Market Update 17 October 2016 October 17, 2016

Straits Times Index

The Straits Times Index (STI) closed 60.50 points, or 2.1% lower to 2815.24 last Friday, compared to a closing of 2,875.24 on the 7th of October. The STI continues to show signs of weakness, as year to date performance is currently down by 73.99 points, or approximately 2.6%, from the opening of 2889.23 on January 2nd 2016. Although the current index is running at way above the year low of 2528.44 points on 3rd of February 2016, there seems to be continuous signs of mixed investor sentiments resulting in some investors taking on a side – line approach to investing. We do see a trend of the index consistently testing the 2,800 support level over the course of the last two months, and in the event that this support is broken, we might see the next support level at 2,700.

Source: POEMS 2.0 Platform

The Great Debate (Round 3)

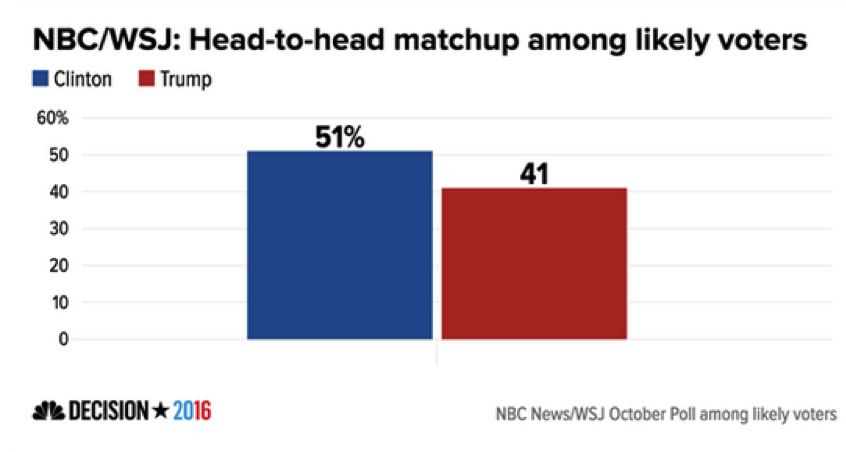

Coming this Thursday, October 20th 2016, the United States of America (USA) will have their presidential candidates make their third and final debate. The debates have been widely followed by Americans and non-Americans alike, as both candidates portray starkly contrasting views on policies and how to run the country. The debates have also pretty much progressed into sessions of political mud – slinging. A string of accusations have plagued both candidates, but most recently, Donald Trump has been dominating the limelight as the comments he made about women years ago seem to be back to haunt him. These comments were generally thought to be distasteful and unsavoury and he has been seen to be losing support from some groups of voters. This has also resulted in some Republicans denouncing and withdrawing their support for him. These negative events seem to have set Donald Trump a couple of points back, versus that of Hillary Clinton, as the lead between Hillary Clinton and Donald Trump widens to approximately 11%, according to a NBC/WSJ poll compiled on 16th October 2016.

Source: NBC, WSJ

The country will decide on its incoming President on November 8th, 2016.

Phillip SGX APAC Dividend Leaders REIT ETF

The introduction of the first ever REIT ETF of its kind, the Phillip SGX APAC Dividend Leaders REIT ETF, will commence trading on October 20th, 2016. There was strong initial interest gathered from investors during the pre – IPO phase, and it would seem that there are many investors keen on investing in an ETF that comprise of diversified regional REITS that generally provide for relatively higher dividend yield. With global economic uncertainty plaguing the equity markets, coupled with a growing appetite for dividend yield, investors who are looking into holding a basket of REITs with relatively lower beta for a mid to long term duration can find out more about this ETF by viewing the prospectus at: http://phillipfunds.com/uploads/funds_file/Phillip_SGX_APAC_Dividend_Leaders_REIT_ETF_Prospectus.pdf. Alternatively, investors can find out more about this ETF by approaching a Dealer at a Phillip Investor Centre near you.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them. The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

About the author

Kervin Ong

POEMS Dealer

Jurong West Dealing Team

Mr. Kervin Ong currently manages a portfolio of trading accounts and is part of the POEMS Dealing Team. Apart from his Dealing role, he also gives training seminars to further enrich the financial knowledge of clients under his care. An external auditor by profession before joining Phillip Securities, his background in due diligence and statutory audits for listed companies equips him with in-depth analytical skills; a skill hugely advantageous for value investors who seek to invest in companies with favorable valuations or shrewd management. Kervin holds a Bachelor of Science in Applied Accounting (Hons) from the Oxford Brookes University, along with memberships under the Association of Chartered Certified Accountants (ACCA) and Institute of Singapore Chartered Accountants (ISCA).