Quantitative Easing: How should investors react? March 9, 2022

Quantitative easing, or QE, is an unconventional monetary policy to spur economic growth. It was first introduced by Bank of Japan, or BOJ, in 2001.

BOJ used QE to fight deflationary pressure in the economy given the fact that conventional monetary policy of lowering interest rate did not work as BOJ had maintained the short-term interest rate near zero back in 1999.

Other than Japan, the US, UK and the Eurozone all deployed QE to support their economies after the global financial crisis in 2007-08.

How does QE work?

QE is done by purchasing long-term government bonds and other types of assets such as mortgage-backed securities, or MBS, to increase money supply in the market so as to provide more liquidity to expand economic activities.

Central banks use QE when their nominal interest rate is very low or near zero.

Usually when interest rates are low, this suggests that the economy is not doing well as central banks need to deliberately lower the rates to spur economic growth.

In poor economic conditions, companies may reduce investment and consumers will be more likely save more. This may then induce a liquidity trap, which is a contradictory economic situation.

A liquidity trap forms when consumers choose to hold on to their cash and not invest in higher-yielding financial instruments due to their pessimistic view of the economy and when the interest rate reaches the floor.

Why is there a need for QE?

QE can be used to resolve a liquidity trap as central banks send a strong signal to the market that the rates will stay low for a long period of time thus encouraging consumers to invest in bonds.

Some investors avoid bond purchases since bonds have an inverse relationship with interest rates. However, if the interest rate is not going to increase in the near future it would make sense to purchase bonds since they will give a higher return as compared to cash with zero interest.

What is the impact of tapering

Tapering refers to central banks slowing down the rate of purchase of long-term bonds and other asset classes. There is a difference between tapering and tightening even though often tapering will lead to tightening. When central banks are tapering, they reduce their purchases, but this does not mean that they are no longer providing liquidity to the market. In fact, this is a way to curb inflation by injecting less liquidity.

Tapering is unwinding the liquidity provided in the market. And for tightening, central banks try to reduce lending and curb economic activities to lower inflation.

When the economy is overheated, central banks proceed to reduce their balance sheets through tapering for a few months to cool down the economy.

Subsequently, the central banks use contractionary monetary policies like rate hikes to control inflation.

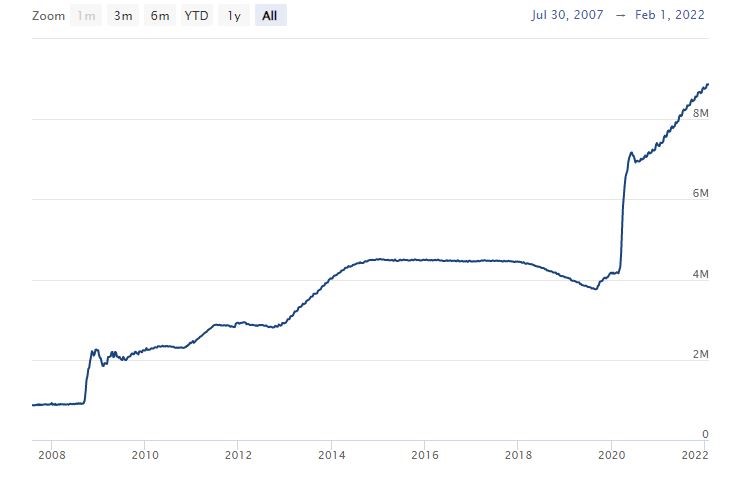

In late 2014 and at the start of 2020, the Fed was trying to do tapering as can be seen in Figure 1 where there is a decreasing rate of balance sheet increment. There is significant impact on the economy during tapering.

The most direct impact is on the credit channel. As QE provides easier and cheaper lending to banks, households and companies, tapering makes it harder for them to get lending and thus slows down economic activities.

Also, tapering gives a signal to the economy that easy monetary policies are about to end, and this may lead to deflating asset prices.

Why do we need to taper?

It is important to understand the reason for tapering now as it is essential for investors to make investment decisions. Tapering is now being used to tackle inflation. But the inflation is a sign of strength in the economy as consumers are spending money and companies are investing. As the economy is strong there is no detrimental impact to credit or financial services like in the Great Financial Crisis. Currently, there are industries affected by COVID-19, but economies are resilient and thus are showing strong inflation numbers.

Strong consumer spending lead to inflation

Currently, the inflation numbers are being driven by strong demand from consumers, and the supply-chain disruption is also resulting in higher prices for goods and services.

It is hard to predict when the COVID-19 virus will be completely gone and when the supply-chain issues will be resolved as different companies have different problems.

So, it may be easier to understand consumer behavior which results in strong demand and pushes inflation numbers up.

According to Federal Reserve Q3 flow of funds report the average US household net worth rose 2.4 trillion to 144.7 trillion in Q3 2021. And with the higher net worth of the household, demand is likely to be sustainable in the near term.

Strong demand reflects strength in an economy, and thus it makes sense for the Fed to consider tapering to prevent inflation rates going wild and at the same time not discourage consumption spending.

What is the impact of tapering

When investors think about tapering, they may be scared that the stock market will tank significantly. This may be as they consider the gain in the stocks market in the recent years as being due to easy monetary policies. So, if the economy turns to contractionary monetary policies, they may feel that the stock market will give back all the returns.

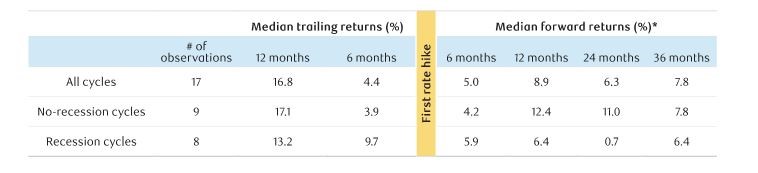

But investors need not panic, as according to RBC reports, there have been 17 rate hike cycles since 1954. And 12 months after the first rate hike there is a 76% chance that the stock market will go up and the average forward return is 7.8% as shown in Figure 2.

Sectors affected by tapering

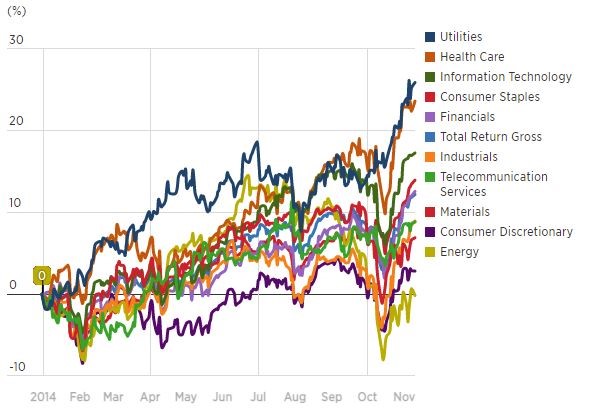

To understand which sectors will benefit from tapering, look at the sector performance back in 2014.

From Figure 3, investors can get a sense of the sectors which could be winners in the tapering followed by rate hikes.

Generally, companies with strong pricing power do well in a tapering environment as they are able to pass on the cost increments to the end consumer and thus prevent the increments from eating into their profit margins. As such, utilities, health care and consumer staples were the leaders in 2014 as consumers needed their products and services even if the prices were raised.

However, there are differences in the economic scenarios from 2014 and 2022. So, this information can be used only for reference on the sector performance for 2022.

For 2022, the energy sector is up more than 15% year-to-date(YTD) and the software companies that have no earnings are down more than 30%.

The reason why energy sector is up in 2022 but was a laggard in 2014 is due to reasons such as growing oil shortage fears this year if OPEC fails to deliver.

Sectors/companies to look out for

When the Fed tapers, look for companies with earnings that will not be significantly affected by higher interest rates. Software stocks have fallen recently as their future cash flows will be discounted at a higher rate which lowers their expected stock prices.

Financials could be a winner in the tapering environment, but do take note that the returns for financials in 2021 is about 34%, while the average 10-year return is about 13%. So, finding the right sector to enter is important, but timing is equally important when it comes to short- and medium-term investing.

Overall, the probability of positive return after the tapering is high, and selecting companies with high earning power and a low level of debt could be a strategy to deploy to gain a higher-than- average return for your portfolio.

Reference:

- [1]https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

- [2]https://www.rbcgam.com/en/ca/article/market-update-july-2021/detail

- [3]https://www.cnbc.com/2014/11/17/the-top-performing-sectors-of-the-us-stock-market.html

- [4]https://finance.yahoo.com/quote/XLF/performance/

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Li Wei Wei

Wei Wei graduated from University of Exeter with a Bachelor’s Degree in Economics and Finance. He specializes in US equities and has worked in a family office to horn his skills in fundamental analysis. He believes in long term investment and the importance of stay invested throughout every business cycles

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry! ![[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close](https://www.poems.com.sg/wp-content/uploads/2024/03/Valerie-Lim-LI-X-SMART-Park-Article-300x157.jpg) [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close

[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close  Deciphering the Updates: Understanding the latest CPF Changes

Deciphering the Updates: Understanding the latest CPF Changes