Popular US Stocks traded on POEMS in January 2022 February 11, 2022

Here are some of the more popular stocks – not in any order of ranking – traded by POEMS customers in January.

At a glance:

- All three indices plunged in January

- Federal Reserve expect to raise rates and taper assets soon

- Fed Fund rate remains unchanged

- Fed Chair Powell made mixed remarks on monetary policy

- Advance Gross Domestic Product (GDP) beats estimates

The three US major indices – the Dow Jones, the S&P 500 and the Nasdaq Composite dropped in January.

| NASDAQ | DOW JONES | S&P 500 | |

| Month Open | 15,733.50 | 36,418.94 | 4,781.00 | Month Close | 13,770.60 | 34,726.20 | 4,431.85 | Monthly return | -12.48% | -4.65% | -7.30% |

January was embedded with fear and constant selloffs. At the FOMC Press conference in January, the Fed fund rate was left unchanged. However, the Fed Chair Jerome Powell said that inflation risks were still on the upside and would move even higher.

The Fed is 100% committed to bring inflation back to 2%, while not causing a stock market crash. With a strong labour market and inflation well above 2%, Powell feels that the US economy no longer need sustained high levels of monetary policy support. As such, the Fed will phase out its asset purchases by March 2022, and eventually raise the target range for the Fed fund rate.1

The advance Gross Domestic Product (GDP) was announced at 6.9%, beating estimates of 5.3% and up from the previous 2.3%. A higher GDP signifies that the US economy is improving, but it also contributes to higher inflation.

Thus, with a high growth rate the Fed is more inclined to raise rates.2

Microsoft Corp (NASDAQ: MSFT)

It was another fantastic quarter for MSFT, with EPS and revenue beating estimates3. MSFT’s EPS of US$ 2.48 and revenue of US$ 51.73 billion are higher than the forecast of US$ 2.31 and US$ 50.88 billion respectively.

After four quarters of consistent growth above 50%, MSFT’s cloud services grew 46 % for this quarter.

Investors in MSFT are now more interested in the gaming arm of Microsoft and the acquisition of Activision Blizzard as gaming represents 11% of MSFT’s revenue. MSFT started January at US$ 335.35 and fell 7.27% to US$ 310.98.

Base on Phillip Securities Research (PSR), MSFT is a BUY with a target price of US$ 410.

Technical analysis.

Status: Neutral

Support: US$297.97 – US$300

Resistance: US$314 – US$318.65

Range-bound

SoFi Technologies Inc (NASDAQ: SOFI)

SOFI is a financial technology company. It provides financial services that include student loan refinancing, mortgages, personal loans, credit cards and investing4.

SOFI made headlines in January after gaining approval from regulators for a U.S. banking charter5. Previously, SOFI worked under 50 different state regulations6. Now, SOFI only needs to work under one set of federal regulations and it is also able to lend money and accept deposits independent of partner banks.

Getting the U.S. banking charter allows SOFI to provide more competitive rates and more services. However, crypto transactions are not covered under the new licence. The opening price of SOFI in January was US$16.10 and it closed at US$12.48, translating to a loss of 22.48%.

Technical analysis.

Status: Bearish momentum

Support: US$11.78 – US$12

Resistance: US$14 – US$ 14.29

Immediate support has to hold for any form of upside

Wells Fargo & Co (NYSE:WFC)

WFC gained 9.95% in January. It opened at US$48.93 and reached a high of US$58.87 before closing at US$ 53.8. This increase in price could be partly due to WFC’s stellar earnings. Both its earnings per share and revenue of US$1.245 and US$20.856 billion beat estimates of US$1.13 and US$18.824 billion respectively. Net income was US$5.75 billion, an 86% increase from US$3.09 billion a year ago7. For 2022, WFC expects overall expenses to be lower than 2021 by 4%. At the same time it aims to bring its efficiency ratio in line with peers .

Technical analysis.

Status: Bullish momentum

Support: US$54.48 – US$55.02

Resistance: US$56.63 – US$57.18

Bullish momentum will continue as long as immediate support holds

Morgan Stanley (NYSE:MS)

MS opened January at US$99.33 and gained 3.23% to close at US$102.54. MS reported better-than-expected earnings this quarter with a positive outlook. The reported earnings per share (EPS) of US$2.01 and revenue of US$14.52 billion beat estimates of US$1.91 and US$14.6 billion respectively. MS was able to perform better than its peers such as Goldman Sachs Group (NYSE: GS) and JP Morgan Chase & Co (NYSE: JPM) due to its ability to hold the line on compensation cost9. The firm increased its return on tangible capital equity (ROTCE), a key metric which measures how well a bank uses shareholder money to produce profit, to at least 20% from the previous 17%.10

Technical analysis

Status: Bearish momentum

Support: US$99.83 – US$100.47

Resistance: US$104.45 – US$105

Range-bound

Goldman Sachs Group (NYSE: GS)

GS delivered earnings results that missed estimates this quarter. GS reported lower earnings per share (US$10.81 against the estimate of US$11.76). However, reported revenue was higher than the estimate (US$12.64 billion against the expected US$12.08 billion).

The results missed estimates due to surging expenses.

GS expects surging expenses due to expected persistent inflation in wages while trading revenues normalize from a record period11.

GS started the month at US$389.00 and closed at US$354.68 which is 8.82% lower.

Base on Phillip Securities Research (PSR), GS is a BUY with a target price of US$ 440.

Technical analysis

Status: Neutral

Support: US$346.97 – US$349.14

Resistance: US$377.35 – US$378.84

Range-bound

Netflix Inc (NASDAQ: NFLX)

NFLX delivered great results last quarter but investors were not satisfied with the outlook given by the management12.

Netflix EPS for the fourth quarter was US$ 1.33, which is around 60% higher than the expected EPS of US$ 0.82. Revenue was in line with expectations of US$ 7.71 billion, while subscribers grew by 8.28 million against estimates of 8.19 million.

What caused NFLX to shed 20% from US$ 508.25 to US$ 397.50 was the disappointing number of subscribers Netflix is expecting to add for the first quarter of 2022.

NFLX expects to add 2.5 million subscribers which is a far cry from the 6.93 million analysts are expecting.

NFLX started January at US$ 605.61 and closed 29.47% lower at US$ 427.14.

Base on Phillip Securities Research (PSR), NFLX is a BUY with a target price of US$ 724.

Technical analysis

Status: Bearish Momentum

Support: US$379.92 – US$387.03

Resistance: US$508.44 – US$515.52

Might see covering of gap from the strong demand at US$360

JP Morgan Chase & Co (NYSE: JPM)

JPM beat earnings estimates for this quarter. JPM’s EPS of US$ 3.33 and revenue of US$30.35 billion are higher than the estimates of US$3.01 and US$29.9 billion respectively. Although JPM had a great earnings release, its shares dropped because the management expects “headwinds” of higher expenses and moderating Wall Street revenue to cause the firm to miss their 17% target for return on tangible capital equity (ROTCE). JPM opened January at US$159.86 and dropped by 7.04% to close at US$148.60.13

Base on Phillip Securities Research (PSR), JPM is a BUY with a target price of US$ 188.

Technical analysis

Status: Neutral

Support: US$144.96 – US$145.50

Resistance: US$148.95 – US$150.67

Range-bound

Procter & Gamble Co (NYSE: PG)

PG opened January at US$161.69 and dropped 0.76% to close at US$160.45. The reported earnings per share (EPS) of US$1.66 and revenue of US$20.95 billion beat estimates of US$1.65 and US$20.34 billion respectively. Half of PG’s growth was due to raising prices on selected products. The pandemic also helped increase demand for PG’s healthcare and cleaning products. For fiscal 2022, PG called for 3-4% sales growth compared with prior 2-4%. However, the outlook for earnings did not change as it also predicted higher cost.14

Technical analysis

Status: Neutral

Support: US$155.78 – US$156.65

Resistance: US$160.41 – US$161.32

Range-bound

Robinhood Markets Inc (NASDAQ: HOOD)

HOOD reported disappointing earnings for the third quarter of 202115. It’s revenue of US$ 365 million missed revenue estimates of US$ 431.5 million. The slump in revenue was due to a decrease in crypto trading. The revenue of the previous quarter was US$ 565 million, with US$ 233 million coming from crypto trading. The loss per share was higher than expected too. Analysts were expecting a loss of US$ 1.37 per share while HOOD reported US$ 2.06 loss per share. For the next quarter, HOOD expects revenue to be no more than US$ 325 million and lower retail trading activity to persist. For January, Hood opened at US$ 18.05 and closed lower 21.60% at US$ 14.15.

Technical analysis

Status: Bearish Momentum

Support: US$11.90 – US$12.21

Resistance: US$16.15

Range-bound

Cenntro Electric Group Limited (NASDAQ: CENN)

Cenntro Electric Group, previously known as Naked Brand, is an electric vehicle (EV) company. Naked Brand wanted to enter into the field of EVs which motivated the acquisition of the once privately held Cenntro Automotive Group16. This acquisition made by Naked Brand seems like a SPAC deal where the name and ticker of the acquirer changes. In this case, the name was changed to Cenntro Electric Group with the ticker changing to CENN. CENN expects US$ 506 million on 21,500 vehicle sales in 2022 and US$ 2.1 billion on 74,800 vehicle sales in 2023. For January, CENN lost 68.78%. It opened at US$5.51 and closed at US$ 1.72.

Technical analysis

Status: Bearish momentum

Support: US$1.50

Resistance: US$2.18

Range-bound

Bloomberg analysts’ recommendations

The table below shows the consensus ratings and average ratings of all analysts updated on Bloomberg in the last 12 months. Consensus ratings have been computed by standardising analysts’ ratings from a scale of 1 (Strong Sell) to 5 (Strong Buy). The table also shows a number of analysts’ recommendations to buy, hold or sell the stocks, as well as their average target prices.

| Security | Consensus Rating | BUY | HOLD | SELL | 12 Mth Target Price (US$) |

| Microsoft Corp (NASDAQ: MSFT) | 4.85 | 48 (92.3%) | 4 (7.7%) | 0 | 373.31 |

| SoFi Technologies Inc (NASDAQ: SOFI) | 4.45 | 8 (72.7%) | 3 (27.3%) | 0 | 20.23 |

| Wells Fargo & Co (NYSE:WFC) | 4.43 | 20 (71.4%) | 8 (28.6%) | 0 | 62.08 |

| Morgan Stanley (NYSE:MS) | 4.35 | 21 (67.7%) | 10 (32.3%) | 0 | 114.47 |

| Goldman Sachs Group (NYSE: GS) | 4.20 | 19 (63.3%) | 11 (36.7%) | 0 | 445.61 |

| Netflix Inc (NASDAQ: NFLX) | 4.00 | 30 (57.7%) | 18 (34.6%) | 4 (7.7%) | 524.54 |

| JP Morgan Chase & Co (NYSE: JPM) | 3.90 | 16 (51.6%) | 13 (41.9%) | 2 (6.5%) | 173.23 |

| Procter & Gamble Co (NYSE: PG) | 3.77 | 12 (46.2%) | 12 (46.2%) | 2 (7.7%) | 166.69 |

| Robinhood Markets Inc (NASDAQ: HOOD) | 3.59 | 8 (47.1%) | 7 (41.2%) | 2 (11.8%) | 25.57 |

| Cenntro Electric Group Limited (NASDAQ: CENN) | – | – | – | – | – |

To round up

January saw a major downward movement due to Federal Reserve intention to increase interest rates and reduce its balance sheet. Generally, most companies dropped substantially due to a selloff over fears about the Federal Reserve’s next cause of action. In February, downward movement could still be seen with interest rates expected to increase in March and also due to geopolitical tensions.

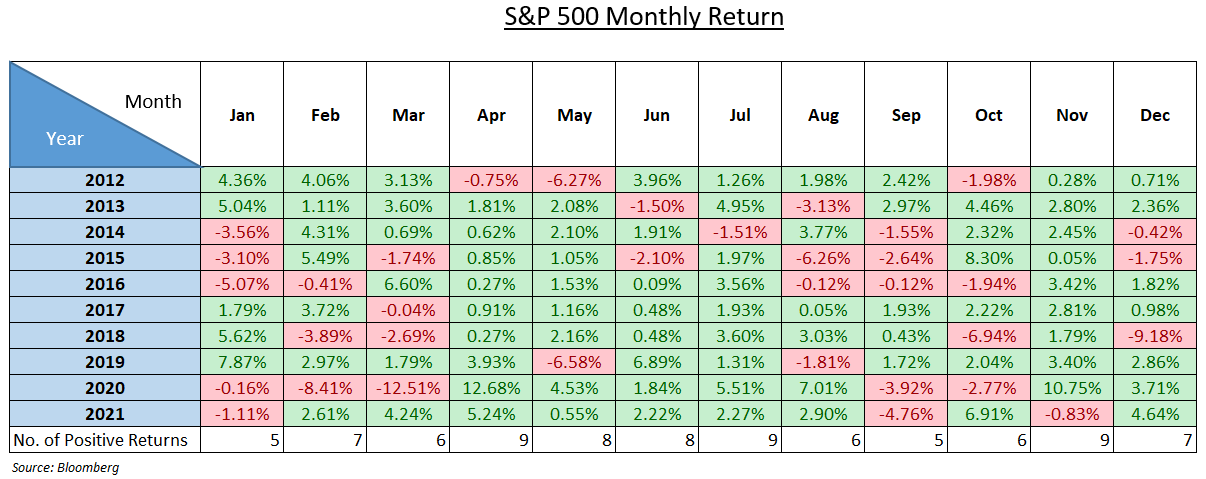

In the last 10 years, February has one of the months with a higher probability of generating positive returns (70%). Thus, based on seasonality, investors can expect to see positive returns.

Like what you have read? Join our Global Markets Investment Community on Telegram today to share your thoughts with us and other like-minded investors!

Open a POEMS account to start trading or chat with one of our licensed representatives to find out more.

Reference:

- [1] “A full recap of the Fed rate decision and the Powell remarks that ….” 27 Jan. 2022

- [2] US Q4 GDP and December Durable Goods – Orbex

- [3] “Microsoft (MSFT) earnings Q2 2022 – CNBC.” 26 Jan. 2022

- [4] “Great Rates. Great Benefits. SoFi..”

- [5] SoFi Rises After Regulator Approves U.S. Bank Charter – Bloomberg.”

- [6] “Fintech disruptor SoFi wants to become a national bank — again.”

- [7] “Wells Fargo’s fourth-quarter revenue tops estimate, profit jumps.” 14 Jan 2022

- [8] Wells Fargo’s stock price pops following Q4’21 results, 2022 guidance.” 14 Jan. 2022

- [9] Morgan Stanley shares rise after fourth-quarter profit tops estimates.” 19 Jan. 2022

- [10] “Morgan Stanley outperforms rivals with profit beat | Reuters.” 20 Jan. 2022

- [11] “Goldman earnings 4Q 2021 – CNBC.” 18 Jan. 2022

- [12] “Netflix shares fall 20% on slowing subscriber growth – CNBC.” 21 Jan. 2022

- [13] “JPMorgan shares fall 6% after CFO lowers guidance on ‘headwinds ….” 14 Jan. 2022

- [14] “P&G earnings top estimates as price hikes offset rising costs – CNBC.” 19 Jan. 2022

- [15] “Robinhood (HOOD) third-quarter earnings 2021 – CNBC.” 26 Oct. 2021

- [16] “Naked Brand Group and Privately-Held Cenntro Automotive Group ….” 8 Nov. 2021

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Jonah Sim Hong Chee (Dealer), Lee Ying Jie (Dealer) & Chan Zi Quan (Dealer)

Jonah Sim is a US Equity Dealer in the Global Markets Team and specializing in US and Canadian markets. He graduated from University of Essex with a bachelor’s degree in Banking and Finance.

Ying Jie is a US Equity Dealer in the Global Markets Team and specializing in US and Canadian markets. He is proficient in trading using Technical Analysis, placing emphasis on supply and demand, and price action.

Zi Quan is a US Equity Dealer in the Global Markets Team and specializes in the US and Canadian markets. He is an avid crypto fan and is adept in macro analysis..

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile