Night Owls and Early Birds: A Guide to Extended Hours Trading October 14, 2025

Introduction

Extended-hours trading refers to buying and selling securities outside regular trading hours. Unlike standard trading sessions, these transactions are executed primarily through Electronic Communication Networks (ECNs), which facilitate trades when traditional exchanges are closed.

Key Takeaways

- Two Sessions: Extended-hours trading in the US consists of two sessions — pre-market (4:00 am to 9:30 am ET) and post-market (4:00 pm to 8:00 pm ET).

- Market Indicator: Activity during these sessions often provides early signals for the regular trading day, though participation is typically lower, resulting in reduced liquidity.

- News Impact: Extended-hours trading is especially useful for reacting to breaking news, earnings releases, and merger announcements, many of which occur outside standard market hours.

- Risks & Volatility: Prices can swing more sharply during these sessions due to reduced trading volume and wider spreads. As a result, extended-hours activity may not always reflect the true momentum of the broader market.

What is Extended-Hours Trading?

Extended-hours trading is exactly what it sounds like — trading that takes place outside of the US market’s official opening hours. It is divided into two sessions: the pre-market (4:00 am to 9:30 am ET) and the post-market (4:00 pm to 8:00 pm ET).

Pre-market activity often provides early clues about how stocks might perform once the market officially opens. While trading volume is generally lower during this period, significant changes in price and volume can hint at potential market direction and investor sentiment.

Similarly, the post-market session reflects how investors react to news and earnings announcements released by many highly traded companies after the closing bell. This activity can offer insights into overall market sentiment and may influence expectations for the next trading day.

Why Trade in Extended-Hours?

1. Opportunities for Early Reactions to News and Announcements

Important news — such as earnings reports, financial results, or merger and acquisition news — is typically made before the market opens or after it closes. Extended-hours trading gives investors the chance to respond immediately, rather than waiting for the opening bell.

Key economic data releases, such as jobs reports and inflation figures, also tend to come out around 8:30 am ET, during pre-market hours. In times of heightened volatility, extended sessions are often the first to reflect breaking news, allowing investors to adjust their positions quickly.

Likewise, announcements made during post-market hours can trigger sharp price swings and significant gaps from the previous close. For example, Oracle (ORCL.US) surged more than 30% in post-market trading following news of a deal with OpenAI.

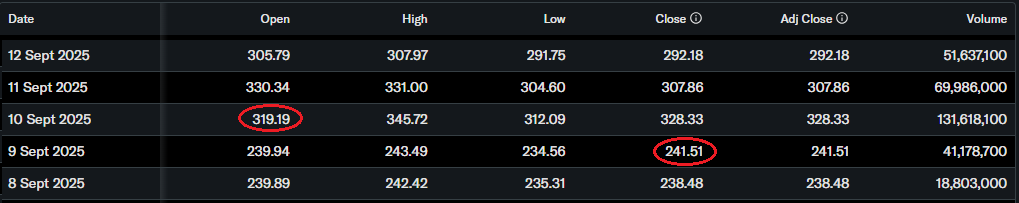

Yahoo Historical Price on ORCL.US

Yahoo Historical Price on ORCL.US

Though not as drastic, these movements after earnings reports or stock exchange filings are quite common. An example is when Coinbase (COIN.US) fell about 6% after its Q2 2025 earnings release.

CNBC Reporting on Coinbase (COIN.US) Q2 Results

CNBC Reporting on Coinbase (COIN.US) Q2 Results

2. Gauge for breakouts or breakdowns during normal trading hours

The price range of a stock during extended-hours trading can provide traders with insight into its support and resistance levels during regular hours, as well as potential breakouts or breakdowns. Changes in prices and trading volumes during these hours can foreshadow broader market movements throughout the day.

3. Access to longer trading hours

Extended-hours trading allows investors to place trades immediately to manage their positions without for the market to open. This offers greater flexibility and convenience, as the trading window is longer. Traders restricted to regular trading hours may have to limit their strategies accordingly.

Monitoring extended-hour activity also aids in risk management and informed trade positioning. Engaging in extended-market trading can offer opportunities for a timely entry or exit, giving investors a potential edge when the regular market resumes.

Risks in Extended-Market trading

1. Lower Liquidity and Wider Spreads

In extended hours trading, there are usually fewer buy and sell orders compared to regular market hours. This lower activity makes it difficult to buy or sell at your desired price. Your order may only be partially filled, or not filled at all. Fewer trades and higher volatility can also cause wider bid-ask spreads and larger price gaps between buyers and sellers.

2. Risk of Higher Volatility

Prices can move more sharply during extended hours than during the regular session. This increased volatility means your order might not be fully executed, or it may be completed at a less favourable price.

3. Risk of Unlinked Markets

Different extended-hours trading systems may display varying prices for the same security. Because these systems are not always interconnected, you might receive a less competitive price on one platform compared to another.

4. Risk of News Announcements

Important company or market news is often released outside regular trading hours. Such announcements can cause sudden and sharp price movements during extended sessions, making it harder to trade at expected prices.

What are the differences between extended-market and regular trading?

| Characteristics | Extended Hours | Regular |

| Liquidity and volume | Low | High | Bid-ask spread | Wide | Narrow | Susceptible to higher or lower price gaps (refer to chart A above) | Yes | Generally no | Price movements | Prices are determined by a smaller group of investors, which may be heavily influenced by market news. (e.g. earnings release) | Proper supply and demand dynamics determine price movements, ensuring orderly trading conditions. | Market participants | Predominantly institutional investors | Both institutional and retail investors |

The table above captures the main differences between extended-market and regular trading sessions.

Can I trade in the extended-hours market? How?

Yes, you can! US extended-hours market prices on POEMS are available from 4:00 am to 9:30 am ET and 4:00 pm. to 8:00 pm. ET. You may refer to the table below to see the corresponding time in Singapore.

| Pre-market start time | Pre-market end time | Regular market start time | Regular market end time | Post-market start time | Post-market end time | |

| US Eastern Standard Time (EST) | 04:00 | 09:30 | 09:30 | 16:00 | 16:00 | 08:00 |

| Singapore time (daylight saving) | 16:00 | 21:30 | 21:30 | 04:00 | 04:00 | 08:00 |

| Singapore time (non-daylight saving) | 17:00 | 22:30 | 22:30 | 05:00 | 05:00 | 09:00 |

Extended-market orders can be placed starting from 4:00 am ET and remain valid until the close of the post-market session at 8:00 pm ET. Quotes for extended-market trading are only available during these hours. Any unfilled orders will automatically be carried forward into the next regular trading session.

To begin trading in the extended market, click here. If you have any further questions, please visit our FAQ on US pre-market trading.

Visit our website or contact our dedicated Night Desk team at globalnight@phillip.com.sg or (+65) 6531 1225.

Start investing smarter with POEMS today — open an account and trade the US markets now!

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Global Markets Desk US Dealing Team

The Global Markets Desk US Dealing team specialise in handling the US Markets in the Global Markets Desk.

Their responsibilities and capabilities extend from managing and taking orders from clients trading in the US market, to content generation, Technical Analysis and providing educational content to POEMS clients.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile