Market Update 29 August 2016 August 29, 2016

Straits Times Index (STI)

The Straits times Index (STI) closed slightly higher last week, with an opening of 2843.76 on the 22nd of August, to a closing of 2857.65 on Friday, up by approximately 14 points, or 0.4 percent for the whole of last week. The year to date performance of the STI, however, is looking less than favourable, as performance is down being by approximately 1 percent, from the year opening of 2889.23.

On the Oil and Gas (O&G)

Last week, Iraq announced that it is increasing crude output exports in order to gain market share. Reuters reported that the current production output for Iraq stands at 4.6 to 4.7 million barrels per day. This comes at a time when members of Organisation of the Petroleum Exporting Countries (OPEC) continue to fail to agree on the freezing crude oil output.

Crude futures prices fell during early hours on Monday as investors saw that Saudi Arabia does not seem as committed to exert more effort in curbing producer output. Focus will be placed on the informal meeting that will be held by OPEC in Algeria next month, as it is expected that further discussions will shed some light to any potential output freeze.

Yellen’s Hawkish Vibes

During last Friday’s Kansas City Federal Reserve annual gathering in Jackson Hole, Wyo, Yellen presented a hawkish attitude towards the performance of the US economy, quoting her “in light of the continued solid performance of the labour market and our outlook for economic activity and inflation,” raises the belief that a rate hike will be expected sometime soon. The next FOMC meeting will be on the 20th to 21st of September. Investors will do well to watch for any rate hike announcements that might be made during this coming meeting.

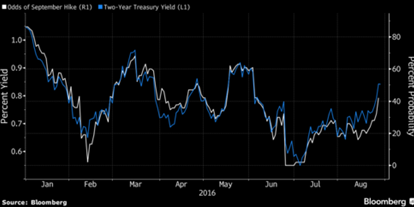

The likelihood is a rate hike in September is still believed to remain relatively low, compared to the possibility of a hike in December. According to Bloomberg, futures indicate a 42 percent chance that the Fed will exercise a rate hike next month, up from the 22 percent back in mid – August. The odds of an increase by December have rocketed to 65 percent, from a low of 8 percent during the middle of the year, right after the Brexit event.

Source: Bloomberg

US Jobs Report

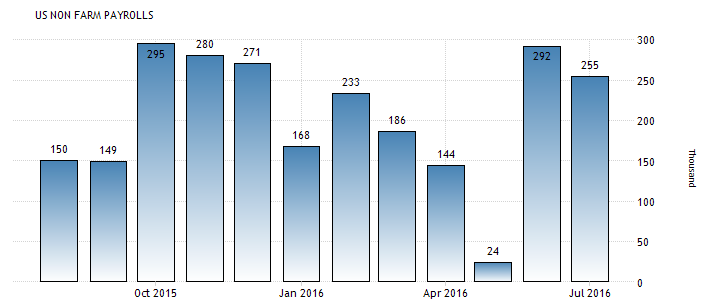

The primary concern for this week would be the US Jobs report, which will be released later this Friday. The US Jobs report will further reinforce the case for Yellen and the Feds to raise interest rates. Labour and payroll numbers have exceeded expectations in the past two readings, and these point to renewed strength in the job market.

Source: US Bureau of Labour Statistics, TradingEconomics

With impending possibility that the Fed would go through with an interest rate hike later this year, the Dollar will likely strengthen. The Bloomberg Dollar Spot Index climbed to its highest in three weeks after comments made by Fed leaders renewed interest and speculation on a rate increase. Investors can therefore consider Powershares CB US Dollar Index Bullish Fund (Symbol: UUP), in order to be exposed to any up-side potential in the Dollar.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them. The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

About the author

Kervin Ong

POEMS Dealer

Jurong West Dealing Team

Kervin Ong currently manages a portfolio of trading accounts and is part of the POEMS Dealing Team. Apart from his Dealing role, he also gives training seminars to further enrich his clients’ financial knowledge under his care. An external auditor by profession before joining Phillip Securities, his background in due diligence and statutory audits for listed companies equips him with in-depth analytical skills; a skill hugely advantageous for value investors who seek to invest in companies with favorable valuations or shrewd management. Kervin holds a Bachelor of Science in Applied Accounting (Hons) from the Oxford Brookes University, along with memberships under the Association of Chartered Certified Accountants (ACCA) and Institute of Singapore Chartered Accountants (ISCA).