Dealing Team, and currently provides dealing services to over 35,000 trading accounts. Kai frequently conducts seminars to enrich his clients' trading and financial knowledge. Apart from this, Kai also provides weekly market updates to his clients to keep them informed and up to date on their stock holdings. Kai holds a Bachelor Degree of Finance from the SIM University – UniSIM and was awarded the CFA Singapore Gold Award and CFP® Certification Achievement Award in 2015.