Overcoming Volatility with Regular Savings Plans (RSP) July 23, 2020

Other than asking what to invest in and how to invest, investors are also often concerned about having sufficient funds to invest and finding the right time to invest.

However, timing the market is extremely difficult, especially during such volatile times.

Time in the Market is Better than Timing the Market

Let us show you why time in the market is important with the example below:

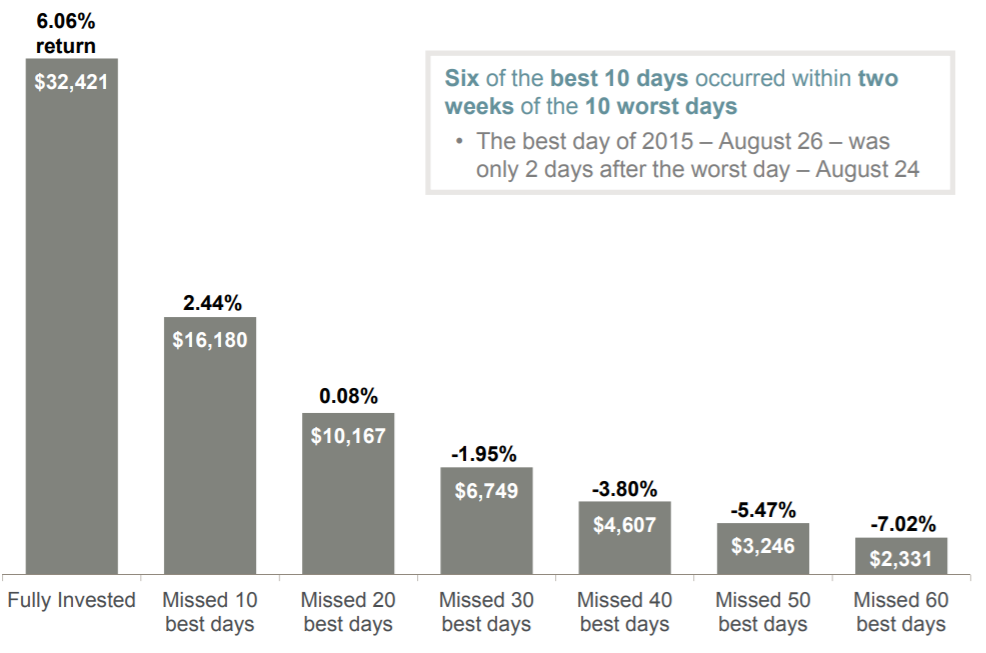

Chart 1: Performance of a $10,000 investment in S&P 500 from 3 Jan 2000 to 31 Dec 2019

Assuming in year 2000, you had $10,000 to invest.

If you stay fully invested in the S&P 500 for 20 years:

- Your portfolio returns would be 6.06%

- Your portfolio value would have increased to more than $32,000 at the end of the 20-year period.

However, if you miss the 10 best days in the S&P 500 during this 20-year period:

- Your portfolio returns would have reduced to 2.44%

- Your portfolio value would have increased to approximately $16,000 only.

While there is exposure to market risks, there are also growth opportunities which you can enjoy. Especially for long-term investors, staying engaged in the market will help you to compound your wealth over time.

Don’t Let Emotions Affect You

Decisions by emotions are usually impulsive and not based on information gathered. Investment decisions based on emotion – such as fear – is the main reason why many people are buying at market tops and selling at market bottoms instead.

Remember, having personal feelings for your investment will not improve your winning probability, but a longer investment horizon will.

So, what now?

Fret not!

Time and Emotions.”

”

Instead of trying to perfectly time the market, you can have time in the market by adopting Dollar Cost Averaging (DCA).

Diversify your risk by taking advantage of DCA, buy more unit trusts when prices are low; buy less unit trusts when prices are high. This enables you to smooth out the returns and also reduce the stress in investing as you will not be required to decide whether it’s the right time to invest.

Here’s how it works:

Assuming Amy and Bob have $300 each to invest.

Amy chooses to invest all $300 in January and receives 30 units at $10/unit.

Bob however, chooses to invest $100 monthly into an RSP.

Here’s the calculations for Bob’s investment:

| January | February | March | |

| Amount Invested (a) | $100 | $100 | $100 |

| Price/Unit (b) | $10 | $5 | $8 |

| Unit Received (a-b)td> | $100 ÷ $10 = 10 | $100 ÷ $5 = 20 | 100 ÷ $8 = 12.5 |

Here’s the calculations for Bob’s investment:

| Amy’s Investment | Bob’s Investment |

| Unit Price:$10/unit | Average Unit Price (Total Price ÷ No of transactions)$(10+5+8) ÷ 3= $7.67/unit |

| Cost of Investment:$10/unit | Average Cost of Investment (Total Cost ÷ No of Units purchased)$300 ÷ 42.5= $7.05 |

| Total Units Received: 30 | Total Units Received: 42.5 |

At the end of three months, Amy would have a total of 30 units at a cost of $10/unit.

However, with DCA, the average unit price is $7.67. Therefore, Bob would have received a total of 42.5 units, at an average cost of only $7.05/unit.

As prices fluctuate all the time, it is difficult to time the market. Adopting DCA as an investment strategy may potentially result in a lower cost per unit that is lesser than the average price per unit over time.

At PhillipCapital, the RSP begins from as low as $100*, allowing investors to start investing at affordable amounts. What’s more, you get to enjoy 0% Platform Fees, 0% Sales Charge and 0% Switching Fees when you trade via POEMS.

Visit the Unit Trust Website to learn more about Unit Trusts, RSP and the choices available for you to choose from. Begin your investment journey with us today!

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

Focus on Asia in 2024: Where to put your money?

Focus on Asia in 2024: Where to put your money?  Investing in Unit Trusts with POEMS

Investing in Unit Trusts with POEMS  Is There a “Fairest of Them All”?

Is There a “Fairest of Them All”?  Maximising Your Financial Growth: Opportunities Beyond the 2.5% CPF Return

Maximising Your Financial Growth: Opportunities Beyond the 2.5% CPF Return