Phillip SGX APAC Dividend Leaders REIT ETF October 10, 2016

Over the weekend, we have garnered extremely high interest on our company’s latest launch on Real Estate Investment Trust ETF. The initial offering period will be till 13 October 2016, while trading for this counter will start trading 9am on 20 October 2016. It is the first SGX Reit ETF listed in Singapore tracking both local and regional REITS passively.

Putting on the hat of an investor, this is a short table that I think might be useful to know with regards to the subscription of this ETF pre-listing.

Please note that personally, I am currently not vested in this counter to prevent conflicts of interest. I do however own shares that are components of this ETF.

| Pros | Cons |

|---|---|

| Diversification – Different Sector + Geography | Corporate Taxation on fund for certain countries’ dividends – taxes are not charged to investors |

| Low Cost Access to a basket of REITS across APAC | Concentration Risk – Australia + Retail |

| Tracks 30 highest dividend stocks – Useful for Passive Income | Tracking Error Risk – Due to fees and expenses |

| Easier to Dollar Cost Average – Rebalance with just 1 ETF instead of getting 30 stocks | Foreign Exchange Risk |

| No brokerage charges – Subscription basis |

This ETF gives investors an exposure in Asia ex Japan REITs issuing high dividends. Considering Asia economic prospects of increasing population, growth in mid-tier income families and increasing urbanisation, there are a myriad of factors that pose a strong case to purchase this ETF. Investors need to appreciate the reality that there is a new norm of low growth, low bond yields and relatively low global interest rates which is further fuelled by events like Brexit. We now see capital inflow into “yielding assets” in Asia. The search for yield still remains making REITs an attractive asset class to have in any portfolio. This particular ETF will be useful for retail investors with little time to analyse performance of each stock in the REIT Universe.

The component stocks were screened for factors such as:

| Market Capitalisation (measured at each index review date) | New Constituents – USD $300milExisting Constituents – USD $240mil |

| Liquidity (Based on minimum median daily traded value measured at each index review date) | New Constituents– US$400k Existing Constituents – $320k |

| Domicile | Not limited to Australia, China, Hong Kong, India, Indonesia, Malaysia, New Zealand , Philippines, Singapore, South Korea, Taiwan or Thailand |

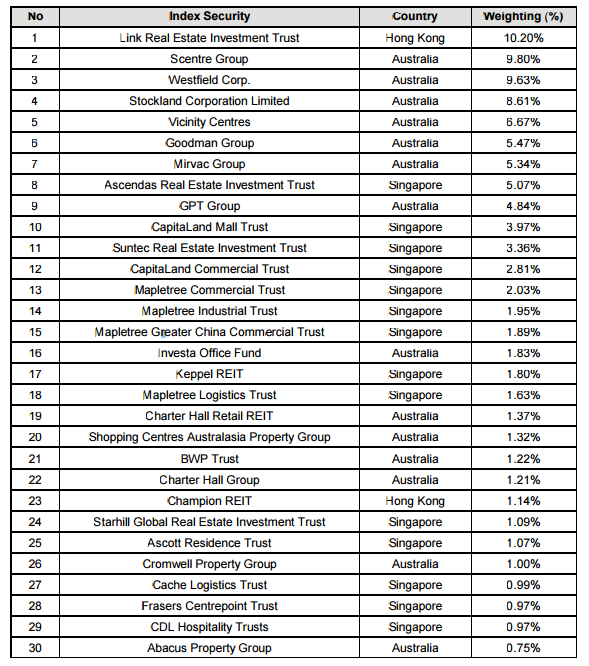

One of the more prevalent questions that was asked amongst clients was what the constituent weightings of the index are and what the 30 stocks are.

Source: http://phillipfunds.com/uploads/funds_file/Phillip_SGX_APAC_Dividend_Leaders_REIT_ETF_Prospectus.pdf

If you wish to know more information about the ETF mentioned above, you can talk to your Dealer at the nearest Phillip Investor Centre. An investment made with knowledge pays the best dividends, we are here to help achieve that.

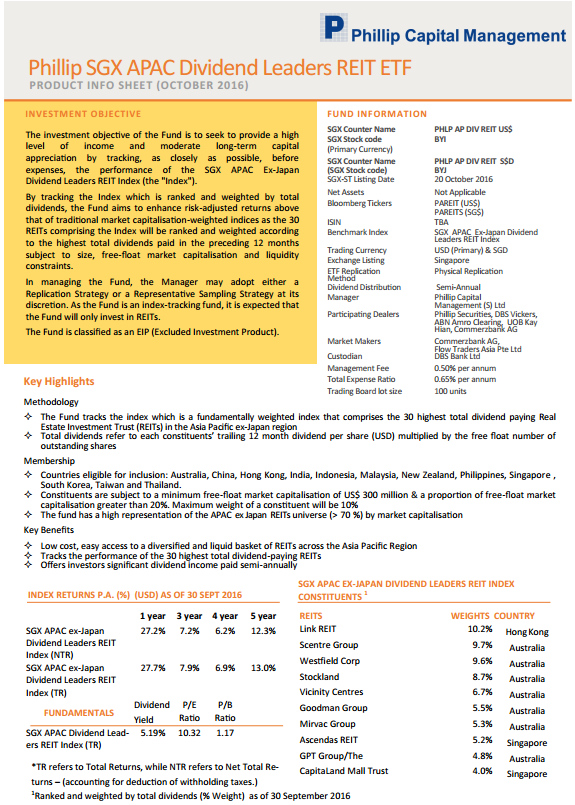

Factsheet

Source: http://www.phillipfunds.com/uploads/funds_file/Phillip_SGX_APAC_Dividend_Leaders_REIT_ETF_Product_Info_Sheet_ipo_USD.pdf

Prospectus

http://phillipfunds.com/uploads/funds_file/Phillip_SGX_APAC_Dividend_Leaders_REIT_ETF_Prospectus.pdf

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them. The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

About the author

Sky Kwah Wen Yao

Dealing Manager

Raffles Place Dealing Team

Sky Kwah is part of the POEMS Equity Dealing Team that provides dealing services to over 17,000 trading account customers. Sky gives talks in tertiary institutions like NYP & SIM and he often conducts seminars on Fundamental Analysis, most recent was at the InvestFair 2016. He particularly focuses on value stocks in Singapore and the US with a top-down macro approach. He is frequently interviewed by Media Corp News 938Live radio station as a market commenter and he hopes to help clients become better stewards of wealth and believes in succeeding in what truly matters – the fullness of life.Sky holds a Bachelor Degree of Commerce with a triple major in Financial Accounting, Investment Finance, and Corporate Finance, from the University of Western Australia.

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection  ETF Market Review: February Outlook Signals Strong Performance

ETF Market Review: February Outlook Signals Strong Performance  ETF Market Analysis: Oil & Hang Seng Set for January Gains

ETF Market Analysis: Oil & Hang Seng Set for January Gains  Buffer ETFs — What Are They and How Do They Work?

Buffer ETFs — What Are They and How Do They Work?