Rise of the Smart Beta ETFs September 27, 2018

Exchange Traded Funds (ETFs) are gaining popularity amongst investors as a cost-effective investment tool to gain exposure to index performance and achieve diversification. However, one of the fastest growing segments of the ETF industry has to be the Smart Beta ETFs.

To illustrate the industry’s exponential growth, total Assets under Management (AUM) for Smart Beta products has already surpassed US$1 trillion in 2017 – three years earlier than predicted by BlackRock, the largest issuer of Smart Beta ETFs in the world.1

Many of us may know what ETFs are but may be clueless when it comes to Smart Beta ETFs. So what exactly is a Smart Beta ETF and why are they gaining traction among investors worldwide? Read on to find the answers to these questions in this article.

Traditional Market Capitalisation Weighted ETF

Before we explain more about Smart Beta ETFs, it is vital for us to know the difference between Smart Beta ETFs and Traditional Market Capitalisation Weighted ETFs.

Traditional Passive ETFs adopt and replicate the market capitalization-weighted index strategy. Criteria for inclusion of the holdings into the traditional index is simple; a fixed number of the largest market capitalisation publicly-traded stocks will be included into the index and its weightage inside the index will be dependent on its market capitalisation against the total market capitalisation of the index.

By including a fixed number of the largest market-cap stocks inside the index, the index seeks to replicate the desired market performance and sieve out weaker-performing companies through routine rebalancing.

However, such an orthodox index construction methodology may result in overweighting of certain companies or sectors where the companies inside the index have the largest market capitalisation amongst the index holdings. It may also be short-sighted and ignore other essentials like companies’ fundamentals, competitive advantages, growth potential, etc.

For example, the Straits Times Index (STI) has over 40% of its exposure on the financial sector.

What are Smart Beta ETFs?

Unlike traditional Market Capitalisation Weighted ETFs, Smart Beta ETFs use alternative rules-based index construction strategy. It is built around the concept of factor investing. Factor investing is a strategy that chooses securities that are associated with higher returns or lower risks. There are two main factors that have driven returns of financial assets over the last few decades; macroeconomic factors and style factors.2

Macroeconomic factors can be used to explain and predict returns across asset classes. For example, macroeconomic factors like rising interest rates and inflation can boost financial sector stock prices and commodities prices respectively. But they can also drive down bond prices.

Style factors can help to explain excess returns within asset classes. Style factors can include value, momentum, quality, size and volatility. According to Fama and French’s Three Factor Model, value stocks tend to outperform growth stocks and small-cap stocks tend to outperform large-cap stocks.3

From the basic CAPM (Capital Asset Pricing Model) in the 1960s to the complex algorithms used by analysts today, academics and investors have been actively trying to identify factors that help drive returns or lower risks.

Factors can be return-oriented or risk-oriented. Below are some of the popular factors that are commonly used by investors worldwide.

Common Types of Factors

Return-oriented Factors

| Factors | Types of Stocks or Bonds or Financial Products |

| Size | Market Capitalisation |

| Value | Stocks with low prices relative to their fundamentals |

| Growth | Stocks that are expected to grow at a faster rate relative to the market average |

| Momentum | Stocks with positive price trends |

| Quality | Companies with strong financials and fundamentals |

| Earnings | Companies with strong earnings or net profits |

Risk-oriented Factors

| Factors | Types of Stocks or Bonds or Financial Products |

| Minimum Volatility | Stocks with lower than average volatility |

| Low/High Beta | Stocks’ volatility or sensitivity to broad market movements |

Other Types of Smart Beta Strategies

| Smart Beta Strategies | Financial Products |

| Equal Weighted | Funds that assign an equal weighting to securities |

| Price Weighted | Funds that assign weighting proportional to the price of each security |

| Blend | Funds with a mix of value and growth stocks |

| Multi-asset | Funds with a mix of asset classes |

| Multi-factor | Funds that include holdings based on a number of different factors |

While the concept of factors is not new, the use of factors is being revolutionised by advancement in technology and big data today. With the increase in computing power and access to databases of non-financial information; large amounts of data can be processed more efficiently, allowing factors to be identified with greater precision and speed. Hence, index providers can now have greater flexibility, accuracy and variety when it comes to rules-based index construction.

Smart Beta ETFs that track these rules-based indexes seek to outperform traditional market capitalisation weighted indexes by targeting exposure to one or more factors. Thus, Smart Beta ETFs are convenient investment vehicles for investors to gain access to factor investing to seek higher returns, lower risk or enhanced diversification.

Why Are Smart Beta ETFs Gaining Popularity?

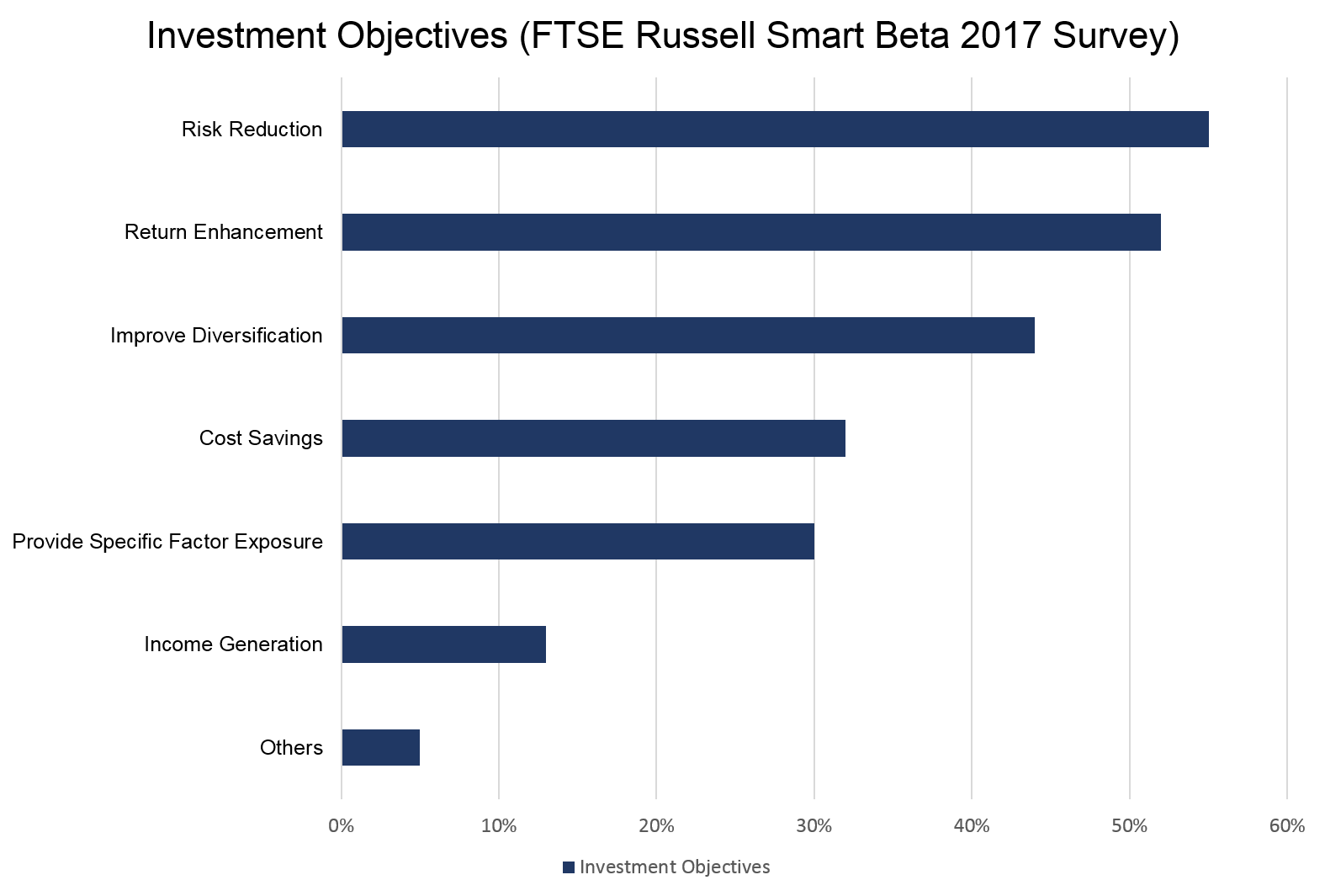

According to the FTSE Russell Smart Beta 2017 Survey, risk reduction and return enhancement have been the top two investment objectives for the surge in popularity of Smart Beta Strategies amongst investors and asset owners in 2017.5

Furthermore, by adopting a rules-based and systematic approach to selecting its constituents, Smart Beta ETFs tend to have lower expense ratios as compared to traditional active funds. From the survey results last year, cost savings have been growing in importance for investors and Smart Beta Strategies are increasingly being used in place of active strategies.

Smart Beta ETFs: A Mix of Active and Passive Strategies

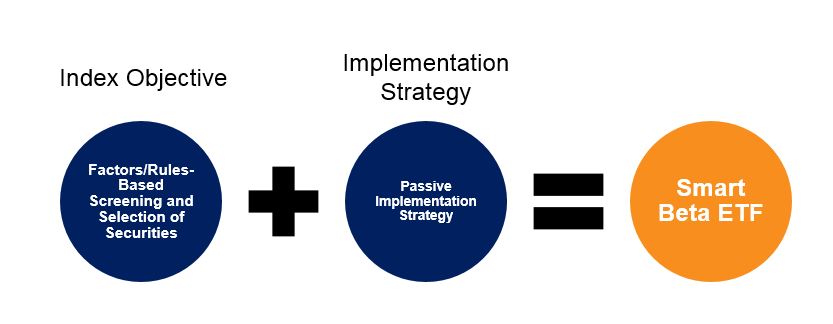

By tracking rules-based indexes, Smart Beta ETFs incorporate characteristics of both active and passive investment strategies.

Hedge Funds and Active Funds Managers have always been identifying and using factors to generate alpha. Alpha refers to excess returns generated by a security relative to its benchmark and is generally a measure of an active fund or portfolio manager’s performance. However, the strategies used by these professionals are often confidential and proprietary information. Active investment strategies are not revealed to the public for fear of other market participants shadowing and front-running their investment positions.

Smart Beta ETFs are similar to these active funds in the sense that they can potentially target specific investment outcomes by using factor-weighted approaches.

At the same time, Smart Beta ETFs adopt the same passive implementation strategies used by traditional Market Capitalisation Weighted ETFs. The implementation strategy is transparent, quantifiable and systematic, which eliminates any potential irrational behavioural factors that may arise from active management.

Phillip SING Income ETF

For instance, the Phillip SING Income ETF is a Strategic / Smart Beta ETF that focuses on 30 high quality Singapore Listed stocks to offer investors a cost-effective and diversified exposure to the Singapore market.

The ETF tracks the Morningstar® Singapore Yield Focus IndexSM, which uses a series of factors to select the 30 stocks for inclusion into the index, to achieve its objective of delivering quality income to investors.

The underpinning factors for stocks selection are:

1) Business Quality – The index screens for companies with sustainable competitive advantage to protect income stream from erosion

2) Financial Health – The index methodology avoids companies with deteriorating balance sheets at risk of financial distress

3) Dividend Yield – The index weighting scheme maximises yield and anchors the portfolio in the most liquid and stable companies, while capping individual stock’s weight as a risk control

By using a rule / factor-based approach for stocks selection, Phillip SING Income ETF aims to deliver better risk-adjusted returns than traditional Market Capitalisation Weighted ETFs.

The Phillip SING Income ETF is suitable for investors who seek:

- Easy access to 30 high quality Singapore Listed Stocks

- Liquidity, transparency and easy diversification across the Singapore market

- Stable and quality income with semi-annual dividend distribution

Conclusion

Smart Beta ETFs have democratised factor investing for retail investors and investors do not have to cipher through chunks of data or be coding experts to acquire information for their desired factor investing strategy. Moreover, Smart Beta ETFs provide investors with many of the investment themes and strategies present in active management at a fraction of the cost.

There are now more than a thousand Smart Beta ETFs available worldwide as investors demand more effective and precise ways to invest with factors.6 The future for Smart Beta ETFs looks rosy and it is predicted that AUM for Global Smart Beta ETFs will hit US$2.4 trillion by 2025 because of their growing popularity with market participants.7

Reference:

- [1] https://www.ipe.com/reports/special-reports/factor-investing/etfs-smart-beta-or-smart-marketing/10023929.article

- [2] https://www.investopedia.com/terms/f/factor-investing.asp

- [3] https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

- [4] https://www.ipe.com/reports/special-reports/factor-investing/factor-investing-embraces-big-data/10018692.article

- [5] https://www.ftserussell.com/sites/default/files/smart-beta-2017-global-survey-findings-from-asset-owners.pdf

- [6] https://sg.morningstar.com/ap/news/ETF-Watch/161286/A-Global-Guide-to-Strategic-Beta-Exchange-Traded-Products-%C3%A2%C2%80%C2%93-2017.aspx

- [7] https://www.irishfunds.ie/news-knowledge/newsletter/autumn-2017-newsletter-fund-focus/whats-next-for-etfs-the-evolution-of-smart-beta-and-active-strategies

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mr. Joel Lim

ETF Specialist

Joel graduated from Singapore Institute of Management, University of London with a First Class Honours in Business. He was the recipient of SIM University of London’s Top Student Bronze Award in 2017 and was the worldwide examination topper for the “Financial Management” module in 2016. Joel was also commended by University of London for his excellent performance in the 2014 Examinations.

Joel is involved in ETF education, providing trading ideas and support to traders, dealers and fund managers. Joel also works closely with ETF issuers to educate retail investors about new ETFs during the Initial Offering Period.

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection  ETF Market Review: February Outlook Signals Strong Performance

ETF Market Review: February Outlook Signals Strong Performance  ETF Market Analysis: Oil & Hang Seng Set for January Gains

ETF Market Analysis: Oil & Hang Seng Set for January Gains  Buffer ETFs — What Are They and How Do They Work?

Buffer ETFs — What Are They and How Do They Work?