Market Update 26 September 2016 September 28, 2016

Straits Times Index (STI)

The Straits times Index (STI) closed 26.28 points higher, or 0.38 percent to 2,856.95 last week, compared to an opening of 2,830.67 on the 19th of September. The year to date performance of the STI is not as positive, as performance is down by approximately 32.28 points, or 1.1 percent, from the year opening of 2889.23. There was little to drive investor sentiment in the local market last week, even as the Federal Reserve announced that they will not proceed with an interest rate hike in September.

The Great Debate (Round 1)

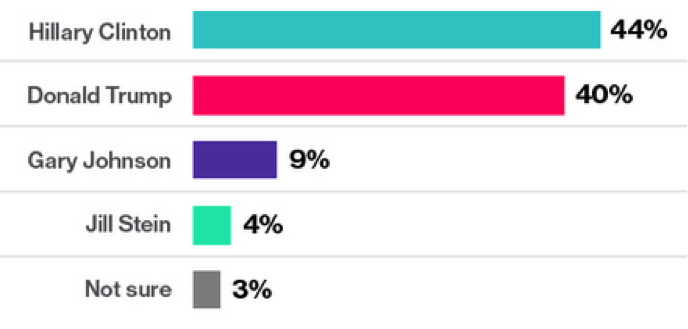

This will be an exciting week for investors, as the world will be watching the first of the three presidential debates take place on Monday, September 26. All eyes are set on the first debate, as candidates Hillary Clinton and Donald Trump, backed by the Democrats and Republicans respectively, show increasingly close popularity percentages in recent United States (US) polls.

Source: Bloomberg

The incoming President would set forth changes that would inadvertently affect trading relations between the US and its partners. Apart from this, various sectors will also be impacted by the election of a new President.

Impact on Energy Sector

The Energy sector will likely experience near term volatility depending on which candidate succeeds as the new President. Donald Trump is known to be bias towards traditional energy sources, and have raised interest in investing more on coal, as well as approving more contracts for Crude oil drilling in the USA.

Hillary Clinton is known to be more of an advocate of eco – friendly initiatives, and prefers renewable energy over other traditional sources of energy. Hillary Clinton has pledged to push through a proposal to generate approximately 700% increase in solar capacity by the year 2020, in the event that she assumes the role of the new President.

Impact on Defence Sector

Both leading candidates have brought up the issue about national security on multiple occasions. With prevailing internal threats of terrorism, existing involvement of US military presence in the Middle East, rising tensions between the US and Russia over Syria, as well as opposing positions adopted by the US and China over the South China Sea disputes, we will likely see the successful candidate maintain or even increase defence spending.

Impact on Healthcare Sector

The cost of rising healthcare in the USA has been mentioned more than once during Hillary Clinton’s road to nomination. More than once have Hillary Clinton called out to companies on exorbitant pricing imposed on drugs and life supporting devices. Hillary Clinton is looking at increasing, or at least maintaining the Affordable Care Act, or better known as Obamacare in current times. Donald Trump is looking at repealing the Act. Both candidates do see the need to keep drug costs down, in order to make healthcare more affordable for the average American.

The US presidential election will be held on November 8, 2016.

Investors who are interested in gaining exposure to the mentioned sectors can consider wide ranging list of ETFs offered, such as Energy Select Sector SPDR Fund (symbol: XLE) for energy, IShares U.S Aerospace & Defence ETF (symbol: ITA) for defence, Health Care Select Sector SPDR (symbol: XLV) for healthcare.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them. The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

About the author

Kervin Ong

POEMS Dealer

Jurong West Dealing Team

Kervin Ong currently manages a portfolio of trading accounts and is part of the POEMS Dealing Team. Apart from his Dealing role, he also gives training seminars to further enrich his clients’ financial knowledge under his care. An external auditor by profession before joining Phillip Securities, his background in due diligence and statutory audits for listed companies equips him with in-depth analytical skills; a skill hugely advantageous for value investors who seek to invest in companies with favorable valuations or shrewd management. Kervin holds a Bachelor of Science in Applied Accounting (Hons) from the Oxford Brookes University, along with memberships under the Association of Chartered Certified Accountants (ACCA) and Institute of Singapore Chartered Accountants (ISCA).