Markets Offered

NYSE-MKT, NASDAQ, NYSE (New York Stock Exchange)

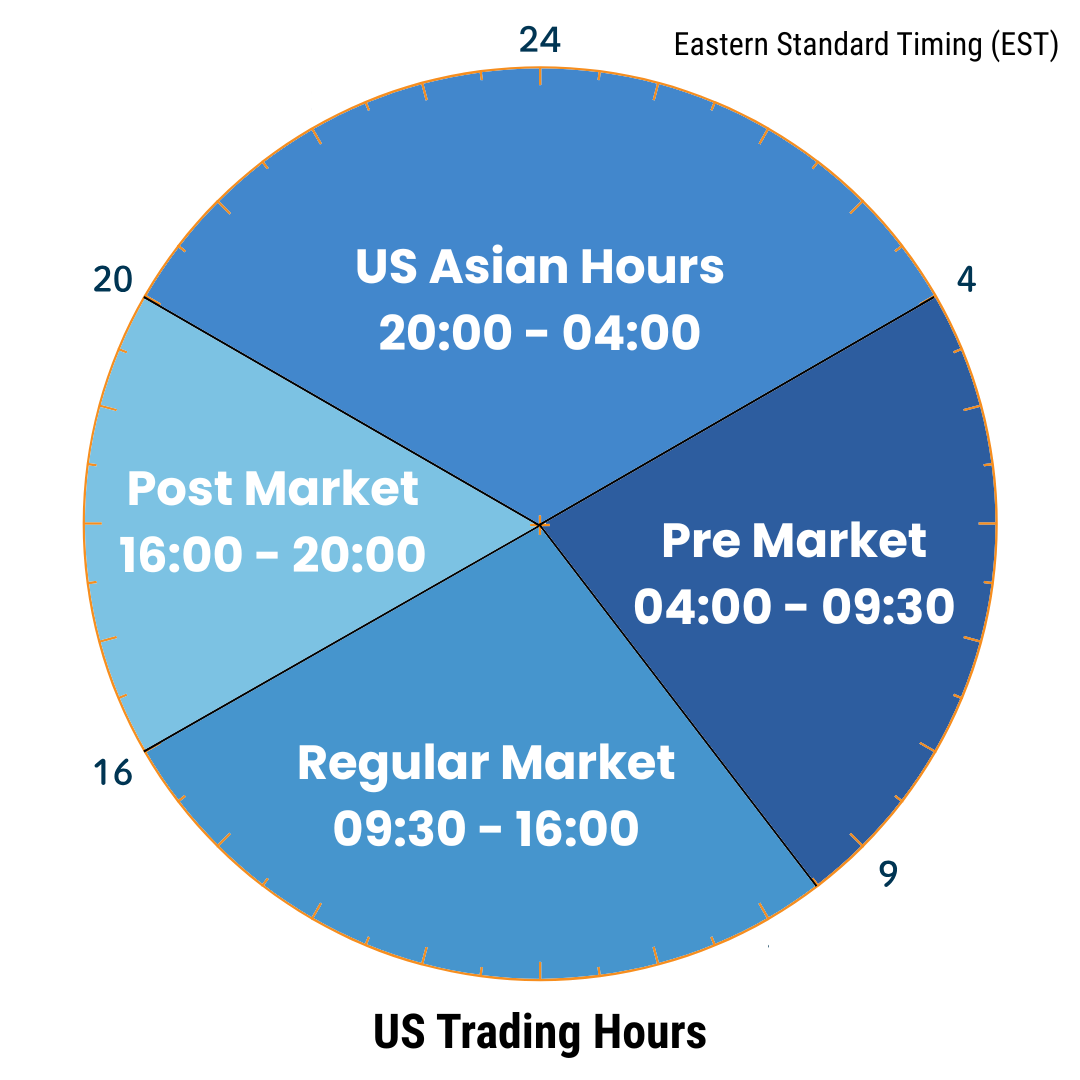

- What is extended hours? Extended hours refers to the trading hours outside regular trading sessions including both pre-market and post-market. POEMS NOW OFFERS you Pre and Post-Market trading between 1600hrs – 2130hrs SGT and 0400hrs – 0800hrs SGT (for Non-Daylight between 1700hrs – 2230hrs SGT and 0500hrs – 0900hrs SGT).

Contracts for completed trades executed in the post-market session will be reflected by 10:00 AM SGT on T+1.

- What time are the extended hours?

Pre-Market Start Time Pre-Market End Time Regular Market Start Time Regular Market End Time Post-Market Start Time Post-Market End Time Eastern Standard Timing (EST) 04:00 09:30 09:30 16:00 16:00 20:00 Singapore timing (Daylight) 16:00 21:30 21:30 04:00 04:00 08:00 Singapore timing (Non-Daylight) 17:00 22:30 22:30 05:00 05:00 09:00 - What time will the extended hours quote be available? Extended hours quote will be available from 1600hrs – 2130hrs SGT & 0400hrs – 0800hrs (for Non-Daylight between 1700hrs – 2230hrs SGT & 0500hrs – 0900hrs)

- What is a Market Order?

- A market order is an order placement with a defined quantity but without a price. It will be traded at the best price currently available in the market.

- What is Market on Open?

- A MOO order is an order placement with a defined quantity but without a price. It is placed before a market is opened and will trade at the best price when the exchange starts trading. It is an order to execute at the day’s opening price.

- What is Market on Close?

- A MOC order is an order placement with a defined quantity but without a price. It is placed during the market trading session and will be executed at the closing. It is an order to execute at the day’s closing price.

- When can I start placing a Market Order, MOO and

MOC?

- A Market Order, MOO and MOC orders can be placed on the trading day from 0900 EST till US market close at 1600 EST (subject to cut off time below). Any order placements outside of the allowed hours will be rejected with effect from 12 September 2022.

- What is the cut-off time for placing an order?

Order Type Market Cut Off Time (Before market open/close) Order Entry Order Withdrawal Market on Open(MOO)Marketable Limit Orders prior to open NYSE No cut off on both Order Entry or Withdrawal NASDAQ 2 mins 5 mins AMEX 5 secs 1 min Market on Close(MOC)Marketable Limit Orders prior to close NYSE 10 mins 2 mins NASDAQ 5 mins 10 mins AMEX 10 mins 10 mins

Risk of Overtrading for Market, Market on Open and Market on Close orders:

Financial markets may fluctuate rapidly and susceptible to ‘gapping ’where there is a sudden shift in prices from one level to another. As Market, Market-On-Close and Market-On-Open orders are executed at the best price currently available in the market, there will always exist a risk of over-trading due to excessive price movements.- What is GTD Order GTD orders will continue to be effective until the order is fully executed, cancelled or expired. For clients who may have a target price away from the current levels, GTD orders allow for orders to be entered at a bid (offer) well below (above) the current trading price of the counter without replacing the order daily.

- Eligible order types for GTD Only Regular Trading Hours (RTH) Limit and Stop-Limit (SLO) orders are eligible for GTD.

- Validity and expiry of GTD orders Only expiry dates of T+1 or more and up till 30 days from T can be selected. GTD orders will stay effective till a maximum of 30 days and will expire after the market closes on the expiry date selected. GTD orders with expiry dates that fall on a weekend/US holiday are invalid and will be rejected.

- Corporate action on GTD order

- Forward/Reverse split and Stock Dividend: Any outstanding GTD orders will be withdrawn on the date of corporate action at 0815hrs (EST) with the exception of overnight GTD orders (orders submitted after the market closes i.e. 1615 EST on the day before the corporate action).

- Cash Dividend: Any outstanding GTD orders with stock having cash dividend will be withdrawn on the ex-date prior to regular market opening.

- Withdrawal of in-queue GTD Please do note that GTD withdrawals for the US markets may be delayed until the counterparty’s system comes online to process the request at 810am EST. For immediate withdrawal of in-queue GTD, please contact the Nightdesk at 6531 1225 for assistance.

| Order Placement | Via 1) POEMS or 2) Your designated Trading Representative or 3) Night dealer (US Trading Hours) |

| Trading lot | 1 share | |

| Live price | Via POEMS (live price quote) | |

| Exchange | NYSE, NASDAQ and NYSE-MKT | |

| Order Type1 | Limit Order, Stop Limit Order, Market Order, Market on Open Order, Market on Close Order | |

| Minimum bid size2 | Share price (USD) | Minimum Bid Size (USD) |

| <1 | 0.0001 | |

| ≥1 | 0.01 | |

| Exchange fees: | |

| Securities and Exchange Commission (SEC) Fee | 0.00% (sell trades effective trade date 13 May 2025) |

| Trading Activity Fee (TAF) | Applicable only for sell trades at USD 0.000195 per share, subject to maximum of USD 9.79 (With effect from 1 January 2026). |

| Other charges/exchange fees: | |

| Financial Transaction Tax | 0.4% (Buy trades only, applicable for French ADRs with market cap >= EUR 1 B) 0.2% (Buy trades only, applicable for Italian ADRs with market cap >= EUR 500 M) 0.2% (Buy trades only, applicable for Spanish ADRs with market cap >= EUR 1 B) |

| American Depository Receipt (ADR) / Depository Receipt (DR) fee | Varies for each counter |

| Panel on Takeovers and Mergers (PTM) Levy | GBP 1.5 (Buy and Sell trades, applies to UK-incorporated ADRs with a market capitalization of >= GBP 1B, for transactions exceeding GBP 10,000 or equivalent in other currencies). |

| Singapore Time | 09:30pm – 04:00am (Daylight Saving Time) |

| 10:30pm – 05:00am (Non-Daylight Saving Time) | |

| US(Eastern) Time | 09:30am – 04:00pm |

| Month | Day | Date | Holidays | Settle | Trading Day |

| January | Thursday | 1 January | New Year’s Day | No | No |

| Monday | 19 January | Martin Luther King Jr. Day | No | No | |

| February | Monday | 16 February | Presidents’ Day | No | No |

| April | Friday | 3 April | Good Friday | No | No |

| May | Monday | 25 May | Memorial Day | No | No |

| June | Friday | 19 June | Juneteenth | No | No |

| July | Friday | 3 July | Independence Day (obs) | No | No |

| September | Monday | 7 September | Labor Day | No | No |

| October | Monday | 12 October | Columbus Day | No | Full |

| November | Wednesday | 11 November | Veterans’ Day | No | Full |

| Thursday | 26 November | Thanksgiving | No | No | |

| Friday | 27 November | Day After Thanksgiving | Yes | Partial | |

| December | Thursday | 24 December | Day Before Christmas | Yes | Partial |

| Friday | 25 December | Christmas Day | No | No |

An ADR is a stock that trades in the United States but represents a specified number of shares in a foreign corporation. ADR agents (banks and investment banks) purchase stocks on foreign exchanges and then sell receipts for these shares on American exchanges. ADR agents charge these ADR fees to compensate for inventorying the foreign stocks and all other costs involving registration, compliance and recordkeeping services.

The ADR Fees will vary for each counter and you will be billed according to the shareholdings for each ADR shares.

No. US Citizens or US Residents are not allowed to trade in US Stocks through PSPL.

Can I continue to trade in US markets if I subsequently become a US Resident/US Citizen/US Taxpayer?

No. Once you are a US Resident/US Citizen/US Taxpayer, you will not be able to trade in US Stocks through PSPL and you are required to notify PSPL should there be any change of your citizen/residency status.

A negotiable financial instrument issued by a bank to represent a foreign company’s publicly traded securities. The depositary receipt trades on a local stock exchange. Examples of DR include American Depository Receipt (ADR) that trades in the United States and Global Depository Receipt (GDR) that trades globally. DR agents (banks and investment banks) purchase stocks from the originating foreign exchanges and sell them on the domestic exchanges (e.g. American exchange). DR agents charge DR fees to compensate for inventorying the foreign stocks and all other costs involving registration, compliance and recordkeeping services

DR fees will vary for each counter and you will be billed according to the shareholdings for each DR shares.

Why is my limit or market orders not done when market opens at 9.30am (EST) and why is my executed price different from the opening price shown on POEMS?

All the orders received prior to market open will be routed and protected versus the stock’s primary listing exchange market opening print. Sometimes, there may be a delay in the opening for certain stocks in the primary exchange which will result in these counters not being able to open at 9.30am sharp.

However, you may still see transactions execute off the primary exchange before the official open, which by themselves are still required to be reported under SEC regulation. Any activity prior to the primary market open that is reported to the tape would be from alternative display facilities or dark pools. The reason that these trades are still reported to the tape, even though the primary market is not opened, is because under SEC rules, every stock transaction must be reported to a consolidated data feed, whether it occurs on an exchange, like the Nasdaq or Intercontinental Exchange Inc’s (ICE.N) New York Stock Exchange (NYSE), or in a dark pool. Off-exchange trades are reported through Trade Reporting Facilities (TRFs) run by Nasdaq and NYSE in conjunction with FINRA.

Similarly, the high and low of the day for certain counters may be executed off the primary exchange and may not be taken as official primary executed prices

In addition to the usual rejects for insufficient quantity or buying limits, please note the following specific rejection criteria;

- Orders with quantities exceeding 30% of 30-day average daily volume will be rejected.

- Marketable (aggressive) orders that exceeds a specified percentage of deviation during market hours will be rejected. As a general guideline, deviations of up to 20% are permitted for shares prices below $5, up to 15% for prices between $5 to $25, and up to 10% for prices above $25 (please note these are approximate thresholds and can vary).

- Limit prices with more than two decimal places for shares priced above $1 will be rejected due to compliance with SEC Rule 612 (Sub-Penny rule)

You may contact the night dealing team at 6531 1225 if you wish to sell your existing OTC shares held with us. Broker-assisted rates will apply.

As electronic systems become increasingly prevalent, US stock exchanges and self regulatory organizations (SROs) are implementing policies that will address the problem of clearly erroneous trades – defined as trades resulting from a market participant placing a transaction or a series of transactions that adversely affect the market price of a security.

Please note that with effect from 2nd May 2011, our US counterparty will implement trading rules control check on all orders being routed to their order management system

The control rules will (1) Check order size relative to a percentage of the stock’s 30-days average daily volume (ADV); (2) Check the price of the order relative to a percentage parameter against the National Best Bid/Best Offer (NBBO) quote during core trading session. If these rules are violated, the system will automatically reject the orders submitted through our online systems.

Trading in US Markets via Phillip Securities is only available to non-US citizen / non-US resident.

You have to sign and mail-in the W-8Ben Form before trading in the US market.

When will W8-BEN form expire?

W8-BEN form will remain in effect for a period of 3 years, starting on the date the form is signed and expiring on the last day of the 3rd succeeding calendar year. It is mandatory for you to renew this form before the last day of the 3rd succeeding calendar year in order to continue to trade in the US market. Failing which, Phillip Securities Pte Ltd “PSPL” will cease to provide custodian services to your US portfolio.

Yes, you are required to accept ALL the agreements.

No. It does not matter where you live. To have access to real-time market data and quotes from NASDAQ, NYSE and NYSE-MKT, you must accept the appropriate Exchange Subscriber Agreement(s).

You are a PROFESSIONAL if you meet any one of the following criteria for the entire term of your subscription and you must sign further agreements as well as are subject to the appropriate additional Exchange fee structure:

- You are subscribing on behalf of a firm, corporation, partnership, trust, or association.

- You use the information in connection with any trade or business activities and not for personal investment.

- You plan to furnish the information to any other person(s).

- You are a securities broker-dealer, registered representative, investment advisor, investment banker, futures commission merchant, commodities introducing broker or commodity trading advisor, money manager, member of the Securities Exchange or Association or Futures Contract market, or any owner, partner, or associated person of the foregoing.

- You are employed by a bank or an insurance company or an affiliate of either to perform functions related to securities or commodity futures investment or trading activity.

You are a NON-PROFESSIONAL investor if you do not meet any one of the criteria outlined above.

Please note that subscriber assumes all liability declaring status as a professional or non-professional and will be held accountable for all applicable penalties and/or the Exchange fees if declaration is incorrect. There shall be no refund of the unused portion should you wish to terminate the services prior to the expiry date.

Non-professional Users

Subscribe on POEMS 2.0:

- Login to POEMS 2.0 --> Market Data & Rewards --> New Subscriptions

- Click on the Market Data & Rewards tab, then click on the New Subscriptions subtab

- Select US Live Price (Non-Pro) - 12 Months (U.P S$20.00)

- Fill out subscription agreement forms

- Click on the ‘Submit’ and 'Confirm' button to complete your redemption

Subscribe on POEMS Mobile 3 App:

- Login to POEMS Mobile 3 App --> “Me” tab --> Market Data --> New Subscription

- Select "US" and click "Subscribe" on US Live Price (Non-Pro) - 12 Months (U.P S$20.00)

- Fill out subscription agreement forms

- Click "Submit" to complete your redemption

Terms & Conditions:

1) The promotion is applicable to new and existing clients of Phillip Securities Pte Ltd (PSPL).

2) This promotion is open to individuals who qualify as non-professional as defined in the FAQ on this page.

3) Subscribers must subscribe and agree to the agreements set out in the subscription page to enjoy this promotion

4) A subscriber, who falsely declare to be Non-Professional but is a Professional, will be held accountable for all applicable penalties and/or Exchange fees

5) PSPL staff and agents, and PSPL cross-border clients are not eligible for this promotion

6) PSPL account application Terms & Conditions apply

7) The management reserves the right to make changes to the Terms and Conditions of this promotion without prior notice.

When will my US Live Price Subscription(s) be activated?

Upon receipt of the agreement and payment, the Live Price Subscription will be activated within 2 working days.

Can I cancel the subscription?

Redemption of Reward Points must be done though online redemption system on POEMS and once effected, is final. No cancellation or amendments to the subscription will be entertained.

Professional User:

What is the charge for real-time market data for Professional investors?

US Live Price Subscription fee (inclusive of GST):

NASDAQ Live Price = S$19 per month

NYSE Live Price = S$10 per month

AMEX Live Price = S$10 per month

Subscription will end on the last day of the month. For example of 2 months of subscription, if a subscription is activated on 10 March, it will end on 30 April.

Only Non-Professional Investors are eligible for the free Live Price promotion. Please note that subscriber assumes all liability declaring status as a Professional Investor or Non-Professional Investor and will be held accountable for all applicable penalties and/or the Exchange fees if declaration is incorrect.

There shall be no refund of the unused portion should you wish to terminate the services prior to the expiry date.

What is the application procedure for Professional user?

Professional Investors subscribing to the real-time market data need to submit the relevant exchange agreements to Phillip Securities Pte Ltd (“PSPL”) to seek exchange approval before real-time market information can be granted.

The agreement should be completed by person/s that are authorised (as per Board resolution) to execute contracts on behalf of the company and be completed using the full legal name of the entity.

For real-time data, the Professional Investor is required to submit the NASDAQ Subscriber Agreement.

Please complete the relevant Subscriber Agreement and email the scanned copy to reward@phillip.com.sg.

Can I submit redemption using POEMS Reward program?

No, Points redemption is not available for US Live Price Subscription for Professional user.

Without accepting these Agreements, you can continue to place orders via TRADE page. To view real-time prices, you have to accept the Agreements and subscribe the service accordingly.

No, there is no change in the order execution process.

If you decide not to accept the Exchange Subscriber Agreement, you will not have access to real-time market information.

However, you may continue to view prices with a 15 to 30 minutes delay.

Help is available through the Exchange:

NASDAQ (301) 978–5307 / DataOps@nasdaq.com

For the purposes of the Exchange Subscriber Agreements, real-time market data means last sale information for securities listed on the respective Exchanges, including quotations, volumes, highs and lows, and all other information that is derived from the last sale information, during exchange market hours of operation.

Phillip Securities Pte Ltd and the Data Providers do not warrant or make any representations or claims concerning the validity, accuracy and timeliness or otherwise of the Information provided herein, nor shall Phillip Securities Pte Ltd or the Data Providers (NYSE, NYSE-MKT and NASDAQ) shall be liable or responsible for any claim or damage, direct or consequential, arising out of the use, interpretation or other implementation of said Information.

The various Exchanges have each developed an Exchange Subscriber Agreement to ensure that clients understand and agree to the terms of retrieval and use of real-time market data.

The following Exchanges require Exchange Subscriber Agreements:

- NYSE MKT – The New York Stock Exchange

- NASDAQ – The NASDAQ Stock Market

- NYSE – The New York Stock Exchange